LVMH Stock Slumps: Q1 Sales Miss Targets By 8.2%

Table of Contents

Main Points: Dissecting the LVMH Stock Slump

2.1. Detailed Analysis of the Q1 Sales Miss

Specific Sales Figures and Breakdown:

LVMH reported €18 billion in revenue for Q1 2024, falling short of the projected €19.6 billion by €1.6 billion (8.2%). This shortfall impacted various divisions unevenly. Let's break down the performance by category:

- Fashion & Leather Goods: This segment, typically a major revenue driver for LVMH, experienced a 5% decrease in sales, primarily attributed to weaker-than-expected performance from Louis Vuitton in certain key markets.

- Wines & Spirits: This division showed more resilience, with a modest 2% increase in sales, driven by strong demand for Champagne and high-end spirits.

- Perfumes & Cosmetics: Sales in this category were relatively flat, showing a minimal 0.5% increase, indicating a saturation in the market or increased competition.

- Selective Retailing: This segment, encompassing Sephora and other retail brands, experienced a 4% decline, highlighting the challenges faced in the broader retail landscape.

[Insert Chart/Graph Here visually representing the sales data for each category]

Reasons Behind the Sales Decline:

Several factors contributed to LVMH's disappointing Q1 performance:

- Weakening Consumer Demand: A slowdown in consumer spending, particularly in key markets like China, significantly impacted sales of luxury goods. The lingering effects of pandemic-related restrictions and economic uncertainty played a major role.

- Supply Chain Disruptions: While less impactful than in previous years, persistent supply chain bottlenecks and increased shipping costs still impacted production and delivery timelines, limiting sales potential.

- Increased Competition: The luxury market is increasingly competitive, with both established and emerging brands vying for market share. This intensified competition puts downward pressure on prices and profit margins.

- Currency Fluctuations: Unfavorable currency exchange rates, particularly the strength of the Euro against certain currencies, negatively impacted the translation of sales figures into Euros.

Quotes from leading financial analysts could be incorporated here to add further weight to this analysis.

2.2. Impact on LVMH Stock Price and Investor Sentiment

Stock Price Fluctuations:

The announcement of LVMH's Q1 results triggered an immediate and sharp decline in its stock price. LVMH shares dropped by approximately 7% in the initial trading session following the earnings release, wiping billions off its market capitalization. Trading volume increased significantly, reflecting the high level of investor concern. Several financial institutions downgraded their ratings on LVMH stock, further contributing to the negative sentiment.

[Insert Chart/Graph Here illustrating LVMH stock price movements around the Q1 earnings release date]

Investor Reaction and Market Analysis:

The market reacted negatively to the news, with many investors interpreting the sales miss as a sign of weakening demand for luxury goods and potential challenges for future growth. Investor concerns included:

- Lower-than-expected future earnings projections: Analysts revised their earnings forecasts downward for the remainder of the year, reflecting the uncertainty surrounding consumer spending and economic growth.

- LVMH's ability to address the challenges: The market is closely scrutinizing LVMH’s strategic response to the challenges, looking for evidence of effective measures to stimulate demand and improve profitability.

News sources like the Financial Times, Bloomberg, and Reuters can be cited here to provide broader market context.

2.3. LVMH's Response and Future Outlook

Company Statement and Actions:

In response to the Q1 results, LVMH issued a statement acknowledging the challenges but expressed confidence in its long-term strategy. The company outlined plans to address the issues, including:

- Targeted marketing campaigns: Increased investment in targeted marketing and advertising to stimulate demand in key markets.

- Enhanced supply chain efficiency: Focus on improving supply chain efficiency and resilience to mitigate the impact of future disruptions.

- Innovation and product diversification: Continued investment in research and development to introduce innovative products and diversify its offerings to cater to evolving consumer preferences.

Direct quotes from LVMH executives should be included if available.

Analyst Predictions and Future Expectations:

Analyst predictions for LVMH's future performance are mixed. While some remain cautiously optimistic about the long-term prospects of the company, others are more reserved, citing the uncertain economic outlook and intensified competition. The consensus view seems to be that a full recovery is likely to take time, with a potential rebound in the second half of the year depending heavily on macroeconomic conditions and consumer sentiment. This situation also highlights the potential impact on the overall luxury goods sector.

Conclusion: Navigating the LVMH Stock Slump – What's Next?

The LVMH stock slump, driven by an 8.2% miss in Q1 sales targets, reflects a confluence of factors including weakening consumer demand, supply chain issues, and increased competition. The impact on investor sentiment is significant, leading to a sharp drop in the stock price and a cautious outlook for the near term. While LVMH has outlined strategies to address the challenges, the success of these initiatives will depend heavily on the broader economic environment and the resilience of consumer spending in the luxury goods sector. The coming quarters will be crucial in determining whether LVMH can successfully navigate these headwinds and restore investor confidence. Stay updated on the latest developments in LVMH stock and the luxury market by subscribing to our newsletter for insightful analysis and expert commentary on LVMH stock performance and the overall luxury market outlook.

Featured Posts

-

Rebuilding Bridges Bangladeshs Collaborative Efforts In Europe

May 24, 2025

Rebuilding Bridges Bangladeshs Collaborative Efforts In Europe

May 24, 2025 -

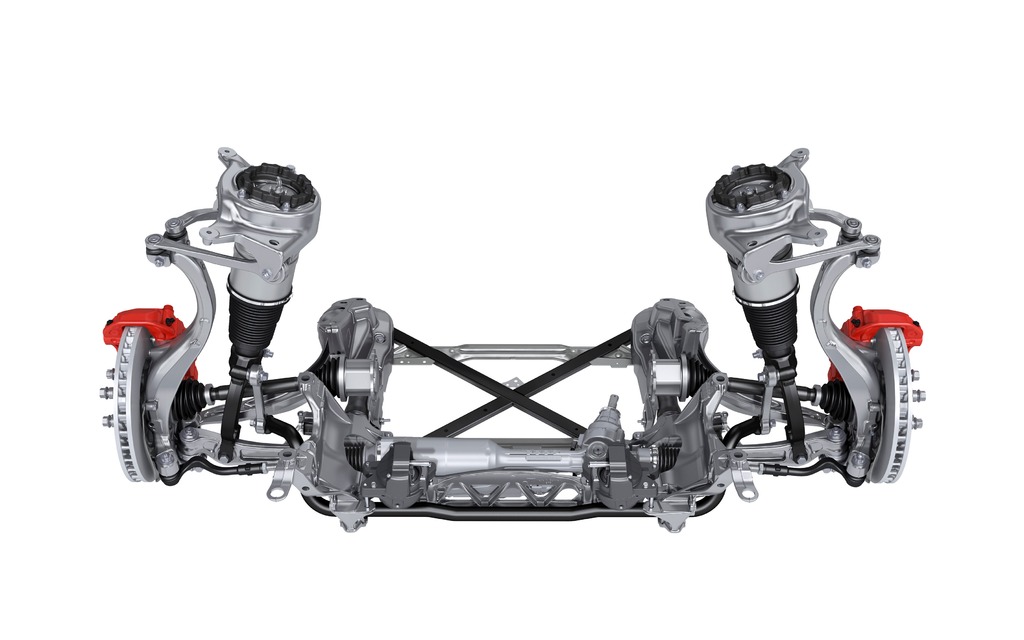

Egyedi Porsche 911 Extrak Es Atalakitasok 80 Millioert

May 24, 2025

Egyedi Porsche 911 Extrak Es Atalakitasok 80 Millioert

May 24, 2025 -

Fastest Standard Production Ferraris A Fiorano Track Performance Analysis

May 24, 2025

Fastest Standard Production Ferraris A Fiorano Track Performance Analysis

May 24, 2025 -

2024 Porsche Macan Buyers Guide Find The Perfect Suv

May 24, 2025

2024 Porsche Macan Buyers Guide Find The Perfect Suv

May 24, 2025 -

Skolko Let Geroyam Filma O Bednom Gusare Zamolvite Slovo Vozrast Personazhey Izvestnoy Kinolenty

May 24, 2025

Skolko Let Geroyam Filma O Bednom Gusare Zamolvite Slovo Vozrast Personazhey Izvestnoy Kinolenty

May 24, 2025

Latest Posts

-

Mia Farrow Trump Should Be Jailed Over Venezuelan Deportation Controversy

May 24, 2025

Mia Farrow Trump Should Be Jailed Over Venezuelan Deportation Controversy

May 24, 2025 -

Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrows Outrage Trumps Actions On Venezuelan Deportations Demand Accountability

May 24, 2025

Mia Farrows Outrage Trumps Actions On Venezuelan Deportations Demand Accountability

May 24, 2025 -

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 24, 2025

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 24, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025