Miami Hedge Fund Manager Banned From US For Alleged Immigration Fraud

Table of Contents

H2: The Allegations of Immigration Fraud

The allegations against Mr. Smith center around his application for an EB-5 investor visa. This visa category requires significant financial investment in a US-based enterprise to create jobs and stimulate the economy. Specific charges include:

- False Statements on Visa Applications: Prosecutors allege Mr. Smith knowingly made false statements regarding the source of his investment funds, inflating the value of his assets and underreporting liabilities. This constitutes a serious violation of immigration law and is a common element in immigration fraud cases.

- Use of Fraudulent Documents: The investigation uncovered evidence suggesting Mr. Smith submitted forged bank statements and other financial documents to support his visa application. The fabrication of supporting documents is a key indicator of immigration fraud.

- Perjury During Legal Proceedings: During initial interviews with immigration officials, Mr. Smith is alleged to have given false testimony under oath, further exacerbating the severity of the charges. Perjury carries significant legal ramifications, both in immigration cases and general criminal law.

These charges carry severe penalties, including deportation, fines, and potential criminal prosecution for financial fraud alongside the immigration violations. The gravity of these accusations underscores the importance of transparency and honesty throughout the immigration process, especially within the context of investment visas.

H2: The Impact on the Hedge Fund and its Investors

The ban against Mr. Smith has sent shockwaves through the financial community. His hedge fund, previously a reputable firm in Miami, now faces significant challenges:

- Hedge Fund Operations: The immediate impact is operational disruption. With the manager banned from the US, the day-to-day management of the fund is severely hampered, impacting investment decisions and client relations.

- Investor Confidence: The news has understandably shaken investor confidence, leading to potential withdrawals and significant financial losses for those who entrusted their funds to Mr. Smith's management. Investor concerns highlight the ripple effect of immigration fraud on the wider financial landscape.

- Market Impact and Regulatory Scrutiny: The case has drawn significant attention from market regulators, prompting increased scrutiny of similar operations and potentially affecting investor sentiment across the board within the Miami hedge fund community. It also invites wider discussion about strengthening regulatory oversight to prevent such occurrences.

The long-term consequences for the hedge fund and its investors remain uncertain but are likely to be substantial.

H2: The Legal Proceedings and the Ban

The legal proceedings involved several hearings before the US Immigration Court. The court ultimately found Mr. Smith guilty on the charges of immigration fraud, leading to his ban from the US.

- Deportation Proceedings: Deportation proceedings are underway, aiming to remove Mr. Smith from the country. This highlights the serious nature of the offenses and the government's commitment to enforcing immigration laws.

- Permanent Ban: The ban is currently classified as permanent, although the possibility of appeal remains. However, given the seriousness of the charges and the evidence presented, the chances of a successful appeal seem slim. The case serves as a cautionary example of the severe implications of illegal immigration activities.

- Legal Representation and Appeal: Mr. Smith is represented by legal counsel and has the right to appeal the decision. However, the appeal process itself would involve further scrutiny of the evidence and a thorough review of the court's judgement.

H2: The Broader Implications for Immigration Policy and Financial Regulation

This case raises critical questions about the existing regulatory framework:

- Immigration Reform: The incident necessitates a review of current immigration policies, particularly those related to investor visas, and underscores the urgent need for tighter controls to prevent future instances of visa fraud. Strengthening the due diligence process is crucial to reduce the risk of such violations.

- Financial Crime and Regulatory Oversight: The case highlights the interconnectedness of immigration fraud and financial crime, emphasizing the need for increased cooperation and enhanced regulatory oversight across different government agencies. This collaborative approach is paramount in the fight against financial crimes and immigration violations.

- Investor Visa Reform and Due Diligence: The need for stricter due diligence procedures on the part of both immigration authorities and financial institutions is apparent. More rigorous checks on the sources of funds and thorough vetting of applicants would reduce fraud within the investor visa system.

The case of Mr. Smith sends a clear message about the importance of ethical conduct and rigorous compliance with both financial and immigration regulations.

Conclusion:

The case of the Miami hedge fund manager banned for alleged immigration fraud underscores the severe consequences of violating US immigration laws and highlights the importance of ethical conduct in the financial industry. The legal proceedings and potential repercussions send a strong message about maintaining transparency and integrity in both financial dealings and immigration processes. This case should serve as a cautionary tale for all Miami hedge fund managers and those involved in similar financial and immigration matters.

Call to Action: Stay informed about this developing story and the ongoing implications for Miami hedge fund managers, immigration fraud, and US immigration policy. Follow reputable news sources for updates on this significant case and the broader implications for financial and immigration regulations. Understanding the details of this case will help others navigate the legal complexities of immigration and finance within the United States.

Featured Posts

-

Manchester Uniteds Rashford Shines In Fa Cup Win Against Preston

May 20, 2025

Manchester Uniteds Rashford Shines In Fa Cup Win Against Preston

May 20, 2025 -

Two Supreme Court Justices Alito And Roberts Influence After Two Decades

May 20, 2025

Two Supreme Court Justices Alito And Roberts Influence After Two Decades

May 20, 2025 -

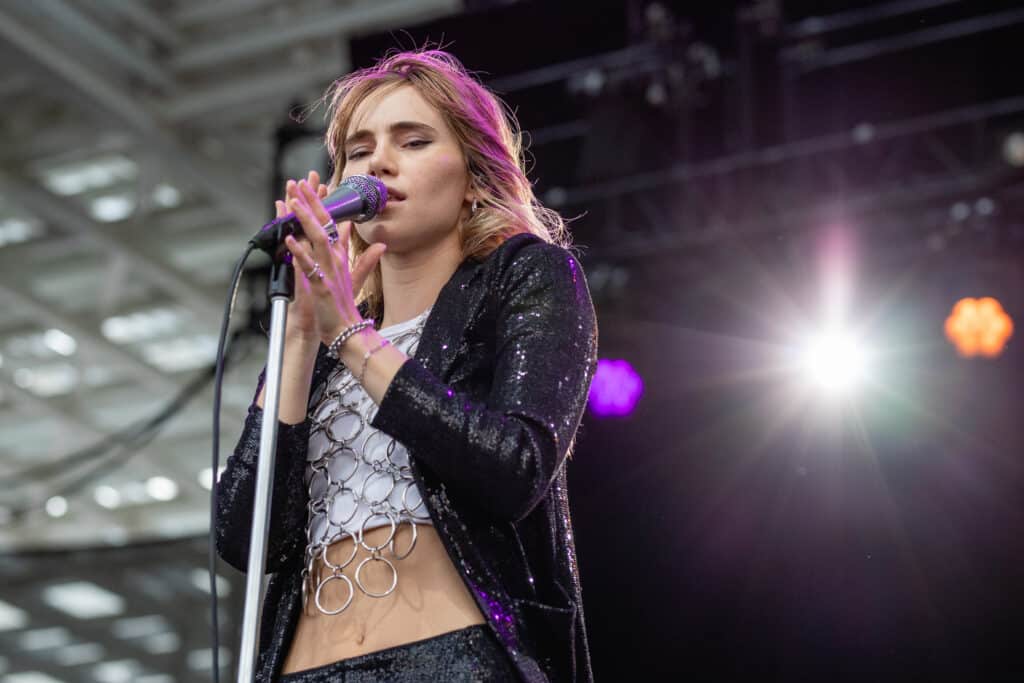

Step Inside Suki Waterhouses North American Surface Tour A Disco Retrospective

May 20, 2025

Step Inside Suki Waterhouses North American Surface Tour A Disco Retrospective

May 20, 2025 -

Parcours Des Femmes A Biarritz Un Programme Riche D Evenements Pour Le 8 Mars

May 20, 2025

Parcours Des Femmes A Biarritz Un Programme Riche D Evenements Pour Le 8 Mars

May 20, 2025 -

Abidjan Le Port Autonome Atteint 28 33 Millions De Tonnes En 2022

May 20, 2025

Abidjan Le Port Autonome Atteint 28 33 Millions De Tonnes En 2022

May 20, 2025