Market Rally: S&P 500 Up Over 3% Following US-China Tariff Truce

Table of Contents

Understanding the US-China Tariff Truce and its Impact

The recent US-China tariff truce marks a pivotal moment in the protracted trade war. While not a complete resolution, it offers temporary relief and a pathway towards further negotiations.

The Details of the Agreement:

The agreement, while lacking specifics publicly available immediately, signaled a pause in further tariff escalation. Key aspects include:

- Temporary Suspension of New Tariffs: The immediate impact was a halt to planned increases in tariffs on goods traded between the two economic giants.

- Commitment to Further Negotiations: Both sides committed to resuming negotiations aimed at resolving the remaining trade disputes. The details of these future negotiations remain to be seen.

- Phase One Deal Potential: While not explicitly confirmed, the truce implied a potential path towards a "Phase One" trade deal, addressing some immediate points of contention before tackling broader structural issues.

Market Reaction to the News:

The market reacted swiftly and decisively to the news of the truce. The S&P 500 saw a significant jump, exceeding 3% in a single day, reflecting a surge in investor optimism.

- Increased Trading Volume: Trading volume spiked significantly, indicating heightened investor activity and engagement.

- Positive Sentiment Shift: Investor sentiment noticeably shifted from apprehension and uncertainty to cautious optimism, reflected in various market indicators.

Long-Term Implications for the Economy:

The long-term effects of this tariff truce remain to be seen, but potential impacts include:

- Boosted Economic Growth: A reduction in trade tensions could stimulate economic growth both in the US and China, leading to increased consumer spending and business investment.

- Supply Chain Stabilization: The truce could lead to greater stability in global supply chains, reducing uncertainty for businesses and consumers alike.

- Reduced Inflationary Pressures: Reduced tariffs could help alleviate inflationary pressures on various goods and services. However, this depends on the duration and scope of the tariff reductions.

Analyzing the S&P 500's Performance During the Rally

The S&P 500's performance during this market rally reveals interesting insights into investor behavior and sector-specific responses.

Sector-Specific Gains:

Certain sectors within the S&P 500 experienced disproportionately large gains during the rally.

- Technology Stocks: Technology companies, often sensitive to trade tensions, saw substantial gains, reflecting investor confidence in the sector's future growth prospects.

- Consumer Discretionary: Companies in the consumer discretionary sector also saw significant increases as improved economic sentiment boosted consumer spending expectations.

Investor Sentiment and Market Volatility:

Following the announcement, market volatility decreased slightly, indicating a reduction in uncertainty.

- Increased Risk Appetite: Investors displayed a noticeably increased risk appetite, shifting their allocations towards higher-growth, higher-risk assets.

- Speculative Buying: Some analysts attributed the market rally to speculative buying, driven by anticipation of a broader trade deal.

Technical Analysis of the Rally:

While a detailed technical analysis is beyond the scope of this article, several indicators, such as increased trading volume and the upward movement of key moving averages, supported the rally.

Investing Strategies Following the Market Rally

The market rally following the tariff truce presents both opportunities and challenges for investors.

Risk Assessment and Diversification:

Even with the positive news, maintaining a diversified investment portfolio remains crucial.

- Strategic Asset Allocation: Rebalance your portfolio regularly to ensure alignment with your long-term goals and risk tolerance.

- Risk Management Strategies: Implement strategies like stop-loss orders to protect against potential market downturns.

Long-Term vs. Short-Term Investment Strategies:

The approach to investing following the market rally should depend on individual circumstances.

- Long-Term Investors: Maintain a long-term perspective, focusing on consistent investing and weathering short-term market fluctuations.

- Short-Term Investors: Short-term investors should proceed with caution, carefully considering the inherent risks involved in attempting to profit from short-term market movements.

Seeking Professional Financial Advice:

Before making any investment decisions, consult a qualified financial advisor. A professional can help you assess your risk tolerance and develop a personalized investment strategy tailored to your goals.

Conclusion

The US-China tariff truce has triggered a significant market rally, boosting the S&P 500 and impacting various sectors. While the truce presents positive potential, investors must carefully monitor market developments and understand the implications of the S&P 500’s performance. The importance of informed decision-making and a well-diversified portfolio cannot be overstated. Strategize your investment approach by carefully assessing your risk tolerance and seeking professional guidance. Proactive investment planning, in light of this market rally and ongoing trade negotiations, remains critical for long-term success. Monitor the market rally closely and make informed decisions to capitalize on opportunities and mitigate risks.

Featured Posts

-

Dodgers Defeat Cubs 3 0 Yamamotos Two Hit Performance Edmans Three Run Homer

May 13, 2025

Dodgers Defeat Cubs 3 0 Yamamotos Two Hit Performance Edmans Three Run Homer

May 13, 2025 -

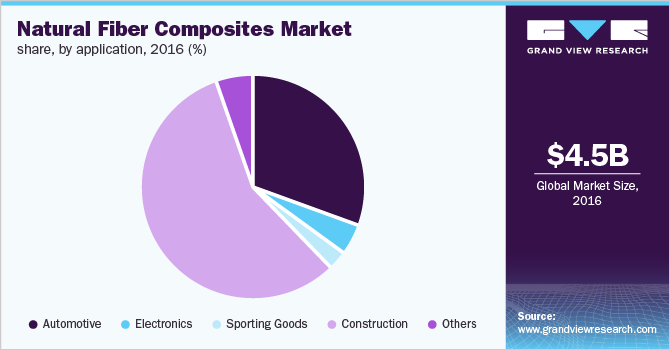

2029 Natural Fiber Composites Market Growth Drivers And Trends

May 13, 2025

2029 Natural Fiber Composites Market Growth Drivers And Trends

May 13, 2025 -

Sicherheitsmassnahmen Nach Amokalarm An Der Neuen Oberschule Braunschweig

May 13, 2025

Sicherheitsmassnahmen Nach Amokalarm An Der Neuen Oberschule Braunschweig

May 13, 2025 -

Byd A Evropsky Trh Analyza Neuspechu A Strategie Pro Budoucnost

May 13, 2025

Byd A Evropsky Trh Analyza Neuspechu A Strategie Pro Budoucnost

May 13, 2025 -

Data Breach Exposes Millions Executive Office365 Accounts Targeted

May 13, 2025

Data Breach Exposes Millions Executive Office365 Accounts Targeted

May 13, 2025