Lion Electric Faces Potential Liquidation: Court-Appointed Monitor's Report

Table of Contents

The Court-Appointed Monitor's Report: Key Findings

The court-appointed monitor's report reveals a concerning state of affairs for Lion Electric. The report details a severe financial predicament, highlighting several critical issues that threaten the company's viability. Key findings include:

- High Debt Burden: Lion Electric is carrying a substantial amount of debt, significantly impacting its financial flexibility and ability to invest in growth initiatives. This high debt-to-equity ratio leaves the company vulnerable to economic downturns and restricts its access to further funding.

- Negative Cash Flow: The report indicates persistent negative cash flow, meaning the company is spending more money than it's generating in revenue. This unsustainable situation necessitates immediate action to avoid insolvency.

- Slow Sales Growth: Despite the growing demand for electric vehicles, Lion Electric has struggled to achieve significant sales growth. This slow growth exacerbates its financial problems and hinders its ability to meet its financial obligations.

- Operational Inefficiencies: The monitor's report points to operational inefficiencies within Lion Electric, leading to increased costs and reduced profitability. Addressing these inefficiencies is crucial for the company's long-term survival.

- Challenges in Securing Additional Funding: The company has faced significant challenges in securing additional funding to address its financial woes. This difficulty in attracting investors further intensifies the pressure on Lion Electric.

Lion Electric's Response to the Report

Lion Electric has issued an official statement acknowledging the challenges highlighted in the monitor's report. While the company acknowledges the severity of its financial situation, it has not yet provided a concrete plan to address the issues. The official response, while acknowledging the problems, lacks specific details regarding the company’s proposed solutions or a potential restructuring plan. This lack of clear action has fueled further investor concerns and uncertainty regarding the company's future. Without a robust restructuring plan and successful debt refinancing, the threat of Lion Electric bankruptcy looms large.

Impact on Investors and the Stock Price

The release of the monitor's report has sent shockwaves through the financial markets, significantly impacting Lion Electric's stock price. [Insert chart or graph showing stock performance]. Investor sentiment has turned overwhelmingly negative, with many investors selling off their shares. This dramatic decline reflects the growing concern about the potential for Lion Electric liquidation. Investors holding Lion Electric stock are facing significant potential losses.

Implications for the Electric Vehicle Industry

The potential failure of Lion Electric carries significant implications for the broader electric vehicle industry. The situation could negatively impact investor confidence in other EV companies, especially those operating in the same market segment. Furthermore, the potential disruption to the EV supply chain could lead to delays and increased costs for other manufacturers. The future of Lion Electric's innovative electric buses and trucks is now uncertain, potentially leaving a gap in the market.

Potential Outcomes and Future Scenarios

Several potential outcomes exist for Lion Electric, ranging from a successful restructuring to complete liquidation. The most likely scenarios include:

- Restructuring and Debt Refinancing: This involves renegotiating debt terms with creditors and implementing cost-cutting measures to improve financial stability.

- Acquisition by Another Company: A larger EV manufacturer or a private equity firm could acquire Lion Electric, potentially saving it from liquidation.

- Chapter 11 Bankruptcy Filing: If restructuring efforts fail, Lion Electric may file for Chapter 11 bankruptcy protection, allowing it to reorganize its finances and potentially emerge from bankruptcy.

- Lion Electric Liquidation: This is the most severe outcome, leading to the company's closure and the sale of its assets.

The likelihood of each scenario remains uncertain, depending on Lion Electric's ability to secure additional funding and implement effective restructuring strategies. The long-term prospects of the company are currently clouded in doubt.

Conclusion: The Uncertain Future of Lion Electric and What's Next

The court-appointed monitor's report reveals a critical situation for Lion Electric, raising serious concerns about the company's financial stability and the potential for Lion Electric liquidation. The impact of this crisis extends beyond Lion Electric itself, affecting investors, the EV industry, and the broader economy. It is crucial to closely monitor developments in this unfolding situation. To stay informed about the latest developments regarding Lion Electric's financial crisis and the potential for Lion Electric bankruptcy, subscribe to our updates, follow reputable financial news sources, and consider seeking professional financial advice. The future of Lion Electric remains highly uncertain, and proactive monitoring is essential.

Featured Posts

-

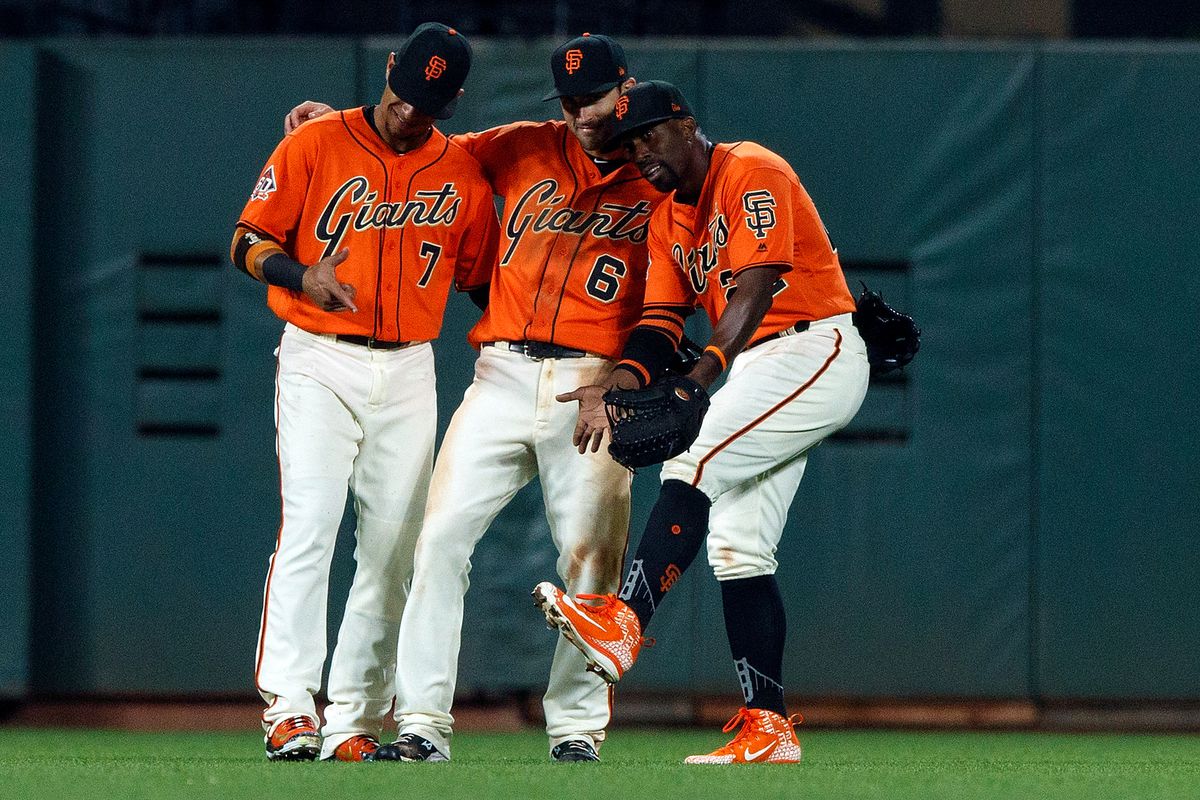

Mariners Vs Giants Outfielders Heroic Catch Steals The Show

May 07, 2025

Mariners Vs Giants Outfielders Heroic Catch Steals The Show

May 07, 2025 -

Winning Numbers Lotto And Lotto Plus Results Saturday April 12 2025

May 07, 2025

Winning Numbers Lotto And Lotto Plus Results Saturday April 12 2025

May 07, 2025 -

Chinas Catl Targets Indonesian Growth With 1 Billion Loan

May 07, 2025

Chinas Catl Targets Indonesian Growth With 1 Billion Loan

May 07, 2025 -

Nfl Draft Steelers Keep Star Wide Receiver

May 07, 2025

Nfl Draft Steelers Keep Star Wide Receiver

May 07, 2025 -

Tajemnice Konklawe Ujawnione Przez Eksperta Z Wprost

May 07, 2025

Tajemnice Konklawe Ujawnione Przez Eksperta Z Wprost

May 07, 2025