Live Stock Market Coverage: Bond Sell-Off, Dow Futures, Bitcoin Rally

Table of Contents

<p>The financial markets are experiencing significant shifts, with a confluence of events impacting various asset classes. Today's live stock market coverage focuses on three key areas: the ongoing bond sell-off, the performance of Dow futures, and the surprising rally in Bitcoin. Understanding these interconnected movements is crucial for investors navigating this period of market volatility. This comprehensive analysis will provide insights into these trends and offer strategies for informed decision-making in this dynamic environment.</p>

<h2>The Bond Sell-Off: Understanding the Implications</h2>

<p>The bond market is currently experiencing a significant sell-off, characterized by rising bond yields and impacting fixed-income investments. This trend is largely attributed to rising interest rates and persistent inflation concerns. Understanding the implications of this sell-off is crucial for investors across various asset classes.</p>

<ul> <li><b>Rising inflation pressures forcing central banks to increase interest rates:</b> Persistent inflation, exceeding central bank targets, necessitates interest rate hikes to cool down the economy. Higher interest rates make existing bonds less attractive, driving down their prices and pushing yields higher.</li> <li><b>Increased bond yields impacting fixed-income investments:</b> As bond yields rise, the returns on existing fixed-income investments decrease, potentially impacting portfolio performance for those heavily invested in bonds.</li> <li><b>The correlation between bond yields and stock market performance:</b> Rising bond yields can negatively impact stock market performance, as investors shift funds from equities to higher-yielding bonds. This is particularly true for growth stocks, which are more sensitive to interest rate changes.</li> <li><b>Potential impact on future economic growth:</b> Aggressive interest rate hikes, while aimed at curbing inflation, could potentially stifle economic growth by increasing borrowing costs for businesses and consumers.</li> <li><b>Strategies for mitigating bond market risk:</b> Investors can mitigate risk by diversifying their portfolios, considering shorter-term bonds, or exploring inflation-protected securities (TIPS).</li> </ul>

<h2>Dow Futures and the State of Equities</h2>

<p>Dow futures contracts offer a glimpse into the anticipated performance of the Dow Jones Industrial Average, a key indicator of the broader equity market. Analyzing these futures is vital for understanding current market sentiment and predicting potential future trends. The interplay between economic data, geopolitical events, and company earnings significantly influences Dow futures movements.</p>

<ul> <li><b>Current Dow futures prices and their relationship to the Dow Jones Industrial Average:</b> Dow futures prices often precede actual Dow Jones movements, providing a valuable forecasting tool for short-term market trends. A rise in futures suggests optimism, while a decline indicates bearish sentiment.</li> <li><b>Factors driving Dow futures movements (e.g., economic data, geopolitical events, company earnings):</b> Macroeconomic factors like inflation reports, interest rate decisions, and GDP growth significantly affect investor confidence and consequently, Dow futures. Geopolitical events and corporate earnings also play crucial roles.</li> <li><b>Analysis of market sentiment: bullish, bearish, or neutral:</b> Analyzing the movement of Dow futures helps gauge prevailing market sentiment. Strong upward trends suggest bullishness, while persistent declines point towards bearishness.</li> <li><b>Predictions for the Dow Jones Industrial Average based on futures performance:</b> While not foolproof, Dow futures provide valuable insights into the likely direction of the Dow Jones Industrial Average in the near term.</li> <li><b>Strategies for investing in equities during market volatility:</b> During periods of volatility, a diversified portfolio, a long-term investment horizon, and a disciplined approach are crucial for mitigating risk in the equity market.</li> </ul>

<h2>Bitcoin's Unexpected Rally: A Deeper Dive</h2>

<p>Bitcoin's recent price surge stands in contrast to the downturn in traditional markets. This rally is a complex phenomenon driven by a confluence of factors, including institutional adoption, macroeconomic conditions, and technological advancements. However, the cryptocurrency market remains highly volatile.</p>

<ul> <li><b>Reasons for Bitcoin's rally (e.g., institutional adoption, macroeconomic factors, technological advancements):</b> Increased institutional investment, the perception of Bitcoin as a hedge against inflation, and ongoing development within the blockchain technology ecosystem all contribute to Bitcoin's price fluctuations.</li> <li><b>Bitcoin's volatility and its potential for both significant gains and losses:</b> Bitcoin's price is known for its extreme volatility. Investors should be prepared for both substantial gains and significant losses.</li> <li><b>Comparison of Bitcoin's performance to other cryptocurrencies:</b> While Bitcoin often leads the cryptocurrency market, its performance isn't always perfectly correlated with other digital assets. Diversification within the crypto space is important.</li> <li><b>The role of regulation and its potential impact on Bitcoin's price:</b> Regulatory clarity and adoption can significantly influence Bitcoin's price, potentially leading to increased institutional investment and stability.</li> <li><b>Strategies for investing in and managing risk in the cryptocurrency market:</b> Risk management in the cryptocurrency market requires careful due diligence, diversification, and a tolerance for high volatility. Only invest what you can afford to lose.</li> </ul>

<h2>Conclusion</h2>

<p>This live stock market coverage highlighted the interconnectedness of various asset classes, showcasing the bond sell-off, Dow futures performance, and Bitcoin's unexpected rally. Understanding these market dynamics is crucial for informed investment decisions. The interplay between these different asset classes demonstrates the complexity of modern finance and the importance of staying informed.</p>

<p>Stay informed on the latest market trends with our comprehensive live stock market coverage. Subscribe to our newsletter for daily updates on bond markets, Dow futures, Bitcoin, and other crucial financial news to refine your investment strategies and navigate market volatility effectively. Don't miss out on vital live stock market coverage – subscribe today!</p>

Featured Posts

-

Intikami Hizli Ve Sert Olan Burclar

May 24, 2025

Intikami Hizli Ve Sert Olan Burclar

May 24, 2025 -

La Lutte Contre La Dissidence Chinoise En France

May 24, 2025

La Lutte Contre La Dissidence Chinoise En France

May 24, 2025 -

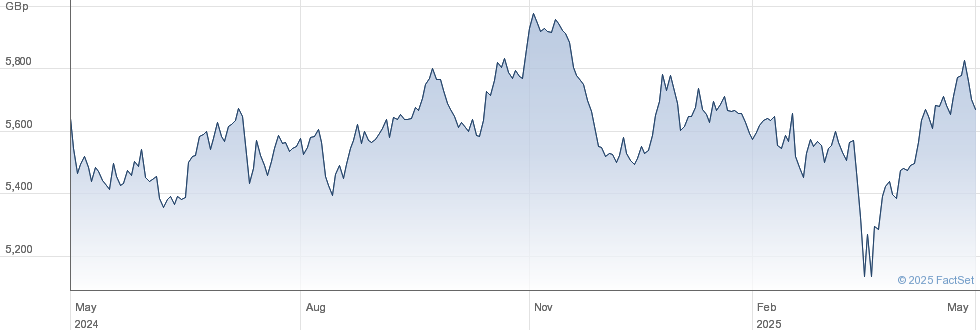

Tracking The Daily Net Asset Value Nav Of The Amundi Msci World Catholic Principles Ucits Etf

May 24, 2025

Tracking The Daily Net Asset Value Nav Of The Amundi Msci World Catholic Principles Ucits Etf

May 24, 2025 -

Tu Horoscopo Semana Del 4 Al 10 De Marzo De 2025 Todos Los Signos

May 24, 2025

Tu Horoscopo Semana Del 4 Al 10 De Marzo De 2025 Todos Los Signos

May 24, 2025 -

Brest Urban Trail Benevoles Artistes Et Partenaires Au Coeur De La Course

May 24, 2025

Brest Urban Trail Benevoles Artistes Et Partenaires Au Coeur De La Course

May 24, 2025

Latest Posts

-

Bjk Cup Final Kazakhstan Through Australia Eliminated

May 24, 2025

Bjk Cup Final Kazakhstan Through Australia Eliminated

May 24, 2025 -

Kazakhstan Triumphs Australias Bjk Cup Run Ends

May 24, 2025

Kazakhstan Triumphs Australias Bjk Cup Run Ends

May 24, 2025 -

Kazakhstan Triumfalnoe Vozvraschenie V Final Kubka Billi Dzhin King

May 24, 2025

Kazakhstan Triumfalnoe Vozvraschenie V Final Kubka Billi Dzhin King

May 24, 2025 -

Madrid Open Andreescu Secures Second Round Berth

May 24, 2025

Madrid Open Andreescu Secures Second Round Berth

May 24, 2025 -

Australia Misses Bjk Cup Finals Kazakhstan Advances

May 24, 2025

Australia Misses Bjk Cup Finals Kazakhstan Advances

May 24, 2025