Lion Electric: Liquidation A Real Possibility, Says Monitor

Table of Contents

The Monitor's Report: Key Findings and Concerns

A court-appointed monitor's report has highlighted several critical concerns regarding Lion Electric's financial stability. The report details significant cash flow problems, unsustainable debt levels, and persistent operational challenges that threaten the company's long-term viability. Specific concerns raised include:

- Severe Cash Flow Issues: The report indicates a substantial shortfall in cash flow, making it difficult for Lion Electric to meet its operational expenses and debt obligations. This is exacerbated by delays in project completion and revenue recognition.

- High Debt Burden: Lion Electric's debt-to-equity ratio is alarmingly high, placing immense pressure on its financial resources. The report suggests the company is struggling to manage its existing debt load.

- Operational Inefficiencies: The monitor’s report identifies operational inefficiencies and production bottlenecks as significant contributors to the company’s financial woes. This points to a need for substantial restructuring and improvements in operational efficiency.

- Negative Profitability: The report underscores consistent negative profitability, raising serious questions about Lion Electric's ability to achieve sustainable growth and generate positive cash flow in the near future.

These findings paint a worrying picture for Lion Electric's future, suggesting a high risk of Lion Electric liquidation or bankruptcy without significant intervention. The severity of these issues warrants immediate attention and decisive action.

Lion Electric's Current Financial Situation: A Deep Dive

Lion Electric's current financial situation is precarious. Analyzing its recent financial statements reveals a concerning trend:

- Declining Revenue: Revenue growth has stagnated, and in some periods, even declined, indicating a weakening market position and struggles to secure new contracts.

- Negative Profit Margins: Consistent losses have depleted the company's cash reserves, making it increasingly vulnerable to financial distress. This highlights challenges with cost management and pricing strategies.

- High Debt-to-Equity Ratio: The company’s high debt-to-equity ratio suggests a heavy reliance on debt financing, increasing its vulnerability to economic downturns and interest rate hikes.

- Falling Stock Price: The Lion Electric stock price reflects investor sentiment, showing a significant decline, indicating a lack of confidence in the company's future prospects.

These factors, combined with intense competition in the EV market and potential supply chain disruptions, significantly contribute to Lion Electric's perilous financial position.

Potential Scenarios and Outcomes: Liquidation vs. Restructuring

Several potential scenarios could unfold for Lion Electric:

- Liquidation: This is the most extreme outcome, involving the sale of assets and the cessation of operations. This scenario would have devastating consequences for employees, creditors, and investors.

- Bankruptcy: A bankruptcy filing would allow Lion Electric to restructure its debt and operations under court supervision, providing a potential path to recovery, although it would involve significant challenges and potential losses for stakeholders.

- Restructuring: A less drastic measure might involve internal restructuring, potentially including layoffs, cost-cutting measures, and a strategic refocusing of business operations. This would require significant changes to its business model and operations.

The likelihood of each scenario depends on various factors, including the company's ability to secure additional funding, its success in restructuring its operations, and the overall market conditions for electric vehicles. The emergence of a potential buyer or investor could also influence the outcome, offering a lifeline to avoid Lion Electric liquidation.

Impact on the Electric Vehicle Market and Industry

The potential Lion Electric liquidation would have far-reaching consequences for the EV industry:

- Increased Consolidation: A failure of Lion Electric could lead to further consolidation in the already competitive EV market, with larger players potentially acquiring its assets.

- Reduced Competition: The exit of a significant player like Lion Electric would lessen competition, potentially impacting innovation and price pressure within the sector.

- Ripple Effect on Suppliers: Lion Electric's suppliers could face financial difficulties if the company ceases operations, resulting in job losses and potential instability across the supply chain.

- Setback for EV Adoption: The failure of a prominent EV manufacturer could dampen consumer confidence and slow down the overall adoption rate of electric vehicles.

Conclusion: The Future of Lion Electric and the Likelihood of Liquidation

The analysis of Lion Electric's financial situation and the monitor's report strongly suggest a significant risk of Lion Electric liquidation. While restructuring remains a possibility, the severity of the company’s financial problems and operational challenges make a positive outcome uncertain. The impact on the broader EV market would be substantial, affecting competition, innovation, and the overall transition to sustainable transportation. Stay updated on the latest developments regarding Lion Electric's financial situation and the potential for Lion Electric liquidation by subscribing to our newsletter or following us on social media. Learn more about the intricacies of Lion Electric's financial challenges and the potential implications of Lion Electric liquidation.

Featured Posts

-

71

May 07, 2025

71

May 07, 2025 -

Isabela Merced And Pedro Pascals Fantastic Four A Box Office Showdown With Superman

May 07, 2025

Isabela Merced And Pedro Pascals Fantastic Four A Box Office Showdown With Superman

May 07, 2025 -

Giorgio Baldi Reopens Rihanna Celebrates With Solo Dinner

May 07, 2025

Giorgio Baldi Reopens Rihanna Celebrates With Solo Dinner

May 07, 2025 -

Mlb Betting Tigers Vs Mariners Predictions And Odds For Todays Match

May 07, 2025

Mlb Betting Tigers Vs Mariners Predictions And Odds For Todays Match

May 07, 2025 -

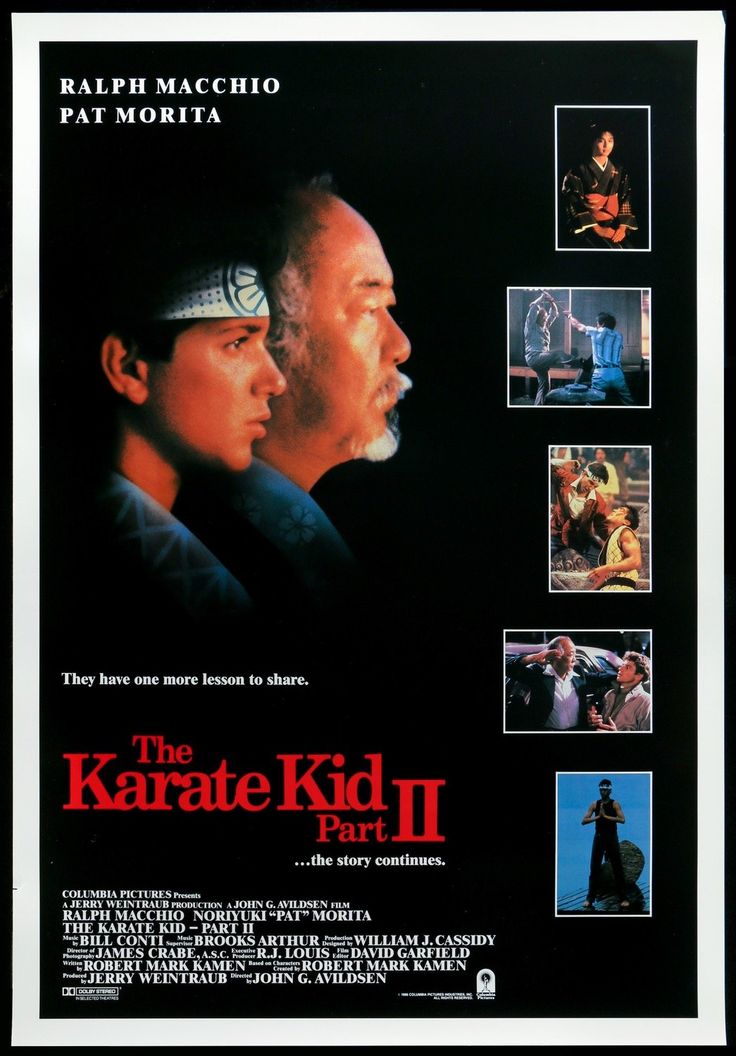

The Karate Kid Part Ii Locations Characters And Cultural Impact

May 07, 2025

The Karate Kid Part Ii Locations Characters And Cultural Impact

May 07, 2025