Low Personal Loan Interest Rates Today: Secure Financing Starting At 6%

Table of Contents

Are you searching for low personal loan interest rates today? Securing affordable financing can be challenging, but with careful research and comparison, you can find rates as low as 6%. This article will guide you through the process of finding the best personal loan interest rates for your financial needs, helping you make informed decisions and achieve your financial goals. We'll cover everything from understanding the factors that affect interest rates to the application process, empowering you to get the best possible deal.

Understanding Personal Loan Interest Rates

Factors Affecting Interest Rates

Several factors influence the interest rate you'll receive on a personal loan. Understanding these factors is crucial for securing a low rate.

-

Credit Score: Your credit score is a major factor. A higher credit score (typically 700 or above) significantly increases your chances of qualifying for lower interest rates. Lenders view individuals with excellent credit history as less risky. Improving your credit score before applying is highly recommended.

-

Loan Amount: Generally, larger loan amounts may come with slightly higher interest rates. Lenders perceive larger loans as carrying more risk.

-

Loan Term: The length of your loan term affects both your monthly payments and the total interest you pay. A shorter loan term (e.g., 12 months) means higher monthly payments but lower overall interest. A longer term (e.g., 60 months) results in lower monthly payments but significantly more interest paid over the life of the loan.

-

Lender Type: Different lenders offer varying interest rates. Banks, credit unions, and online lenders each have their own lending criteria and pricing structures. Shop around and compare offers from multiple lenders to find the best rates. Credit unions often offer more competitive rates for their members.

-

Debt-to-Income Ratio (DTI): Your DTI, calculated by dividing your monthly debt payments by your gross monthly income, impacts your eligibility for a loan and the interest rate offered. A lower DTI demonstrates greater financial responsibility, leading to potentially lower rates.

Types of Personal Loans and Their Interest Rates

The type of personal loan you choose also impacts the interest rate.

-

Secured Loans: Secured loans require collateral, such as a car or savings account. This collateral reduces the risk for the lender, resulting in typically lower interest rates compared to unsecured loans.

-

Unsecured Loans: Unsecured loans don't require collateral. Because they carry a higher risk for lenders, they typically come with higher interest rates.

-

Debt Consolidation Loans: If you have multiple high-interest debts, a debt consolidation loan can help you lower your overall interest payments by combining them into a single loan with a potentially lower interest rate.

Finding the Best Low Personal Loan Interest Rates Today

Comparing Lenders

Finding the best low personal loan interest rates requires diligent comparison shopping.

-

Use Online Comparison Tools: Many websites offer free personal loan comparison tools. These tools allow you to quickly compare offers from multiple lenders based on your criteria.

-

Check Interest Rates, Fees, and Repayment Terms: Don't just focus on the interest rate. Carefully review all fees associated with the loan, including origination fees, late payment fees, and prepayment penalties. Also compare the repayment terms to find a loan that fits your budget.

-

Read Reviews and Compare Customer Experiences: Before applying, read online reviews and compare customer experiences with different lenders. This can help you identify lenders with excellent customer service and transparent practices.

Improving Your Credit Score

Improving your credit score before applying for a loan can significantly impact the interest rate you'll receive.

-

Pay Bills on Time: Paying all your bills on time is crucial for maintaining a good credit history. Even one missed payment can negatively impact your score.

-

Reduce Your Credit Utilization Ratio: Keep your credit card balances low (ideally below 30% of your total credit limit) to improve your credit utilization ratio.

-

Dispute Any Errors on Your Credit Report: Regularly check your credit report for any errors and dispute them with the credit bureaus if necessary.

Negotiating Interest Rates

Don't be afraid to negotiate the interest rate offered by a lender.

-

Shop Around and Use Competing Offers: Having offers from multiple lenders gives you leverage to negotiate a lower interest rate.

-

Consider Bundling Financial Products: Some lenders offer discounts on interest rates if you bundle other financial products, such as checking accounts or savings accounts, with your loan.

Eligibility and Application Process for Personal Loans

Eligibility Requirements

To qualify for a personal loan, you'll generally need to meet certain eligibility requirements.

-

Minimum Credit Score: Lenders have varying minimum credit score requirements. A higher credit score increases your chances of approval and better rates.

-

Stable Income and Employment History: Lenders typically require proof of stable income and a consistent employment history to ensure you can repay the loan.

-

Age Restrictions: There may be age restrictions, depending on the lender and the loan type.

The Application Process

The application process for a personal loan is typically straightforward.

-

Complete an Online Application or Visit a Branch: Many lenders offer online application portals for convenience. Alternatively, you can visit a local branch to apply in person.

-

Provide Necessary Documentation: You'll need to provide documentation to verify your income, identity, and employment history. This may include pay stubs, tax returns, and identification documents.

-

Wait for Approval and Receive the Loan Funds: Once your application is processed, you'll receive a decision regarding approval. If approved, the loan funds will be disbursed according to the lender's terms.

Conclusion

Securing low personal loan interest rates today requires diligent research and comparison. By understanding the factors that influence interest rates, comparing lenders, and improving your credit score, you can significantly increase your chances of obtaining financing at a competitive rate, potentially starting as low as 6%. Don't settle for high interest; take control of your finances and find the best low personal loan interest rates for your needs. Apply today and secure your affordable financing!

Featured Posts

-

Tyrese Haliburton Injury Latest Update Before Bulls Pacers Game

May 28, 2025

Tyrese Haliburton Injury Latest Update Before Bulls Pacers Game

May 28, 2025 -

Decoding Taylor Swifts Easter Eggs Whats The Memorial Day Surprise

May 28, 2025

Decoding Taylor Swifts Easter Eggs Whats The Memorial Day Surprise

May 28, 2025 -

Man Utd Transfer News Is A 50m Player Leaving Old Trafford

May 28, 2025

Man Utd Transfer News Is A 50m Player Leaving Old Trafford

May 28, 2025 -

Affordable Rent Protections Potential Rollback And Market Impact

May 28, 2025

Affordable Rent Protections Potential Rollback And Market Impact

May 28, 2025 -

Is Tyrese Haliburton Playing Tonight Bulls Pacers Injury News

May 28, 2025

Is Tyrese Haliburton Playing Tonight Bulls Pacers Injury News

May 28, 2025

Latest Posts

-

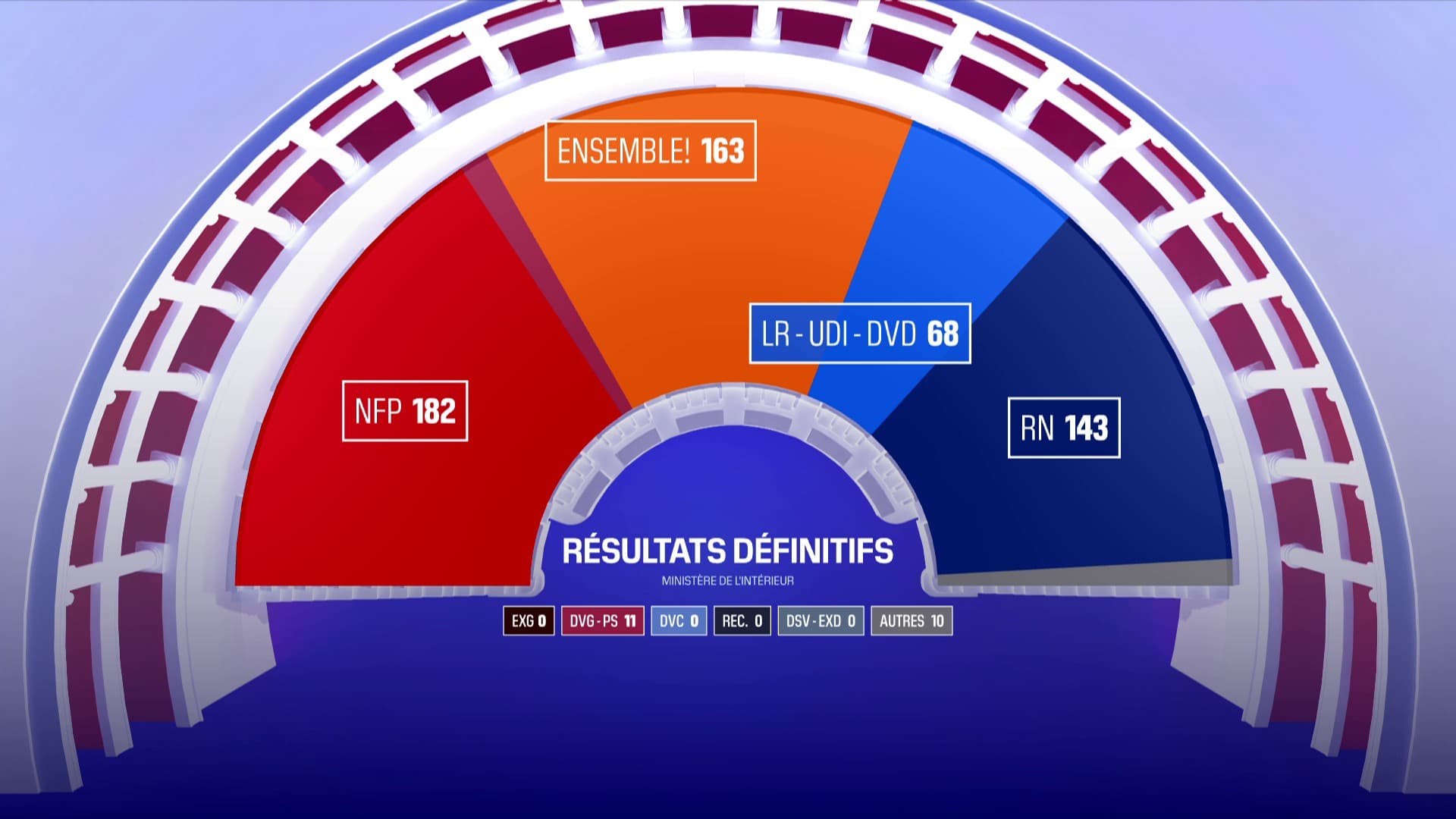

Rn Et Lfi A L Assemblee Nationale Un Bras De Fer Sur La Question Des Frontieres

May 30, 2025

Rn Et Lfi A L Assemblee Nationale Un Bras De Fer Sur La Question Des Frontieres

May 30, 2025 -

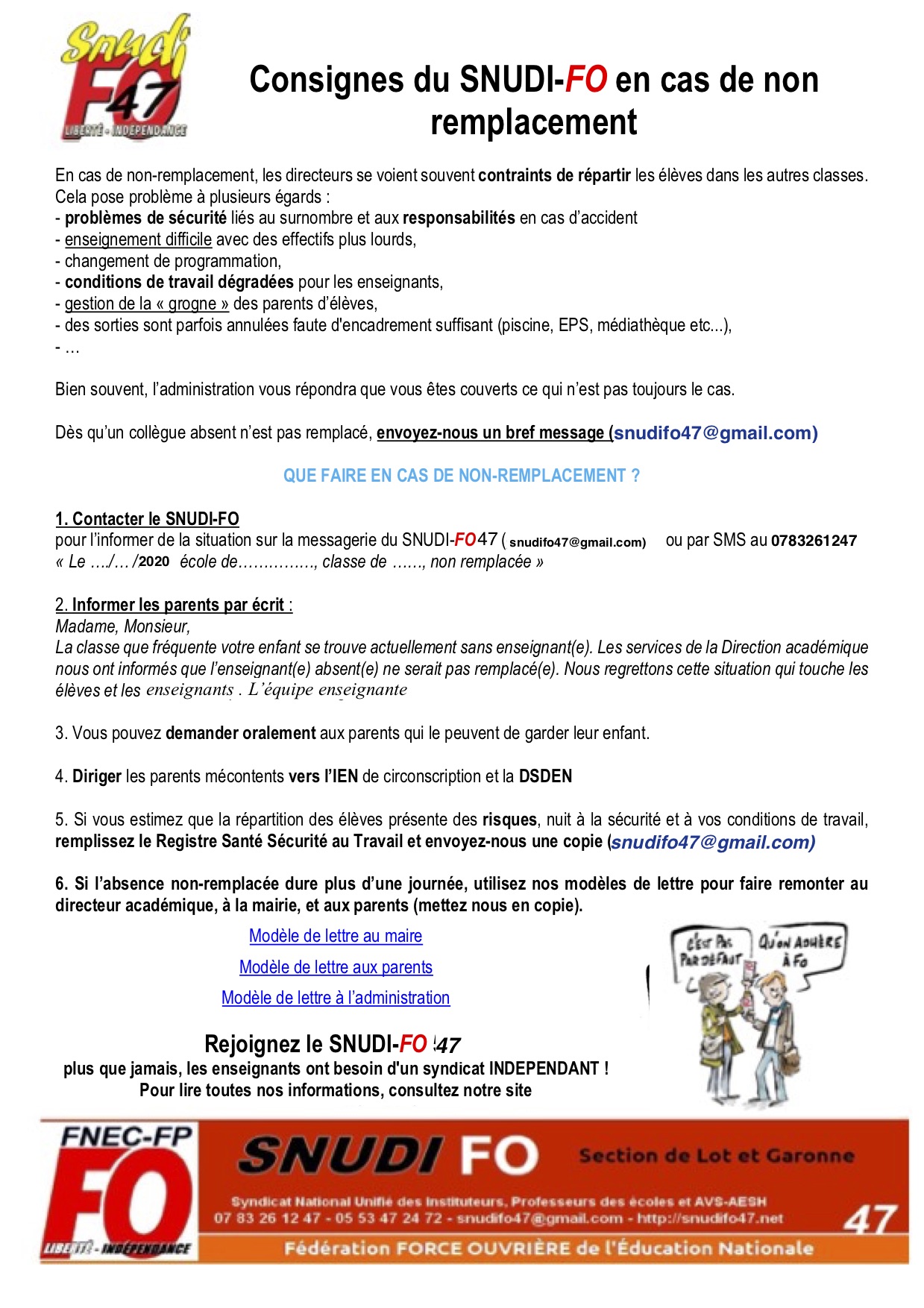

Problemes De Remplacement A Bouton D Or Les Parents S Expriment

May 30, 2025

Problemes De Remplacement A Bouton D Or Les Parents S Expriment

May 30, 2025 -

Elections Assemblee Nationale Le Rn Entre Frontieres Et Confrontation Avec Lfi

May 30, 2025

Elections Assemblee Nationale Le Rn Entre Frontieres Et Confrontation Avec Lfi

May 30, 2025 -

Manque De Professeurs Remplacants A L Ecole Bouton D Or Situation Critique

May 30, 2025

Manque De Professeurs Remplacants A L Ecole Bouton D Or Situation Critique

May 30, 2025 -

Assemblee Nationale Frontieres Et Desordre La Strategie Du Rn Face A Lfi

May 30, 2025

Assemblee Nationale Frontieres Et Desordre La Strategie Du Rn Face A Lfi

May 30, 2025