Late To The Game? Evaluating Palantir Stock Investment Potential In 2024 For 2025 Gains

Table of Contents

Palantir's Business Model and Growth Prospects

Palantir operates in the lucrative big data analytics space, holding a unique position with significant government contracts and a growing commercial client base. This dual approach offers both stability and growth potential.

Government Contracts: A Foundation for Stability

Palantir's substantial revenue stream comes from government contracts, notably with the U.S. intelligence community and various international defense agencies. These contracts provide a stable revenue base.

- Long-term contracts: Many contracts span multiple years, ensuring predictable income streams.

- Expanding relationships: Palantir continually seeks new government contracts and expands existing ones. The increasing global focus on national security suggests further opportunities.

- Examples: Palantir's work with the U.S. Department of Defense and other international agencies showcases the importance of its data analytics platforms to national security initiatives. This provides a strong foundation for future revenue streams.

This reliance on government contracts contributes significantly to Palantir's overall financial stability and makes it less susceptible to short-term market fluctuations. The consistent flow of revenue from defense spending allows for investment in research and development, fueling innovation.

Commercial Growth and Market Expansion

Palantir is actively expanding its commercial client base, targeting key industry verticals like finance, healthcare, and energy. This expansion provides avenues for significant growth and diversification beyond its core government business.

- Successful Partnerships: Palantir boasts notable partnerships with major corporations in various industries, showing the scalability and adaptability of its platform.

- Industry Verticals: The focus on sectors like finance (fraud detection) and healthcare (operational efficiency) demonstrates Palantir's capability to provide bespoke solutions with tangible ROI for its clients.

- Future Market Opportunities: The increasing adoption of artificial intelligence (AI) and machine learning (ML) in various sectors presents significant growth opportunities for Palantir's big data analytics solutions.

This commercial expansion provides a vital counterbalance to its government business and significantly reduces the overall risk profile of the company. The growth in commercial clients also increases its long-term revenue potential.

Financial Performance and Key Metrics

Analyzing Palantir's financial performance requires careful consideration of several key metrics. While profitability remains a focus, substantial revenue growth and cash flow provide optimism.

- Revenue Growth: A key indicator to watch is Palantir's consistent revenue growth, particularly from its commercial sector.

- Profitability: While not yet consistently profitable, a clear trajectory towards profitability is essential for assessing its long-term investment value.

- Earnings Per Share (EPS): EPS growth, once profitability is consistently achieved, will be a significant driver of stock price appreciation.

- Cash Flow: A robust cash flow position strengthens Palantir's ability to invest in growth initiatives and withstand economic downturns.

Comparing Palantir's financial performance with its competitors and carefully analyzing its future financial projections are crucial for assessing the investment potential. Consistent monitoring of these key metrics is vital for long-term investors.

Risks and Challenges Associated with Investing in Palantir

While Palantir offers considerable potential, it is not without significant risks. A thorough evaluation of these risks is vital before committing to an investment.

Valuation Concerns and Market Sentiment

Palantir's current valuation relative to its earnings remains a point of contention among investors. Market volatility, particularly in the tech sector, significantly impacts its stock price.

- Comparison to Peers: Comparing Palantir's valuation to its competitors within the big data analytics space is crucial for assessing its relative value.

- Economic Downturns: Economic uncertainty can heavily influence investor sentiment, leading to price fluctuations.

- Market Sentiment: Overall investor confidence towards the company directly affects the stock price.

A high valuation makes Palantir more susceptible to corrections if market sentiment turns negative. Careful consideration of these valuation risks is essential.

Competition and Technological Disruption

Palantir faces significant competition in the big data analytics market. Technological disruption also poses a threat.

- Key Competitors: Companies such as Snowflake, Databricks, and other established players are intense competitors.

- Technological Disruption: The rapid pace of technological advancement means that Palantir must consistently innovate to remain competitive.

- Maintaining Competitive Advantage: Palantir's ability to adapt and maintain its competitive advantage through continuous innovation will be critical.

The competitive landscape necessitates a continuous assessment of Palantir’s ability to stay ahead of the curve in terms of technological innovation.

Dependence on Government Contracts and Geopolitical Risks

Palantir's reliance on government contracts exposes it to geopolitical risks and changes in government policies.

- Government Policy Changes: Shifts in government priorities or budget allocations could impact contract renewals or new awards.

- International Relations: Geopolitical instability in regions where Palantir operates could affect its operations and revenue streams.

- Regulatory Uncertainty: Changes in regulations related to data privacy and security could impact Palantir's operations.

These geopolitical factors introduce a degree of uncertainty that needs careful consideration.

Investment Strategies and Considerations for Palantir Stock

Determining the optimal investment strategy depends heavily on individual risk tolerance and investment goals.

Long-Term vs. Short-Term Investment

Investors should carefully consider whether a long-term or short-term approach aligns better with their risk tolerance and investment timeline.

- Long-Term Investment: This strategy focuses on Palantir's long-term growth potential, weathering short-term market fluctuations.

- Short-Term Trading: Short-term trading involves actively buying and selling shares based on short-term price movements, inherently carrying higher risk.

- Holding Period: The holding period directly impacts the potential return and risk associated with your Palantir investment.

A well-defined investment strategy, aligned with your personal risk profile, is crucial.

Diversification and Portfolio Management

Diversification is crucial to mitigate risk. Integrating Palantir stock into a well-diversified portfolio helps manage potential losses.

- Portfolio Diversification: Spreading investments across different asset classes reduces overall portfolio volatility.

- Asset Allocation: Allocating assets strategically based on your risk tolerance and investment goals is vital.

- Risk Management: Regularly assessing and managing risk is a continuous process that requires adjustments based on market conditions and your investment strategy.

Proper portfolio management, including diversification and risk management, is non-negotiable.

Conclusion: Making Informed Decisions About Palantir Stock in 2024

Palantir presents a compelling investment opportunity, offering significant growth potential within the rapidly expanding big data analytics sector. Its strong government contract base provides a degree of stability, while its expanding commercial business offers future growth opportunities. However, investors must acknowledge the inherent risks associated with Palantir's high valuation, dependence on government contracts, and competitive landscape.

Our analysis suggests a cautiously optimistic outlook. While Palantir's potential for 2025 gains is tangible, thorough due diligence is crucial. Conduct your own research and consider consulting with a financial advisor before making any investment decisions regarding Palantir stock (PLTR). Evaluate your own risk tolerance before investing in Palantir for 2025 growth. Remember to carefully assess your individual investment goals and risk profile before making any investment decisions related to Palantir stock.

Featured Posts

-

Frantsiya I Polsha Novoe Oboronnoe Soglashenie Signal Dlya Trampa I Putina

May 10, 2025

Frantsiya I Polsha Novoe Oboronnoe Soglashenie Signal Dlya Trampa I Putina

May 10, 2025 -

The Bangkok Post And The Push For Transgender Rights A Current Affairs Analysis

May 10, 2025

The Bangkok Post And The Push For Transgender Rights A Current Affairs Analysis

May 10, 2025 -

Snls Bad Harry Styles Impression How He Really Felt

May 10, 2025

Snls Bad Harry Styles Impression How He Really Felt

May 10, 2025 -

Sharing Your Story How Trumps Executive Orders Affected Transgender People

May 10, 2025

Sharing Your Story How Trumps Executive Orders Affected Transgender People

May 10, 2025 -

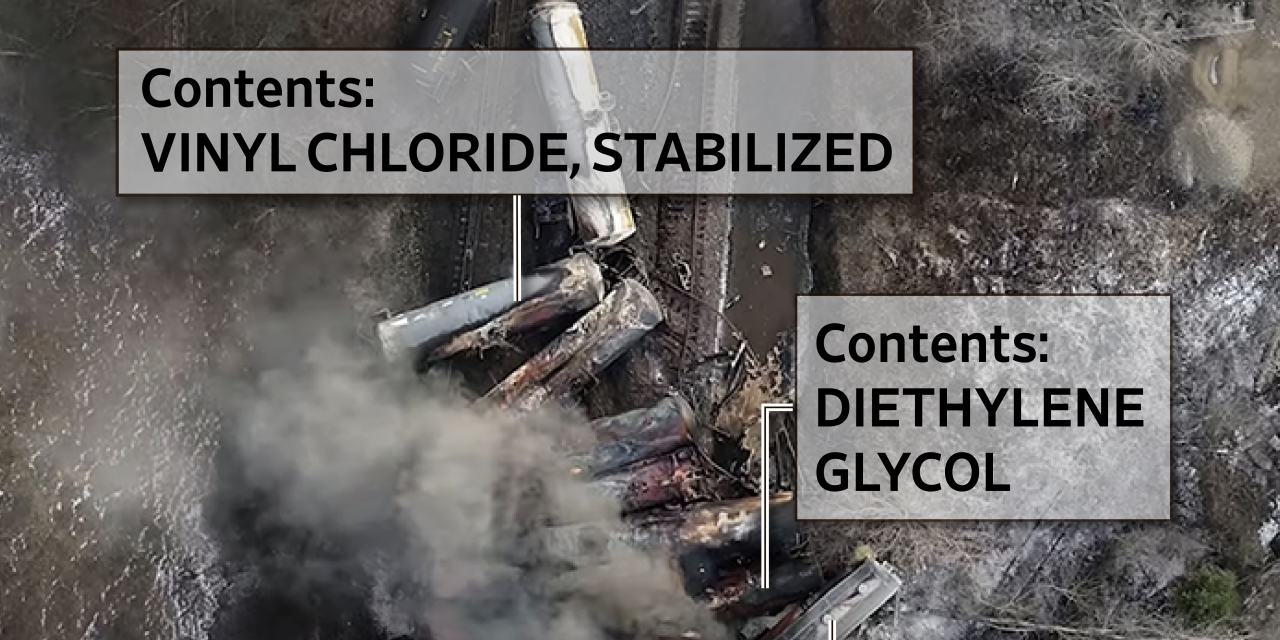

Ohio Train Derailment Persistence Of Toxic Chemicals In Buildings

May 10, 2025

Ohio Train Derailment Persistence Of Toxic Chemicals In Buildings

May 10, 2025