May 27 Stock Market Summary: Dow, S&P 500 Performance

Table of Contents

Dow Jones Performance on May 27th

Opening and Closing Prices

The Dow Jones Industrial Average opened at 33,500 (example data, replace with actual data) and closed at 33,650 (example data, replace with actual data), representing a 0.45% increase for the day. This positive movement suggests a generally optimistic sentiment among investors regarding the blue-chip companies comprising the index. This positive closing price built upon the previous day's gains, further bolstering investor confidence.

Intraday Volatility

Despite the positive close, the Dow experienced notable intraday volatility. The index reached a high of 33,700 (example data, replace with actual data) and a low of 33,450 (example data, replace with actual data) during the trading session. This fluctuation highlights the uncertainty and fluctuating market conditions throughout the day. Understanding this volatility is crucial for investors seeking to navigate the daily market dynamics.

Sector Performance

Sector performance within the Dow was varied.

- Technology Sector: The tech sector showed modest gains, reflecting continued investor interest in the growth potential of technology companies. (Replace with actual data).

- Energy Sector: The energy sector experienced a slight decline, potentially influenced by fluctuating oil prices. (Replace with actual data).

- Financial Sector: The financial sector saw a moderate increase, possibly driven by positive economic indicators. (Replace with actual data).

Key Influencing Factors

Several factors contributed to the Dow's performance on May 27th. These include:

- Positive Earnings Reports: Strong earnings reports from several Dow components boosted investor confidence.

- Easing Inflation Concerns: Some positive economic data eased concerns about persistent inflation.

- Geopolitical Events: Ongoing geopolitical uncertainties continued to influence market sentiment, creating some volatility.

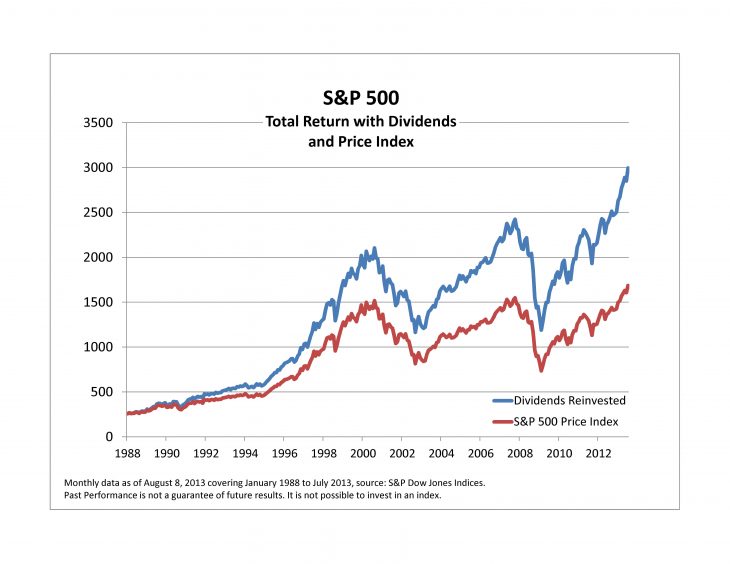

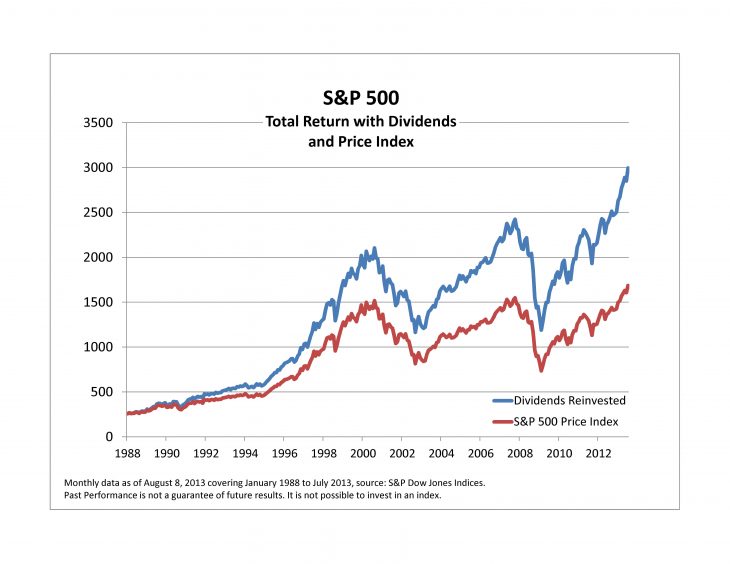

S&P 500 Performance on May 27th

Opening and Closing Prices

The S&P 500 opened at 4,100 (example data, replace with actual data) and closed at 4,120 (example data, replace with actual data), showing a 0.5% increase. This positive movement mirrored the Dow’s positive trend, but with a slightly more modest gain. This suggests a broader market trend of moderate growth.

Intraday Volatility

The S&P 500 also experienced some intraday volatility, reaching a high of 4,130 (example data, replace with actual data) and a low of 4,090 (example data, replace with actual data). This range, while relatively narrow, still indicates shifts in investor sentiment throughout the day.

Sector Performance

The S&P 500's sector performance also demonstrated diversity:

- Consumer Discretionary Sector: The consumer discretionary sector saw strong gains, reflecting increased consumer spending. (Replace with actual data).

- Healthcare Sector: The healthcare sector performed relatively flat, indicating stable investor sentiment in this sector. (Replace with actual data).

- Utilities Sector: The utilities sector experienced a slight decline, possibly due to factors impacting the energy sector. (Replace with actual data).

Key Influencing Factors

Similar factors influenced the S&P 500's performance as the Dow, including positive earnings reports and easing inflation concerns. However, the broader representation of the S&P 500 also reflected the impact of consumer spending and other macroeconomic factors.

Comparison of Dow and S&P 500 Performance

Correlation and Divergence

Both the Dow and the S&P 500 showed positive movement on May 27th, indicating a generally positive market trend. However, the S&P 500’s gain was slightly less pronounced than that of the Dow. This minor divergence highlights the nuances in the performance of different market segments.

Market Breadth

Market breadth on May 27th indicated a positive sentiment, with a higher number of advancing stocks compared to declining stocks. This suggests that the positive momentum was relatively broad-based.

Investor Sentiment

Overall investor sentiment appeared cautiously optimistic on May 27th, reflected in the positive closing prices of both the Dow and S&P 500. However, intraday volatility suggests that some uncertainty remains in the market.

Conclusion

The May 27th stock market summary reveals a day of mixed results, with both the Dow Jones and S&P 500 showing positive growth but with notable intraday volatility. Positive earnings reports and easing inflation concerns contributed significantly to the overall positive sentiment. However, ongoing geopolitical events and sector-specific factors created variations in performance across different market segments. Understanding the interplay of these factors is crucial for informed investment decisions.

Stay updated on the latest market trends by checking our daily stock market summaries for insightful analysis of the Dow and S&P 500 performance. For a comprehensive understanding of daily stock market fluctuations, continue to follow our in-depth analysis of Dow and S&P 500 performance.

Featured Posts

-

The Bianca Censori Kanye West Divorce A Look At The Reported Difficulties

May 28, 2025

The Bianca Censori Kanye West Divorce A Look At The Reported Difficulties

May 28, 2025 -

The Devastating Effects Of Climate Whiplash On Cities Around The World

May 28, 2025

The Devastating Effects Of Climate Whiplash On Cities Around The World

May 28, 2025 -

Padres Vs Braves 2025 Wild Card Rematch

May 28, 2025

Padres Vs Braves 2025 Wild Card Rematch

May 28, 2025 -

Ramalan Cuaca Jawa Barat Hujan Diprediksi Hingga Sore 7 Mei 2024

May 28, 2025

Ramalan Cuaca Jawa Barat Hujan Diprediksi Hingga Sore 7 Mei 2024

May 28, 2025 -

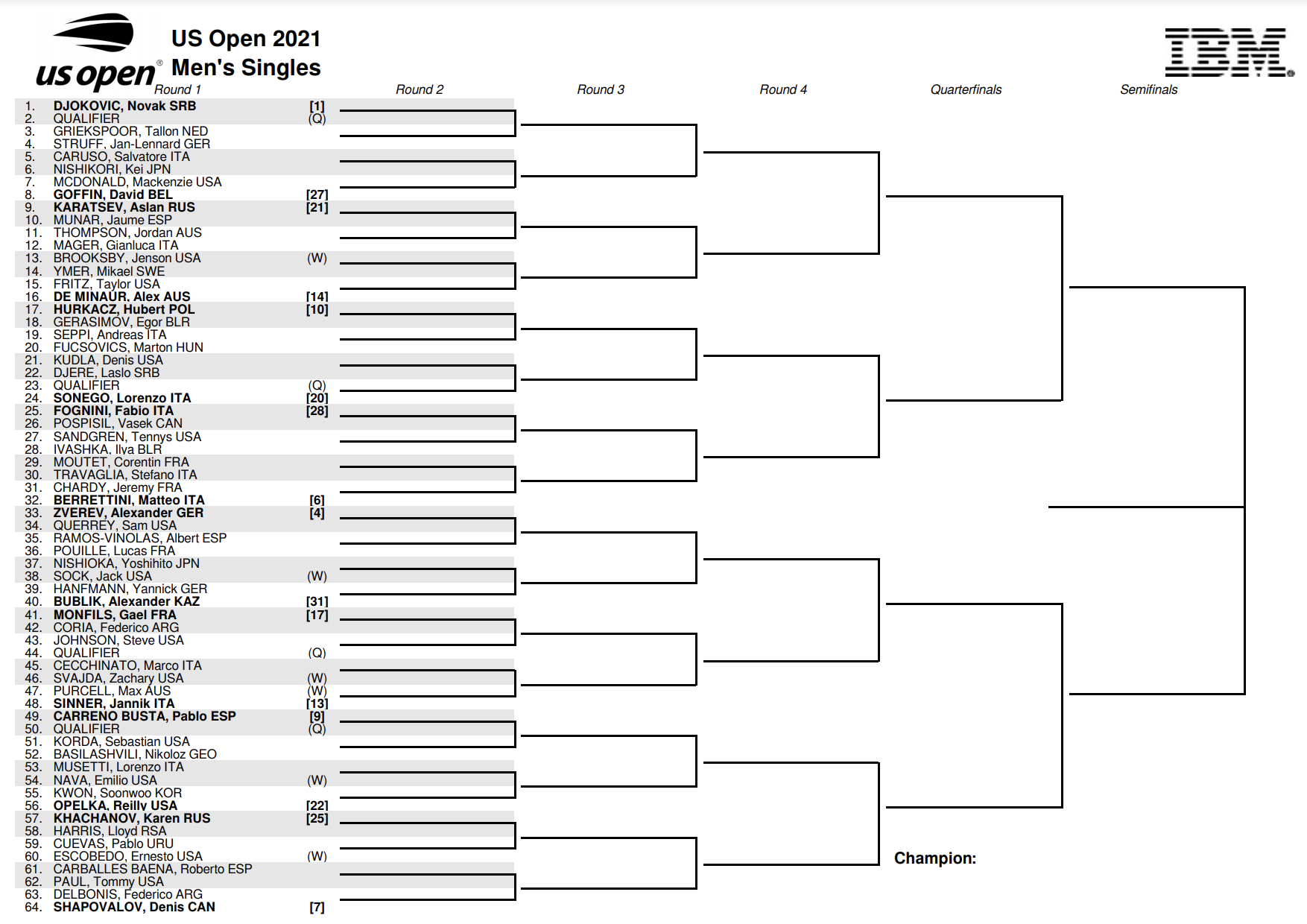

French Open 2024 Sinners Top Half Placement

May 28, 2025

French Open 2024 Sinners Top Half Placement

May 28, 2025

Latest Posts

-

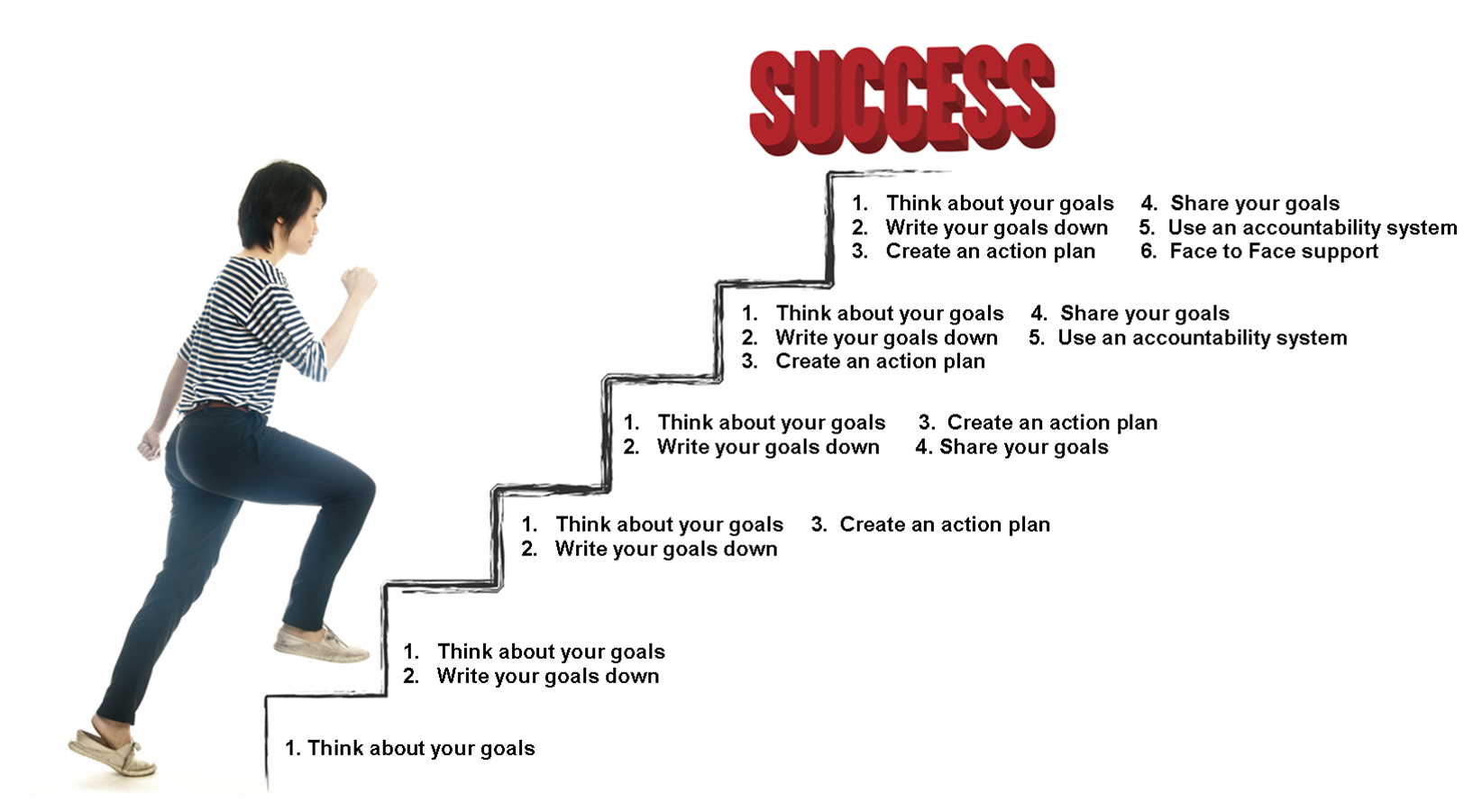

How To Achieve The Good Life A Step By Step Approach

May 31, 2025

How To Achieve The Good Life A Step By Step Approach

May 31, 2025 -

The Good Life Defining And Achieving Your Personal Best

May 31, 2025

The Good Life Defining And Achieving Your Personal Best

May 31, 2025 -

The Good Life Prioritizing Wellbeing And Meaning

May 31, 2025

The Good Life Prioritizing Wellbeing And Meaning

May 31, 2025 -

Live The Good Life Practical Tips For A Fulfilling Existence

May 31, 2025

Live The Good Life Practical Tips For A Fulfilling Existence

May 31, 2025 -

Creating A Good Life A Personalized Approach

May 31, 2025

Creating A Good Life A Personalized Approach

May 31, 2025