LVMH Stock Falls 8.2% After Q1 Revenue Disappoints

Table of Contents

Q1 Revenue Misses Expectations: A Detailed Look

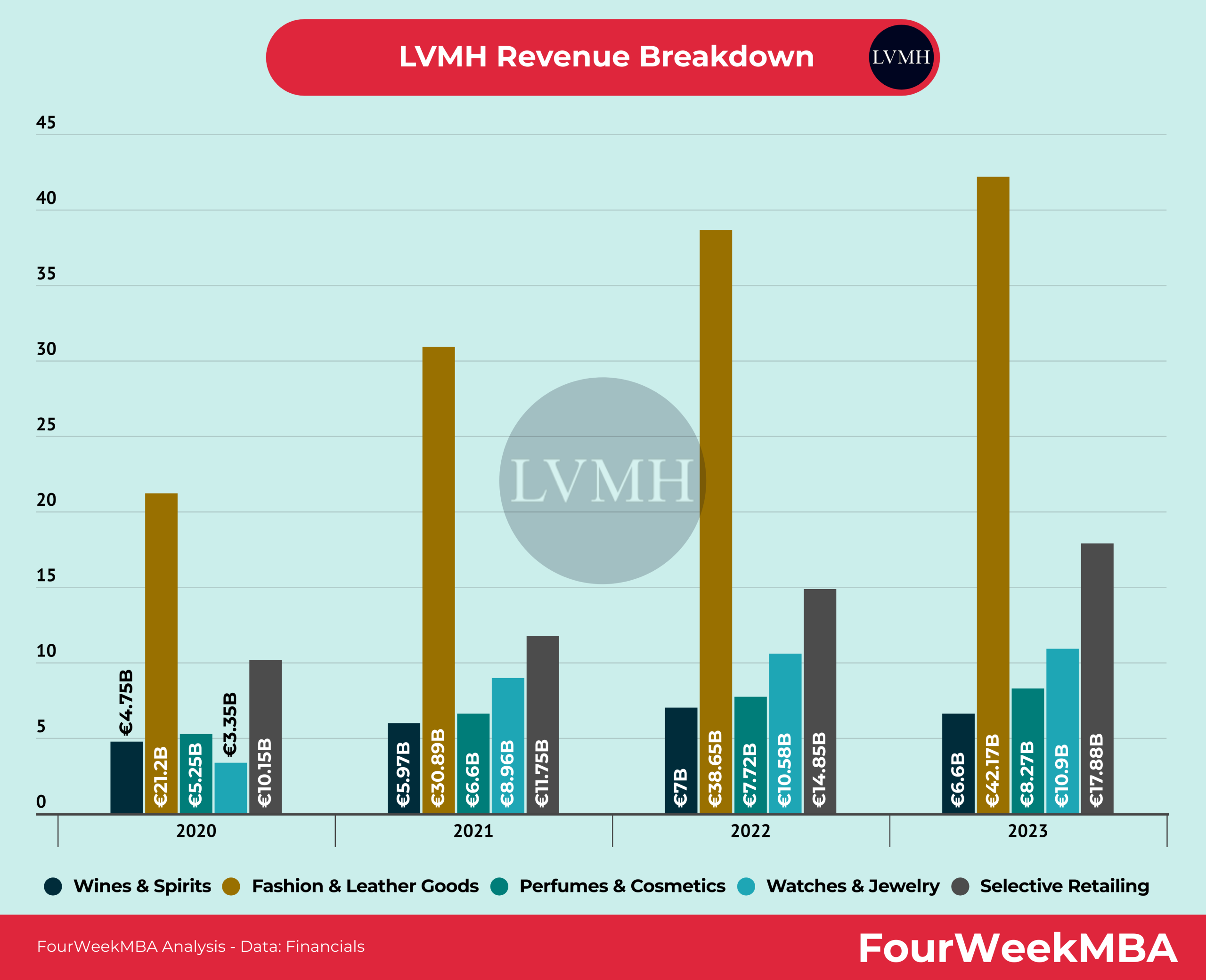

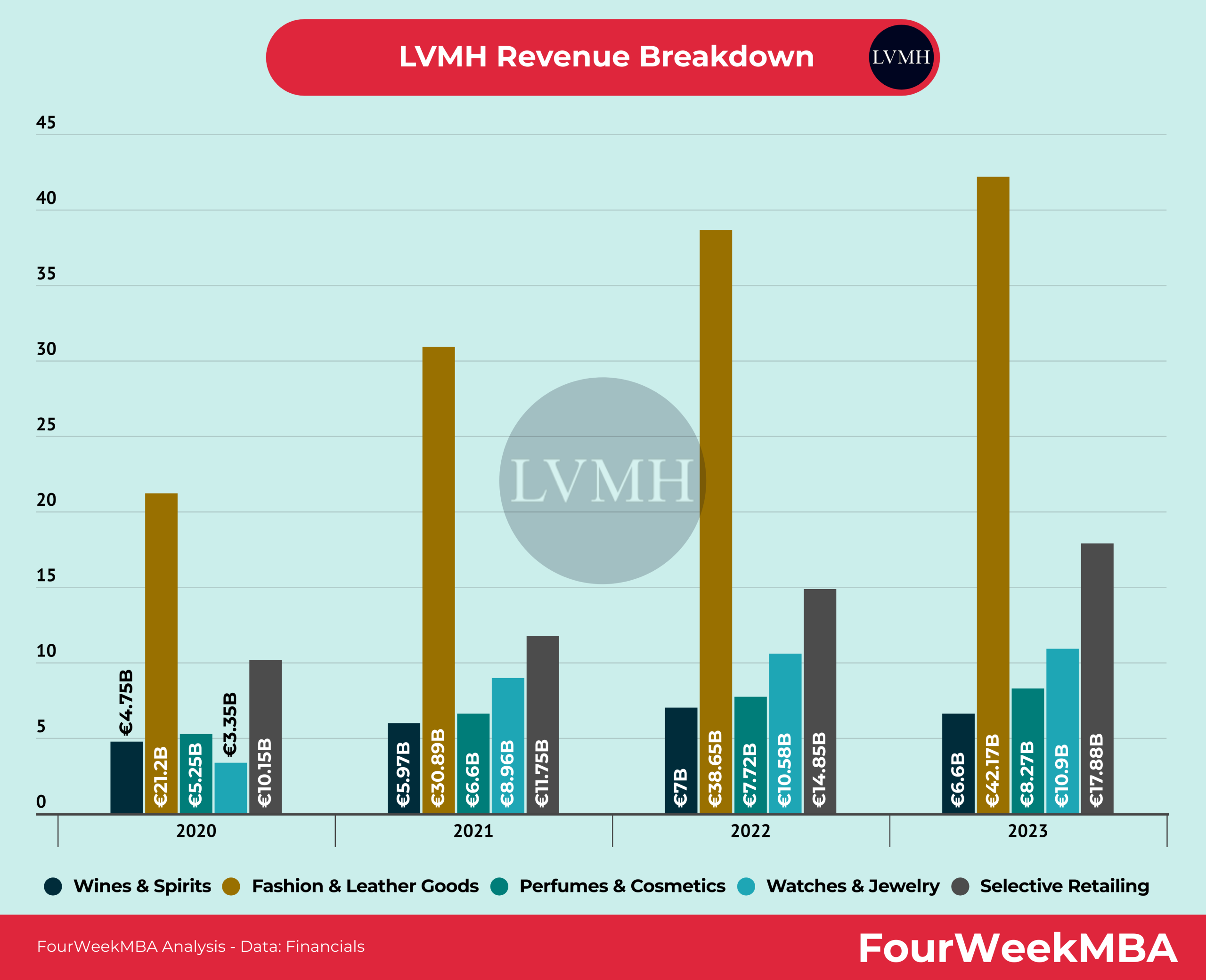

The Q1 2024 results revealed a substantial shortfall compared to both analyst predictions and the previous year's performance. This section dissects the key figures and provides a comprehensive analysis of the revenue breakdown.

Key Revenue Figures and Year-over-Year Comparison

The reported revenue fell short of expectations, highlighting a challenging start to the year for the luxury giant. Let's look at the specific numbers:

- Total Revenue: [Insert Actual Q1 2024 Revenue Figure]. This represents a [Insert Percentage]% decrease compared to Q1 2023's revenue of [Insert Q1 2023 Revenue Figure].

- Analyst Expectations: Analysts had predicted a revenue of [Insert Analyst Prediction]. The actual figures represent a significant [Insert Percentage]% miss.

Here's a further breakdown by product category:

- Fashion & Leather Goods: [Insert Revenue and Percentage Change]

- Wines & Spirits: [Insert Revenue and Percentage Change]

- Perfumes & Cosmetics: [Insert Revenue and Percentage Change]

- Selective Retailing: [Insert Revenue and Percentage Change]

- Watches & Jewelry: [Insert Revenue and Percentage Change]

Geographic Performance: Regional Breakdown and Impact

The revenue decline wasn't uniform across all regions. Significant variations highlight the complexities of the global luxury market:

- Strong Performing Regions: [List regions and percentage growth/decline, explaining contributing factors such as strong local economies or successful marketing campaigns.]

- Weak Performing Regions: [List regions and percentage growth/decline, explaining contributing factors like economic slowdowns, geopolitical instability, or changes in consumer spending habits.] For example, a slowdown in the Chinese market significantly impacted overall revenue.

Impact of Macroeconomic Factors

Several macroeconomic factors contributed to LVMH's underwhelming Q1 performance:

- Inflation: Persistent high inflation eroded consumer purchasing power, particularly affecting discretionary spending on luxury goods.

- Rising Interest Rates: Higher interest rates increased borrowing costs, impacting consumer confidence and reducing overall spending.

- Recessionary Fears: Growing concerns about a potential global recession further dampened consumer sentiment and reduced demand for luxury items.

Market Reaction and Investor Sentiment

The announcement of the disappointing Q1 results immediately triggered a negative market reaction, impacting LVMH stock price and investor sentiment.

Stock Price Volatility and Trading Volume

- Stock Price Movement: LVMH stock experienced a sharp decline of 8.2%, reaching a low of [Insert Stock Price] before partially recovering.

- Trading Volume: Trading volume spiked significantly, indicating heightened investor activity and uncertainty.

- Analyst Ratings: Several analysts downgraded their ratings for LVMH stock, reflecting concerns about the company's future prospects. Price targets were also adjusted downwards.

Analyst Commentary and Future Outlook

Analyst commentary following the Q1 report was predominantly cautious.

- Key Analyst Quotes: [Insert quotes from reputable financial analysts, highlighting their concerns and predictions.]

- Revised Growth Forecasts: Many analysts revised their growth forecasts for LVMH downwards, reflecting the uncertainty surrounding the luxury market.

- Long-Term Implications: The long-term implications for LVMH's strategy are still being assessed. The company's response and ability to adapt to the changing economic landscape will be crucial.

Potential Long-Term Implications for LVMH Stock

The disappointing Q1 results necessitate a careful assessment of LVMH's long-term prospects and potential strategic adjustments.

Strategic Adjustments and Company Response

LVMH may need to implement several strategic changes to address the challenges:

- Pricing Strategies: Adjusting pricing strategies to balance profitability with affordability could be necessary.

- Marketing Campaigns: Refocusing marketing efforts on key demographics and regions will be crucial.

- Product Development: Investing in innovative product development to meet evolving consumer preferences is essential for future growth.

Risks and Opportunities

LVMH faces various risks and opportunities in the coming quarters:

- Increased Competition: Intense competition from other luxury brands poses a significant threat.

- Supply Chain Disruptions: Global supply chain issues could further impact production and profitability.

- Changing Consumer Preferences: Adapting to evolving consumer preferences and maintaining brand relevance are crucial.

Conclusion

The 8.2% drop in LVMH stock following the disappointing Q1 2024 revenue report underscores the challenges facing even the most established luxury brands. Macroeconomic headwinds, regional variations in performance, and the need for strategic adaptation are key takeaways. Monitoring LVMH stock and its future performance is crucial for understanding the dynamics of the luxury goods market and making informed investment decisions. Keep a close eye on LVMH stock and its future performance to make informed investment decisions. Stay tuned for further updates on LVMH's financial reports and strategic moves.

Featured Posts

-

Apple Stock Wedbushs Long Term Bullish Prediction After Price Target Reduction

May 24, 2025

Apple Stock Wedbushs Long Term Bullish Prediction After Price Target Reduction

May 24, 2025 -

2025 Philips Annual General Meeting Agenda And Important Updates

May 24, 2025

2025 Philips Annual General Meeting Agenda And Important Updates

May 24, 2025 -

Bbc Radio 1 Big Weekend 2024 Lineup Jorja Smith Biffy Clyro Blossoms And More

May 24, 2025

Bbc Radio 1 Big Weekend 2024 Lineup Jorja Smith Biffy Clyro Blossoms And More

May 24, 2025 -

Mia Farrow Visits Sadie Sink Backstage A Broadway Encounter

May 24, 2025

Mia Farrow Visits Sadie Sink Backstage A Broadway Encounter

May 24, 2025 -

Sean Penns Comments On The Woody Allen Dylan Farrow Case

May 24, 2025

Sean Penns Comments On The Woody Allen Dylan Farrow Case

May 24, 2025

Latest Posts

-

Mia Farrow Trump Should Be Jailed Over Venezuelan Deportation Controversy

May 24, 2025

Mia Farrow Trump Should Be Jailed Over Venezuelan Deportation Controversy

May 24, 2025 -

Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrows Outrage Trumps Actions On Venezuelan Deportations Demand Accountability

May 24, 2025

Mia Farrows Outrage Trumps Actions On Venezuelan Deportations Demand Accountability

May 24, 2025 -

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 24, 2025

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 24, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025