Low Inflation Podcast: Strategies For The Present

Table of Contents

Understanding the Current Low Inflation Landscape

Defining Low Inflation and its Impact

Low inflation, generally defined as a sustained rate of price increases below 2%, has significant implications for consumers and businesses. While seemingly positive, low inflation can have both positive and negative consequences.

- Impact on Savings: Low inflation means your savings retain their purchasing power longer, but also yields lower returns on traditional savings accounts.

- Borrowing Costs: Low inflation typically translates to low-interest rates, making borrowing more attractive for large purchases like homes or for business expansion.

- Investment Returns: Low inflation can lead to lower returns on certain investments, prompting investors to seek out alternative options with higher potential yields.

- Consumer Spending: Low inflation might stimulate consumer spending as goods and services remain relatively affordable, but this effect can be dampened by economic uncertainty.

Keywords: low inflation rates, deflationary pressures, stagflation, economic growth, interest rates

Analyzing the Causes of Low Inflation

Several factors contribute to the current low inflation environment. Understanding these factors is crucial for informed financial decision-making.

- Global Economic Slowdown: Global economic slowdowns often reduce demand, putting downward pressure on prices. Supply chain issues further exacerbate this effect.

- Technological Advancements: Technological innovation can increase efficiency and productivity, leading to lower production costs and consequently, lower prices.

- Changing Consumer Behavior: Shifting consumer preferences and increased price sensitivity can also contribute to lower inflation.

- Government Policies: Monetary and fiscal policies implemented by governments play a critical role in managing inflation. For example, central banks can manipulate interest rates to influence inflation.

Keywords: supply chain issues, global trade, monetary policy, fiscal policy, commodity prices

Strategies for Protecting Your Finances in a Low Inflation Environment

Smart Savings and Investment Strategies

Preserving and growing wealth during periods of low inflation requires a strategic approach to savings and investments. Diversification is key to mitigating risk.

- Diversification of Investments: Spread your investments across different asset classes (stocks, bonds, real estate) to reduce overall risk and potentially increase returns.

- Inflation-Protected Securities (TIPS): Treasury Inflation-Protected Securities (TIPS) are designed to protect investors from inflation, offering a hedge against rising prices.

- Real Estate Investment: Real estate can be a good inflation hedge, as property values often rise with inflation.

- Alternative Investments: Consider alternative investments such as commodities, precious metals, or private equity, but remember these often carry higher risk.

Keywords: investment portfolio, risk management, asset allocation, diversification, long-term investments, inflation-adjusted returns

Budgeting and Debt Management

Effective personal finance management is critical during any economic climate. Low inflation doesn’t negate the importance of responsible budgeting and debt reduction.

- Creating a Realistic Budget: Track your income and expenses meticulously to identify areas for savings and efficient resource allocation.

- Paying Down High-Interest Debt: Prioritize paying down high-interest debt to minimize financial burden and free up cash flow.

- Negotiating Better Interest Rates: Explore options to negotiate lower interest rates on existing debts, reducing your monthly payments.

- Exploring Debt Consolidation Options: Consider consolidating high-interest debts into a lower-interest loan to simplify payments and potentially reduce overall interest costs.

Keywords: personal finance, budgeting tips, debt reduction, financial literacy, credit score

Opportunities Presented by a Low Inflation Environment

Investing in Growth Sectors

Even in a low-inflation environment, certain sectors are poised for growth. Identifying these areas can provide attractive investment opportunities.

- Technology: The technology sector continues to innovate and expand, offering strong growth potential.

- Healthcare: Aging populations and advancements in medical technology drive consistent growth in the healthcare sector.

- Renewable Energy: The transition to renewable energy sources presents significant investment opportunities.

- Certain Consumer Goods: Essential consumer goods often maintain demand even during economic downturns.

Keywords: growth stocks, sector rotation, long-term growth, emerging markets, sustainable investments

Leveraging Low Interest Rates

Low interest rates can be strategically leveraged for personal and business gains.

- Home Buying: Low mortgage rates make home buying more affordable, potentially increasing wealth through property appreciation.

- Business Expansion: Businesses can benefit from low-interest business loans to expand operations and invest in growth.

- Refinancing Existing Debts: Refinancing existing debts with lower interest rates can significantly reduce the overall cost of borrowing.

Keywords: mortgage rates, business loans, refinancing, low-interest loans, capital expenditure

Conclusion: Staying Ahead with a Low Inflation Podcast and Strategies

Navigating a low inflation environment requires proactive financial planning, diversified investments, and careful debt management. By understanding the underlying economic forces and implementing the strategies outlined above, you can protect your financial well-being and even capitalize on emerging opportunities. Remember, staying informed is key to adapting to changing economic conditions.

To gain further insights and practical advice on navigating the current economic landscape, we strongly encourage you to listen to our "Low Inflation Podcast," a valuable resource designed to help you make informed financial decisions. [Insert Podcast Link Here] This low inflation strategies podcast provides expert analysis and actionable steps for building a resilient financial future in the current climate. Listen now and take control of your financial destiny! This podcast on economic planning will help you confidently navigate this evolving financial world. A financial podcast for the current climate is vital for staying informed! Remember, remaining informed and adaptable is crucial in uncertain economic times.

Featured Posts

-

Avrupa Merkez Bankasi Abd Vergilerindeki Degisimlere Iliskin Kritik Uyari

May 27, 2025

Avrupa Merkez Bankasi Abd Vergilerindeki Degisimlere Iliskin Kritik Uyari

May 27, 2025 -

Where To Watch 1923 Season 2 Episode 5 For Free Tonight

May 27, 2025

Where To Watch 1923 Season 2 Episode 5 For Free Tonight

May 27, 2025 -

American Jewish Congress Weighs In Cuomo Endorsed Lander And Mamdani Criticized In Nyc Mayoral Race

May 27, 2025

American Jewish Congress Weighs In Cuomo Endorsed Lander And Mamdani Criticized In Nyc Mayoral Race

May 27, 2025 -

Potential Canada Post Strike A Customer Exodus

May 27, 2025

Potential Canada Post Strike A Customer Exodus

May 27, 2025 -

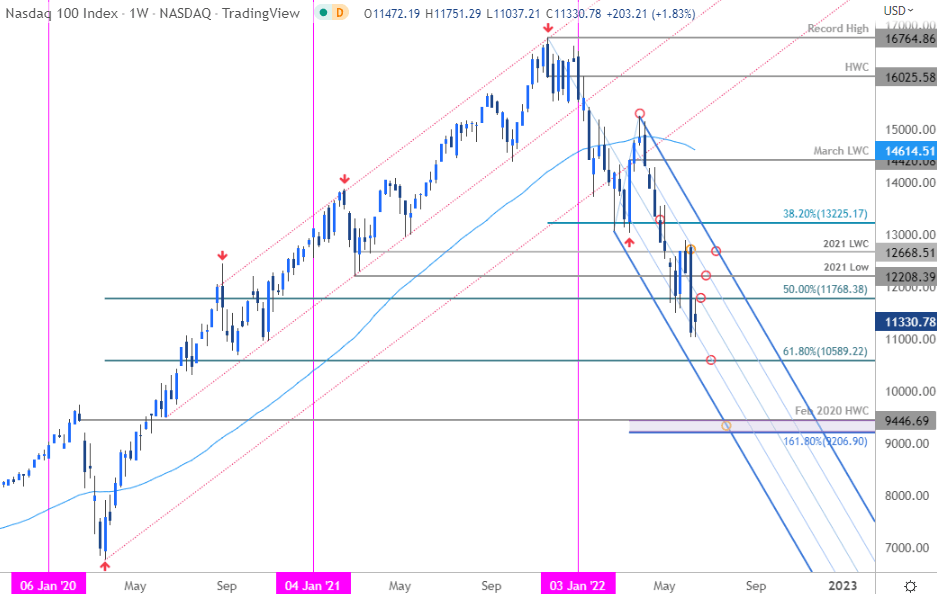

Dow Jones S And P 500 And Nasdaq Stock Market Summary For May 26

May 27, 2025

Dow Jones S And P 500 And Nasdaq Stock Market Summary For May 26

May 27, 2025

Latest Posts

-

Selling Sunset Star Exposes La Landlord Price Gouging Amidst Fires

May 30, 2025

Selling Sunset Star Exposes La Landlord Price Gouging Amidst Fires

May 30, 2025 -

Portugals President To Consult Parties Before Appointing Prime Minister

May 30, 2025

Portugals President To Consult Parties Before Appointing Prime Minister

May 30, 2025 -

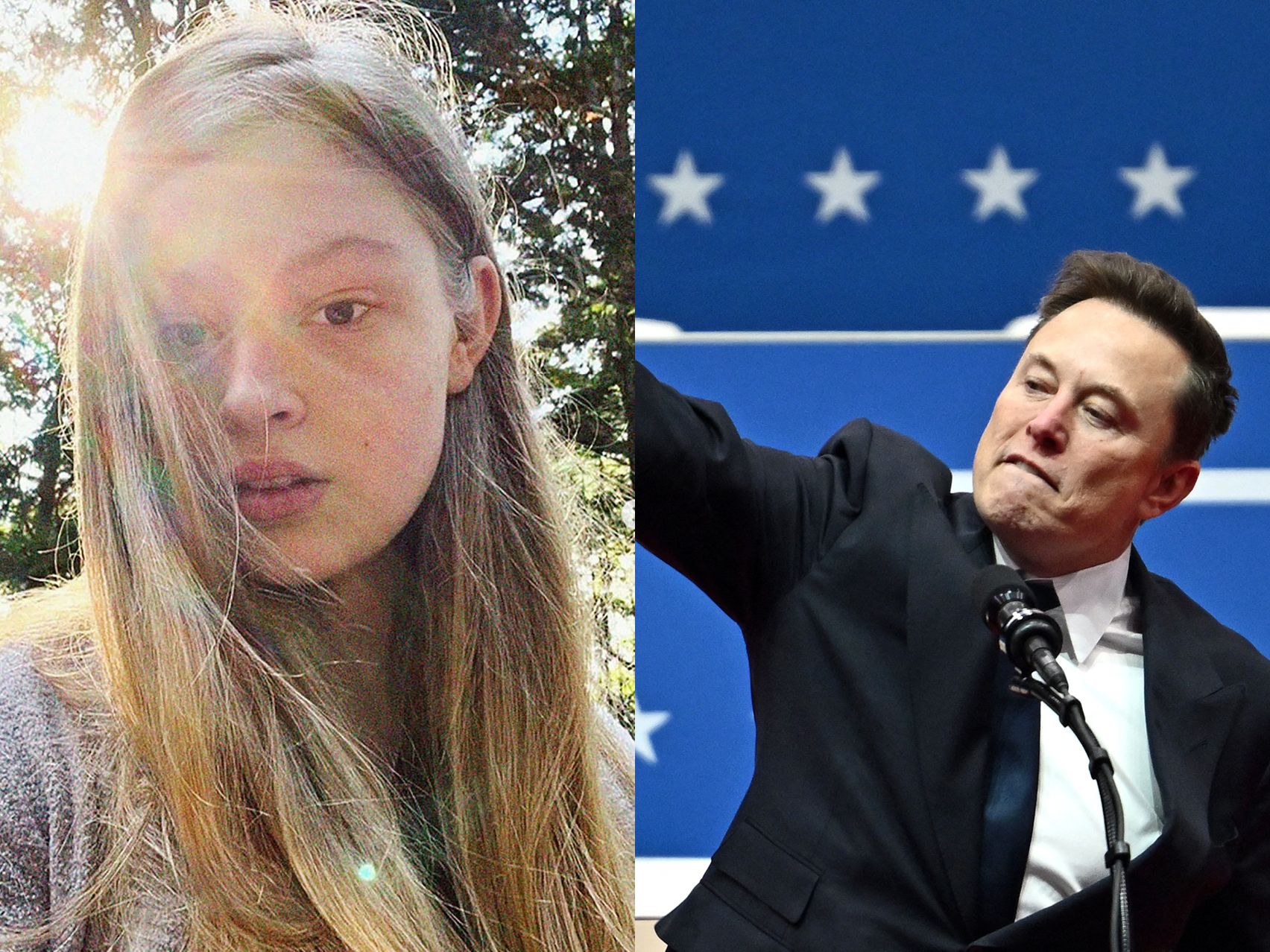

Elon Musks Daughters New Career A Closer Look

May 30, 2025

Elon Musks Daughters New Career A Closer Look

May 30, 2025 -

From Silicon Valley To Runway Vivian Musks Journey

May 30, 2025

From Silicon Valley To Runway Vivian Musks Journey

May 30, 2025 -

Analysis Of Vivian Jenna Wilsons Modeling Debut And Family Life

May 30, 2025

Analysis Of Vivian Jenna Wilsons Modeling Debut And Family Life

May 30, 2025