Live Nation Entertainment Stock (LYV): Investment Strategies For Different Risk Profiles

Table of Contents

Understanding Live Nation Entertainment (LYV) and its Business Model

Live Nation Entertainment (LYV) is a dominant force in the global live entertainment industry. Its business model is multifaceted, encompassing three primary segments: ticketing, venues, and artist management. Live Nation's Ticketmaster division holds a significant market share in ticket sales worldwide, processing millions of transactions annually. Their venues segment operates a vast network of amphitheaters, arenas, and festivals globally, hosting countless concerts and events. Finally, their artist management division represents some of the biggest names in music, offering comprehensive management services.

Several key factors influence LYV stock performance. Concert attendance, naturally, plays a crucial role. Strong ticket sales and high venue occupancy directly impact revenue. The popularity of artists on Live Nation's roster is another significant factor; successful tours by major artists translate to increased revenue and stock appreciation. Furthermore, broader economic conditions significantly influence consumer spending on entertainment. During economic downturns, discretionary spending on concert tickets and live events may decrease, affecting LYV's profitability.

- Global reach and diverse revenue streams: LYV's global presence and diversified business model provide some resilience against regional economic fluctuations.

- Dependence on large-scale events and economic fluctuations: The company's performance is intrinsically linked to the success of large-scale events and the overall economic climate.

- Technological advancements and their impact on ticketing and fan engagement: Live Nation's ability to adapt to and leverage technological advancements in ticketing and fan engagement will be key to future growth.

- Competition within the entertainment industry: The live entertainment industry is competitive, with various players vying for market share.

Investment Strategies for Conservative Investors (Low-Risk)

For conservative investors prioritizing capital preservation, diversification is paramount. Including Live Nation Entertainment stock (LYV) in a portfolio should be approached cautiously. A conservative strategy would involve incorporating LYV as a small component of a larger, well-diversified portfolio encompassing different asset classes. This reduces overall portfolio risk. Dollar-cost averaging (DCA) is a recommended strategy. DCA involves investing a fixed amount of money at regular intervals, regardless of the stock price. This mitigates the risk of investing a large sum at a market peak.

- Diversify across different asset classes (bonds, real estate, etc.): Spread your investments across various asset classes to reduce the impact of any single investment's underperformance.

- Allocate a small percentage of your portfolio to LYV: Limit your exposure to LYV to a small percentage of your overall portfolio, aligning with your risk tolerance.

- Implement a dollar-cost averaging strategy for gradual investment: Invest regularly, regardless of short-term price fluctuations, to minimize risk.

- Regularly review and adjust your portfolio based on market conditions: Periodically reassess your investment strategy and make adjustments as needed based on market changes and your financial goals.

Investment Strategies for Moderate Investors (Medium-Risk)

Moderate investors can adopt a balanced approach, combining LYV with other stocks offering different risk profiles. This approach aims for a blend of growth and stability. Consider incorporating stocks from sectors less correlated with the entertainment industry to help diversify your portfolio. Using stop-loss orders can help limit potential losses. A stop-loss order automatically sells your shares when the price falls to a predetermined level. This helps protect against significant losses if the stock price declines unexpectedly. Investing in ETFs (Exchange-Traded Funds) or mutual funds that include LYV offers another layer of diversification.

- Balance LYV with other stocks in different sectors: Diversify across various sectors to reduce risk and potentially enhance returns.

- Utilize stop-loss orders to protect against significant losses: Set stop-loss orders to mitigate potential downside risk.

- Consider investing in ETFs or mutual funds that hold LYV: This provides diversification within a single investment.

- Monitor market trends and adjust your holdings accordingly: Stay informed about market conditions and adjust your portfolio as needed.

Analyzing LYV's Financial Performance and Future Outlook

Before investing in LYV, conducting thorough fundamental analysis is essential. This involves examining LYV's financial statements, including income statements, balance sheets, and cash flow statements. Analyze key metrics like revenue growth, profit margins, debt levels, and return on equity. Assess the company's competitive landscape and identify potential threats and opportunities. Consider macroeconomic factors like inflation and potential recessions, as these can impact consumer spending on entertainment.

- Review LYV’s earnings reports and financial statements: Scrutinize the company's financial performance to understand its profitability and financial health.

- Analyze industry trends and competitive landscape: Identify emerging trends and potential competitive threats within the live entertainment industry.

- Assess the impact of macroeconomic factors (e.g., inflation, recession): Understand how broader economic conditions could influence LYV's performance.

Investment Strategies for Aggressive Investors (High-Risk)

Aggressive investors with a higher risk tolerance might consider a larger allocation to LYV stock. This approach aims for potentially higher returns, but also accepts the possibility of significant losses. A well-defined investment plan is crucial. Thoroughly understand the inherent risks associated with this strategy. For highly experienced and knowledgeable investors, options trading could be considered. However, this is a complex strategy with high risk and is only suitable for those with a deep understanding of options trading and risk management techniques. Always remember that options trading involves significant potential for losses.

- Higher allocation to LYV within a well-defined investment plan: Increase your exposure to LYV, but only within a broader investment strategy that aligns with your overall risk tolerance.

- Thorough understanding of market risks and potential for losses: Acknowledge and accept the possibility of substantial losses.

- Consider options trading (only with comprehensive knowledge and risk management): Options trading is a sophisticated strategy that should only be undertaken by experienced investors with a strong understanding of risk management.

- Actively monitor market changes and adjust your strategy accordingly: Regularly review your investment performance and adapt your strategy based on market conditions.

Conclusion

Investing in Live Nation Entertainment Stock (LYV) offers exciting opportunities but demands a strategic approach aligned with your individual risk tolerance. Whether you’re a conservative, moderate, or aggressive investor, understanding LYV’s business model and market dynamics is crucial. By carefully assessing your risk profile and implementing the appropriate investment strategies discussed above, you can make informed decisions regarding your investment in Live Nation Entertainment stock (LYV). Remember to always conduct thorough research and consider seeking professional financial advice before making any investment decisions related to Live Nation Entertainment Stock (LYV) or any other security.

Featured Posts

-

Ertekbecsles Mennyit Er A Regi 100 Ft Osod

May 29, 2025

Ertekbecsles Mennyit Er A Regi 100 Ft Osod

May 29, 2025 -

Sobredemanda Escolar En Aragon Que Opciones Existen Para Mi Hijo

May 29, 2025

Sobredemanda Escolar En Aragon Que Opciones Existen Para Mi Hijo

May 29, 2025 -

Upcoming Horror Movie Sinners Filmed In Louisiana

May 29, 2025

Upcoming Horror Movie Sinners Filmed In Louisiana

May 29, 2025 -

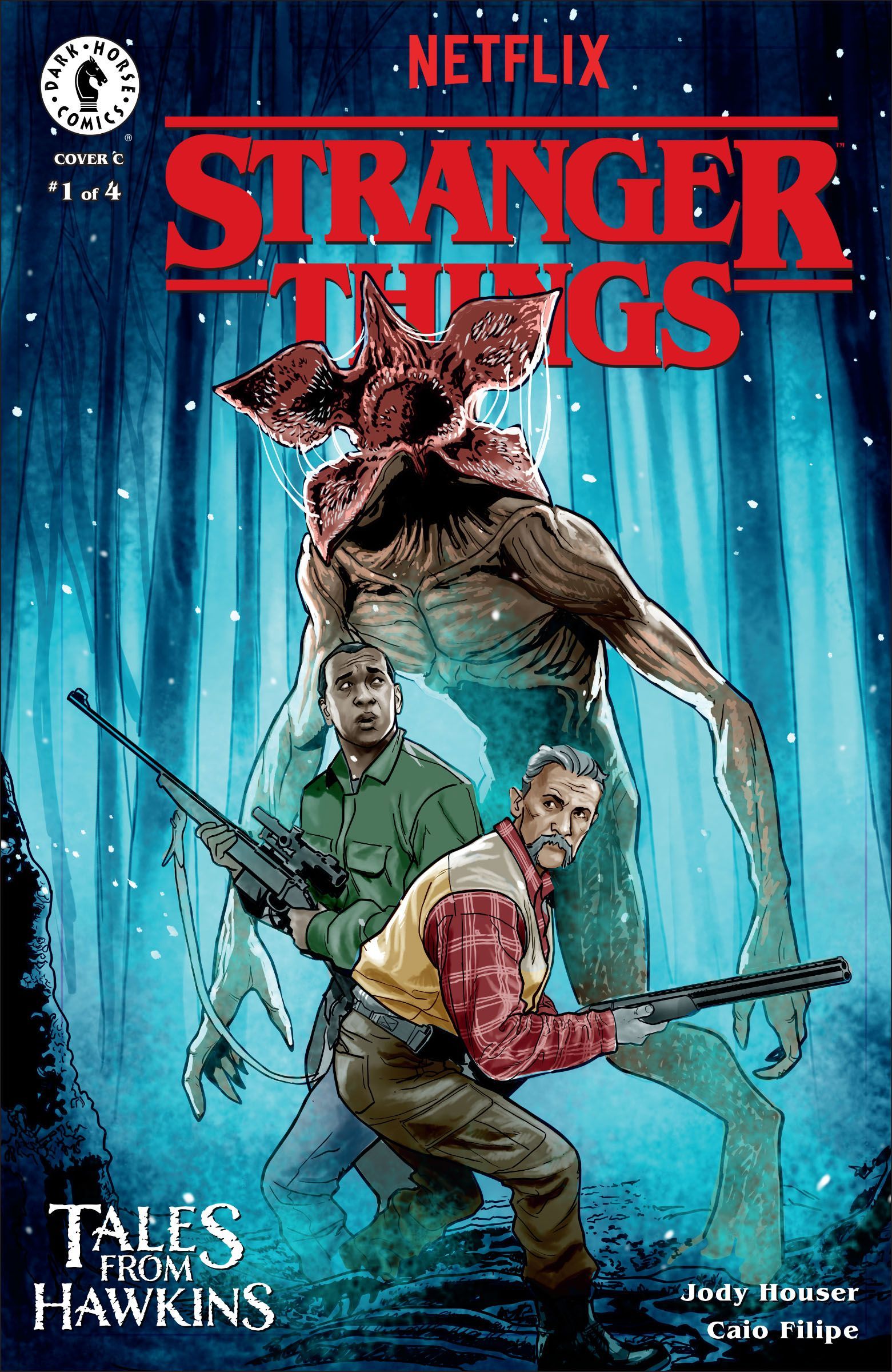

Netflixs Stranger Things Tales From 1985 Release Date And Story Details

May 29, 2025

Netflixs Stranger Things Tales From 1985 Release Date And Story Details

May 29, 2025 -

Analyzing Live Nation Entertainment Lyv Potential Returns And Risks

May 29, 2025

Analyzing Live Nation Entertainment Lyv Potential Returns And Risks

May 29, 2025

Latest Posts

-

Faktor Yang Mempengaruhi Harga Jual Kawasaki Z900 Dan Z900 Se Di Indonesia

May 30, 2025

Faktor Yang Mempengaruhi Harga Jual Kawasaki Z900 Dan Z900 Se Di Indonesia

May 30, 2025 -

Mengapa Z900 Dan Z900 Se Lebih Terjangkau Di Pasar Indonesia

May 30, 2025

Mengapa Z900 Dan Z900 Se Lebih Terjangkau Di Pasar Indonesia

May 30, 2025 -

Harga Kawasaki Z900 Dan Z900 Se Di Indonesia Penjelasannya

May 30, 2025

Harga Kawasaki Z900 Dan Z900 Se Di Indonesia Penjelasannya

May 30, 2025 -

Alasan Kawasaki Z900 Dan Z900 Se Lebih Murah Di Indonesia

May 30, 2025

Alasan Kawasaki Z900 Dan Z900 Se Lebih Murah Di Indonesia

May 30, 2025 -

Exceptional Savings R45 000 Discount On Kawasaki Ninja Bikes

May 30, 2025

Exceptional Savings R45 000 Discount On Kawasaki Ninja Bikes

May 30, 2025