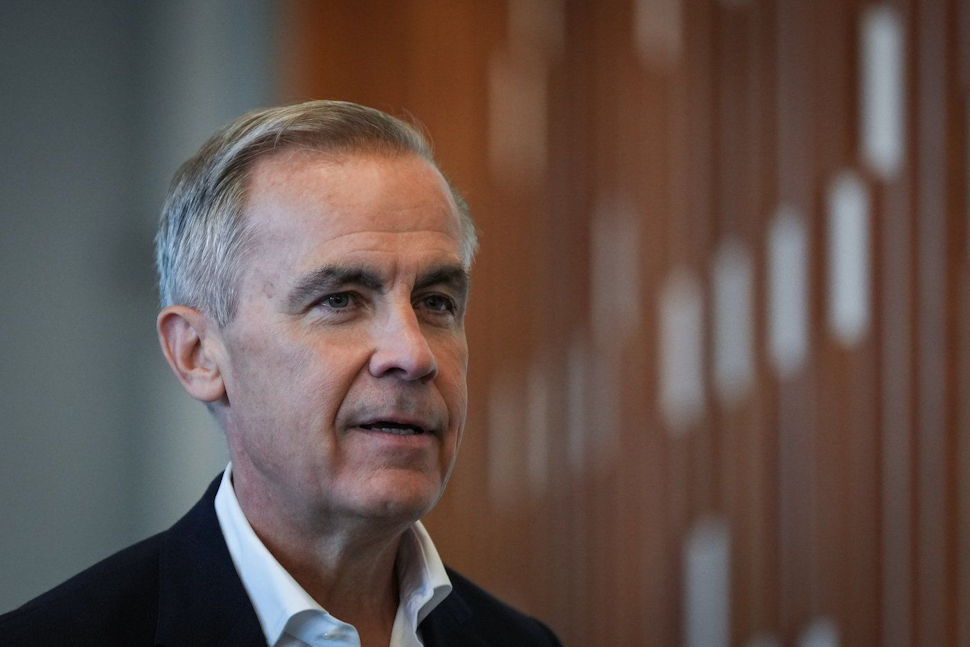

Mark Carney's Leadership Secure: Canada's Liberals Halt Rule Changes

Table of Contents

The Proposed Rule Changes and Their Potential Impact

Several proposed rule changes aimed to alter the Bank of Canada's structure and mandate, sparking widespread concern about their potential negative consequences. These proposals included:

- Increased Independence: Some suggested granting the Bank of Canada even greater independence from government oversight, potentially reducing accountability and increasing the risk of unchecked monetary policy decisions.

- Revised Mandate: Other proposals sought to modify the Bank of Canada's mandate, potentially shifting its focus away from price stability and towards other economic goals. This could have diluted the Bank's primary objective and complicated its ability to effectively manage inflation.

- Structural Changes: There were also discussions surrounding internal structural changes within the Bank of Canada, impacting its operational efficiency and effectiveness.

The potential ramifications of these changes were significant. A weakened Bank of Canada, struggling under a revised mandate or hampered by internal upheaval, could have:

- Reduced Effectiveness of Monetary Policy: Changes could have undermined the Bank's ability to implement effective monetary policy, impacting interest rates and potentially leading to economic instability.

- Increased Uncertainty in Financial Markets: The uncertainty surrounding the proposed changes alone could have spooked financial markets, leading to decreased investment and potentially impacting the Canadian dollar's exchange rate.

- Erosion of Public Trust: Any perceived weakening of the Bank of Canada's independence or competence could have eroded public trust in the institution's ability to manage the Canadian economy.

The Liberal Government's Intervention and Reasoning

Faced with the potential for significant economic disruption, the Liberal government swiftly intervened, halting the proposed rule changes. The government's official reasoning centered on several key points:

- Maintaining Economic Stability: The government emphasized the importance of maintaining stability and confidence in the Canadian economy, arguing that the proposed changes posed an unacceptable risk.

- Supporting Mark Carney's Leadership: The government explicitly stated its support for Mark Carney's leadership and recognized the importance of his continued tenure in navigating economic challenges. Statements from government officials reiterated their confidence in his expertise and experience. (Specific quotes could be inserted here if available).

- Avoiding Disruption: The government sought to avoid any disruption to the Bank of Canada's operations, recognizing the potential negative impact on investor confidence and economic growth.

This intervention highlights the Canadian government's commitment to maintaining a strong and stable central bank, crucial for navigating the complexities of the global financial landscape. The decision demonstrates a clear understanding of the importance of Mark Carney's leadership in achieving these objectives.

Impact on Mark Carney's Role and the Bank of Canada

The Liberal government's decision has had a significant positive impact on Mark Carney's role and the Bank of Canada's operations:

- Reinforced Leadership: The intervention has reinforced Mark Carney's position as Governor, solidifying his authority and providing stability during uncertain economic times.

- Operational Continuity: The Bank of Canada can continue its operations without the disruption and uncertainty that the proposed changes would have caused. This ensures the continuity of effective monetary policy.

- Long-Term Implications: The decision may also have long-term implications for the Bank of Canada's autonomy and its relationship with the government, reaffirming the importance of its independent role in managing the Canadian economy.

This stability is essential for attracting foreign investment and maintaining confidence in the Canadian dollar. The clear signal sent by the government reassures stakeholders that Canada’s central bank maintains its robust structure and experienced leadership.

Public and Expert Reactions to the Decision

The government's intervention has been met with mixed reactions, but overall, there's been a significant amount of support.

- Positive Reactions: Many economists and financial analysts have praised the government's decision, highlighting the potential negative consequences of the proposed changes and emphasizing the importance of maintaining stability and confidence in the Bank of Canada under Mark Carney's leadership. Several news outlets have published positive commentary.

- Mixed Reactions: Some have expressed concerns about the potential for government overreach, suggesting that the intervention could set a negative precedent. These voices often highlight the need for a balance between government oversight and the independence of the central bank.

However, the prevailing sentiment seems to be one of relief, with many welcoming the continuation of Mark Carney's leadership and the avoidance of potentially disruptive changes to the Bank of Canada. Credible sources such as [insert relevant sources here] offer comprehensive analysis of the varied perspectives.

Conclusion: Securing Mark Carney's Leadership for Continued Canadian Economic Stability

The proposed rule changes to the Bank of Canada posed a significant threat to economic stability and Mark Carney's leadership. However, the Liberal government's decisive intervention has successfully averted this risk. The government’s reasoning, focusing on maintaining economic stability, supporting Mark Carney's leadership, and avoiding disruption, underscores the importance of a strong, independent central bank. The outcome reinforces Mark Carney's role and ensures the continued effectiveness of the Bank of Canada in managing the Canadian economy. The overall impact on the Canadian financial system is one of strengthened stability and continued confidence. Stay informed about the ongoing developments regarding Mark Carney's leadership and its impact on the Canadian economy by following reputable financial news sources and the Bank of Canada's official website.

Featured Posts

-

Yellowstones Lost Wolves New Documentary Trailer

May 27, 2025

Yellowstones Lost Wolves New Documentary Trailer

May 27, 2025 -

Emegha Transfer West Ham And Newcastle Vie For Striker

May 27, 2025

Emegha Transfer West Ham And Newcastle Vie For Striker

May 27, 2025 -

11 Krayin Stvoryuyut Koalitsiyu Dlya Postachannya Ukrayini Sistem Reb

May 27, 2025

11 Krayin Stvoryuyut Koalitsiyu Dlya Postachannya Ukrayini Sistem Reb

May 27, 2025 -

Before Yellowstone The Essential Taylor Sheridan Film Dutton Fans Need To See

May 27, 2025

Before Yellowstone The Essential Taylor Sheridan Film Dutton Fans Need To See

May 27, 2025 -

Gratitude On Sesame Street Sza And Elmos New Musical Collaboration

May 27, 2025

Gratitude On Sesame Street Sza And Elmos New Musical Collaboration

May 27, 2025

Latest Posts

-

Vaktsinatsiya Protiv Kori V Mongolii Srochnaya Neobkhodimost

May 30, 2025

Vaktsinatsiya Protiv Kori V Mongolii Srochnaya Neobkhodimost

May 30, 2025 -

Kak Mongoliya Boretsya S Epidemiey Kori

May 30, 2025

Kak Mongoliya Boretsya S Epidemiey Kori

May 30, 2025 -

Korevoy Krizis V Mongolii Chto Nuzhno Znat

May 30, 2025

Korevoy Krizis V Mongolii Chto Nuzhno Znat

May 30, 2025 -

Zarazhenie Koryu V Mongolii Prizyv K Nemedlennym Deystviyam

May 30, 2025

Zarazhenie Koryu V Mongolii Prizyv K Nemedlennym Deystviyam

May 30, 2025 -

Situatsiya S Koryu V Mongolii Nekhvatka Meditsinskikh Resursov

May 30, 2025

Situatsiya S Koryu V Mongolii Nekhvatka Meditsinskikh Resursov

May 30, 2025