Navigating Homeownership With Existing Student Loan Debt

Table of Contents

Assessing Your Financial Health and Debt-to-Income Ratio (DTI)

Before diving into the exciting world of house hunting, it's crucial to understand your current financial standing and, more specifically, your debt-to-income ratio (DTI). Your DTI is a crucial factor in determining your mortgage eligibility and the interest rates you'll qualify for. A lower DTI significantly improves your chances of securing a favorable mortgage.

Calculating your DTI: Your DTI is calculated by dividing your total monthly debt payments (including student loans, credit cards, car payments, etc.) by your gross monthly income. Lenders typically prefer a DTI below 43%, and a lower DTI often translates to better mortgage terms.

Listing all debts: Make a comprehensive list of all your debts, including student loans (both federal and private), credit card balances, car loans, and any other recurring monthly payments. Be precise; accuracy is key in this assessment.

Impact of high DTI: A high DTI indicates a greater financial burden, making lenders hesitant to approve your mortgage application. A high DTI can also lead to higher interest rates, increasing the overall cost of your mortgage.

Strategies for lowering DTI: Several strategies can help reduce your DTI. Making extra payments on your high-interest student loans is a powerful approach. Consider debt consolidation to simplify your payments and potentially lower your interest rates. Exploring ways to increase your income, such as taking on a side hustle or negotiating a raise, can also significantly improve your DTI.

- Use online DTI calculators: Many free online calculators simplify the DTI calculation process.

- Consider debt consolidation options: Consolidating your debts into a single loan can simplify payments and potentially lower your interest rate.

- Explore strategies to increase your income: A higher income directly improves your DTI, making you a more attractive borrower.

Exploring Mortgage Options with Student Loan Debt

Understanding the various mortgage options available is crucial when dealing with student loan debt. Different mortgage types cater to different financial situations and risk profiles.

Understanding different mortgage types:

- Conventional Loans: These loans are offered by private lenders and typically require a higher credit score and a larger down payment (often 20%).

- FHA Loans: Backed by the Federal Housing Administration, FHA loans are more accessible to borrowers with lower credit scores and smaller down payments (as low as 3.5%).

- VA Loans: Offered to eligible veterans and active-duty military personnel, VA loans often require no down payment and have competitive interest rates.

- USDA Loans: These loans are designed for rural property purchases and typically require no down payment.

Impact of student loan debt on mortgage approval: Lenders will consider your student loan payments when assessing your DTI. They'll want to see that you can comfortably manage both your student loan repayments and your potential mortgage payments.

Advantages and disadvantages of each mortgage type: Each mortgage type comes with its own set of advantages and disadvantages concerning interest rates, down payment requirements, and eligibility criteria. Researching these differences is vital for making an informed decision.

Importance of a strong credit score: A strong credit score is essential for securing favorable mortgage terms. A higher credit score translates to lower interest rates and a greater chance of approval, regardless of your student loan debt.

- Research lenders who specialize in working with borrowers who have student loan debt. Some lenders have specialized programs to assist borrowers in this situation.

- Get pre-approved for a mortgage: This will give you a clearer understanding of your borrowing power and the types of mortgages you qualify for.

- Compare interest rates and fees from different lenders: Shop around to find the best possible terms for your mortgage.

Budgeting for Homeownership and Student Loan Repayment

Creating a realistic budget is paramount to successful homeownership, especially when juggling student loan debt. This involves meticulously planning your income and expenses to ensure you can comfortably manage both mortgage payments and student loan repayments.

Creating a realistic budget: Your budget should include your mortgage payment (principal, interest, taxes, and insurance – PITI), property taxes, homeowner's insurance, and, of course, your student loan payments. Factor in other monthly expenses like utilities, groceries, transportation, and entertainment.

Prioritizing debt repayment: Develop a strategy for paying down your student loans while managing your mortgage payments. Consider making extra payments towards your high-interest student loans to reduce the overall interest paid and accelerate your repayment process.

Tracking expenses and income: Utilize budgeting apps or spreadsheets to monitor your income and expenses closely. This provides valuable insights into your spending habits and helps you identify areas where you can cut back.

Adjusting your lifestyle to accommodate new expenses: Homeownership brings additional responsibilities and expenses. Be prepared to adjust your lifestyle and make necessary sacrifices to accommodate these new financial obligations.

- Use the 50/30/20 budgeting rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Automate student loan and mortgage payments: Automating payments ensures you never miss a payment and helps maintain a good credit score.

- Explore options like refinancing student loans: Refinancing could help lower your monthly payments and free up cash flow.

Seeking Professional Advice: Financial Advisors and Mortgage Brokers

Navigating the complexities of homeownership with student loan debt can be overwhelming. Seeking professional guidance from experienced financial advisors and mortgage brokers can greatly simplify the process and help you make informed decisions.

The role of a financial advisor: A financial advisor can help you create a comprehensive financial plan that addresses both your student loan debt and your homeownership goals. They can provide personalized advice on debt management strategies, budgeting, and long-term financial planning.

The value of a mortgage broker: A mortgage broker acts as an intermediary between you and various lenders. They can help you find the best mortgage rates and terms, saving you time and potentially money.

When to seek professional help: Seek professional help if you're struggling to manage your debt, understand the home buying process, or create a realistic budget. Don't hesitate to reach out for support; it's a sign of proactive financial management.

Finding reputable professionals: Thoroughly research and verify the credentials and experience of any financial advisor or mortgage broker you consider working with. Read reviews and check for certifications and licensing.

- Attend free financial literacy workshops: These workshops provide valuable insights into personal finance and debt management.

- Get referrals from trusted friends and family: Ask for recommendations from people you trust who have successfully navigated similar situations.

- Check for certifications and licensing: Ensure your chosen professionals hold the necessary qualifications and licenses to operate legally and ethically.

Conclusion:

Successfully navigating homeownership with existing student loan debt requires careful planning, financial discipline, and a realistic assessment of your financial situation. By meticulously assessing your DTI, exploring various mortgage options that align with your financial profile, creating a detailed budget that accommodates both your mortgage and student loan payments, and seeking professional advice when needed, you can significantly increase your chances of achieving your homeownership goals. Don't let student loan debt deter you from pursuing the dream of homeownership. Start planning your journey today! Begin navigating your path to homeownership and successfully manage your student loan debt with the right strategies and professional guidance.

Featured Posts

-

Angel Reeses Sweet Message To Mom During Brothers Ncaa Win

May 17, 2025

Angel Reeses Sweet Message To Mom During Brothers Ncaa Win

May 17, 2025 -

Ny Knicks Vs La Clippers Live Stream March 26 2025 Free Nba Game Time And Channel Guide

May 17, 2025

Ny Knicks Vs La Clippers Live Stream March 26 2025 Free Nba Game Time And Channel Guide

May 17, 2025 -

Reconciliation Thibodeau And Bridges Settle Post Game Comments

May 17, 2025

Reconciliation Thibodeau And Bridges Settle Post Game Comments

May 17, 2025 -

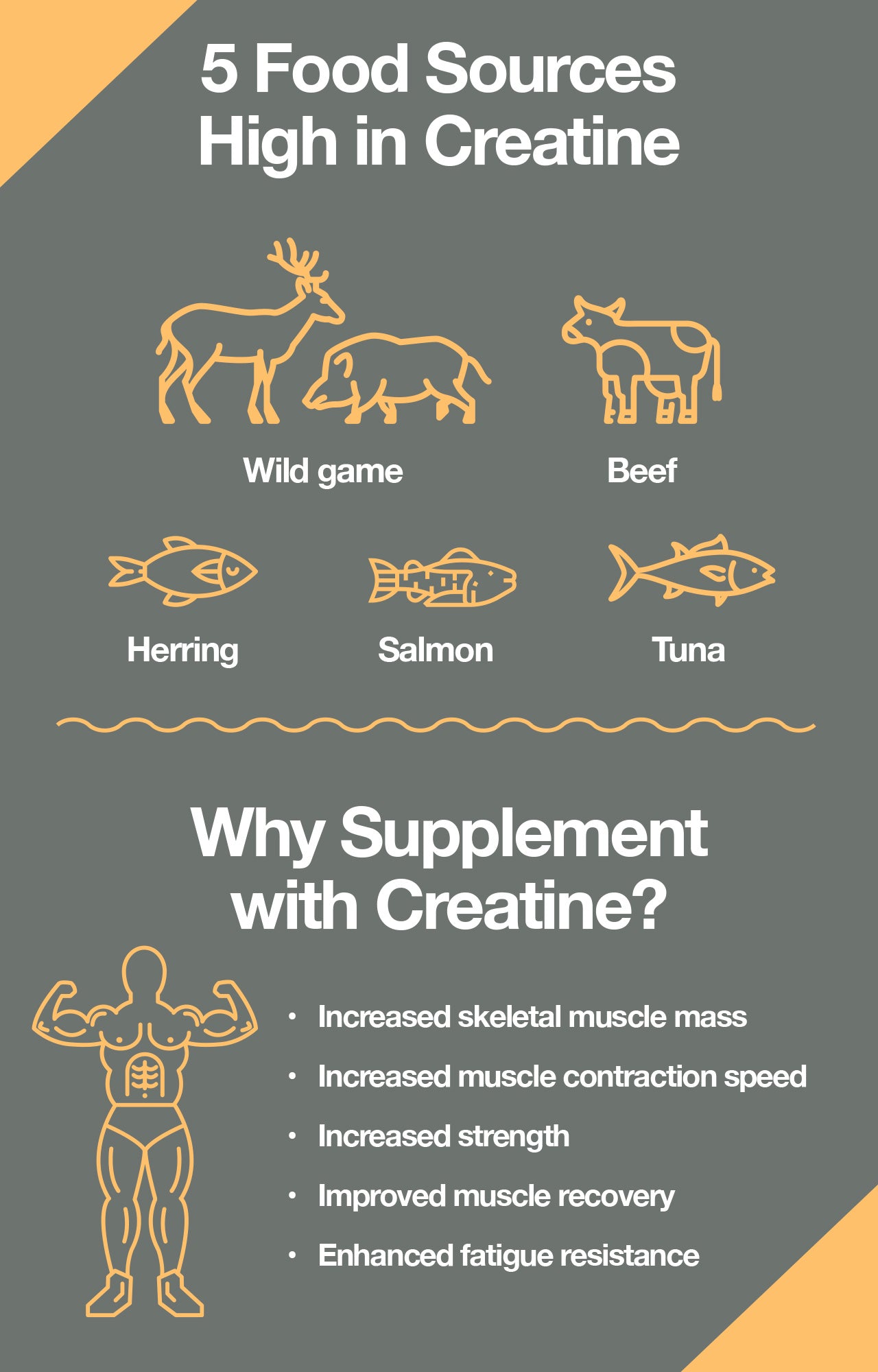

What Is Creatine And How Does It Work

May 17, 2025

What Is Creatine And How Does It Work

May 17, 2025 -

Austintown And Boardman Police Blotter Latest News Sports And Jobs

May 17, 2025

Austintown And Boardman Police Blotter Latest News Sports And Jobs

May 17, 2025