Managing Malaysian Ringgit (MYR) Exchange Rate Risk Through Front-Loading

Table of Contents

Understanding MYR Exchange Rate Volatility and its Impact

MYR volatility stems from various interconnected factors. Interest rate adjustments by Bank Negara Malaysia (BNM), the country's central bank, significantly influence the MYR's value. Global economic conditions, particularly shifts in the US dollar (USD) and other major currencies, also play a crucial role. Political stability within Malaysia and global geopolitical events can further contribute to MYR exchange rate fluctuations.

The potential negative impacts of these fluctuations on businesses are substantial:

- Reduced Profitability: Unexpected changes in exchange rates can dramatically decrease profit margins on international transactions.

- Increased Costs: Importing businesses face higher costs if the MYR weakens against the currency of their supplier.

- Difficulty in Budgeting and Forecasting: Unpredictable exchange rates make accurate financial planning extremely challenging.

- Competitive Disadvantage: Businesses might lose competitiveness if their costs increase due to unfavorable exchange rate movements.

For example, a Malaysian exporter selling goods to the US might experience reduced revenue if the MYR strengthens against the USD, while an importer sourcing goods from China might face higher costs if the MYR weakens against the Chinese Yuan (CNY). Effective Malaysian Ringgit risk management is crucial to navigate these challenges.

What is Front-Loading in the Context of MYR Exchange Rates?

Front-loading, in the context of MYR exchange rates, is a proactive risk management technique. It involves securing future exchange rates or hedging future transactions to mitigate potential losses from unfavorable MYR volatility. Instead of waiting for the actual transaction date, businesses use financial instruments to lock in a specific exchange rate today for a future transaction.

For example, imagine a Malaysian company needs to import equipment from Germany in three months. Using front-loading, they could enter into a forward contract with a bank, securing a specific MYR/EUR exchange rate for the transaction. This protects them from potential losses if the MYR weakens against the Euro (EUR) in the next three months. This proactive approach ensures predictable costs and avoids the uncertainty inherent in fluctuating exchange rates. Effectively, they are hedging MYR risk.

Different Front-Loading Strategies for MYR

Several hedging techniques can be employed for managing MYR exchange rate risk:

- Forward Contracts MYR: These agreements lock in a specific exchange rate for a future date. They are relatively simple to understand and implement, making them suitable for businesses with predictable future currency needs.

- Currency Options MYR: These provide the right, but not the obligation, to buy or sell a specific amount of currency at a predetermined exchange rate within a specified timeframe. They offer flexibility but come with a premium.

- Futures Contracts MYR: These are standardized contracts traded on exchanges, offering liquidity and transparency. They are suitable for larger transactions and businesses comfortable with the complexities of futures markets.

Pros and Cons:

| Strategy | Pros | Cons |

|---|---|---|

| Forward Contracts | Simplicity, certainty of exchange rate | Less flexibility, potential for missed opportunities |

| Currency Options | Flexibility, downside protection | Premium cost, potential for unused options |

| Futures Contracts | Liquidity, transparency | Requires understanding of futures markets |

Financial institutions play a critical role in facilitating these hedging strategies, offering expertise and access to various financial instruments.

Practical Steps to Implement Front-Loading for MYR Risk Management

Implementing effective front-loading for MYR risk mitigation involves a systematic approach:

- Forecasting Future Currency Needs: Accurately estimate your future foreign currency requirements for imports, exports, or investments. This involves analyzing sales forecasts, production plans, and other relevant business data.

- Identifying Appropriate Hedging Instruments: Choose the hedging strategy (forward contract, currency option, or futures contract) that best aligns with your risk tolerance, transaction size, and timeframe. Understanding your MYR forecasting needs is vital here.

- Consulting with Currency Specialists or Financial Advisors: Seek professional advice to determine the most suitable hedging strategy and to navigate the complexities of the foreign exchange market.

- Monitoring Market Conditions and Adjusting Strategies as Needed: Continuously monitor MYR exchange rate movements and adjust your hedging strategy as necessary to optimize your risk management approach.

Potential Challenges and Limitations of Front-Loading

While front-loading is a powerful tool, it's crucial to acknowledge its limitations:

- Inaccurate Forecasting: Incorrectly forecasting future currency needs can lead to either insufficient or excessive hedging, both of which can be costly.

- Transaction Costs: Hedging strategies involve fees and commissions, which need to be factored into the overall cost-benefit analysis.

- Complexity of Hedging Strategies: Understanding and implementing complex hedging strategies requires expertise and can be time-consuming.

- Market Volatility: Even with hedging, unexpected sharp movements in the MYR can still result in some losses.

Front-loading may not be the most suitable approach for all situations. For instance, businesses with highly uncertain future currency needs or those with a high tolerance for risk might prefer alternative strategies.

Conclusion

Effectively managing Malaysian Ringgit (MYR) exchange rate risk is crucial for businesses operating in the global market. By understanding and implementing front-loading strategies, businesses can minimize potential losses and secure their financial future. Front-loading, through techniques like forward contracts, currency options, and futures contracts, offers a proactive approach to mitigate the impact of MYR volatility. However, careful planning, accurate forecasting, and professional advice are vital for successful implementation. Learn more about mitigating your Malaysian Ringgit (MYR) exchange rate risk today! Contact a financial advisor specializing in MYR hedging to create a customized risk management plan.

Featured Posts

-

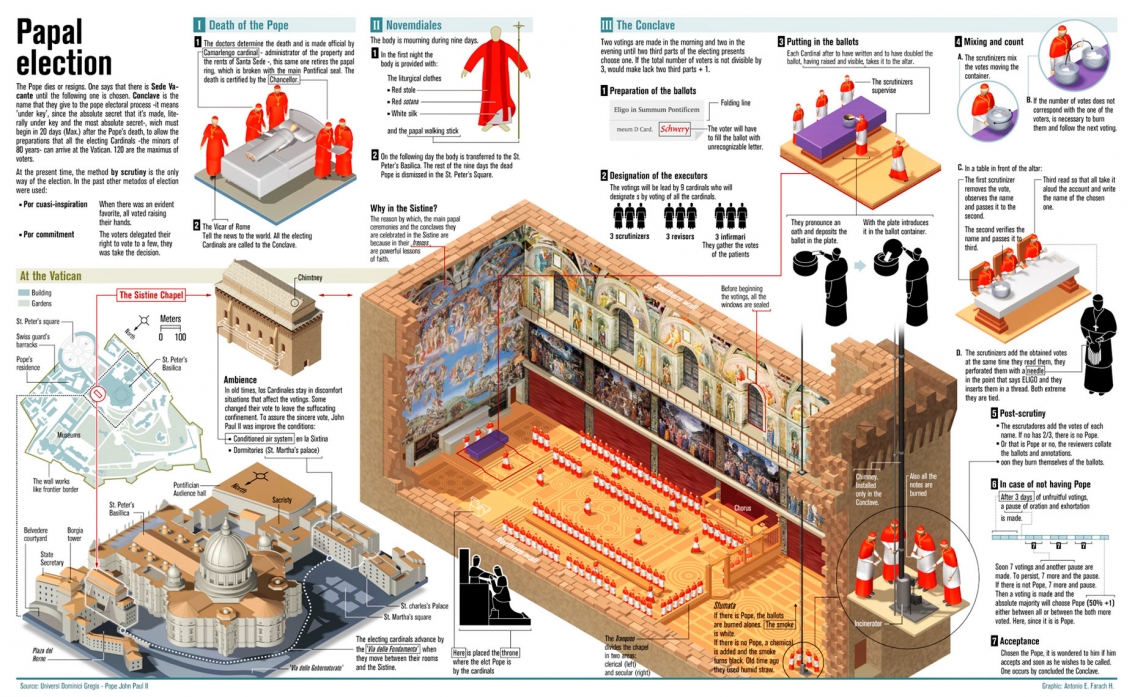

What Happens In A Papal Conclave A Guide To The Election Of The Pope

May 07, 2025

What Happens In A Papal Conclave A Guide To The Election Of The Pope

May 07, 2025 -

Ortega Explains Her Departure From Scream 7 The Full Story

May 07, 2025

Ortega Explains Her Departure From Scream 7 The Full Story

May 07, 2025 -

Playoff Breakout Stars Analyzing Mitchell And Brunsons Success

May 07, 2025

Playoff Breakout Stars Analyzing Mitchell And Brunsons Success

May 07, 2025 -

Ps 5 Pro Enhanced Top Exclusive Games To Play Now

May 07, 2025

Ps 5 Pro Enhanced Top Exclusive Games To Play Now

May 07, 2025 -

Rihannas Savage X Fenty The New Bridal Collection

May 07, 2025

Rihannas Savage X Fenty The New Bridal Collection

May 07, 2025