NCLH Stock: What Hedge Fund Activity Reveals About Its Future

Table of Contents

Recent Hedge Fund Buying and Selling Activity in NCLH Stock

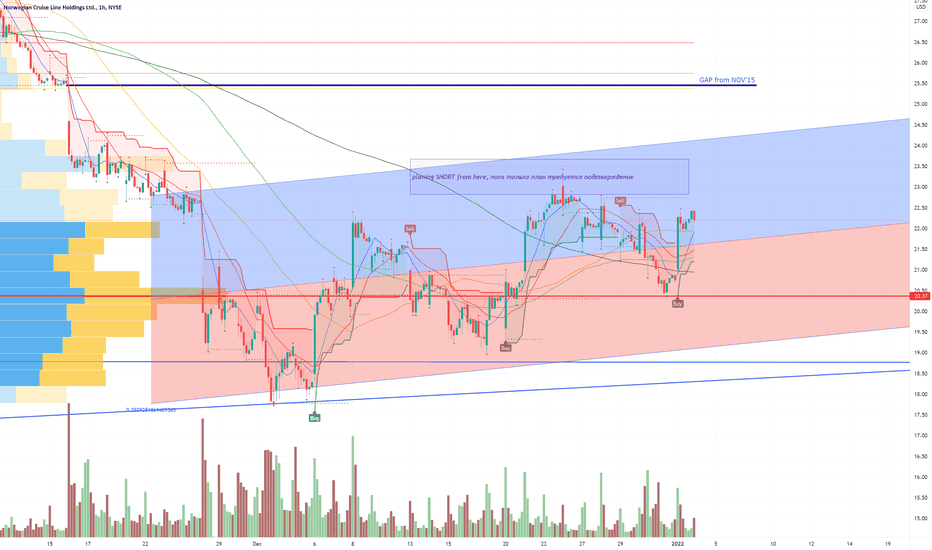

Analyzing hedge fund activity in NCLH stock requires scrutinizing recent 13F filings, which disclose the equity holdings of institutional investors. These filings reveal significant changes in hedge fund ownership of NCLH stock, providing a window into market sentiment.

-

Tracking Ownership Changes: By examining these filings, we can identify the net increase or decrease in NCLH shares held by hedge funds. A significant increase might suggest a bullish outlook, while a decrease could signal concern. For example, a 15% increase in holdings across several prominent funds could be a strong indicator.

-

Identifying Key Players: Pinpointing specific hedge funds that have substantially increased or decreased their NCLH positions is equally important. Understanding their typical investment strategies (value investing, growth investing, etc.) helps interpret their rationale. A value investor's increased stake might suggest they see NCLH as undervalued, while a growth investor's move could point to anticipated future growth.

-

Gauging Overall Sentiment: The aggregate hedge fund activity paints a broader picture. Is the overall sentiment bullish (net buying), bearish (net selling), or neutral? This collective sentiment provides a valuable context for interpreting individual fund actions and contributes to a comprehensive NCLH stock prediction.

Analyzing the Rationale Behind Hedge Fund Moves in NCLH

Understanding the why behind hedge fund activity is crucial for informed investment decisions. Several factors contribute to their choices:

-

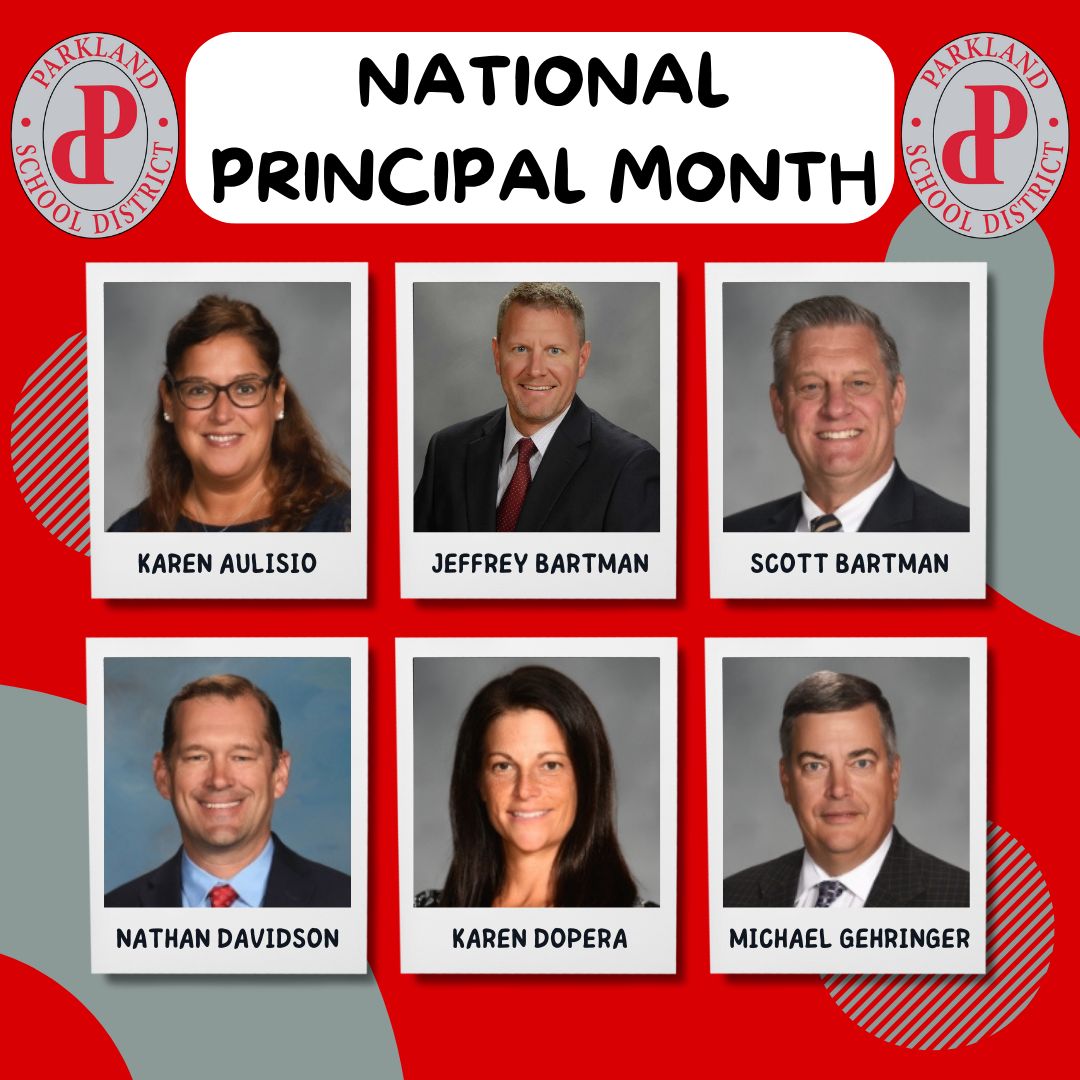

Macroeconomic Influences: The overall health of the global economy, consumer spending habits, and fuel prices significantly impact the cruise industry. Hedge funds consider these macroeconomic factors when assessing the risk and reward associated with NCLH stock. Recessions, for instance, could negatively impact cruise bookings.

-

NCLH's Financial Performance: A deep dive into NCLH's financial reports—revenue growth, profitability margins, and debt levels—is essential. Strong revenue growth and improved profitability are positive indicators, while high debt levels might raise concerns. Hedge fund activity often reflects these financial realities.

-

Booking Trends and Passenger Demand: Crucially, the strength of future cruise bookings is a key driver of hedge fund decisions. Strong booking trends suggest healthy demand and future revenue growth, bolstering investor confidence. Conversely, weak bookings could lead to reduced investments.

-

Market Risks: Investing in NCLH stock involves inherent risks. Fluctuating fuel prices, geopolitical instability (events impacting travel), and the ever-present risk of future health crises all factor into hedge fund risk assessments. These risks can significantly influence investment decisions.

The Impact of NCLH's Strategic Initiatives on Hedge Fund Interest

NCLH's strategic direction significantly influences hedge fund interest. Initiatives like fleet modernization, expansion plans, and marketing campaigns affect future profitability.

-

Fleet Modernization: Investments in new, environmentally friendly ships can boost NCLH's appeal and efficiency, potentially attracting more hedge fund investment.

-

Expansion Plans: Strategic expansion into new markets or the introduction of new cruise itineraries could signal growth potential, attracting investors.

-

Marketing and Cost-Cutting: Effective marketing strategies and successful cost-cutting measures can impact profitability and shareholder value, influencing hedge fund decisions. A focus on sustainability initiatives also increasingly matters to ESG-focused investors.

Interpreting Hedge Fund Activity for NCLH Stock Investment Decisions

Hedge fund activity offers valuable insights but doesn't predict the future with certainty.

-

Cautious Outlook: Based on the analysis of hedge fund buying and selling activity, a cautiously optimistic or pessimistic outlook on NCLH stock can be formulated. This outlook, however, should be combined with other factors.

-

Due Diligence is Paramount: Before making any investment decisions, thorough due diligence is crucial. This includes independent analysis of NCLH's financials, market trends, and competitive landscape.

-

Risk Tolerance and Investment Goals: Individual risk tolerance and investment goals should guide investment choices. NCLH stock, like any investment, carries risk. A long-term investment strategy might be suitable for some investors, while short-term trading may be more appropriate for others.

-

Diversification: Diversifying investments across various asset classes is vital to mitigate risk. NCLH should be only one part of a larger, well-diversified portfolio.

Conclusion

This analysis of hedge fund activity related to NCLH stock offers insights into potential future performance. While hedge fund moves provide valuable clues, they are not guarantees of future success. Investors should consider multiple factors and conduct thorough research before making any investment decisions regarding NCLH stock. By analyzing hedge fund activity alongside broader market trends and the company's financial health, you can make more informed decisions regarding your NCLH stock investments. Continue your research and stay updated on the latest news surrounding NCLH and the cruise industry for a comprehensive understanding of this dynamic sector.

Featured Posts

-

Moderate Reform Needed At Parkland School Board

Apr 30, 2025

Moderate Reform Needed At Parkland School Board

Apr 30, 2025 -

Dr Johnsons Yates Project Celebrating Black Historys Impact

Apr 30, 2025

Dr Johnsons Yates Project Celebrating Black Historys Impact

Apr 30, 2025 -

Schneider Electric Trade Shows As Effective Marketing Touchpoints

Apr 30, 2025

Schneider Electric Trade Shows As Effective Marketing Touchpoints

Apr 30, 2025 -

Farmers And Foragers Owner Selling Charlotte Old Lantern Barn

Apr 30, 2025

Farmers And Foragers Owner Selling Charlotte Old Lantern Barn

Apr 30, 2025 -

De Andre Hunter Leads Cavaliers To 10th Straight Win Over Trail Blazers

Apr 30, 2025

De Andre Hunter Leads Cavaliers To 10th Straight Win Over Trail Blazers

Apr 30, 2025