Moody's 30-Year Yield At 5%: Is 'Sell America' Back?

Table of Contents

The Significance of the 5% 30-Year Treasury Yield

A 5% 30-year Treasury yield is a noteworthy event. Historically, such yields have been relatively rare, typically associated with periods of higher inflation and economic uncertainty. Reaching this level signifies a substantial shift in the bond market. Several factors contributed to this rise:

- Inflationary Pressures and Federal Reserve Policy: Persistent inflation, fueled by factors like supply chain disruptions and strong consumer demand, forced the Federal Reserve to implement a series of aggressive interest rate hikes. These hikes directly impact Treasury yields, pushing them higher.

- Increased Government Borrowing: The US government's substantial borrowing needs to finance its debt further contribute to upward pressure on Treasury yields. Increased demand for funds in the market competes with other borrowers, driving up rates.

- Global Economic Uncertainty: Geopolitical instability, ongoing conflicts, and concerns about a potential global recession contribute to investor demand for safe-haven assets like US Treasuries, influencing yields.

The impact of a 5% 30-year Treasury yield is far-reaching. It leads to:

- Higher Borrowing Costs: Businesses face increased costs for loans and capital expenditures, potentially impacting investment and economic growth. Consumers also experience higher mortgage rates and borrowing costs for other loans.

- Impact on the Housing Market: Higher mortgage rates directly impact the housing market, potentially cooling demand and leading to a slowdown in price appreciation or even price declines. This is a significant concern given the recent strength of the US housing market.

Understanding the "Sell America" Narrative

The "Sell America" narrative describes a scenario where international investors reduce their holdings of US assets, leading to capital outflows and potentially weakening the dollar. Historically, this has been associated with:

- Economic Downturns: Recessions or significant economic slowdowns can trigger a loss of confidence in the US economy, prompting investors to seek safer havens.

- Geopolitical Instability: Global conflicts or political uncertainty can negatively impact investor sentiment towards the US, leading to capital flight.

- Loss of Investor Confidence: Significant policy changes, economic mismanagement, or other negative events can erode investor confidence, causing them to divest from US assets.

Whether the current economic climate fully supports the "Sell America" narrative is debatable. While rising yields are a factor, other economic indicators need to be considered.

Analyzing the Correlation Between Yields and "Sell America" Sentiment

Historically, there has been some correlation between rising Treasury yields and capital outflows from the US. However, the relationship is complex and not always straightforward. Currently:

- Investor Sentiment: Investor sentiment is mixed, with some expressing concerns about a potential recession, while others remain optimistic about the US economy's long-term prospects.

- Capital Flows: Capital flows are dynamic and depend on various factors, including relative interest rates, economic growth prospects, and geopolitical events. While some capital outflows might occur, it's not necessarily a definitive "Sell America" scenario.

Alternative interpretations of rising yields exist beyond "Sell America":

- Strong Economic Recovery: Higher yields could reflect a strong economic recovery, with investors demanding higher returns on their investments due to increased economic activity.

- Increased Demand for US Debt: Global demand for safe-haven assets like US Treasuries can increase during periods of uncertainty, leading to higher yields.

- Reflecting a Healthy Economy Requiring Higher Returns: Higher yields might simply reflect a healthy economy where investors expect higher returns to compensate for inflation and economic growth.

International Capital Flows and the US Dollar

Higher yields generally strengthen the US dollar, making US assets more attractive to foreign investors. However, this effect can be offset by other factors, such as global economic conditions and investor sentiment. Significant capital outflows could weaken the dollar, impacting international trade and investment.

Potential Future Scenarios and Implications

Continued high yields present several potential scenarios:

- Sustained Economic Growth: If the economy remains robust despite higher interest rates, we could see sustained economic growth, albeit at a potentially slower pace.

- Economic Slowdown or Recession: Higher borrowing costs could trigger an economic slowdown or even a recession, leading to lower inflation and potentially lower yields in the long run.

- Increased Inflation: If inflation remains persistent despite higher interest rates, it could further exacerbate the situation, potentially leading to even higher yields.

The implications for different market segments are significant:

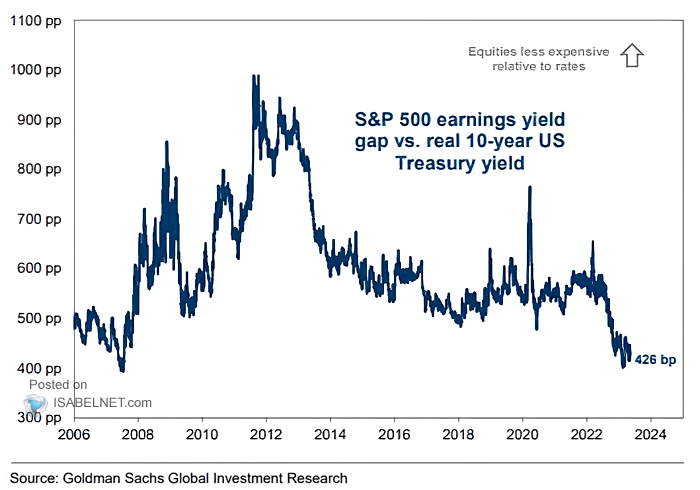

- Stocks: Higher interest rates typically negatively impact stock valuations, as investors shift towards safer investments like bonds.

- Bonds: The bond market will react to yield changes, impacting bond prices and returns.

- Real Estate: Higher mortgage rates significantly affect the real estate market, potentially leading to reduced demand and price adjustments.

Moody's 30-Year Yield at 5%: A Call to Action

The 5% 30-year Treasury yield is a significant development with potential implications for the US and global economies. While it has sparked concerns about a "Sell America" scenario, a nuanced analysis reveals alternative interpretations, reflecting a complex interplay of factors. It’s crucial to monitor interest rates and their impact closely. The evolving situation with the Moody's 30-year yield and its influence on the US and global markets requires continuous vigilance. Stay informed about the impact of a 5% yield by following reputable financial news sources and consulting with financial professionals. Understanding the dynamics of 30-year Treasury bond yields is critical for navigating the current economic climate. Further research into the interplay between 30-year Treasury yields and global capital flows will be vital in making informed investment decisions.

Featured Posts

-

La Wildfires And The Gambling Industry Exploring The Ethics Of Disaster Betting

May 20, 2025

La Wildfires And The Gambling Industry Exploring The Ethics Of Disaster Betting

May 20, 2025 -

Wwes Aj Styles Contract Status And Future

May 20, 2025

Wwes Aj Styles Contract Status And Future

May 20, 2025 -

School Delays And Closures Due To Winter Weather Advisories

May 20, 2025

School Delays And Closures Due To Winter Weather Advisories

May 20, 2025 -

Atkinsrealis Droit Inc Votre Partenaire Pour Le Succes Juridique

May 20, 2025

Atkinsrealis Droit Inc Votre Partenaire Pour Le Succes Juridique

May 20, 2025 -

Agatha Christies Poirot A Deep Dive Into The World Of Hercule Poirot

May 20, 2025

Agatha Christies Poirot A Deep Dive Into The World Of Hercule Poirot

May 20, 2025