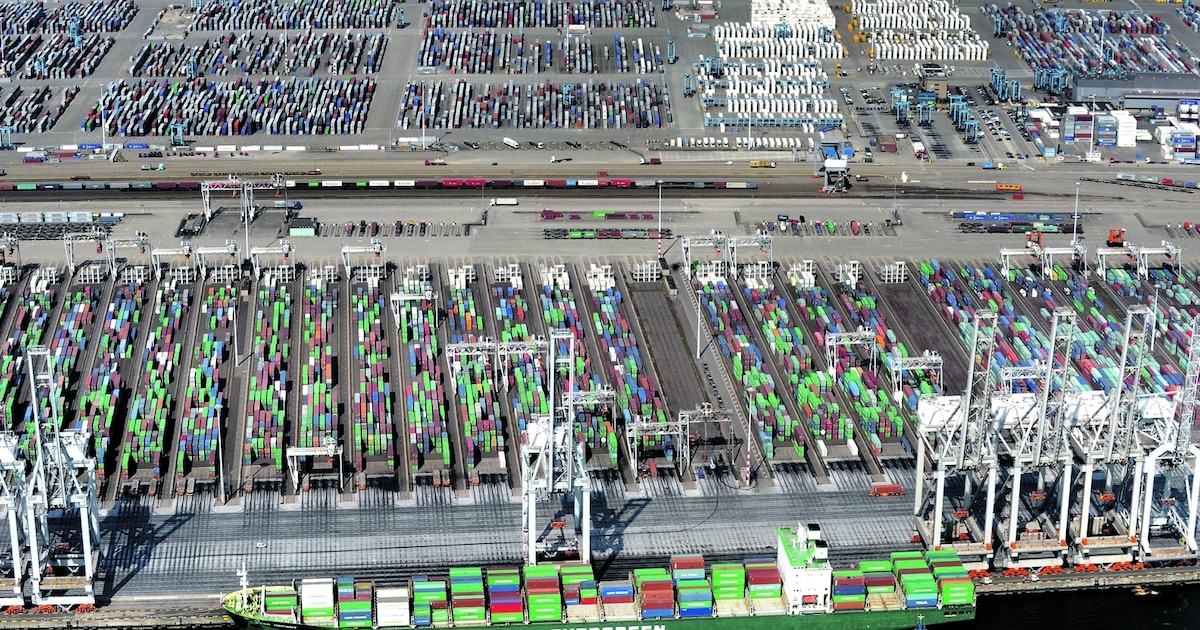

Major Losses Continue: Amsterdam Stock Exchange Down 11%

Table of Contents

Causes of the AEX's 11% Decline

The 11% plunge in the AEX isn't an isolated event; it's a reflection of broader global economic headwinds and specific weaknesses within the Dutch market.

Global Economic Uncertainty

Global economic uncertainty is a primary driver of the AEX's decline. Several factors contribute to this instability:

- Weakening Euro: The Euro's weakening against the US dollar increases the cost of imports for Dutch businesses, impacting profitability and dampening investor confidence.

- US Recession Fears: Concerns about a potential recession in the United States, a major trading partner, create a ripple effect across global markets, including the AEX. The interconnectedness of the global economy means that instability in one region quickly impacts others.

- Energy Crisis Impact on Dutch Businesses: The ongoing energy crisis in Europe, particularly impacting gas prices, significantly burdens Dutch businesses, reducing their competitiveness and profitability. Inflation in the Eurozone recently reached 10%, impacting consumer spending and business confidence, further exacerbating the situation.

Sector-Specific Weakness

The AEX downturn isn't uniform across all sectors. Some have suffered more significant losses than others:

- Energy Sector: Fluctuating oil prices and concerns over future energy demand have heavily impacted energy companies listed on the AEX, leading to substantial stock price drops. For example, [mention a specific energy company and its percentage drop].

- Technology Sector: The tech sector globally has experienced a correction, and the AEX is not immune. [Mention a specific tech company and its performance]. Concerns over interest rate hikes and reduced investor appetite for growth stocks are major factors.

- Financial Sector: Banks and financial institutions listed on the AEX are also feeling the pressure from rising interest rates and economic uncertainty, impacting their profitability and share prices. [Mention a specific financial company and its performance].

Investor Sentiment and Market Psychology

Fear and uncertainty are powerful drivers of market downturns. Negative news cycles and increased market volatility fuel a climate of fear, leading to widespread sell-offs. This "herd behavior," where investors react emotionally rather than rationally, contributes significantly to amplified price declines. The resulting market psychology creates a self-fulfilling prophecy, accelerating the downward trend in the AEX.

Impact on the Dutch Economy

The AEX's decline has significant repercussions for the Dutch economy as a whole.

Broader Economic Consequences

The stock market's performance serves as a barometer of a nation's economic health. The sharp drop in the AEX suggests several negative implications:

- Impact on GDP Growth: A weakened stock market can negatively impact GDP growth as businesses struggle with reduced investment and consumer spending.

- Consumer Confidence: The market downturn erodes consumer confidence, leading to reduced spending and further economic slowdown.

- Employment Rates: Companies facing financial pressure may be forced to implement cost-cutting measures, including potential job losses.

Impact on Dutch Businesses

Publicly traded Dutch companies are directly impacted by the AEX's decline:

- Reduced Investment Opportunities: The downturn makes it harder for companies to secure funding through equity markets, hindering growth and expansion.

- Difficulty Securing Funding: Banks and other lenders may become more risk-averse, making it harder for businesses to access credit.

- Potential Layoffs: To offset losses, companies may be forced to reduce their workforce, leading to increased unemployment. The risk of company bankruptcies also increases significantly in such a climate.

Strategies for Investors Amidst the Downturn

While the current market situation is challenging, investors can take steps to mitigate risks and protect their portfolios.

Risk Assessment and Diversification

A well-diversified investment portfolio is crucial to mitigating risk:

- Investing in Different Asset Classes: Don't put all your eggs in one basket. Diversify across stocks, bonds, real estate, and other asset classes.

- International Diversification: Investing in international markets reduces dependence on any single economy's performance.

- Rebalancing Portfolios: Regularly review and rebalance your portfolio to maintain your desired asset allocation, adjusting to market changes.

Long-Term Investment Strategy

Maintaining a long-term perspective is critical during market fluctuations:

- Dollar-Cost Averaging: Invest a fixed amount regularly, regardless of market prices, to reduce the impact of volatility.

- Patience and Discipline: Avoid impulsive decisions driven by fear or panic. Stick to your long-term investment plan.

- Holding Investments: History shows that markets recover over time. Holding investments through downturns often leads to better long-term returns.

Seeking Professional Advice

Seeking professional financial advice is highly recommended:

- Personalized Financial Planning: A financial advisor can help create a personalized investment strategy tailored to your risk tolerance and financial goals.

- Risk Tolerance Assessment: They can help you assess your risk tolerance and build a portfolio that aligns with your comfort level.

- Navigating Market Volatility: An advisor can provide guidance and support during periods of market uncertainty.

Conclusion

The 11% drop in the Amsterdam Stock Exchange is a significant event with potentially far-reaching consequences for the Dutch economy and investors. Understanding the underlying causes, including global economic uncertainty and sector-specific weaknesses, is crucial for navigating this challenging period. While the current situation with the Amsterdam Stock Exchange is concerning, investors should carefully assess their risk tolerance and implement a sound long-term investment strategy. Stay informed about developments in the Amsterdam Stock Exchange and consider seeking professional advice to navigate this period of market volatility. Don't panic; instead, develop a robust plan to manage your investments during this Amsterdam Stock Exchange downturn. Remember, successful long-term investing requires patience, discipline, and a well-defined strategy.

Featured Posts

-

Glastonbury 2025 Lineup Fan Fury Over Headliners

May 24, 2025

Glastonbury 2025 Lineup Fan Fury Over Headliners

May 24, 2025 -

Analyse Hogere Kapitaalmarktrentes En De Eurokoers Boven 1 08

May 24, 2025

Analyse Hogere Kapitaalmarktrentes En De Eurokoers Boven 1 08

May 24, 2025 -

Listen Now Joy Crookes Drops New Track Carmen

May 24, 2025

Listen Now Joy Crookes Drops New Track Carmen

May 24, 2025 -

Access To Birth Control The Over The Counter Revolution After Roe V Wade

May 24, 2025

Access To Birth Control The Over The Counter Revolution After Roe V Wade

May 24, 2025 -

Securing Your Bbc Big Weekend 2025 Sefton Park Tickets A Step By Step Guide

May 24, 2025

Securing Your Bbc Big Weekend 2025 Sefton Park Tickets A Step By Step Guide

May 24, 2025

Latest Posts

-

Canada Post Strike Averted Details Of The New Offer

May 24, 2025

Canada Post Strike Averted Details Of The New Offer

May 24, 2025 -

Trumps Trade Threats Prompt Call To Action From Canadian Auto Industry

May 24, 2025

Trumps Trade Threats Prompt Call To Action From Canadian Auto Industry

May 24, 2025 -

Canada Posts New Offers Averted Strike

May 24, 2025

Canada Posts New Offers Averted Strike

May 24, 2025 -

Canadian Automotive Executives Call For Increased Ambition In Face Of Us Trade Threats

May 24, 2025

Canadian Automotive Executives Call For Increased Ambition In Face Of Us Trade Threats

May 24, 2025 -

Canadian Auto Industry Leaders Urge Bold Response To Trump Administration

May 24, 2025

Canadian Auto Industry Leaders Urge Bold Response To Trump Administration

May 24, 2025