Luxury Goods Exports From The UK: The Brexit Bottleneck

Table of Contents

Increased Tariffs and Customs Duties

The introduction of new tariffs and customs duties post-Brexit has significantly increased the cost of exporting luxury goods from the UK. These tariff barriers directly impact profitability, making UK products less competitive in international markets.

- Specific examples: Scotch whisky, a cornerstone of UK luxury exports, faces higher tariffs in some key markets, reducing its price competitiveness. Similarly, high-end clothing and bespoke tailoring have also experienced tariff increases, impacting their profitability.

- Price Competitiveness: The added costs associated with tariffs make UK luxury goods more expensive compared to competitors from countries with preferential trade agreements. This price disparity directly affects market share and sales volume.

- Case Studies: Several high-profile UK luxury brands have reported significant losses due to increased export costs. Smaller businesses, often lacking the resources to navigate complex customs regulations, are particularly vulnerable. The impact extends beyond mere financial loss; it undermines the competitive edge of these brands, impacting their market position and brand recognition. This demonstrates the far-reaching consequences of the Brexit bottleneck.

Complex Customs Procedures and Documentation

Brexit has introduced significantly more complex customs procedures and documentation requirements for exporting luxury goods from the UK. This increased administrative burden places a heavy strain on businesses, adding both time and financial costs.

- Increased Administrative Burden: Businesses now face a mountain of paperwork, including customs declarations, certificates of origin, and various other compliance regulations. This extra workload often requires hiring specialized staff or outsourcing to customs brokers, increasing operational expenses.

- Specialized Services and Costs: The need for specialized customs brokers has driven up costs for many businesses. The expertise required to navigate the complexities of post-Brexit customs regulations is highly specialized, making these services expensive. This adds a further layer of expense to an already strained export process, directly impacting profit margins.

- Border Control Delays: Increased scrutiny at borders leads to significant delays, impacting delivery times and potentially damaging perishable goods. This lack of efficient border control significantly contributes to the Brexit bottleneck. Timely delivery is critical for luxury goods, and delays directly affect customer satisfaction and brand reputation.

Supply Chain Disruptions

The new border controls and logistical challenges introduced by Brexit have created significant disruptions to UK luxury goods supply chains. These disruptions have far-reaching consequences for businesses, affecting not only delivery times but also operational efficiency.

- Longer Delivery Times: Delays in obtaining raw materials and components from overseas suppliers are now commonplace. This directly impacts production schedules and increases lead times for finished goods. This is particularly critical for high-value luxury goods where production time is often intricate and extensive.

- Increased Storage Costs and Spoilage: Delays at borders can lead to increased storage costs, particularly for perishable luxury goods such as fresh flowers or certain food items. The risk of spoilage increases, adding another significant financial burden. The additional logistical complexity further increases the pressure on efficient supply chain management.

- International Logistics and Transportation Challenges: Coordinating international logistics and transportation has become significantly more complex and costly since Brexit. Finding reliable and efficient transportation options has become a significant challenge, adding to the overall bottleneck in the export process. This necessitates new strategic approaches to managing global supply chains.

Impact on UK Luxury Brands and Businesses

The cumulative effect of increased tariffs, complex customs procedures, and supply chain disruptions has had a significant impact on UK luxury brands and businesses. This impact extends beyond mere financial losses, affecting brand reputation and long-term market competitiveness.

- Reduced Profitability and Job Losses: Many UK luxury businesses are experiencing reduced profitability due to increased export costs and reduced sales volumes. This has, in some cases, led to job losses and reduced investment in innovation and growth. The Brexit bottleneck is directly impacting the financial stability and sustainability of businesses within this sector.

- Damage to Brand Reputation: Delays and delivery issues can damage the reputation of UK luxury brands, impacting customer loyalty and brand image. The perception of unreliability can be extremely damaging to luxury brands that rely heavily on reputation and impeccable service.

- Loss of Market Share: Increased costs and reduced efficiency are contributing to a loss of market share to competitors from other countries. This creates a downward spiral, further impacting profitability and long-term viability. The ability to maintain competitiveness within a global marketplace is crucial for success.

Conclusion

The Brexit bottleneck is significantly impacting UK luxury goods exports, leading to increased costs, complexities, and disruptions to the supply chain. Businesses are facing higher tariffs, complex customs procedures, and significant supply chain disruptions, all impacting profitability and long-term viability. Overcoming Brexit's impact on exports requires proactive strategies. UK businesses involved in luxury goods exports need to invest in streamlined customs processes, seek expert advice on compliance, and explore new strategies for navigating the complex export landscape. Further research into Brexit's lasting impact on UK luxury goods exports is vital. Proactive adaptation and innovation are crucial to overcome this Brexit bottleneck and ensure the continued success of the UK's renowned luxury goods sector.

Featured Posts

-

April 18 2025 Nyt Mini Crossword Hints And Answers

May 20, 2025

April 18 2025 Nyt Mini Crossword Hints And Answers

May 20, 2025 -

Bbai Stock Analyst Downgrade Reflects Growth Challenges

May 20, 2025

Bbai Stock Analyst Downgrade Reflects Growth Challenges

May 20, 2025 -

Action Required Urgent Messages From Hmrc About Your Child Benefit

May 20, 2025

Action Required Urgent Messages From Hmrc About Your Child Benefit

May 20, 2025 -

Isabelle Nogueira Anuncia Maiara E Maraisa Para O Festival Da Cunha Em Manaus

May 20, 2025

Isabelle Nogueira Anuncia Maiara E Maraisa Para O Festival Da Cunha Em Manaus

May 20, 2025 -

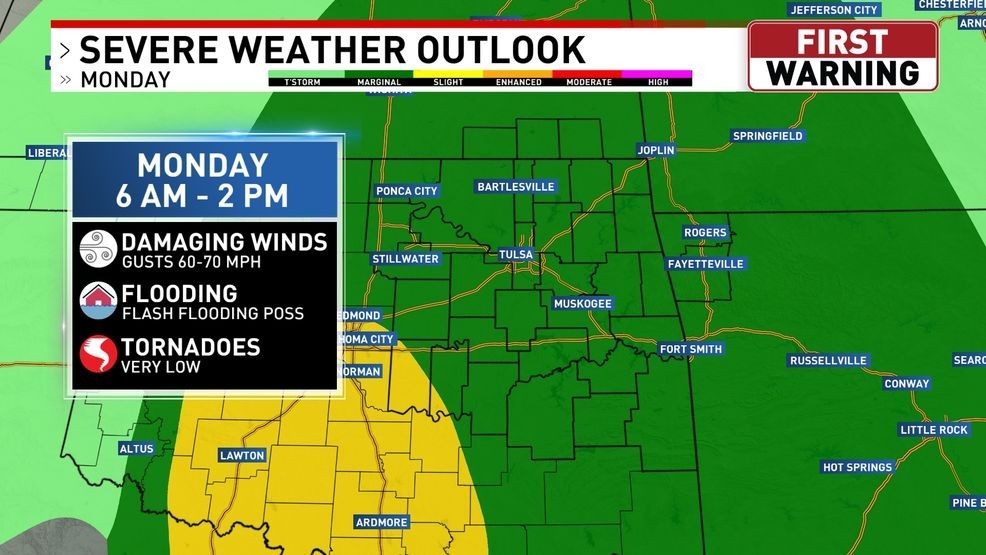

Increased Storm Risk Overnight Severe Weather Possible Monday

May 20, 2025

Increased Storm Risk Overnight Severe Weather Possible Monday

May 20, 2025