Market Reaction: Dow Futures And Dollar After US Credit Downgrade

Table of Contents

H2: Immediate Impact on Dow Futures

The news of the US credit downgrade triggered an immediate and significant drop in Dow futures. This reflected a widespread sense of uncertainty and risk aversion among investors.

-

Percentage Drop: Initial reports indicated a drop of [Insert Percentage]% in Dow futures contracts within the first hour of the announcement. This was followed by continued volatility throughout the trading day.

-

Trading Volume: Trading volume surged dramatically, indicating heightened investor activity and a scramble to react to the unexpected news. [Insert data on increased trading volume if available].

-

Factors Contributing to the Decline: The decline wasn't solely due to the downgrade itself but a confluence of factors:

- Negative Investor Sentiment: The downgrade reinforced existing concerns about the US economy, fueling negative investor sentiment.

- Increased Uncertainty: The downgrade introduced significant uncertainty about the future direction of the US economy and financial markets.

- Potential Ripple Effects: Fears of potential ripple effects across global markets contributed to the sell-off.

-

Unusual Trading Patterns: [Mention any unusual trading patterns observed, such as increased short-selling or unusual price swings].

H3: Short-Term Outlook for Dow Futures

The short-term outlook for Dow futures remains uncertain. Several factors will influence whether we see a recovery or further decline:

- Technical Analysis: Technical indicators [mention specific indicators and their implications].

- Economic Forecasts: The consensus among economists on the impact of the downgrade will significantly influence market sentiment.

- Geopolitical Factors: Global geopolitical events could exacerbate or mitigate the impact of the downgrade. [Mention any relevant geopolitical factors]. The Dow Jones Industrial Average will be closely watched for any signs of stabilization or further decline. Stock market volatility is expected to remain high in the coming days and weeks.

H2: The Dollar's Response to the US Credit Downgrade

Initially, the US dollar's reaction was somewhat counterintuitive. Despite the downgrade, the dollar [strengthened/weakened] against many major currencies.

- Changes in the Dollar Index (DXY): The DXY [Insert data on changes in the DXY].

- Safe-Haven Aspect: The dollar often acts as a safe-haven asset during times of uncertainty. This may explain the initial strengthening, as investors sought refuge in a relatively stable currency.

- Impact on International Trade and Capital Flows: The change in the dollar's value will affect international trade and capital flows. A stronger dollar could make US exports more expensive and imports cheaper.

H3: Long-Term Implications for the Dollar

The long-term impact on the dollar's value remains uncertain. However, several factors could play a crucial role:

- Global Reserve Currency Status: The downgrade could potentially challenge the dollar's status as the world's primary reserve currency, although this is unlikely to happen immediately.

- US Monetary Policy: The Federal Reserve's response to the downgrade and its impact on interest rates will influence the dollar's value. The US Dollar Index will be a key metric to watch for long-term trends in the foreign exchange market. Changes in currency exchange rates will significantly affect global trade and finance.

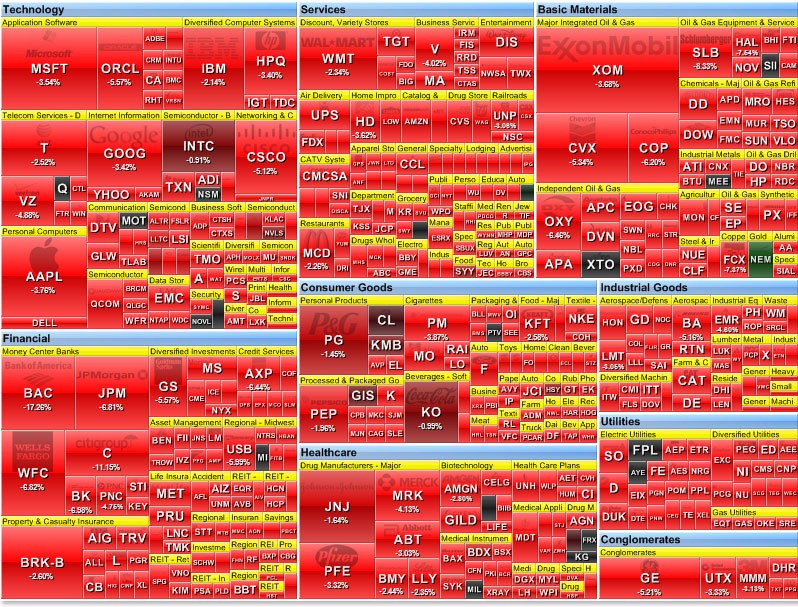

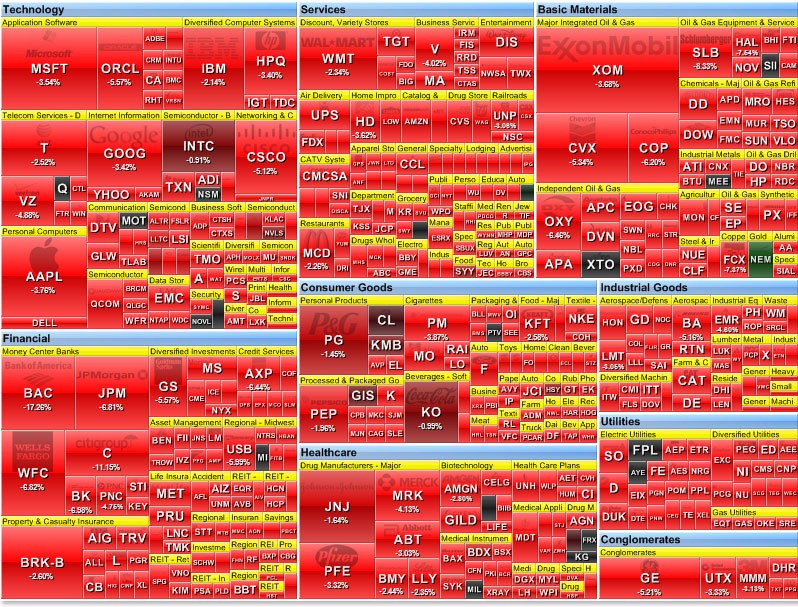

H2: Analysis of Investor Sentiment and Market Behavior

Following the downgrade, the prevailing market sentiment was characterized by fear, uncertainty, and doubt (FUD).

- Investor Behavior: Many investors exhibited risk aversion, leading to a flight to safety. This was evident in the increased demand for safe-haven assets like government bonds and gold. However, some opportunistic investors may have sought to buy assets at discounted prices.

- Affected Sectors: [Mention specific sectors or asset classes that were particularly affected. Example: The bond market saw significant movements as investors reassessed the risk associated with US treasuries].

- Investor Reactions:

- Institutional investors generally reacted with caution, reducing risk exposure and diversifying portfolios.

- Retail investors showed a mix of panic selling and attempts to weather the storm.

H2: Potential Long-Term Economic Consequences

The US credit downgrade has significant potential long-term economic consequences:

- Inflation and Interest Rates: Higher borrowing costs for the US government could lead to higher inflation and interest rates.

- Economic Growth: The downgrade could negatively affect economic growth by reducing investor confidence and hindering investment.

- Government Borrowing Costs: The cost of borrowing for the US government will likely increase, potentially leading to fiscal challenges.

- Global Economic Stability: The downgrade could have ripple effects across the global economy, impacting global economic stability.

Conclusion:

The US credit downgrade has undoubtedly created significant market volatility, impacting Dow futures and the US dollar in the short term. The long-term consequences remain to be seen, but this event highlights the importance of monitoring economic indicators and adapting investment strategies accordingly. Understanding the market reaction to the US credit downgrade is crucial for informed decision-making. Stay informed and adapt your investment strategies based on the evolving market conditions. Continue monitoring the impact of this US credit downgrade on both Dow Futures and the US Dollar for updated insights.

Featured Posts

-

Charles Leclercs Collaboration With Chivas Regal A Winning Partnership

May 20, 2025

Charles Leclercs Collaboration With Chivas Regal A Winning Partnership

May 20, 2025 -

Kaellman Ja Hoskonen Loppu Puolan Seuralehdelle

May 20, 2025

Kaellman Ja Hoskonen Loppu Puolan Seuralehdelle

May 20, 2025 -

Robert Pattinson And Accents How His Voice Shapes His Roles Including Mickey 17

May 20, 2025

Robert Pattinson And Accents How His Voice Shapes His Roles Including Mickey 17

May 20, 2025 -

Rtl Groups Streaming Growth Key Factors Driving Profitability

May 20, 2025

Rtl Groups Streaming Growth Key Factors Driving Profitability

May 20, 2025 -

Numerotation Des Batiments A Abidjan Guide Du Projet D Adressage

May 20, 2025

Numerotation Des Batiments A Abidjan Guide Du Projet D Adressage

May 20, 2025