Millions Could Be Owed HMRC Refunds: Check Your Payslip Now

Table of Contents

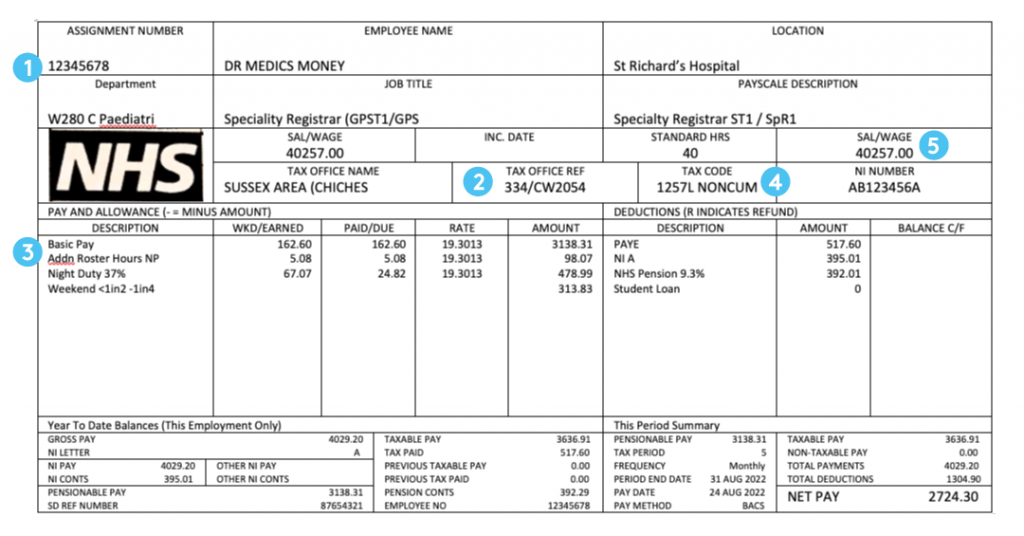

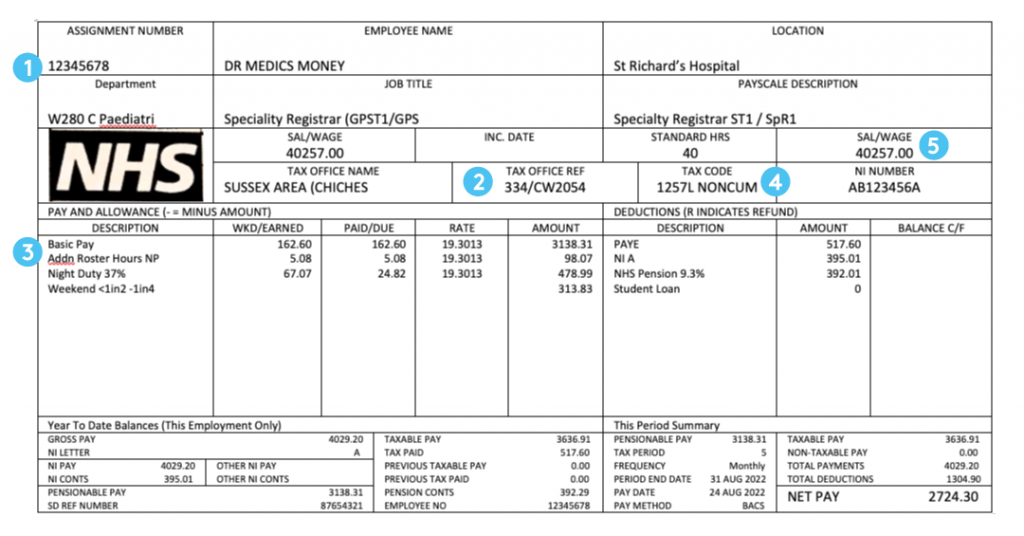

Understanding Your Tax Code and Payslip

Your tax code is a crucial piece of information determining how much income tax your employer deducts from your salary each month through PAYE (Pay As You Earn). It's essentially a numerical code that reflects your personal tax allowance. Understanding your tax code is the first step in identifying potential HMRC tax refunds. Common tax code errors leading to overpayment include: incorrect codes assigned after a life event (marriage, birth, etc.), codes not reflecting changes in employment status, or simply mistakes in data entry.

-

Identifying Common Payslip Miscalculations: Carefully examine your payslip for inconsistencies.

- Look for incorrect tax bands – are you being taxed at the wrong rate for your income bracket?

- Check your National Insurance contributions (NICs). Are the deductions correct based on your earnings?

- Understand the difference between gross pay (your total earnings before tax and deductions) and net pay (your take-home pay after deductions). Large discrepancies could indicate an overpayment.

-

Deciphering Payslip Information: Your payslip should clearly outline your gross pay, deductions for income tax and NICs, and your net pay. Learning to interpret this information is key to spotting potential errors.

-

Example Payslip: (Insert image here: A sample payslip with key areas like gross pay, tax deducted, NI contributions, and net pay clearly highlighted.)

Common Reasons for HMRC Refunds

Overpaying tax happens more often than you might think. Several factors can contribute to an HMRC refund being due:

-

Changes in Circumstances: Life events significantly impact your tax allowance and can result in overpayment if not correctly reflected in your tax code.

- Marriage or civil partnership

- Divorce or separation

- Starting a new job

- Changes in your personal allowance

-

Incorrect Tax Code: Errors in your tax code are a primary cause of overpayment. This is often due to administrative issues or changes not being properly communicated to your employer and HMRC.

-

PAYE Calculation Errors: While uncommon, errors in the PAYE system can lead to incorrect tax deductions.

-

Overpayment of National Insurance Contributions: Similar to income tax, mistakes in calculating your NICs can also result in overpayment.

-

Changes in Personal Allowances: Changes to personal allowance thresholds (the amount you can earn tax-free) may not be immediately reflected in your tax code, leading to over-taxation.

Claiming Time Limit: It's crucial to be aware of the HMRC's time limits for claiming tax refunds. Generally, you have four years to claim a refund from the tax year in which the overpayment occurred.

How to Check Your Payslips for Potential Refunds

To determine if you're owed an HMRC refund, meticulously review your payslips. Here's a step-by-step process:

-

Gather Your Payslips: Collect all your payslips for the relevant tax years (up to four years prior).

-

Analyze Deductions: Compare your gross pay, tax deducted, NICs deducted, and net pay across your payslips. Look for any inconsistencies or unusual deductions.

-

Cross-Reference with Tax Code and P60: Verify the information on your payslips against your tax code and your P60 (end-of-year summary of earnings and tax). Discrepancies could signal a problem.

-

Use Online Tax Calculators: Several online tax calculators can help verify your tax liability based on your income and circumstances. Compare the results to your actual tax deductions.

-

Accurate Record Keeping: Maintaining accurate records of your income and tax deductions is vital for successful HMRC refund claims.

Claiming Your HMRC Refund

Once you've identified a potential overpayment, claiming your refund is relatively straightforward.

-

Accessing the HMRC Website: Begin by visiting the official HMRC website.

-

Gather Necessary Documentation: You’ll need your payslips, P60s, and potentially other relevant documentation to support your claim.

-

Completing the Online Application Form: The HMRC website provides a clear online form to submit your refund claim.

-

Processing Time: Allow sufficient processing time for your claim. HMRC usually specifies estimated processing times on their website.

-

Alternative Contact Methods: If you have difficulties using the online system, you can contact HMRC via telephone or post. However, the online method is generally the most efficient.

-

Addressing Potential Issues: Be prepared for potential delays or requests for additional information. Keep records of all communication with HMRC.

Conclusion

Millions of pounds in potential HMRC refunds remain unclaimed due to various reasons, including incorrect tax codes and payroll errors. Checking your payslips carefully can reveal whether you are entitled to a refund. Don't miss out on potentially significant money; take the time to review your payslips and claim what you're owed. Check your payslips now to see if you're due an HMRC refund! Don't delay – reclaim your money today! Visit the HMRC website for more information and to start your claim.

Featured Posts

-

Goretzkas Nations League Call Up Nagelsmanns Germany Squad Announcement

May 20, 2025

Goretzkas Nations League Call Up Nagelsmanns Germany Squad Announcement

May 20, 2025 -

Ecrire Comme Agatha Christie Un Cours D Ecriture Assiste Par L Ia

May 20, 2025

Ecrire Comme Agatha Christie Un Cours D Ecriture Assiste Par L Ia

May 20, 2025 -

Atkinsrealis Droit Inc Navigation Du Droit Avec Des Experts Experimentes

May 20, 2025

Atkinsrealis Droit Inc Navigation Du Droit Avec Des Experts Experimentes

May 20, 2025 -

Adressage Abidjan 14 279 Voies Identifiees A Ce Jour

May 20, 2025

Adressage Abidjan 14 279 Voies Identifiees A Ce Jour

May 20, 2025 -

Enquete Sur Des Allegations De Maltraitance Et D Abus Sexuels A La Fieldview Care Home Maurice

May 20, 2025

Enquete Sur Des Allegations De Maltraitance Et D Abus Sexuels A La Fieldview Care Home Maurice

May 20, 2025