Microsoft: A Safe Haven In The Software Stock Market Amidst Tariff Turmoil

Table of Contents

Microsoft's Diversified Revenue Streams Mitigate Tariff Risks

One of the key reasons Microsoft stands out as a relatively safe haven investment is its remarkably diverse revenue streams. Unlike companies heavily reliant on a single product or market sector, Microsoft operates across multiple thriving sectors, significantly reducing its vulnerability to tariff impacts. This revenue diversification strategy effectively acts as a buffer against economic headwinds.

- Azure's global reach: Microsoft's cloud computing platform, Azure, boasts a massive global infrastructure. This widespread presence minimizes the impact of tariffs affecting specific regions. If one market experiences a downturn, Azure's global reach ensures continued revenue growth from other areas.

- Office 365's widespread adoption: The ubiquitous Office 365 suite provides a consistent stream of recurring revenue, largely unaffected by trade disputes. Its global user base ensures steady income regardless of regional economic fluctuations.

- Xbox's gaming dominance: The Xbox gaming division represents another significant revenue source, relatively insulated from the direct impact of tariffs on hardware or software components. The gaming market’s resilience further bolsters Microsoft's overall stability.

- Strong enterprise software business: Microsoft’s substantial enterprise software business provides a bedrock of stability. This segment is less vulnerable to consumer spending fluctuations, offering consistent revenue streams even during economic downturns. This includes enterprise solutions like Dynamics 365 and Power BI.

Strong Fundamentals and Consistent Growth Despite Economic Headwinds

Microsoft's consistent profitability and growth are further testaments to its resilience. The company demonstrates strong financial stability, even during times of economic uncertainty. This track record inspires investor confidence.

- Robust balance sheet and cash flow: Microsoft boasts a robust balance sheet and healthy cash flow, providing a strong financial foundation to withstand market fluctuations. This financial strength allows them to weather storms and continue investing in innovation.

- Consistent earnings growth: Year after year, Microsoft demonstrates consistent earnings growth, exceeding analyst predictions and reflecting the company's strong performance across various sectors. This consistent growth makes it an attractive investment for long-term gains.

- Market leadership: Microsoft maintains a dominant market position in key sectors like cloud computing (Azure), productivity software (Office 365), and gaming (Xbox). This leadership position translates into significant market share and pricing power.

- Data-backed performance: [Insert relevant financial data here, such as revenue figures for the last few quarters or years, and profit margins. Ensure the data comes from reliable sources like Microsoft's financial reports.]

Microsoft's Cloud Business (Azure) as a Growth Driver and Tariff Hedge

The rapid growth of Azure is not just a driver of Microsoft's overall success; it also serves as a crucial hedge against tariff risks. Azure's global infrastructure minimizes the impact of regional trade disputes.

- Global infrastructure: Azure's geographically diverse data centers significantly reduce reliance on any single region, mitigating the impact of tariffs and other localized economic issues.

- Increased cloud adoption: Businesses increasingly adopt cloud services like Azure for cost efficiency and scalability, fueling Azure's ongoing growth and making Microsoft less reliant on traditional software licensing models.

- Competitive advantage: Azure's innovative features and comprehensive suite of services provide a competitive advantage over other cloud providers, further strengthening its position in the market and driving future growth.

Long-Term Investment Potential and Relatively Low Risk Profile

Considering its consistent performance and diversified revenue streams, Microsoft presents a compelling long-term investment opportunity with a relatively low-risk profile compared to other tech stocks more vulnerable to tariff fluctuations.

- Strong brand reputation and customer loyalty: Microsoft’s strong brand reputation and established customer base foster enduring loyalty, ensuring consistent demand for its products and services.

- Ongoing innovation and R&D: Significant investments in research and development ensure Microsoft's continued innovation and competitiveness in the long term, protecting it against disruptive technologies.

- Risk mitigation compared to peers: Compared to other tech companies heavily reliant on specific hardware components or geographical markets, Microsoft’s diversification significantly lowers its risk exposure to tariff-related uncertainties.

Conclusion: Microsoft: A Safe Haven for Your Portfolio During Tariff Turmoil

In conclusion, Microsoft's diversified revenue streams, robust fundamentals, and the explosive growth of Azure make it a relatively safe haven investment during times of economic instability caused by tariffs. Its consistent performance and strong market position offer a compelling opportunity for investors seeking both stability and growth potential. Microsoft’s resilience in the face of economic headwinds positions it as a strong, safe haven stock in the software market. Consider adding Microsoft to your portfolio to secure your investment and benefit from its potential for long-term gains. Invest in Microsoft and protect your portfolio today. A Microsoft stock investment is a smart strategy for navigating the current volatile market conditions.

Featured Posts

-

Andor Season 2 Delayed Trailer Sparks Intense Speculation Among Fans

May 15, 2025

Andor Season 2 Delayed Trailer Sparks Intense Speculation Among Fans

May 15, 2025 -

Black Decker Steam Iron Buying Guide Expert Recommendations

May 15, 2025

Black Decker Steam Iron Buying Guide Expert Recommendations

May 15, 2025 -

Kid Cudis Art Up For Auction On Joopiter Details Announced

May 15, 2025

Kid Cudis Art Up For Auction On Joopiter Details Announced

May 15, 2025 -

Tonights Nhl Game Maple Leafs Vs Rangers Match Preview Predictions And Odds

May 15, 2025

Tonights Nhl Game Maple Leafs Vs Rangers Match Preview Predictions And Odds

May 15, 2025 -

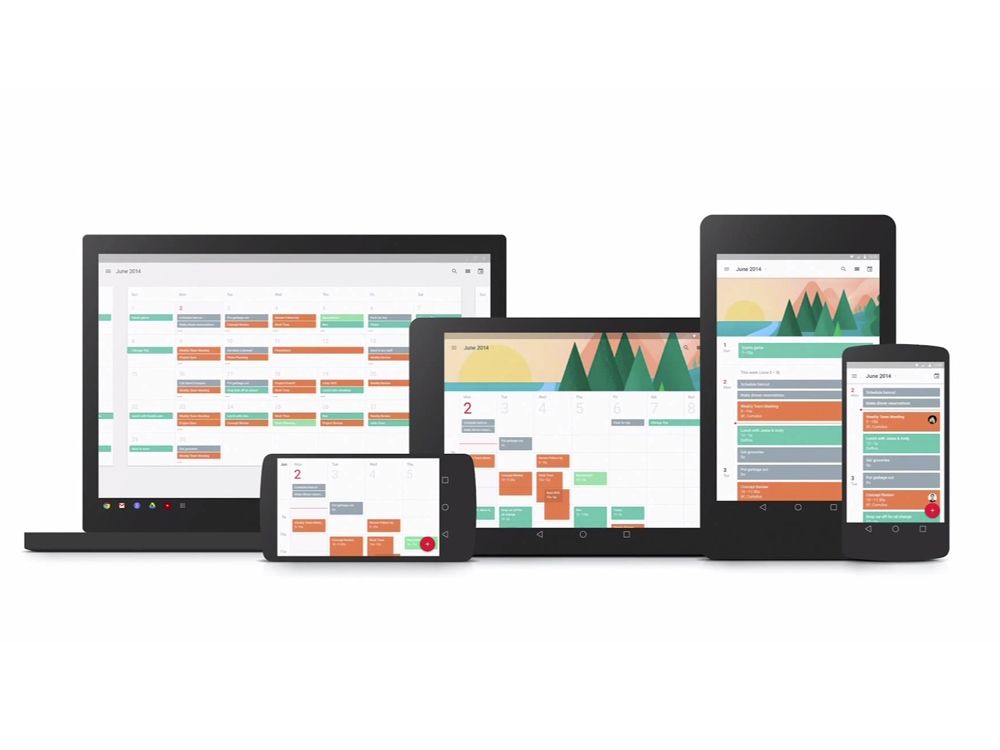

Understanding Androids Evolved Design Language

May 15, 2025

Understanding Androids Evolved Design Language

May 15, 2025