Live Stock Market Updates: China Tariffs And UK Trade Deal Fallout

Table of Contents

The Impact of China Tariffs on Global Markets

Escalating trade tensions between the US and China continue to significantly impact global markets. The imposition of tariffs has created a complex web of consequences, rippling through supply chains and impacting investor confidence. Keywords: China Tariffs, Trade War, Supply Chain Disruptions, Inflation, Stock Market Volatility

-

Escalating trade tensions: The ongoing trade war between the US and China has led to a series of tit-for-tat tariff increases, disrupting established trade relationships and creating uncertainty in the market. This uncertainty is a major driver of stock market volatility.

-

Supply chain disruptions: Tariffs have forced companies to reconsider their global supply chains, leading to delays, increased costs, and in some cases, relocation of manufacturing facilities. This disruption adds to inflationary pressures and reduces corporate profitability.

-

Inflationary pressures: Increased tariffs directly translate to higher prices for consumers. This can lead to reduced consumer spending and overall economic slowdown, negatively impacting various sectors of the stock market.

-

Sectoral vulnerability: Certain sectors, particularly technology and manufacturing, are disproportionately vulnerable to the impacts of tariffs. Companies heavily reliant on Chinese components or markets face significant challenges in maintaining profitability.

-

Market performance analysis: Recent market performance clearly demonstrates a correlation between tariff announcements and stock market fluctuations. Periods of heightened trade tensions are often accompanied by increased market volatility and decreased investor confidence.

Mitigating the Risks of China Tariffs

Navigating the complexities of China tariffs requires a proactive and diversified investment strategy. Keywords: Risk Management, Diversification, Investment Strategy, Portfolio Optimization

-

Diversification: Diversifying investments across different sectors and geographies is crucial to reduce exposure to China-related risks. Investing in companies less reliant on the US-China trade relationship can help mitigate potential losses.

-

Monitoring market developments: Closely monitoring news and developments concerning US-China trade relations is essential. Staying informed about any new tariff announcements or policy changes allows for timely adjustments to investment strategies.

-

Supply chain resilience: Investing in companies with strong and diversified supply chains can provide a buffer against disruptions caused by tariffs. Businesses that have successfully adapted to the changing trade landscape are better positioned for long-term success.

-

Hedging strategies: Utilizing hedging strategies, such as options or futures contracts, can help mitigate potential losses from tariff-related market fluctuations. These strategies allow investors to protect their portfolios against adverse market movements.

Analyzing the Fallout from the UK Trade Deal

The UK's departure from the European Union and subsequent trade deals have introduced both opportunities and challenges for investors. Keywords: UK Trade Deal, Brexit, Economic Uncertainty, Post-Brexit Economy, Investment Opportunities

-

Post-Brexit economic landscape: The UK's new trade agreements have redefined its economic relationships, creating a new and uncertain landscape for businesses and investors. This requires a thorough understanding of the new rules and regulations governing trade.

-

Sectoral impact: The impact of new trade rules varies significantly across different sectors of the UK economy. Some sectors may benefit from increased access to new markets, while others may face challenges due to altered trade relationships.

-

EU and global partnerships: Changes in trade relationships with the EU and other global partners will have a profound impact on the UK economy. Investors need to carefully assess these changes and their potential implications for their portfolios.

-

Investment opportunities: Despite the uncertainties, the post-Brexit landscape also presents potential investment opportunities. Companies adapting to the new environment and capitalizing on new trade agreements may offer attractive investment prospects.

-

Long-term economic effects: The long-term effects of the UK trade deal on economic growth and stability remain uncertain. Careful analysis and monitoring are crucial for making informed investment decisions.

Navigating the UK Trade Deal’s Uncertainties

Successfully navigating the uncertainties surrounding the UK trade deal requires meticulous analysis and careful decision-making. Keywords: Market Analysis, Due Diligence, Investment Decisions, Economic Forecasting

-

Due diligence: Conducting thorough due diligence before making any investment decisions in UK-based companies is paramount. This involves assessing the company's financial health, its exposure to Brexit-related risks, and its adaptation strategies.

-

Risk assessment: Carefully assessing the potential risks and rewards associated with investing in the post-Brexit UK economy is crucial. Understanding the potential downsides is just as important as recognizing opportunities.

-

Economic forecasts: Staying updated on economic forecasts and analyses related to the UK trade deal's impact can help inform investment strategies. Monitoring reputable economic sources provides valuable insights into future trends.

-

Market volatility: Investors should be prepared for increased volatility in the UK stock market in the short term, as the long-term effects of the trade deal unfold. A robust investment strategy should account for these potential fluctuations.

Live Stock Market Updates and Investment Strategies

Developing a well-defined investment strategy is vital for navigating the current market environment. Keywords: Investment Strategy, Portfolio Management, Risk Tolerance, Long-Term Investing, Short-Term Trading

-

Strategic planning: A robust investment strategy should align with your risk tolerance and long-term financial goals. This includes defining your investment objectives and determining your acceptable level of risk.

-

Market monitoring: Regularly monitoring live stock market updates is essential for adapting your strategy as needed. Staying informed about current market trends allows for timely adjustments to your portfolio.

-

Long-term vs. short-term: Consider both long-term investing and short-term trading opportunities, based on your preferences and risk profile. A balanced approach may be suitable for mitigating risks and capturing potential gains.

-

Professional advice: Seeking professional financial advice can be beneficial, particularly when navigating the complexities of the current market conditions. A financial advisor can offer personalized guidance and support.

-

Utilizing resources: Utilizing various financial tools and resources, such as financial news websites, market analysis platforms, and investment research reports, can enhance your understanding of market trends.

Conclusion

The current global economic climate, shaped by China tariffs and the UK trade deal fallout, necessitates a vigilant and adaptable approach to investment. By closely monitoring live stock market updates, understanding the intricacies of these global events, and employing sound risk management strategies, investors can navigate these challenging times and potentially capitalize on emerging opportunities. Stay informed, stay adaptable, and leverage the available resources to make informed decisions in this dynamic market. Remember to regularly check for the latest live stock market updates to stay ahead of the curve.

Featured Posts

-

Shevchenkos Ufc 315 Challenge Fiorot And The Retirement Question

May 11, 2025

Shevchenkos Ufc 315 Challenge Fiorot And The Retirement Question

May 11, 2025 -

Mc Gregor At Bkfc A Repeat Of The Famous Aldo Press Conference Showdown

May 11, 2025

Mc Gregor At Bkfc A Repeat Of The Famous Aldo Press Conference Showdown

May 11, 2025 -

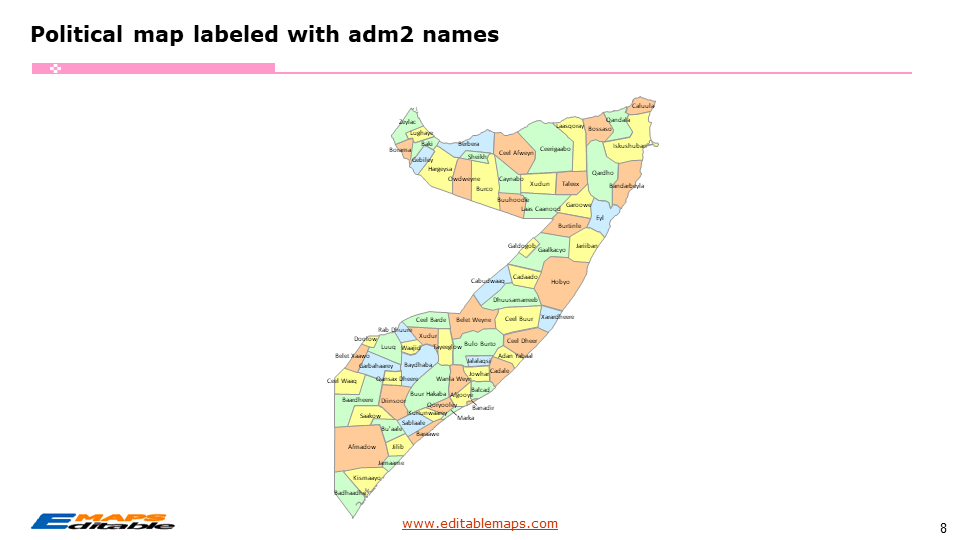

Jowhar Somali News Rory Mc Ilroys Daughters Golf Moment

May 11, 2025

Jowhar Somali News Rory Mc Ilroys Daughters Golf Moment

May 11, 2025 -

Analyzing Chaplins Impact On Ipswich Towns Wins

May 11, 2025

Analyzing Chaplins Impact On Ipswich Towns Wins

May 11, 2025 -

Jamaica Observer Grand Slam Delight

May 11, 2025

Jamaica Observer Grand Slam Delight

May 11, 2025