Navigate The Private Credit Job Market: 5 Do's & Don'ts

Table of Contents

5 Do's to Land Your Dream Private Credit Job

Do 1: Network Strategically

Building relationships is paramount in the private credit industry. Don't underestimate the power of networking to uncover hidden job opportunities and gain valuable insights.

- Attend industry events: SuperReturn, PEI events, and smaller, niche conferences are excellent places to connect with professionals.

- Master LinkedIn: Optimize your profile with relevant keywords (Private Credit, Credit Analyst, Private Equity, etc.), and actively connect with recruiters and professionals in the field. Engage with their posts and participate in relevant groups.

- Informational interviews: Reach out to individuals working in private credit for informational interviews. These conversations provide invaluable insights and can lead to unexpected opportunities.

- Join professional organizations: The CFA Institute and AMAs offer networking opportunities and access to industry knowledge.

Do 2: Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. Make them count by showcasing your qualifications and understanding of private credit.

- Highlight relevant skills: Emphasize quantitative analysis, financial modeling, and experience with private credit instruments like mezzanine debt and unitranche loans.

- Use keywords: Incorporate keywords from job descriptions to improve your chances of getting past Applicant Tracking Systems (ATS).

- Quantify accomplishments: Instead of simply stating responsibilities, quantify your achievements. For example, "Increased portfolio returns by 15%" is more impactful than "Managed portfolio assets."

- Tailor each application: Generic applications rarely succeed. Customize your resume and cover letter for each job application, highlighting the skills and experience most relevant to the specific role and company.

Do 3: Master the Interview Process

The interview process for private credit jobs is rigorous. Preparation is key to success.

- Prepare for all question types: Expect behavioral questions ("Tell me about a time you failed"), technical questions (related to financial modeling and credit analysis), and case studies.

- Practice your responses: Rehearse your answers to common interview questions, focusing on demonstrating your knowledge of financial statements, valuation methodologies, and credit analysis.

- Research the firm: Thoroughly research the firm's investment strategy, portfolio companies, and recent transactions. Prepare insightful questions to ask the interviewer.

- Showcase your personality: While technical skills are crucial, interviewers also assess your personality and cultural fit. Let your enthusiasm shine through.

Do 4: Develop In-Demand Skills

The private credit landscape is constantly evolving. Continuous learning is essential.

- Master financial modeling: Develop expertise in discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and other valuation techniques.

- Become proficient in software: Proficiency in Excel, Bloomberg Terminal, and other relevant software is crucial.

- Pursue relevant certifications: Consider obtaining the CFA charter, CAIA charter, or other relevant certifications to enhance your credibility.

- Stay updated on industry trends: Keep abreast of the latest market trends, regulations, and industry news through reputable sources.

- Consider an advanced degree: An MBA or other advanced degree can significantly boost your career prospects.

Do 5: Showcase Your Passion for Private Credit

Genuine enthusiasm is contagious. Demonstrate your passion for the industry throughout the job search process.

- Demonstrate genuine interest: Your research and networking efforts should reflect your genuine interest in private credit.

- Articulate your career goals: Clearly articulate your career goals and how they align with the firm's mission and values.

- Show understanding of challenges: Demonstrate your understanding of the challenges and opportunities within the private credit market.

- Highlight relevant projects: Showcase any personal projects or extracurricular activities that demonstrate your interest in finance and investing.

5 Don'ts When Searching for Private Credit Jobs

Don't 1: Neglect Networking

Networking is not optional in private credit.

- Don't rely solely on job boards: Online job boards are a starting point, but networking is crucial for uncovering hidden opportunities.

- Don't underestimate personal connections: Leverage your existing network and actively expand it through industry events and online platforms.

- Don't be afraid to reach out: Proactively reach out to people in your network for advice and introductions.

Don't 2: Submit Generic Applications

Each application should be tailored to the specific job and company.

- Don't send the same resume and cover letter: Generic applications demonstrate a lack of effort and rarely result in interviews.

- Don't ignore job description requirements: Carefully review each job description and tailor your application to highlight the relevant skills and experience.

- Don't overlook the importance of tailoring: Demonstrate that you understand the specific role and the firm's investment strategy.

Don't 3: Underprepare for Interviews

Thorough preparation is essential for success in private credit interviews.

- Don't go into an interview unprepared: Practice your responses to common interview questions and case studies.

- Don't underestimate practice: Practice makes perfect. Rehearse your answers until you feel confident and articulate.

- Don't fail to research the firm: Thoroughly research the firm, its investment strategy, and the interviewers.

Don't 4: Ignore Skill Gaps

Identify and address any skill gaps to enhance your competitiveness.

- Don't ignore areas where you lack expertise: Actively work to improve your skills in areas where you lack proficiency.

- Don't hesitate to pursue further education: Consider taking courses, attending workshops, or pursuing further education to enhance your skills.

- Don't underestimate continuous learning: The private credit industry is dynamic. Continuous learning is crucial for staying competitive.

Don't 5: Appear Unenthusiastic

Your passion for private credit should be evident throughout the job search process.

- Don't be passive in your job search: Actively network, research companies, and tailor your applications.

- Don't appear disinterested: Demonstrate genuine interest in the industry and the specific firm.

- Don't let your passion go unnoticed: Let your enthusiasm for private credit shine through in your interactions with recruiters and interviewers.

Conclusion

Successfully navigating the private credit job market requires a proactive and well-planned approach. By following these "do's" and avoiding the "don'ts," you can significantly increase your chances of landing your dream private credit job. Remember to network strategically, tailor your application materials, master the interview process, develop in-demand skills, and showcase your passion for the industry. Start your successful private credit job search today!

Featured Posts

-

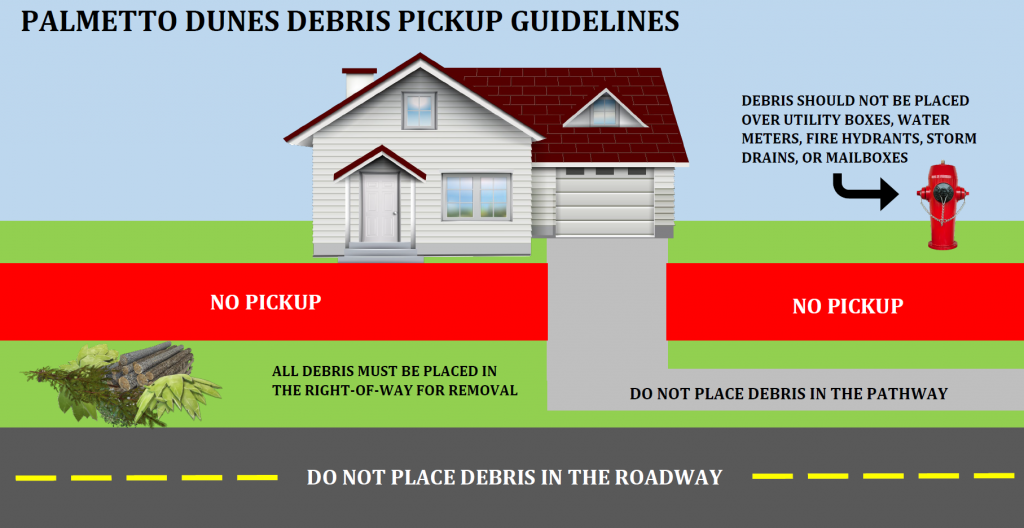

Get Your Storm Debris Removed Louisvilles Pickup Request Process

Apr 30, 2025

Get Your Storm Debris Removed Louisvilles Pickup Request Process

Apr 30, 2025 -

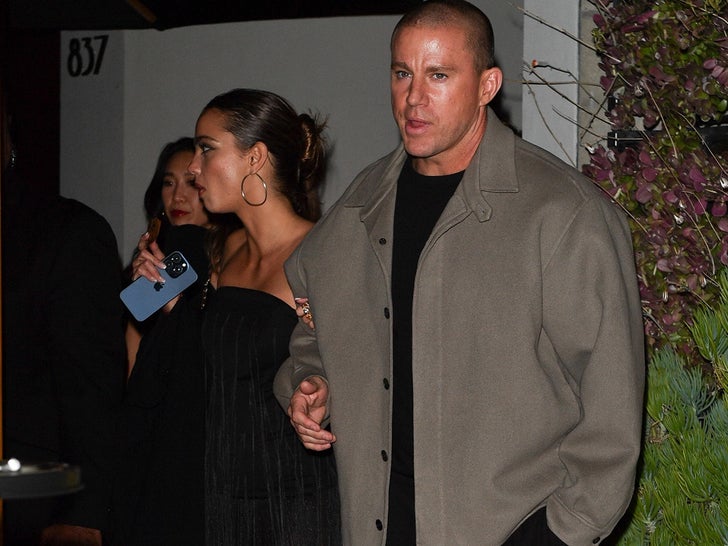

Channing Tatum Moves On New Romance With Inka Williams Following Zoe Kravitz Breakup

Apr 30, 2025

Channing Tatum Moves On New Romance With Inka Williams Following Zoe Kravitz Breakup

Apr 30, 2025 -

Post Zoe Kravitz Split Channing Tatums Date Night With Inka Williams

Apr 30, 2025

Post Zoe Kravitz Split Channing Tatums Date Night With Inka Williams

Apr 30, 2025 -

Thang Dam Tam Hop Gianh Chien Thang Goi Thau Cap Nuoc Gia Dinh Truoc 6 Doi Thu Manh

Apr 30, 2025

Thang Dam Tam Hop Gianh Chien Thang Goi Thau Cap Nuoc Gia Dinh Truoc 6 Doi Thu Manh

Apr 30, 2025 -

Tien Linh Hanh Trinh Thien Nguyen Cua Dai Su Tinh Binh Duong

Apr 30, 2025

Tien Linh Hanh Trinh Thien Nguyen Cua Dai Su Tinh Binh Duong

Apr 30, 2025