Navigate The Private Credit Boom: 5 Do's And Don'ts To Get Hired

Table of Contents

Do's to Get Hired in the Private Credit Boom

1. Tailor Your Resume and Cover Letter to Private Credit Specifics

Your resume and cover letter are your first impression. Generic applications won't cut it in the competitive private credit market. To make your application stand out, you need to speak the language of private credit.

- Highlight relevant experience: Emphasize experience with private equity, debt funds, credit analysis, portfolio management, or similar roles. Showcase your understanding of different credit strategies, such as direct lending, mezzanine financing, distressed debt, and structured credit.

- Incorporate industry keywords: Use keywords like "structured credit," "direct lending," "distressed debt," "mezzanine financing," "credit underwriting," "portfolio monitoring," "risk assessment," and "credit risk modeling" throughout your resume and cover letter. These terms demonstrate your familiarity with the industry's terminology.

- Quantify your achievements: Instead of simply stating your responsibilities, quantify your accomplishments. For example, instead of "managed a portfolio," say "managed a $50 million portfolio, achieving a 15% annualized return and reducing non-performing loans by 10%."

- Showcase technical skills: Highlight relevant software proficiencies, including Bloomberg Terminal, Argus, and advanced Excel modeling skills (including VBA and financial modeling techniques). These are essential tools in private credit.

- Customize for each application: Don't use a generic template. Tailor your resume and cover letter to each specific job description, emphasizing the skills and experiences most relevant to that particular role and company.

2. Network Strategically Within the Private Credit Industry

Networking is crucial for landing a job in private credit. Building connections within the industry opens doors and provides valuable insights.

- Attend industry events: Attend conferences, seminars, and workshops related to private credit, private debt, and alternative investments. These events provide opportunities to meet professionals and learn about new trends.

- Join professional organizations: Membership in organizations like the CFA Institute, the Association for Corporate Growth (ACG), and other relevant groups can expand your network and provide access to industry resources and job postings.

- Leverage LinkedIn: Optimize your LinkedIn profile with relevant keywords and connect with professionals in private credit. Engage with their posts and participate in industry discussions.

- Conduct informational interviews: Reach out to people working in private credit to learn about their roles and the industry. These conversations can provide valuable advice and potential leads. Remember to express gratitude for their time and follow up.

- Focus on building genuine relationships: Networking is not just about collecting contacts; it's about building authentic relationships. Focus on creating meaningful connections with people who share your interests and career goals.

3. Master the Private Credit Interview Process

The interview process for private credit roles is rigorous. Preparation is key to success.

- Prepare for technical questions: Expect in-depth questions on financial modeling, credit analysis, valuation techniques, LBO modeling, industry trends, and specific investment strategies. Practice your answers thoroughly.

- Practice behavioral questions: Use the STAR method (Situation, Task, Action, Result) to prepare compelling answers to behavioral questions that highlight your problem-solving skills, teamwork abilities, and experience handling pressure.

- Research the firm: Thoroughly research the firm's investment strategy, recent transactions, team members, and company culture. Demonstrate your genuine interest in their work and how your skills align with their objectives.

- Demonstrate market knowledge: Stay up-to-date on current market trends and demonstrate your understanding of the private credit landscape, including interest rate changes, economic factors, and regulatory changes.

- Ask insightful questions: Prepare thoughtful questions to ask the interviewer, showing your genuine interest and understanding of the role and the firm.

Don'ts to Avoid When Seeking a Private Credit Job

1. Don't Neglect the Fundamentals of Finance

A strong foundation in finance is essential for a successful career in private credit.

- Master financial statements: Develop a deep understanding of financial statements (balance sheets, income statements, cash flow statements) and their analysis. This forms the basis for credit analysis and valuation.

- Sharpen your modeling skills: Develop advanced Excel skills, including financial modeling techniques for discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and other valuation methods. Proficiency in financial modeling software is crucial.

- Don't underestimate Excel: Advanced Excel skills are non-negotiable. Practice building complex models and mastering functions like VBA, pivot tables, and data manipulation.

2. Don't Submit Generic Applications

Generic applications are easily overlooked. Each application should be tailored to the specific job description and the firm's investment strategy.

- Customize your materials: Carefully review the job description and tailor your resume and cover letter to highlight the skills and experiences that directly match the requirements.

- Show genuine interest: Research the firm and demonstrate your understanding of their investment strategy and how your skills and experience align with their objectives.

- Highlight relevant projects: If you've worked on projects related to private credit, highlight them specifically and explain your contribution and the results achieved.

3. Don't Underestimate the Importance of Soft Skills

Technical skills are essential, but soft skills are equally important in private credit.

- Develop communication skills: Practice clear and concise communication, both written and verbal. Effective communication is crucial for building relationships with investors, borrowers, and colleagues.

- Highlight teamwork skills: Private credit often involves working collaboratively with different teams and individuals. Showcase your ability to work effectively in a team setting.

- Demonstrate problem-solving skills: Highlight examples of how you've identified and solved complex problems in previous roles.

- Show passion for the industry: Demonstrate your genuine interest and enthusiasm for private credit. Your passion will be evident in your interviews and networking efforts.

Conclusion

The private credit boom presents incredible opportunities for skilled professionals. By following these do's and don'ts – tailoring your application materials, networking strategically, and mastering the interview process – you significantly increase your chances of landing your dream job in private credit. Don't delay; start navigating this exciting market today and secure your place in the thriving world of private credit. Remember, thorough preparation and a targeted approach are key to success in this competitive field. Begin your private credit job search now and leverage these tips to make a powerful impact.

Featured Posts

-

San Diego Padres Vs Los Angeles Dodgers A Battle Of Strategies

May 15, 2025

San Diego Padres Vs Los Angeles Dodgers A Battle Of Strategies

May 15, 2025 -

Tarifkonflikt Bvg Die Folgen Des Schlichtungsversagens

May 15, 2025

Tarifkonflikt Bvg Die Folgen Des Schlichtungsversagens

May 15, 2025 -

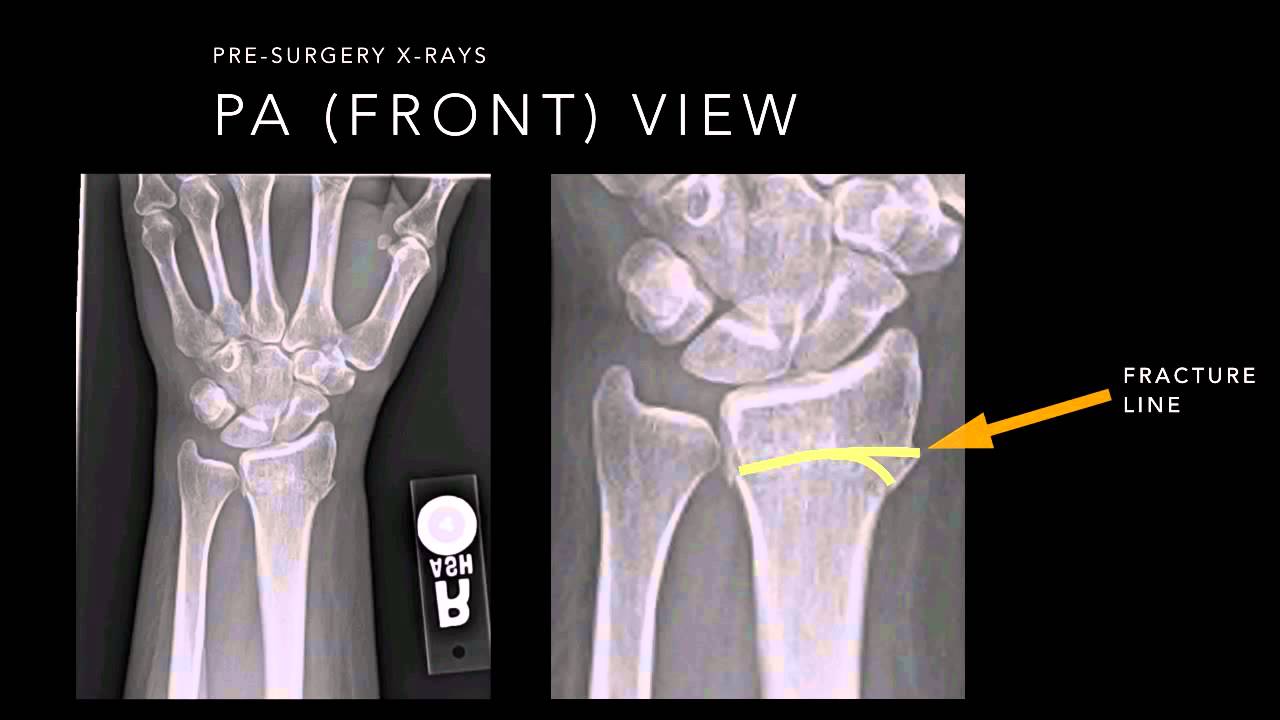

Jayson Tatums Wrist Injury X Rays Show No Fracture After Playoff Fall

May 15, 2025

Jayson Tatums Wrist Injury X Rays Show No Fracture After Playoff Fall

May 15, 2025 -

Election 2024 Albanese And Duttons Key Policy Proposals Compared

May 15, 2025

Election 2024 Albanese And Duttons Key Policy Proposals Compared

May 15, 2025 -

Maple Leafs Vs Red Wings Prediction Picks And Odds For Tonights Nhl Game

May 15, 2025

Maple Leafs Vs Red Wings Prediction Picks And Odds For Tonights Nhl Game

May 15, 2025