Navigating The Private Credit Boom: 5 Key Do's And Don'ts For Job Seekers

Table of Contents

Do: Network Strategically within the Private Credit Industry

Networking is paramount in a niche field like private credit. Building relationships with professionals in the industry can significantly increase your chances of landing a job. This isn't just about collecting business cards; it's about establishing genuine connections.

Leverage LinkedIn Effectively:

LinkedIn is your primary tool for connecting with private credit professionals. Optimize your profile with relevant keywords like "private credit," "credit analysis," "investment management," and "alternative lending."

- Optimize your profile: Use keywords throughout your profile summary, experience section, and skills section.

- Personalize connection requests: Don't send generic invitations. Mention something specific that connects you to the person.

- Engage actively: Participate in relevant group discussions, share insightful articles, and comment on industry news.

Attend Industry Events and Conferences:

Private credit conferences and workshops are invaluable networking opportunities. These events bring together key players in the industry, offering chances to meet recruiters and build relationships.

- Research upcoming events: Look for conferences, seminars, and networking events focused on private credit and alternative lending.

- Prepare talking points: Have a concise and engaging introduction ready, highlighting your skills and career goals.

- Follow up: After the event, send personalized emails to the people you met, reinforcing your connections.

Informational Interviews:

Informational interviews provide invaluable insights into different roles and companies. They allow you to learn about the day-to-day realities of private credit jobs and make valuable connections.

- Research potential contacts: Identify professionals working in private credit firms that interest you.

- Prepare thoughtful questions: Ask insightful questions about their career path, the company culture, and the industry.

- Express gratitude: Always send a thank-you note or email after the interview.

Do: Develop In-Demand Skills for Private Credit Roles

Private credit roles demand a specific skillset. Financial modeling, credit analysis, and due diligence are essential, along with a solid understanding of legal and regulatory frameworks.

Enhance Your Financial Modeling Proficiency:

Proficiency in financial modeling is crucial. Mastering Excel and learning advanced modeling techniques is a must.

- Master Excel: Develop expertise in functions like VBA, pivot tables, and data analysis.

- Learn advanced techniques: Familiarize yourself with discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and other relevant techniques.

- Practice building models: Work on sample models and seek feedback to improve your skills.

Gain Expertise in Credit Analysis and Due Diligence:

Understanding credit risk assessment and due diligence processes is paramount. This involves analyzing financial statements, conducting background checks, and assessing the creditworthiness of borrowers.

- Study credit rating methodologies: Familiarize yourself with the approaches used by rating agencies like Moody's and S&P.

- Learn about different types of due diligence: Understand financial, legal, and operational due diligence procedures.

- Pursue relevant certifications: Consider certifications such as the CFA charter or other finance-related credentials.

Do: Tailor Your Resume and Cover Letter to Private Credit Positions

A generic resume won't cut it in the competitive private credit job market. Your resume and cover letter must be tailored to each specific position.

Highlight Relevant Keywords and Experience:

Incorporate keywords specific to private credit, such as "private debt," "leveraged loans," "distressed debt," "credit funds," and "alternative investments."

- Use action verbs: Start your bullet points with strong action verbs that showcase your accomplishments.

- Quantify achievements: Use numbers and data to demonstrate the impact of your work.

- Tailor your resume: Customize your resume for each job application, highlighting the skills and experience most relevant to the specific role.

Showcase Your Understanding of the Private Credit Market:

Demonstrate your knowledge of market trends and specific areas within private credit, such as direct lending, mezzanine financing, or distressed debt investing.

- Stay updated on industry news: Read industry publications and follow key players on social media.

- Research target companies: Understand their investment strategies, recent transactions, and portfolio companies.

- Mention relevant market trends: Reference current trends in your cover letter to show your awareness of the industry landscape.

Don't: Neglect Soft Skills and Professionalism

While technical skills are essential, soft skills like communication, teamwork, and problem-solving are equally important in securing a private credit role.

Master Communication and Interpersonal Skills:

Clear and concise communication is vital, both written and verbal. The ability to articulate complex financial concepts to both technical and non-technical audiences is a significant advantage.

- Practice your communication skills: Engage in mock interviews and presentations to hone your skills.

- Work on active listening: Pay close attention to what others are saying and ask clarifying questions.

- Improve your presentation skills: Learn to deliver compelling presentations that effectively communicate key information.

Demonstrate Professionalism at All Stages:

Professionalism is crucial throughout the job search process. This encompasses punctuality, appropriate attire, and respectful communication.

- Research company culture: Understand the dress code and communication style of the firm.

- Dress professionally for interviews: Choose attire that reflects the company's culture and demonstrates your seriousness.

- Respond promptly to emails and calls: Show respect for the recruiter's time by responding promptly and professionally.

Don't: Underestimate the Importance of Research and Company Knowledge

Thorough research on private credit firms and their investment strategies is crucial before applying. Demonstrating your understanding of the firm's approach will significantly strengthen your application.

Research Target Companies Thoroughly:

Go beyond simply reading the "About Us" section. Dive into their investment strategies, recent transactions, and key personnel.

- Understand the firm's investment focus: Identify their target sectors, deal sizes, and investment styles.

- Analyze recent transactions: Review their portfolio companies and investment theses to demonstrate your understanding of their approach.

- Research key personnel: Learn about the partners, managing directors, and other key individuals to demonstrate your interest in the firm's leadership.

Ask Informed Questions During Interviews:

Asking insightful questions demonstrates your preparation and genuine interest. Avoid generic questions; instead, ask questions that showcase your understanding of the private credit market and the firm's specific strategies.

- Prepare a list of thoughtful questions: Develop questions based on your research of the firm and the industry.

- Avoid generic questions: Focus on specific aspects of the firm's investment strategy, recent transactions, or market trends.

Conclusion: Successfully Navigating the Private Credit Job Market

Securing a private credit job requires a multifaceted approach. By strategically networking, developing in-demand skills, tailoring your application materials, demonstrating professionalism, and conducting thorough research, you significantly increase your chances of success. Remember, the private credit job market is competitive, but with a strategic and well-prepared approach, you can navigate the private credit boom and land your dream private credit job. Start by implementing these strategies, subscribe to industry newsletters like Private Debt Investor or PEI Media, and actively participate in industry events to stay ahead of the curve.

Featured Posts

-

Metas Future Under A Trump Administration Zuckerbergs Challenges

Apr 24, 2025

Metas Future Under A Trump Administration Zuckerbergs Challenges

Apr 24, 2025 -

Legal Showdown Averted Trump Administration Signals Willingness To Negotiate With Harvard

Apr 24, 2025

Legal Showdown Averted Trump Administration Signals Willingness To Negotiate With Harvard

Apr 24, 2025 -

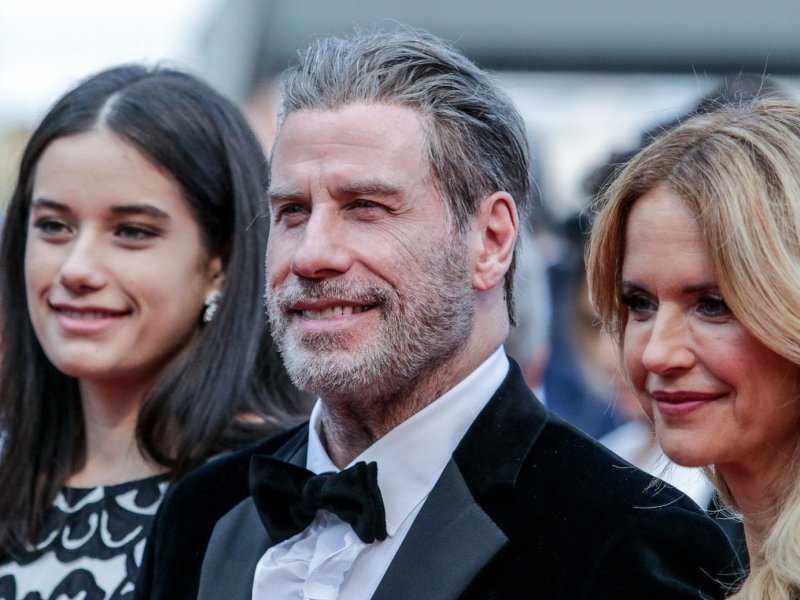

Kci Johna Travolte Nevjerojatna Transformacija U Prekrasnu Mladu Zenu

Apr 24, 2025

Kci Johna Travolte Nevjerojatna Transformacija U Prekrasnu Mladu Zenu

Apr 24, 2025 -

China Market Headwinds Bmw Porsche And The Future Of Luxury Auto Sales

Apr 24, 2025

China Market Headwinds Bmw Porsche And The Future Of Luxury Auto Sales

Apr 24, 2025 -

Review 77 Inch Lg C3 Oled Tv Is It Right For You

Apr 24, 2025

Review 77 Inch Lg C3 Oled Tv Is It Right For You

Apr 24, 2025