Live Now, Pay Later: Is It Right For Your Budget?

Table of Contents

Understanding Live Now, Pay Later (BNPL) Services

"Live Now, Pay Later," often shortened to BNPL, encompasses various services that allow you to purchase goods and services and pay for them over time, typically in installments. These services differ significantly in their structures and associated costs.

Types of BNPL Services:

- Point-of-Sale Financing: Offered directly at the checkout of many online and brick-and-mortar retailers. This is often the most straightforward type of BNPL, with simple application processes.

- Installment Loans: These are more formal loans with a set repayment schedule and potentially higher interest rates. They might be used for larger purchases.

Key Terms:

- Interest Rates: The cost of borrowing money. Some BNPL services advertise "0% interest," but this often comes with conditions and may convert to a high rate if payments are missed.

- Fees: Late payment fees, processing fees, or other charges can significantly increase the total cost of your purchase.

- Repayment Schedules: Understand the frequency and amount of your payments to avoid falling behind.

- Credit Impact: While some BNPL providers don't report to credit bureaus, others do, and missed payments can negatively impact your credit score.

Popular BNPL Providers:

Many providers offer BNPL, such as Affirm, Klarna, Afterpay (now a part of Square), and PayPal's Pay in 4. It's crucial to compare their offerings.

Pros and Cons of BNPL Services:

| Feature | Point-of-Sale Financing | Installment Loans |

|---|---|---|

| Pros | Convenient, easy application, often 0% interest (with conditions) | Clear repayment schedule, potentially lower interest than credit cards |

| Cons | Can lead to overspending, high interest if payments are missed | Higher interest rates than some BNPL options, more formal application |

Comparison Table of Major BNPL Providers (Example - Check current rates):

| Provider | Interest Rate (Typical) | Late Fee (Typical) | Minimum Payment |

|---|---|---|---|

| Affirm | Varies depending on creditworthiness | Varies | Varies |

| Klarna | Varies depending on creditworthiness | Varies | Varies |

| Afterpay | Typically 0% if paid on time | Varies | Varies |

The Benefits of Live Now, Pay Later

BNPL offers several advantages, particularly for smaller purchases:

- Convenience and Accessibility: It simplifies the purchase process, making it easy to acquire needed items even with limited immediate funds.

- Helpful in Emergencies: Unexpected car repairs or medical bills can be easier to manage by spreading the cost.

- Improved Cash Flow: Spreading payments over time can improve short-term cash flow, preventing larger immediate outlays.

Specific Examples:

- Paying for a necessary appliance repair without depleting your savings.

- Covering unexpected medical expenses without incurring high credit card debt.

Budgeting and Expense Tracking: Some BNPL apps offer features to help track spending, offering a potential budgeting aid.

The Risks of Live Now, Pay Later

While convenient, BNPL carries significant risks:

- Debt Accumulation: Missed payments quickly lead to accumulating debt with high interest and fees.

- High Interest Rates and Fees: Late fees and unexpectedly high interest rates can significantly increase the total cost of your purchase.

- Negative Credit Impact: Missed payments can severely damage your credit score, affecting your ability to secure loans or credit in the future.

- Overspending and Impulse Purchases: The ease of BNPL can encourage overspending and impulse purchases, leading to financial strain.

Real-life Examples: Stories abound of individuals struggling with debt accumulated through irresponsible use of BNPL services.

Tips for Avoiding BNPL Debt Traps:

- Only use BNPL for essential purchases.

- Always read the terms and conditions carefully.

- Set up automatic payments to avoid late fees.

Is Live Now, Pay Later Right for You? Assessing Your Budget

Before using any pay later services, honestly assess your financial situation:

- Create a Realistic Budget: Track your income and expenses meticulously.

- Existing Debt: Understand your current debt levels and repayment obligations.

- Affordability: Can you comfortably afford the monthly payments in addition to your other financial commitments?

Checklist for Evaluating Financial Readiness for BNPL:

- Do I have a clear budget?

- Can I comfortably afford the monthly payments?

- What is my current debt level?

- What are the interest rates and fees associated with this BNPL plan?

Questions to Ask Yourself:

- Is this a need or a want?

- Can I afford this purchase outright, even if it means waiting?

- What are the consequences of missing a payment?

Alternative Financing Options: Consider a personal loan or using a credit card (if you have a good credit history and can manage your spending responsibly) as alternatives.

Conclusion: Making Informed Decisions with Live Now, Pay Later

"Live Now, Pay Later" services like buy now, pay later options offer convenience and can be helpful in specific situations. However, the risks of accumulating debt, high interest rates, and negative credit impact are significant. Responsible use requires careful budgeting, understanding the terms and conditions, and considering alternative financing options such as personal loans or traditional credit cards before opting for pay later services. Assess your financial situation thoroughly. Is buy now, pay later the right choice for your budget? Make an informed decision that protects your financial well-being.

Featured Posts

-

Foreign Office Warning Four Urgent Problems Facing Brits In Greece

May 30, 2025

Foreign Office Warning Four Urgent Problems Facing Brits In Greece

May 30, 2025 -

Steffi Graf Ehe Geheimnis Und Ungewoehnliche Freizeitaktivitaet

May 30, 2025

Steffi Graf Ehe Geheimnis Und Ungewoehnliche Freizeitaktivitaet

May 30, 2025 -

Laurent Jacobelli Actions Et Positions Politiques A L Assemblee Nationale

May 30, 2025

Laurent Jacobelli Actions Et Positions Politiques A L Assemblee Nationale

May 30, 2025 -

Holder Vejret Spaendingen Stiger Vil Danmark Blive Afvist

May 30, 2025

Holder Vejret Spaendingen Stiger Vil Danmark Blive Afvist

May 30, 2025 -

Sacramento County Wastewater Shows Measles Virus What You Need To Know

May 30, 2025

Sacramento County Wastewater Shows Measles Virus What You Need To Know

May 30, 2025

Latest Posts

-

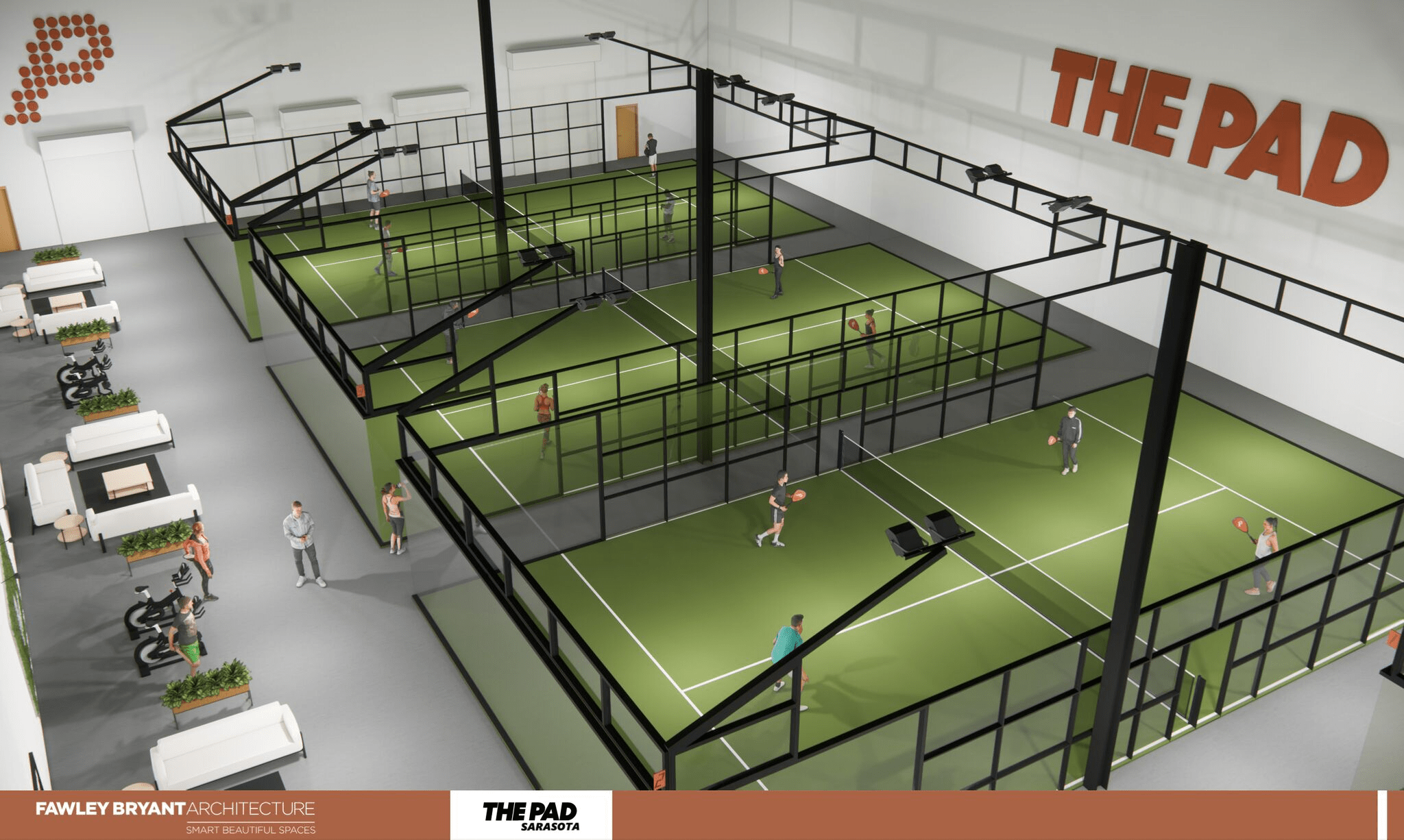

Padel Court Development Update Bannatyne Health Club Ingleby Barwick

May 31, 2025

Padel Court Development Update Bannatyne Health Club Ingleby Barwick

May 31, 2025 -

Post Dragons Den Entrepreneurs 40 Profit Growth

May 31, 2025

Post Dragons Den Entrepreneurs 40 Profit Growth

May 31, 2025 -

Chafford Hundred Health Club Secures Investment For Padel Courts

May 31, 2025

Chafford Hundred Health Club Secures Investment For Padel Courts

May 31, 2025 -

40 Profit Jump For Dragons Den Business Owner

May 31, 2025

40 Profit Jump For Dragons Den Business Owner

May 31, 2025 -

Dragon Dens Interest In New Chafford Hundred Padel Facility

May 31, 2025

Dragon Dens Interest In New Chafford Hundred Padel Facility

May 31, 2025