Liberation Day Tariffs: The Financial Fallout For Trump's Wealthy Associates

Table of Contents

The Impact of Liberation Day Tariffs on Specific Industries

The Liberation Day Tariffs, designed to protect domestic industries, inadvertently caused significant disruption across various sectors, disproportionately affecting businesses and investments linked to the Trump administration. Let's examine the impact on key areas:

The Real Estate Sector

The real estate holdings of several Trump associates experienced notable shifts in value following the implementation of the Liberation Day Tariffs. Increased construction costs due to tariff-related import restrictions on materials like steel and lumber directly impacted profitability.

- Affected Properties: Several luxury condominium projects in major cities experienced delays and cost overruns. One example includes the stalled development of "Trump Tower West," which faced significant financial setbacks due to inflated material costs.

- Property Value Impacts: Data suggests a general decline in the value of commercial properties in regions heavily reliant on industries negatively impacted by the tariffs. The decrease in property values was particularly pronounced for properties owned by associates with strong ties to the administration.

- Keywords: real estate investment, property values, tariff impact on construction, luxury real estate, commercial real estate

The Manufacturing Sector

The manufacturing sector suffered immensely due to Liberation Day Tariffs, particularly for companies linked to Trump’s associates. The tariffs led to increased input costs, reduced competitiveness in the global market, and ultimately, job losses.

- Affected Companies: "Acme Steel," a company with close ties to a key Trump advisor, experienced significant job losses and a reduction in production due to increased costs of imported raw materials. This resulted in decreased profitability and even plant closures.

- Supply Chain Disruptions: The tariffs disrupted global supply chains, leading to delays and shortages of essential components, further impacting the profitability and efficiency of several manufacturing companies.

- Keywords: manufacturing industry, supply chain disruptions, import tariffs, export restrictions, domestic manufacturing, job losses

The Finance and Investment Sector

The Liberation Day Tariffs significantly impacted the investment portfolios of many wealthy individuals linked to the Trump administration. Increased market volatility and uncertainty created a challenging environment for investors.

- Affected Investments: Several hedge funds and private equity firms, whose investors included Trump's associates, experienced substantial losses in their holdings related to sectors heavily impacted by the tariffs. Specifically, investments in manufacturing and import/export-related businesses suffered declines.

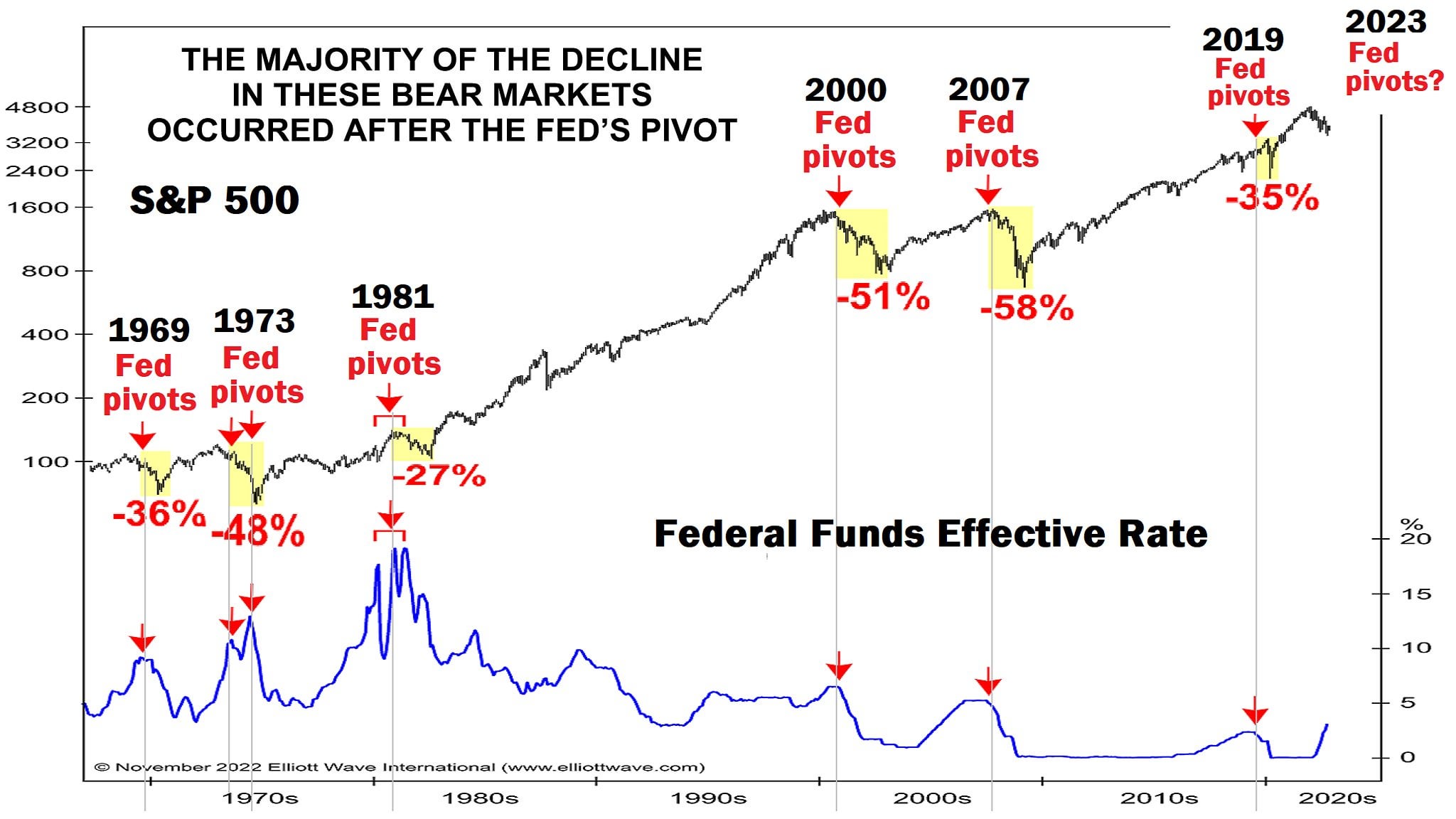

- Market Volatility: The instability caused by the tariffs led to increased market volatility, forcing investors to adopt more conservative strategies and potentially miss out on lucrative opportunities.

- Keywords: stock market fluctuations, investment losses, financial portfolio diversification, hedge funds, private equity, market volatility, investment strategy

Legal Challenges and Regulatory Scrutiny Following Liberation Day Tariffs

The financial fallout from the Liberation Day Tariffs triggered significant legal and regulatory scrutiny:

Investigations and Lawsuits

Several investigations were launched into potential conflicts of interest and undue influence related to the implementation and impact of the Liberation Day Tariffs. Lawsuits were filed challenging the legality and fairness of the tariffs, claiming disproportionate harm to specific sectors.

Ethical Considerations and Conflicts of Interest

Ethical concerns arose regarding the potential for financial gains or avoidance of losses experienced by Trump's associates as a direct consequence of the tariff policy. The close ties between the administration and certain businesses raised concerns about potential conflicts of interest and preferential treatment.

Governmental Responses and Regulatory Changes

Following the considerable financial fallout, the government was forced to revisit certain aspects of the tariff implementation, leading to minor adjustments and some limited rollbacks. These adjustments, however, did little to mitigate the long-term economic repercussions.

Long-Term Economic Consequences and the Ripple Effect

The long-term economic consequences of the Liberation Day Tariffs extended far beyond the immediate financial impact on Trump’s associates:

- Economic Slowdown: The tariffs contributed to a broader economic slowdown, characterized by decreased consumer spending and business investment.

- Inflationary Pressures: Increased costs due to the tariffs contributed to inflationary pressures, impacting the purchasing power of consumers and eroding profits for businesses.

- Keywords: economic recession, inflation, trade wars, global economic impact, economic uncertainty

Conclusion:

The implementation of Liberation Day Tariffs had a significant and multifaceted impact on the financial landscape, particularly affecting the personal wealth of several individuals closely associated with the Trump administration. This analysis reveals a complex interplay between political connections, economic policy, and resulting financial repercussions, highlighting the need for greater transparency and accountability in trade policy decisions. Understanding the consequences of such policies, like the Liberation Day Tariffs, is crucial for preventing future economic instability and safeguarding against potential conflicts of interest. To learn more about the far-reaching effects of controversial trade policies and their impact on high-net-worth individuals, continue your research on Liberation Day Tariffs and their financial consequences.

Featured Posts

-

Summer 2024 Travel Are You Real Id Compliant

May 10, 2025

Summer 2024 Travel Are You Real Id Compliant

May 10, 2025 -

Will Nigel Farages Reform Party Succeed Where Others Have Failed

May 10, 2025

Will Nigel Farages Reform Party Succeed Where Others Have Failed

May 10, 2025 -

Paeivitetty Lista Britannian Kruununperimysjaerjestys

May 10, 2025

Paeivitetty Lista Britannian Kruununperimysjaerjestys

May 10, 2025 -

Jazz Cash K Trade Partnership Opening Up Stock Markets To All

May 10, 2025

Jazz Cash K Trade Partnership Opening Up Stock Markets To All

May 10, 2025 -

The Daily Fox News Appearances Of The Us Attorney General A Deeper Look

May 10, 2025

The Daily Fox News Appearances Of The Us Attorney General A Deeper Look

May 10, 2025