Managing Risk In The Era Of The Great Decoupling

Table of Contents

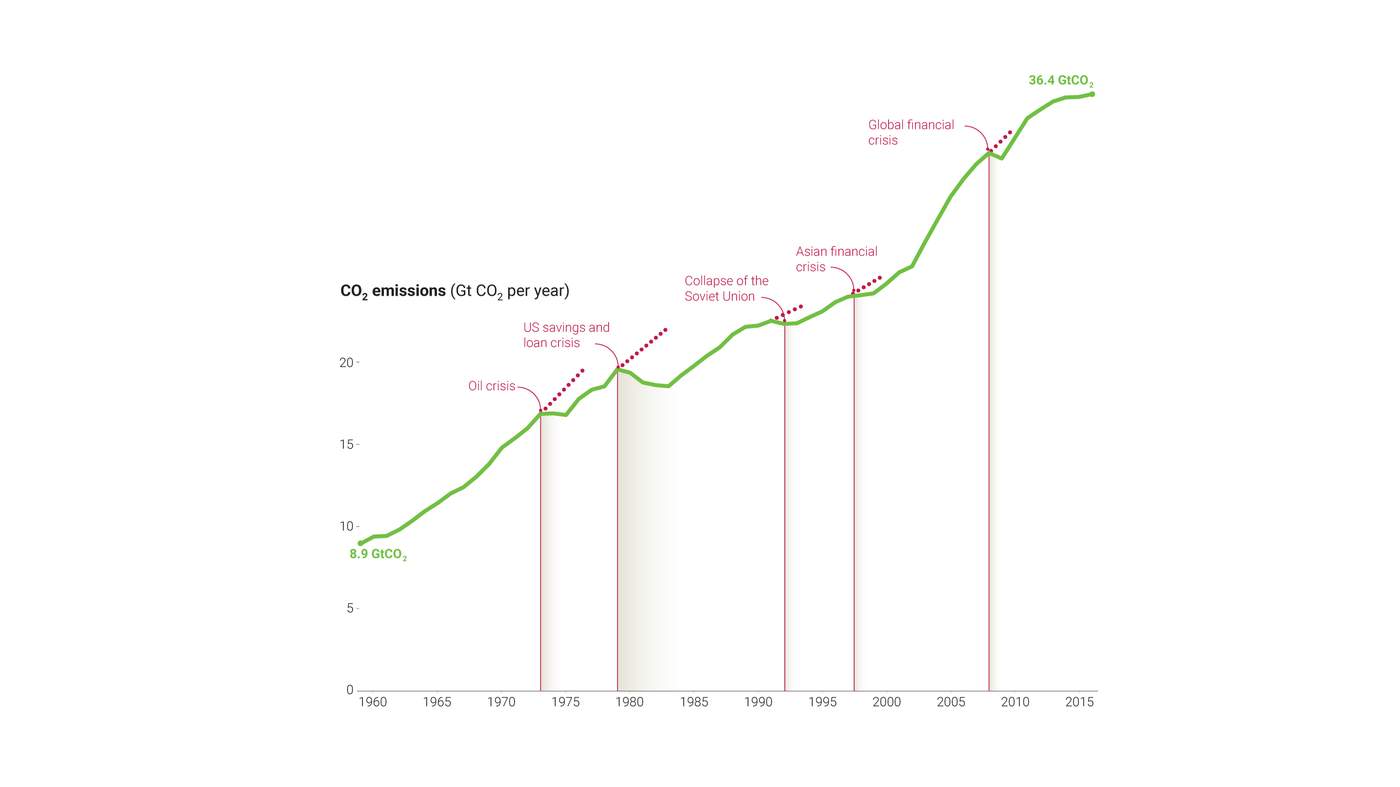

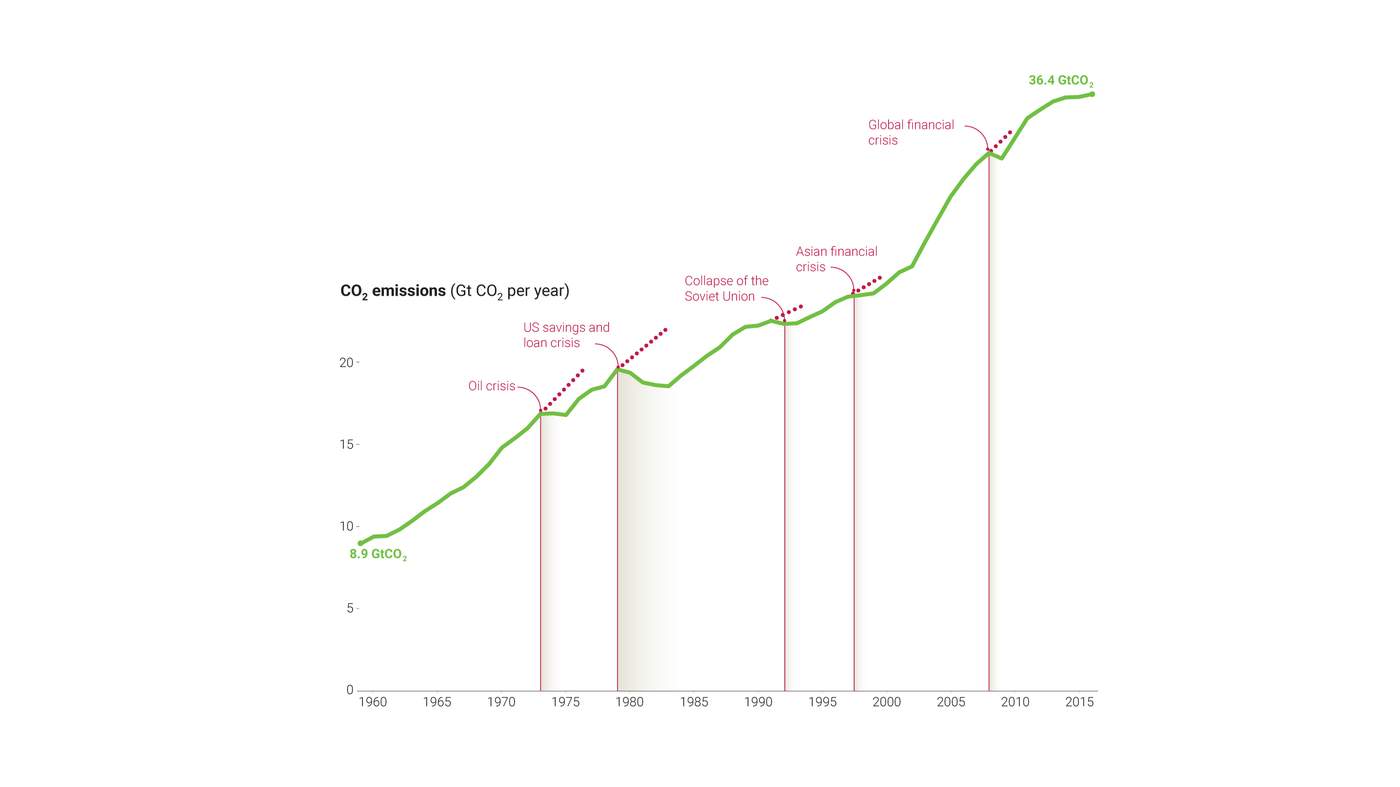

Geopolitical Risk and its Impact on Business

Geopolitical risk, encompassing political instability, trade wars, sanctions, and regional conflicts, significantly impacts businesses. Understanding and mitigating these risks is crucial for long-term sustainability.

Understanding Geopolitical Instability

Factors contributing to geopolitical instability are multifaceted and interconnected.

- Trade Wars: Escalating trade tensions between major economies disrupt global trade flows and increase uncertainty for businesses. The US-China trade war, for example, significantly impacted supply chains and commodity prices.

- Sanctions: International sanctions imposed on specific countries or entities can severely restrict business operations and create financial instability. Sanctions against Russia following the invasion of Ukraine serve as a prime example.

- Political Unrest: Civil unrest, regime changes, and political instability in key regions can lead to operational disruptions, asset damage, and security concerns.

- Regional Conflicts: Armed conflicts and geopolitical tensions in various regions create significant risks for businesses operating in or sourcing from those areas.

Different types of geopolitical risks include:

- Political Risk: Risks associated with changes in government policies, regulations, or political stability.

- Economic Risk: Risks related to economic sanctions, currency fluctuations, and market volatility.

- Security Risk: Risks related to terrorism, civil unrest, and other security threats.

These risks can lead to:

- Disruptions to operations and supply chains.

- Increased costs due to higher insurance premiums, logistics expenses, and raw material prices.

- Reputational damage if a company is perceived as operating in high-risk areas.

Mitigating Geopolitical Risk

Strategies for mitigating geopolitical risk include:

- Diversification of Supply Chains: Reducing reliance on single suppliers or regions by establishing alternative sourcing options (nearshoring, reshoring, friend-shoring).

- Risk Mapping and Assessment: Identifying potential geopolitical risks and assessing their likelihood and impact on the business.

- Scenario Planning: Developing contingency plans to address potential disruptions caused by geopolitical events.

- Political Risk Insurance: Purchasing insurance policies to cover potential losses from political instability or other geopolitical risks.

Practical steps businesses can take include:

- Conducting thorough due diligence on suppliers and partners.

- Developing robust crisis management plans.

- Maintaining open communication with stakeholders.

- Investing in technology to enhance supply chain visibility and resilience.

Supply Chain Resilience in a Fragmented World

The Great Decoupling necessitates a fundamental shift towards building more resilient and adaptable supply chains.

Building a More Resilient Supply Chain

Strategies for building resilience include:

- Nearshoring and Reshoring: Relocating manufacturing or sourcing closer to home to reduce transportation costs and dependence on distant suppliers.

- Regionalization: Focusing on regional supply chains to reduce dependence on long-distance transportation and geopolitical instability.

- Supplier Relationship Management: Developing strong, collaborative relationships with suppliers to improve communication, transparency, and responsiveness.

- Supply Chain Visibility: Implementing technologies to track and monitor goods throughout the supply chain to identify potential disruptions early on.

- Technology's Role: Utilizing AI, blockchain, and other advanced technologies to enhance supply chain efficiency, transparency, and resilience.

Managing Supply Chain Disruptions

Preparing for and responding to disruptions requires:

- Contingency Planning: Developing alternative sourcing strategies, backup suppliers, and buffer inventory levels.

- Inventory Management: Implementing sophisticated inventory management systems to optimize stock levels and mitigate shortages.

- Alternative Sourcing: Identifying and qualifying backup suppliers in different geographical locations.

- Real-Time Monitoring: Utilizing real-time data analytics to monitor supply chain performance and identify potential disruptions early.

Financial Risk Management in Uncertain Times

Economic volatility and currency fluctuations pose significant financial risks.

Currency Fluctuations and Hedging Strategies

Currency fluctuations can significantly impact profitability. Hedging strategies mitigate this risk:

- Forward Contracts: Agreements to buy or sell currency at a future date at a pre-determined exchange rate.

- Options: Contracts that give the buyer the right, but not the obligation, to buy or sell currency at a specific exchange rate on or before a future date.

- Currency Swaps: Agreements to exchange principal and interest payments in different currencies.

Credit Risk and Default Prevention

Assessing and managing credit risk is crucial:

- Due Diligence: Thoroughly vetting potential customers and suppliers to assess their creditworthiness.

- Credit Insurance: Protecting against losses from customer defaults.

- Diversification of Receivables: Spreading credit risk across multiple customers.

Technological Risks and Opportunities

Technological advancements present both risks and opportunities for risk management.

Cybersecurity Threats and Data Protection

Cybersecurity and data protection are paramount:

- Best Practices: Implementing robust cybersecurity measures, including firewalls, intrusion detection systems, and employee training.

- Data Privacy Regulations: Ensuring compliance with data privacy regulations like GDPR and CCPA.

Leveraging Technology for Risk Management

Technology enhances risk management capabilities:

- AI and Machine Learning: Predicting potential disruptions and optimizing risk mitigation strategies.

- Predictive Analytics: Identifying trends and patterns to anticipate future risks.

- Data Analytics: Analyzing large datasets to gain insights into supply chain performance and identify areas for improvement.

Mastering Risk Management in the Age of Decoupling

Navigating the Great Decoupling requires proactive risk management across geopolitical, supply chain, financial, and technological domains. Diversifying supply chains, implementing robust contingency plans, leveraging technology for improved visibility and prediction, and utilizing appropriate hedging strategies are critical for success. Building resilience into your operations is no longer optional; it’s essential for long-term survival and prosperity. To learn more about implementing effective risk management strategies tailored to the complexities of the Great Decoupling, explore our resources and consulting services today. Don't wait until a crisis hits; proactively manage risk and thrive in this evolving global landscape.

Featured Posts

-

Predstoyasch Rimeyk Na Stivn King Ot Netflix

May 09, 2025

Predstoyasch Rimeyk Na Stivn King Ot Netflix

May 09, 2025 -

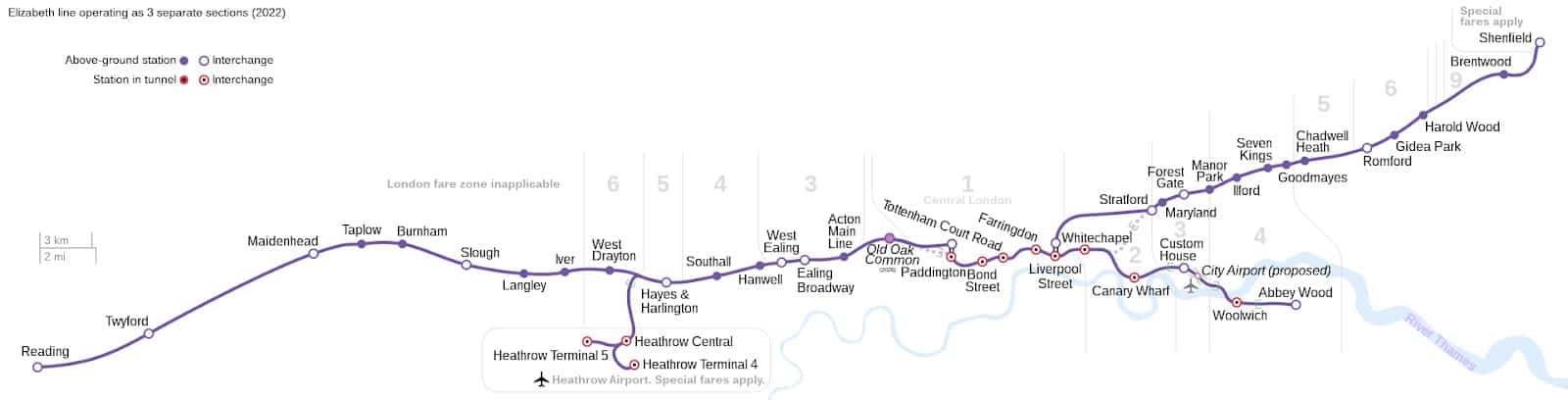

Elizabeth Line Gaps In Accessibility For Wheelchair Users And How To Improve Them

May 09, 2025

Elizabeth Line Gaps In Accessibility For Wheelchair Users And How To Improve Them

May 09, 2025 -

Policia Britanica Prende Mulher Que Se Diz Madeleine Mc Cann

May 09, 2025

Policia Britanica Prende Mulher Que Se Diz Madeleine Mc Cann

May 09, 2025 -

Analyzing The Impact Of The 2025 Nhl Trade Deadline On The Playoffs

May 09, 2025

Analyzing The Impact Of The 2025 Nhl Trade Deadline On The Playoffs

May 09, 2025 -

Dakota Johnson Plintu Nuotraukos Tiesa Apie Incidenta

May 09, 2025

Dakota Johnson Plintu Nuotraukos Tiesa Apie Incidenta

May 09, 2025

Latest Posts

-

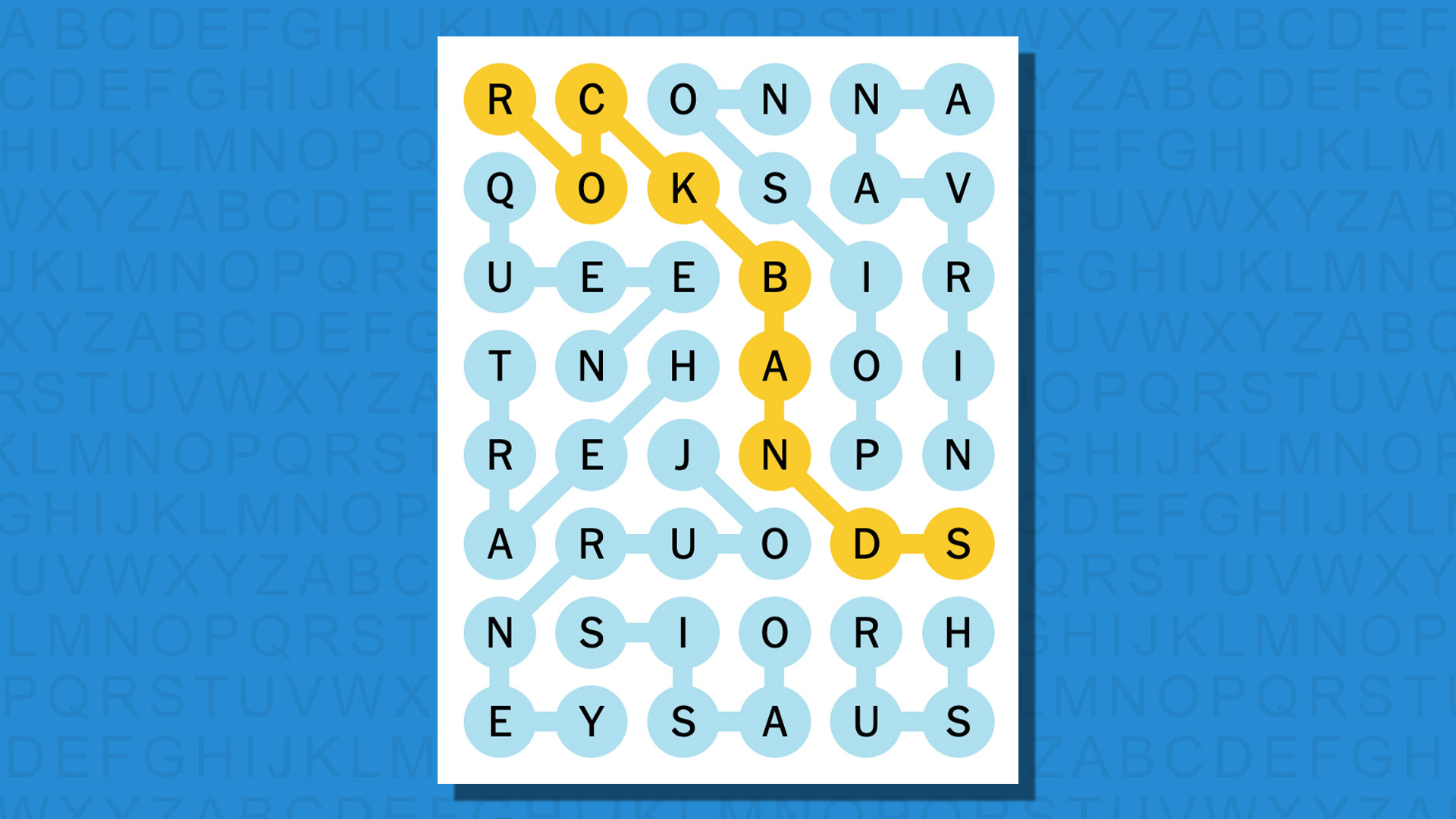

Nyt Strands Game 405 Saturday April 12 Hints And Solutions

May 09, 2025

Nyt Strands Game 405 Saturday April 12 Hints And Solutions

May 09, 2025 -

Solve Nyt Strands Game 402 Wednesday April 9th Hints And Answers

May 09, 2025

Solve Nyt Strands Game 402 Wednesday April 9th Hints And Answers

May 09, 2025 -

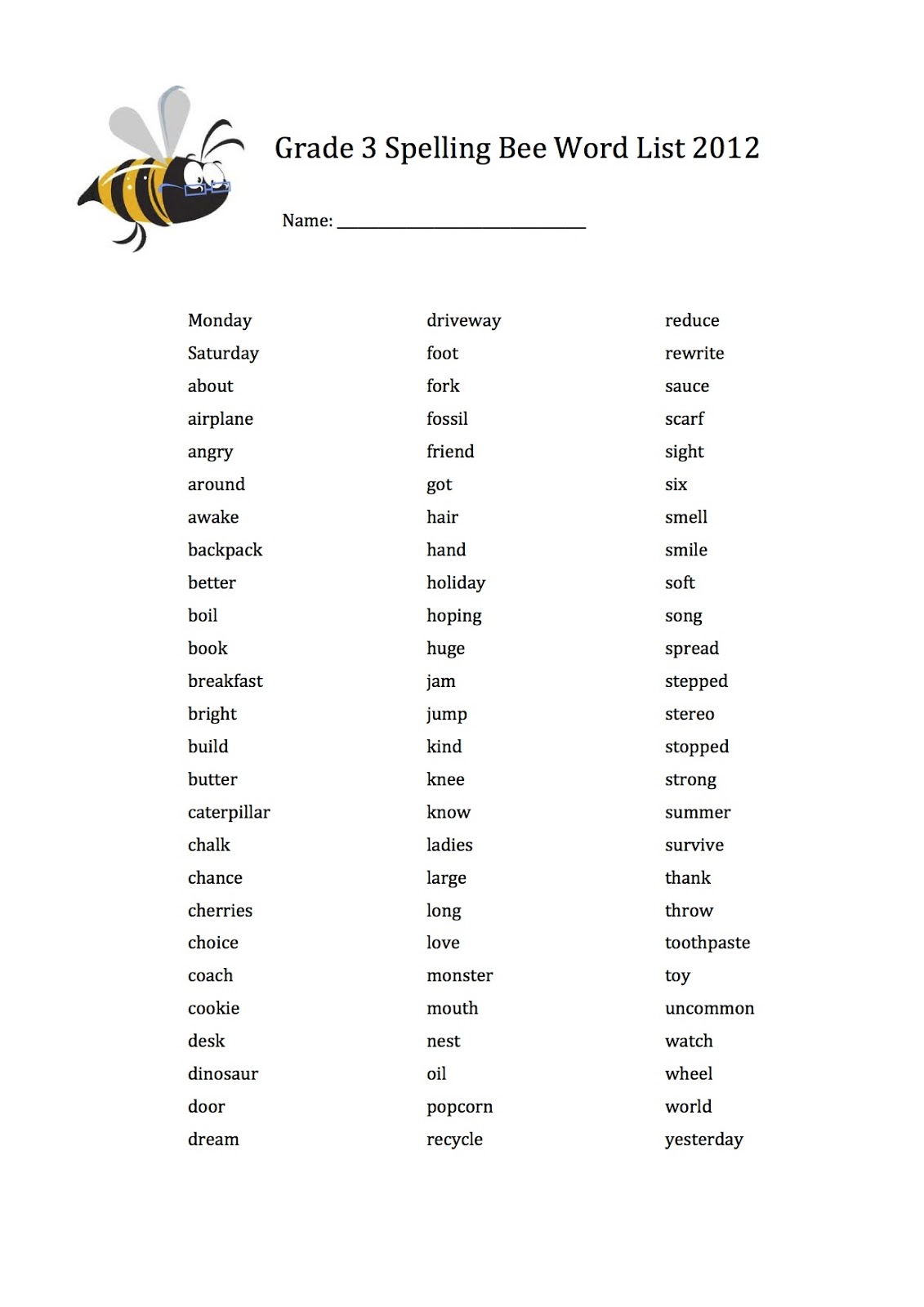

Solve The Nyt Spelling Bee April 1 2025 Complete Guide

May 09, 2025

Solve The Nyt Spelling Bee April 1 2025 Complete Guide

May 09, 2025 -

Wednesday April 9th Nyt Strands Game 402 Hints And Answers

May 09, 2025

Wednesday April 9th Nyt Strands Game 402 Hints And Answers

May 09, 2025 -

Nyt Spelling Bee April 1 2025 Hints Answers And Pangram

May 09, 2025

Nyt Spelling Bee April 1 2025 Hints Answers And Pangram

May 09, 2025