Lowest Personal Loan Interest Rates Today: A Quick Comparison

Table of Contents

Factors Influencing Your Personal Loan Interest Rate

Several key factors significantly impact the interest rate you'll receive on a personal loan. Understanding these factors is the first step towards securing the lowest personal loan interest rates.

Credit Score: The Cornerstone of Your Interest Rate

Your credit score is arguably the most significant factor influencing your personal loan interest rate. Lenders use your credit score to assess your creditworthiness – essentially, how likely you are to repay the loan. A higher credit score indicates lower risk to the lender, leading to lower interest rates.

- Excellent credit score (750+): Access to the lowest rates available. You'll likely qualify for the most competitive offers and attractive terms.

- Good credit score (700-749): You'll still find competitive rates, though potentially not the absolute lowest.

- Fair credit score (650-699): You'll likely face higher interest rates and may encounter stricter lending requirements.

- Poor credit score (below 650): Expect significantly higher rates, and you may need a co-signer to qualify for a loan. Securing a loan might be more challenging. Keywords: credit score impact, personal loan interest rates, credit score and interest rates

Loan Amount and Term: Balancing Payments and Interest

The amount you borrow and the repayment term also influence your interest rate.

- Larger loan amounts: May command slightly higher rates due to the increased risk for the lender.

- Longer loan terms: Generally lead to lower monthly payments but result in higher total interest paid over the life of the loan.

- Shorter loan terms: Mean higher monthly payments, but you'll pay significantly less interest overall.

Carefully consider your budget and financial goals when choosing a loan term. A loan amortization calculator can help you understand the total interest paid under different scenarios. Keywords: loan amount, loan term, repayment term, interest rate calculation

Lender Type: Banks, Credit Unions, and Online Lenders

Different types of lenders offer varying interest rates and loan terms.

- Banks: Often offer competitive rates, but their approval processes can be more stringent.

- Credit Unions: May offer lower rates, particularly to their members, but membership requirements apply.

- Online Lenders: Provide a convenient application process, but their rates can sometimes be higher than those of traditional lenders, particularly for borrowers with less-than-perfect credit.

Comparing offers from various lenders is essential to finding the best rates for your circumstances. Keywords: bank personal loans, credit union loans, online lenders, compare lenders

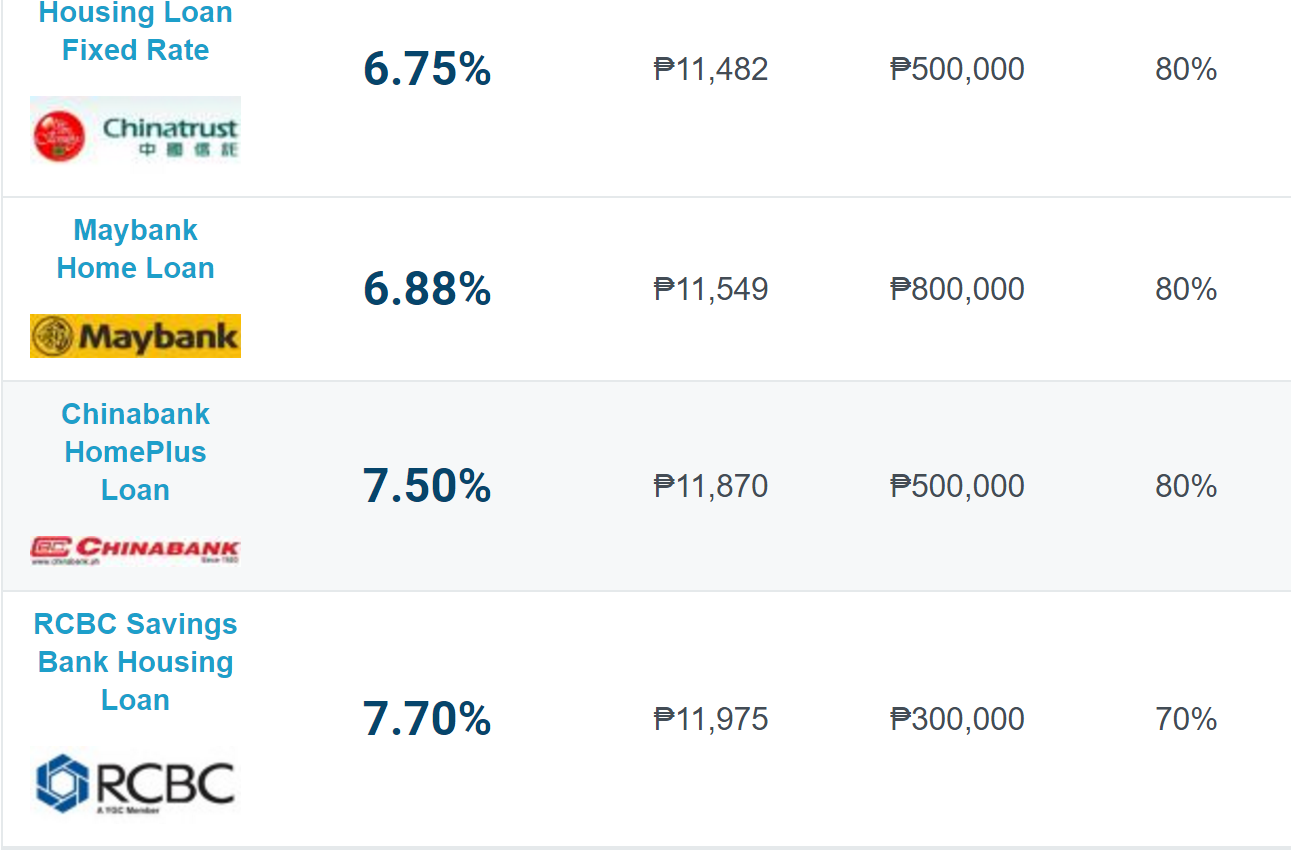

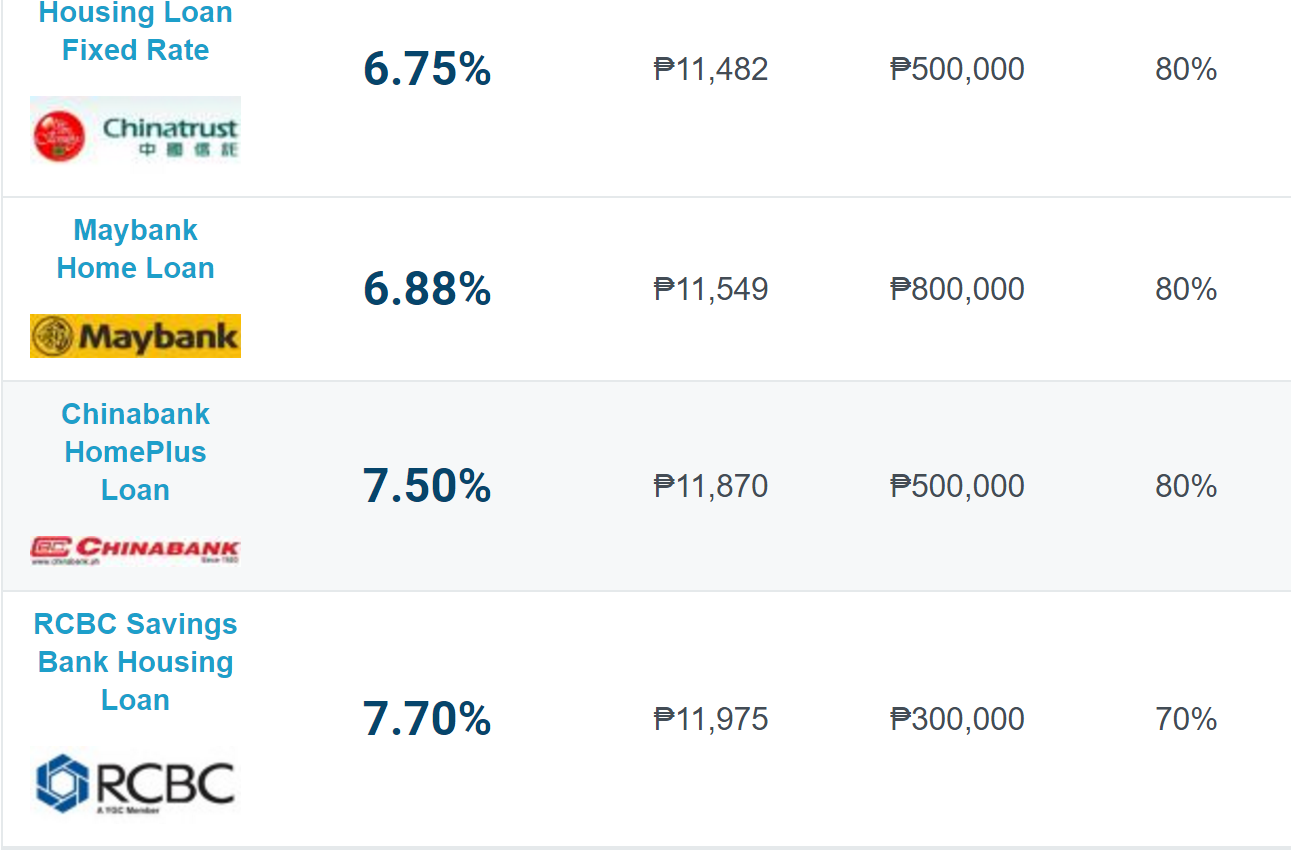

Where to Find the Lowest Personal Loan Interest Rates Today

Finding the lowest personal loan interest rates requires diligent comparison shopping.

- Online comparison websites: Several reputable websites allow you to compare rates from multiple lenders simultaneously, saving you valuable time and effort.

- Individual lender websites: Visit the websites of banks, credit unions, and online lenders directly to check their current offerings.

- Checking multiple lenders: Don't settle for the first offer you receive. Compare at least three to five lenders to ensure you're getting the best possible rate. Remember to read the fine print carefully and understand all fees associated with the loan, including origination fees, late payment fees, and prepayment penalties.

Keywords: compare personal loan rates, best personal loan lenders, find low interest loans

Tips for Getting the Best Personal Loan Interest Rate

Improving your chances of securing the lowest personal loan interest rates involves proactive steps.

- Improve your credit score: Before applying, take steps to improve your credit score, such as paying bills on time and reducing your credit utilization ratio.

- Shop around and compare offers: Don't settle for the first offer; compare rates from multiple lenders.

- Consider a shorter loan term: This reduces the total interest paid over the life of the loan, although it increases your monthly payments.

- Maintain a stable income and employment history: A steady income demonstrates your ability to repay the loan.

Keywords: best personal loan rates, lower interest rates, improve credit score, get approved

Conclusion: Securing Your Lowest Personal Loan Interest Rate

Securing the lowest personal loan interest rates involves understanding the key factors influencing your rate: your credit score, the loan amount and term, and the type of lender you choose. By diligently comparing offers from multiple lenders, improving your credit score, and strategically choosing a loan term, you significantly increase your chances of obtaining the best possible terms. Remember to carefully read the fine print before committing to any loan.

Start your search for the lowest personal loan interest rates today! Compare rates from different lenders and secure the financing you need at the best possible price. Keywords: lowest personal loan rates, personal loan comparison, secure low interest loan

Featured Posts

-

Nl West Standings Shakeup Arraez Injured Dodgers Dominant Diamondbacks Contend

May 28, 2025

Nl West Standings Shakeup Arraez Injured Dodgers Dominant Diamondbacks Contend

May 28, 2025 -

Ronaldo Portekiz Kampinda Fenerbahcelileri Sasirtti

May 28, 2025

Ronaldo Portekiz Kampinda Fenerbahcelileri Sasirtti

May 28, 2025 -

Alejandro Garnacho Transfer Man United Demands E60m

May 28, 2025

Alejandro Garnacho Transfer Man United Demands E60m

May 28, 2025 -

Conquering Bali Belly A Practical Guide To Diagnosis And Treatment

May 28, 2025

Conquering Bali Belly A Practical Guide To Diagnosis And Treatment

May 28, 2025 -

Bob Nuttings Impact Saving The Pittsburgh Pirates Beyond Paul Skenes

May 28, 2025

Bob Nuttings Impact Saving The Pittsburgh Pirates Beyond Paul Skenes

May 28, 2025

Latest Posts

-

Gisele Pelicots Memoir Hbo Adaptation In The Works

May 30, 2025

Gisele Pelicots Memoir Hbo Adaptation In The Works

May 30, 2025 -

Le Depute Rn Et L Immunite De Marine Le Pen Decryptage

May 30, 2025

Le Depute Rn Et L Immunite De Marine Le Pen Decryptage

May 30, 2025 -

Hbo To Adapt Gisele Pelicots Book A French Rape Victims Story

May 30, 2025

Hbo To Adapt Gisele Pelicots Book A French Rape Victims Story

May 30, 2025 -

Marine Le Pen Et La Justice L Analyse De Laurent Jacobelli

May 30, 2025

Marine Le Pen Et La Justice L Analyse De Laurent Jacobelli

May 30, 2025 -

Medine En Concert La Region Grand Est Subventionne Le Rn S Insurge

May 30, 2025

Medine En Concert La Region Grand Est Subventionne Le Rn S Insurge

May 30, 2025