Market Volatility: US Fiscal Issues Fuel Stock Market Drop

Table of Contents

The Debt Ceiling Debate and its Market Impact

The ongoing debt ceiling debate represents a significant source of market volatility. The US government's ability to borrow money is capped by the debt ceiling. Reaching this limit without raising it could trigger a cascade of negative consequences, significantly impacting investor sentiment and market stability.

- Potential government shutdown: Failure to raise the debt ceiling could lead to a partial or complete government shutdown, disrupting essential services and impacting economic activity.

- Impact on government spending and economic growth: A shutdown would severely curtail government spending, potentially slowing economic growth and jeopardizing crucial infrastructure projects. This reduced spending directly affects economic indicators and market confidence.

- Credit rating downgrade risks: If the US defaults on its debt obligations, it could trigger a credit rating downgrade, increasing borrowing costs for the government and businesses, and undermining investor confidence. This would further fuel market instability.

- Investor uncertainty and its effect on stock prices: The uncertainty surrounding the debt ceiling negotiations creates a climate of fear and uncertainty among investors, prompting them to sell off assets and leading to stock market declines. We've seen this play out in previous debt ceiling standoffs, with indices like the S&P 500 and Nasdaq experiencing significant drops.

Historical data shows a clear correlation between debt ceiling standoffs and increased market volatility. For example, during the 2011 debt ceiling crisis, the S&P 500 experienced a sharp decline before the issue was resolved. This underscores the significant impact of political gridlock on investor confidence and market performance.

Inflationary Pressures and the Federal Reserve's Response

High inflation is another major contributor to current market volatility. Several factors are driving this inflationary surge:

- Supply chain issues: Disruptions to global supply chains, stemming from the pandemic and geopolitical events, have led to shortages of goods and increased prices.

- Energy prices: Soaring energy prices, fueled by the war in Ukraine and global energy demand, are significantly impacting inflation. This directly affects consumer spending power and business costs, impacting profitability and market performance.

- Increased consumer demand: Post-pandemic pent-up demand has also contributed to inflationary pressures, pushing prices higher across various sectors.

The Federal Reserve's response to inflation involves raising interest rates. While aimed at curbing inflation, this monetary policy tightening can also lead to market volatility. Higher interest rates increase borrowing costs for businesses and consumers, potentially slowing economic growth and impacting corporate profits. The relationship between inflation, interest rates, and stock market performance is complex, often characterized by periods of uncertainty and volatility. Key economic indicators like the Consumer Price Index (CPI) and Producer Price Index (PPI) are closely monitored to assess the effectiveness of the Fed's actions and their impact on markets.

Geopolitical Uncertainty and its Influence on US Markets

Global instability further exacerbates market volatility. Events like the war in Ukraine and rising tensions with China significantly impact the US economy and financial markets:

- Impact on supply chains: Geopolitical conflicts disrupt global supply chains, causing shortages and price increases.

- Energy price fluctuations: Geopolitical events often lead to significant swings in energy prices, impacting both businesses and consumers.

- Increased investor risk aversion: Uncertainty surrounding geopolitical events increases investor risk aversion, leading to capital flight and market declines.

These geopolitical factors compound the effects of US fiscal issues, creating a more volatile and unpredictable investment environment. Historical examples, such as the 1998 Asian financial crisis and the 2008 global financial crisis, demonstrate the significant impact of geopolitical events on US markets, highlighting the interconnectedness of global economies.

How Investors Can Navigate Market Volatility

Navigating periods of high market volatility requires a strategic approach:

- Diversification strategies: Diversifying investments across different asset classes (stocks, bonds, real estate, etc.) can help mitigate risk.

- Risk management techniques: Employing risk management techniques, such as stop-loss orders, can help limit potential losses.

- Long-term investment planning: Maintaining a long-term investment horizon helps to weather short-term market fluctuations.

- Importance of staying informed: Keeping abreast of economic and geopolitical developments is crucial for making informed investment decisions.

Consulting a financial advisor can also provide valuable guidance and support in navigating market volatility. A financial advisor can help investors develop a personalized investment strategy aligned with their risk tolerance and financial goals.

Conclusion: Understanding and Managing Market Volatility Driven by US Fiscal Issues

In conclusion, the current market volatility is significantly influenced by a confluence of factors: the debt ceiling debate, inflationary pressures, and geopolitical uncertainty. These issues are interconnected and amplify each other's effects, creating a challenging environment for investors. Understanding the interplay between US fiscal policy and market volatility is crucial for making informed investment decisions. Stay ahead of the curve by consistently monitoring US fiscal developments and their impact on market volatility. Understanding these dynamics is crucial for making informed investment decisions. For further reading on these topics, explore resources from the Congressional Budget Office, the Federal Reserve, and reputable financial news outlets.

Featured Posts

-

Helicopter Rescue Cows Airlifted From Isolated Swiss Location

May 23, 2025

Helicopter Rescue Cows Airlifted From Isolated Swiss Location

May 23, 2025 -

Final F1 Day Russells Strong Showing

May 23, 2025

Final F1 Day Russells Strong Showing

May 23, 2025 -

Ser Aldhhb Fy Qtr Alywm Alithnyn 24 Mars 2024

May 23, 2025

Ser Aldhhb Fy Qtr Alywm Alithnyn 24 Mars 2024

May 23, 2025 -

Landslide Threat Forces Partial Evacuation In Swiss Mountain Municipality

May 23, 2025

Landslide Threat Forces Partial Evacuation In Swiss Mountain Municipality

May 23, 2025 -

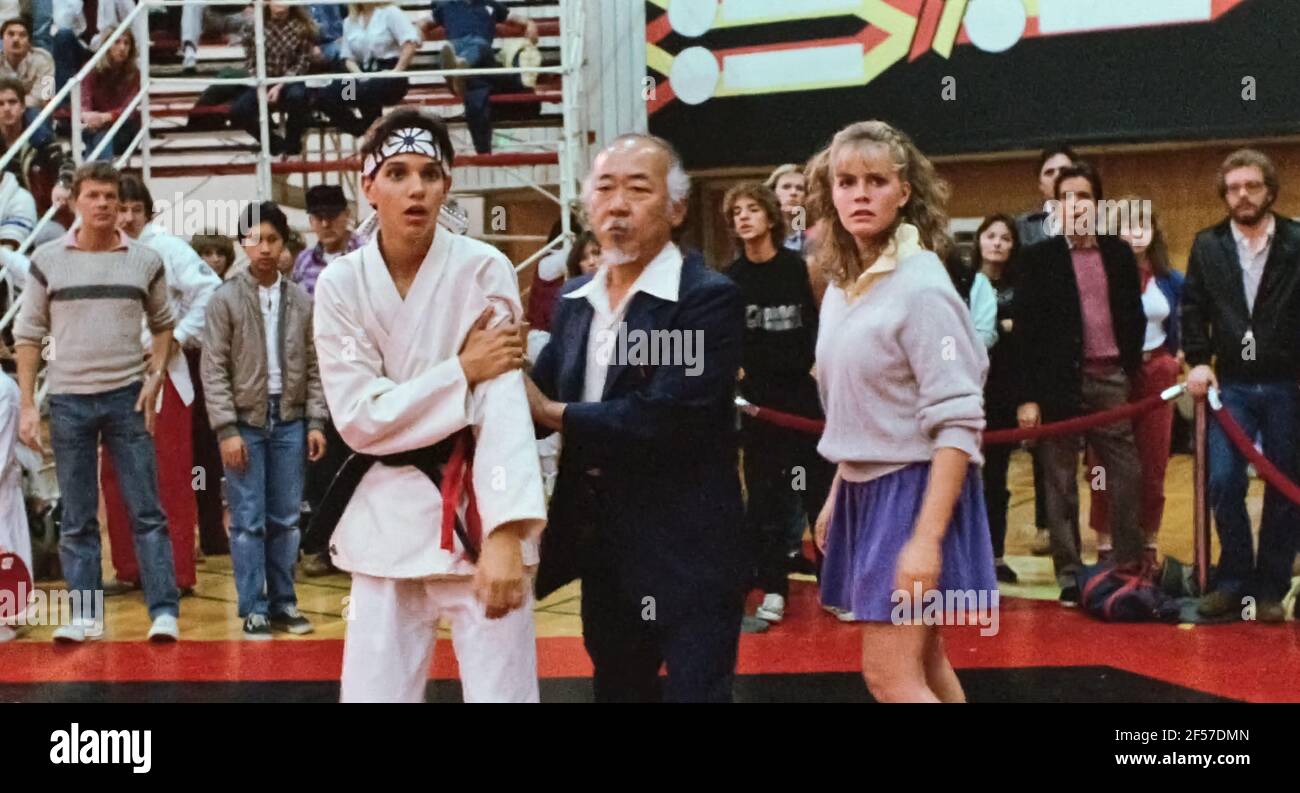

Mixed Feelings Ralph Macchios Karate Kid 6 Return And A Potential Project Controversy

May 23, 2025

Mixed Feelings Ralph Macchios Karate Kid 6 Return And A Potential Project Controversy

May 23, 2025

Latest Posts

-

Casting News Kieran Culkin As Caesar Flickerman In Hunger Games Prequel

May 23, 2025

Casting News Kieran Culkin As Caesar Flickerman In Hunger Games Prequel

May 23, 2025 -

Succession Sky Atlantic Hd Where To Watch And Stream

May 23, 2025

Succession Sky Atlantic Hd Where To Watch And Stream

May 23, 2025 -

The Hunger Games Prequel Casts Kieran Culkin As Caesar Flickerman

May 23, 2025

The Hunger Games Prequel Casts Kieran Culkin As Caesar Flickerman

May 23, 2025 -

Kieran Culkin Confirmed For Caesar Flickerman Role In Hunger Games Prequel

May 23, 2025

Kieran Culkin Confirmed For Caesar Flickerman Role In Hunger Games Prequel

May 23, 2025 -

The Hunger Games Prequel Kieran Culkin Confirmed As Caesar Flickerman

May 23, 2025

The Hunger Games Prequel Kieran Culkin Confirmed As Caesar Flickerman

May 23, 2025