Market Reaction To UK Inflation: Pound Up, BOE Cuts Less Certain

Table of Contents

The Pound's Appreciation: A Temporary Relief?

The initial market reaction to the latest UK inflation figures was positive, primarily due to inflation coming in lower than many analysts had predicted. This led to a strengthening of the pound. However, it's crucial to understand whether this appreciation is a sustainable trend or merely a short-term blip.

- Strength of the pound against other major currencies (USD, EUR): The GBP/USD exchange rate saw a noticeable increase following the inflation announcement, similarly, the GBP/EUR rate also experienced a positive shift. However, the extent of the appreciation varied depending on the currency pair and the timeframe considered.

- Short-term vs. long-term effects on the currency: While the short-term outlook for the pound appears positive, the long-term effects remain uncertain. Sustained lower inflation is necessary to solidify the pound's gains. Other macroeconomic factors, such as global economic conditions and geopolitical events, will also influence the currency's trajectory.

- Potential factors driving the temporary appreciation beyond inflation data: Besides the lower-than-expected inflation data, other contributing factors may include investor sentiment, global economic shifts and speculative trading activity in the foreign exchange market.

- GBP/USD Exchange Rate (Illustrative Example): (Insert a chart or graph showing the GBP/USD exchange rate fluctuations around the time of the inflation announcement. This would greatly enhance the article's visual appeal and provide concrete data to support the analysis.)

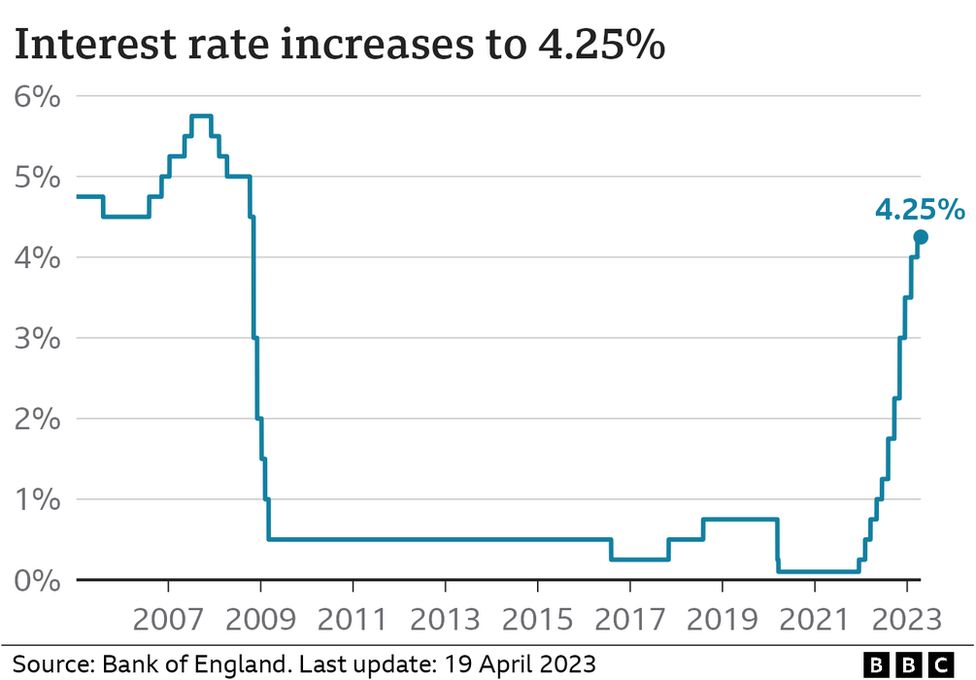

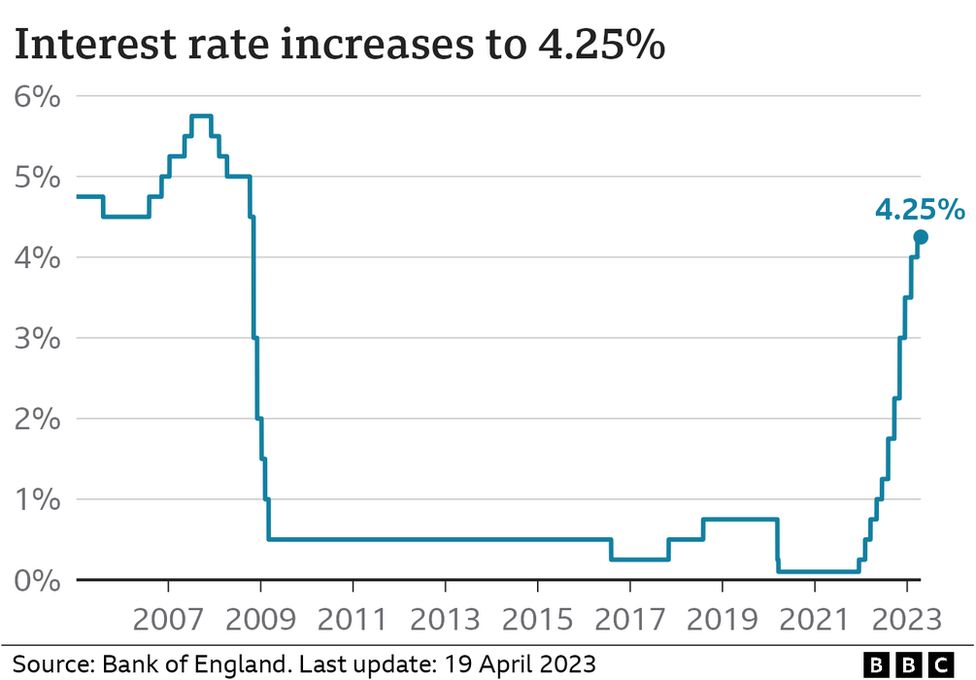

BOE's Dilemma: Interest Rate Cuts on Hold?

The uncertainty surrounding the BOE's future interest rate decisions is a key takeaway from the recent inflation data. While the lower-than-expected inflation provides some breathing room, persistent inflationary pressures still necessitate a cautious approach.

- Analysis of current inflation rates and their relation to the BOE's target: The current inflation rate, although lower than anticipated, is still significantly above the BOE's target of 2%. This discrepancy underscores the continuing challenge for the central bank.

- Potential impacts of continued high inflation on the economy: Persistently high inflation can erode consumer purchasing power, stifle economic growth, and increase the risk of wage-price spirals. These negative effects could force the BOE to maintain a tighter monetary policy.

- Examination of the BOE's current monetary policy stance: The BOE's stance on interest rate adjustments is likely to depend on incoming economic data, particularly on wage growth and core inflation. Any signs of persistent price increases might lead the BOE to reconsider rate cuts.

- Contrasting opinions among economists regarding rate cuts: Economists hold differing opinions on the appropriate path for interest rates. Some argue that the lower inflation justifies cuts, while others believe that the persistent upward pressure on prices necessitates a more cautious, wait-and-see approach.

Market Volatility and Investor Sentiment

The mixed signals from the inflation report have created volatility in various asset classes. This section will explore the impact on investor confidence and overall market behavior.

- How different asset classes (e.g., bonds, equities) reacted: The response of different asset classes has been varied. For example, government bonds might see increased demand if lower inflation signals lower future interest rates. Equities could exhibit volatility depending on investor perceptions of the economic outlook.

- Investor confidence and its impact on market performance: Investor confidence is a key driver of market performance. Positive investor sentiment following lower-than-expected inflation can boost stock prices and improve overall market sentiment. Conversely, concerns about persistent inflation could dampen investor enthusiasm.

- Potential risks and uncertainties facing the UK economy: The UK economy faces a multitude of risks, including global economic slowdown, geopolitical uncertainty, and the lingering impact of Brexit. These factors contribute to market volatility.

- Significant market fluctuations or unusual trading activity: (This point requires specific data related to market activity following the inflation announcement. Include relevant examples of unusual trading patterns or significant price swings in specific markets.)

Impact on Businesses and Consumers

The latest UK inflation data and subsequent market reaction have significant ramifications for UK businesses and consumers.

- Potential impact on consumer spending and borrowing: Lower inflation, if sustained, could boost consumer spending as the cost of living decreases. However, uncertainties surrounding interest rates may influence consumer borrowing behavior.

- The effect on businesses' investment decisions and pricing strategies: Businesses might adjust their investment plans based on the economic outlook. Pricing strategies might also be affected, with companies attempting to balance profit margins with consumer demand.

- Overall economic growth outlook considering the current situation: The overall economic growth outlook hinges on a multitude of interconnected factors including inflation, interest rate decisions, consumer confidence, business investment, and global economic conditions.

Conclusion

The market's reaction to the latest UK inflation data is multifaceted and complex. While the pound sterling experienced a temporary surge due to lower-than-expected inflation, the path of the Bank of England’s interest rates remains uncertain. This points to continued economic volatility in the UK. The impact on businesses and consumers is yet to fully unfold, and the next few months will be crucial in determining the long-term effects.

Call to action: Stay informed about the evolving situation regarding UK inflation and its impact on the market. Continuously monitor updates on UK inflation and related economic indicators to make informed financial decisions. Further analysis of UK inflation trends is crucial for navigating the complexities of the current economic climate.

Featured Posts

-

Hsv Aufstieg Perfekt Der Weg Zurueck In Die Bundesliga

May 26, 2025

Hsv Aufstieg Perfekt Der Weg Zurueck In Die Bundesliga

May 26, 2025 -

Mercedes Lewis Hamilton Investigation Key Developments Revealed

May 26, 2025

Mercedes Lewis Hamilton Investigation Key Developments Revealed

May 26, 2025 -

Jrymt Mrwet Fy Frnsa Tfasyl Jdydt Fy Qdyt Dfn Afrad Asrt Dakhl Mnzl

May 26, 2025

Jrymt Mrwet Fy Frnsa Tfasyl Jdydt Fy Qdyt Dfn Afrad Asrt Dakhl Mnzl

May 26, 2025 -

Ardisson Et Baffie Froid Entre Deux Anciens Amis Analyse Des Accusations De Connerie Et De Machisme

May 26, 2025

Ardisson Et Baffie Froid Entre Deux Anciens Amis Analyse Des Accusations De Connerie Et De Machisme

May 26, 2025 -

The World Of The Hells Angels Membership Rituals And Operations

May 26, 2025

The World Of The Hells Angels Membership Rituals And Operations

May 26, 2025