Last Two ECB Rate Cuts: Economists Sound Alarm On Delays

Table of Contents

The Two Recent ECB Rate Cuts: A Detailed Look

The ECB implemented two significant ECB interest rate cuts in the latter half of 2023 (replace with actual dates if known). The first cut, on [Date], reduced the main refinancing operations (MRO) rate by [Percentage]%, while the second, on [Date], saw a further reduction of [Percentage]%. The ECB's stated rationale behind these moves was to [Insert ECB's stated reasoning, e.g., stimulate economic growth and combat disinflationary pressures].

Key economic indicators considered by the ECB before these decisions included:

- Inflation rates (CPI, core inflation)

- GDP growth figures

- Unemployment levels

- Business and consumer confidence indices

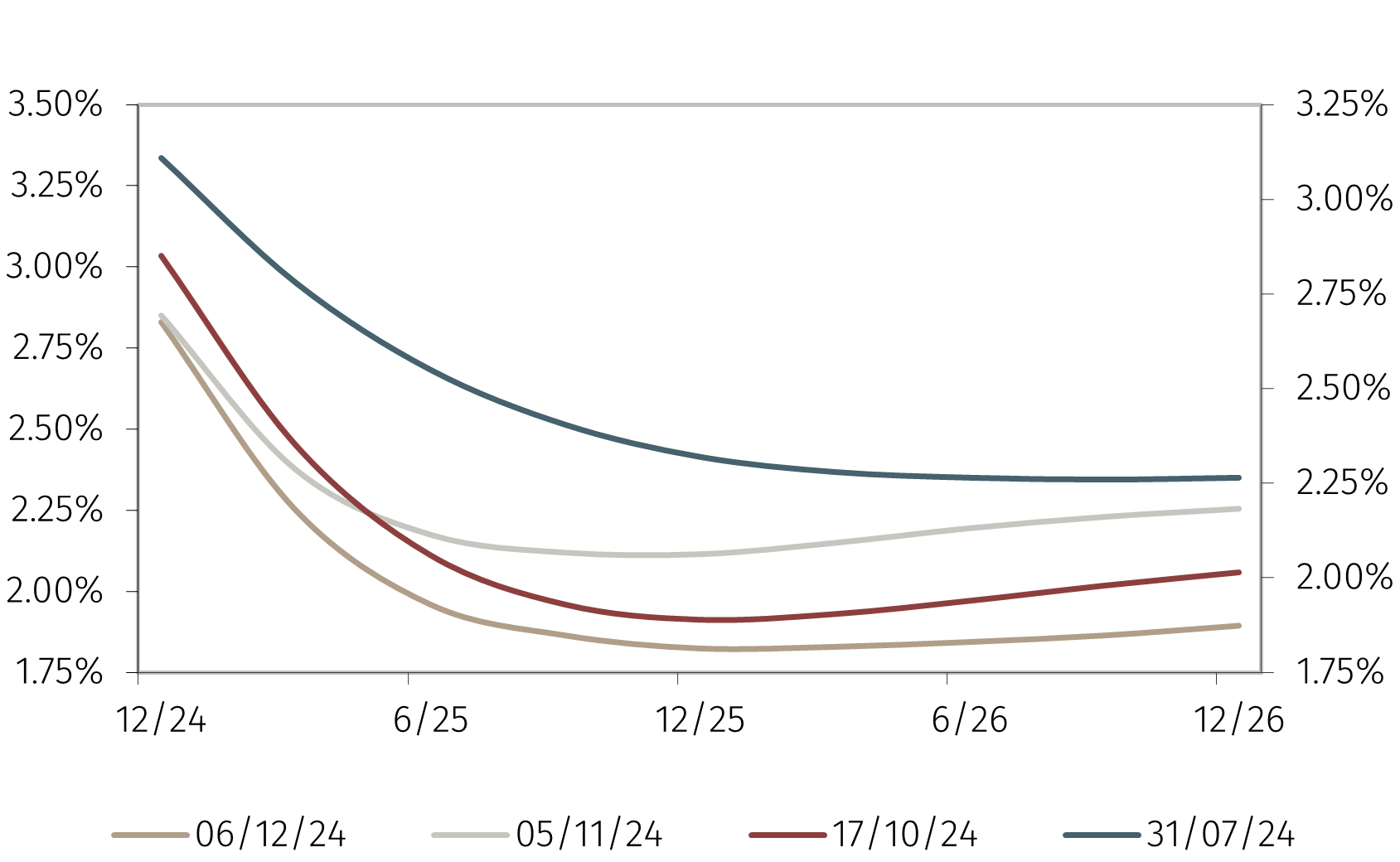

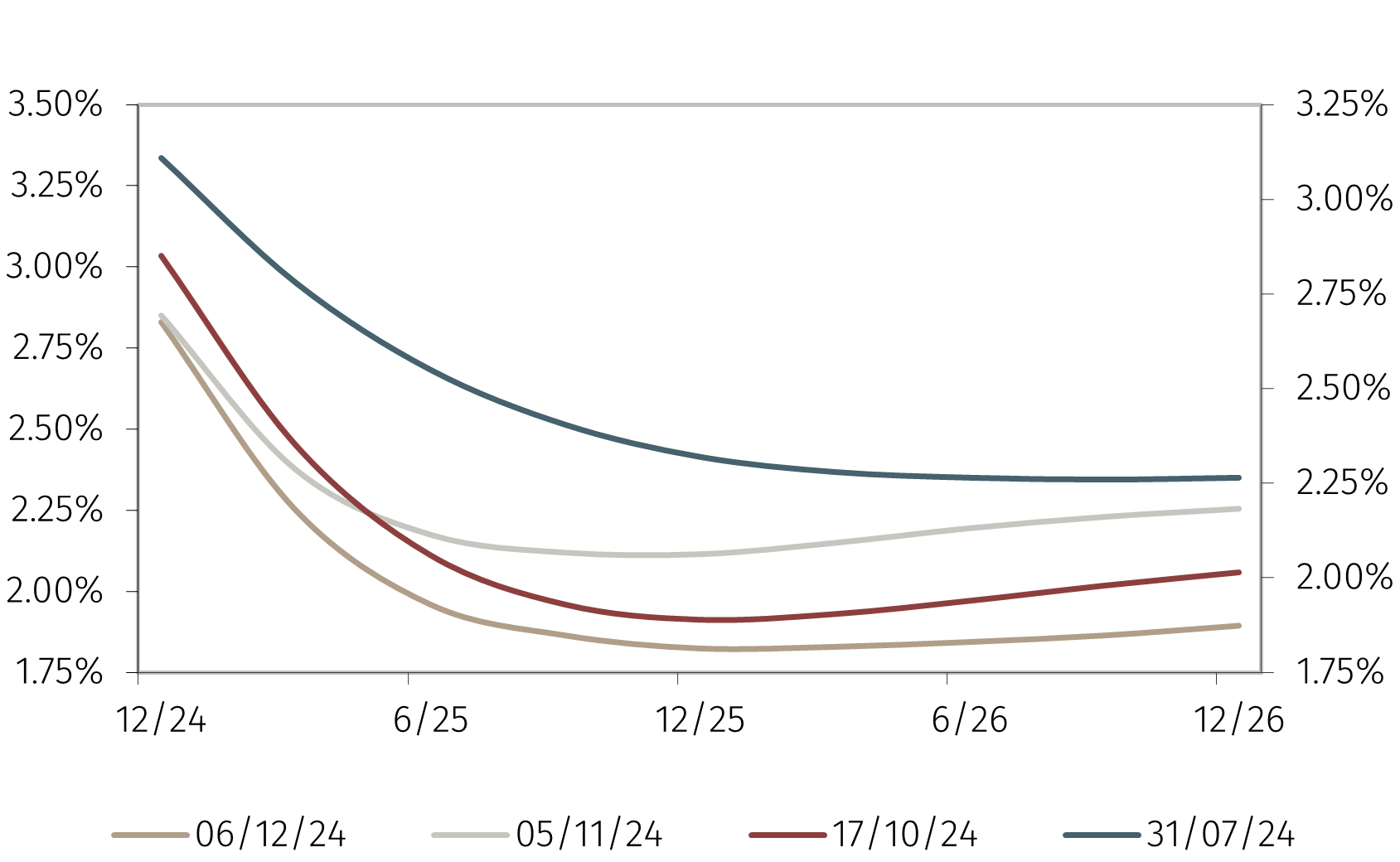

- Eurozone sovereign bond yields

Economists' Concerns: Inflation and Economic Stagnation

Economists have expressed significant concerns regarding the timing and potential impact of these ECB monetary policy decisions. The primary worry centers on the risk of persistent low inflation or even deflation. Delayed rate cuts, some argue, might not be sufficient to stimulate sufficient economic activity to counteract these risks. There are concerns that the current economic climate might render traditional monetary policy tools less effective. The prolonged period of low interest rates could also potentially fuel asset bubbles.

Key arguments from prominent economists include:

- [Economist A] argues that the cuts are too little, too late, citing [Source and supporting data].

- [Economist B] warns of the potential for deflationary spirals, referencing [Source and supporting data].

- [Economist C] expresses concerns about the effectiveness of monetary policy in a context of low aggregate demand, referring to [Source and supporting data].

Alternative Monetary Policy Options: Exploring Other Avenues

Critics suggest that the ECB could have employed alternative monetary policy tools to stimulate the Eurozone economy more effectively. These include:

-

Quantitative easing (QE): The ECB could have expanded its balance sheet by purchasing additional assets, injecting liquidity into the market. Pros: Increased money supply, potential for lower borrowing costs. Cons: Potential for inflation, moral hazard concerns, potential for asset bubbles.

-

Forward guidance: Clear communication regarding the future path of interest rates could have influenced market expectations and encouraged investment. Pros: Improved transparency, enhanced market confidence. Cons: Difficult to accurately predict future economic conditions, potential for loss of credibility if guidance is not met.

The ECB's decision to primarily focus on interest rate cuts may be attributed to [Insert plausible reasons, e.g., concerns about the effectiveness of QE in the current environment, political constraints, etc.].

The Impact on Eurozone Economies: A Sectoral Analysis

The delayed and limited ECB rate cuts have had a varied impact across different Eurozone sectors. The manufacturing sector, particularly in countries heavily reliant on exports, might experience a weaker recovery due to reduced global demand. The service sector, on the other hand, could see some stimulation from lower borrowing costs. The financial sector faces complexities related to profitability in a low-interest-rate environment.

Specific examples include:

- [Country A]'s manufacturing sector has witnessed [Data showing impact].

- [Country B]'s tourism industry shows [Data showing impact].

- [Sector X] across the Eurozone has experienced [Data showing impact].

Conclusion: The Urgency of Addressing ECB Rate Cut Delays

The concerns voiced by economists regarding the timing and magnitude of the recent ECB interest rate cuts highlight the challenges facing the Eurozone economy. The potential consequences of persistent low inflation or economic stagnation are significant, underscoring the need for a proactive and comprehensive monetary policy response. Understanding the implications of ECB monetary policy decisions is crucial for businesses, investors, and policymakers alike. It's imperative to follow future developments in ECB monetary policy closely and to stay informed about the ongoing debate surrounding ECB rate cuts and their impact on the Eurozone. For further reading, consult reports from the ECB, the IMF, and leading economic think tanks.

Featured Posts

-

Sanofi Perspectives De Croissance Et Evaluation Boursiere Selon Loeil Du Loup De Zurich

May 31, 2025

Sanofi Perspectives De Croissance Et Evaluation Boursiere Selon Loeil Du Loup De Zurich

May 31, 2025 -

Posthaste A Comprehensive Look At The Global Tariff Ruling And Its Canadian Consequences

May 31, 2025

Posthaste A Comprehensive Look At The Global Tariff Ruling And Its Canadian Consequences

May 31, 2025 -

Berita Terbaru Selena Gomez Dan Miley Cyrus Berdamai Dan Akan Kencan Bersama

May 31, 2025

Berita Terbaru Selena Gomez Dan Miley Cyrus Berdamai Dan Akan Kencan Bersama

May 31, 2025 -

Analiza Singla Flowers Miley Cyrus Czy To Zapowiedz Wielkiego Powrotu

May 31, 2025

Analiza Singla Flowers Miley Cyrus Czy To Zapowiedz Wielkiego Powrotu

May 31, 2025 -

Where To Watch Kansas City Royals Games On Cbs And Kctv 5

May 31, 2025

Where To Watch Kansas City Royals Games On Cbs And Kctv 5

May 31, 2025