Net Asset Value (NAV) Of Amundi MSCI All Country World UCITS ETF USD Acc: Analysis And Implications

Table of Contents

What is Net Asset Value (NAV) and How Does it Relate to the Amundi MSCI ETF?

Net Asset Value (NAV) represents the net value of an investment fund's assets minus its liabilities, divided by the number of outstanding shares. For the Amundi MSCI All Country World UCITS ETF USD Acc, this calculation considers the market value of all the underlying assets held within the ETF, which encompasses a broad range of global equities. The calculation also accounts for currency conversions (as the fund is denominated in USD) and deducts any expenses, including management fees.

- NAV Calculation (Simplified): (Total Asset Value - Total Liabilities) / Number of Outstanding Shares

- Frequency of NAV Updates: The NAV is typically calculated and published daily, reflecting the closing market prices of the underlying assets.

- Where to find the daily NAV: The daily NAV is readily available on the Amundi website, major financial news sources, and your brokerage platform.

The NAV is closely linked to the ETF's share price. While they ideally track each other very closely, slight discrepancies can occur due to market trading activity and supply/demand dynamics.

Analyzing the Amundi MSCI All Country World UCITS ETF USD Acc NAV Trends

Analyzing the historical NAV of the Amundi MSCI All Country World UCITS ETF USD Acc provides valuable insights into its performance. (Insert chart/graph showing historical NAV performance here). This chart illustrates periods of significant growth, often correlating with positive global market trends, and periods of decline, typically influenced by economic downturns or geopolitical events.

- Significant NAV Changes: For instance, you might observe strong NAV growth during periods of sustained global economic expansion, like the post-2009 recovery. Conversely, periods of market volatility, such as the initial COVID-19 pandemic market crash, will show significant NAV decreases.

- Correlation with Market Indices: The Amundi MSCI All Country World UCITS ETF USD Acc's NAV will generally track the performance of the MSCI All Country World Index, though slight deviations might exist due to fund-specific factors.

- Impact of Global Events: Major global events, such as trade wars, political instability, or unexpected economic shocks, significantly impact the ETF’s NAV.

Factors Affecting the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc

Several factors influence the NAV fluctuations of the Amundi MSCI All Country World UCITS ETF USD Acc. Understanding these factors enables investors to make more informed decisions.

-

Macroeconomic Factors:

- Interest rate changes by central banks globally influence market valuations.

- Inflation rates impact corporate earnings and subsequently, the value of underlying assets.

- Economic growth in various regions directly affects the performance of companies within those regions, reflecting in the ETF's NAV.

-

Individual Asset Performance: The performance of specific companies and sectors within the ETF's portfolio heavily influences the overall NAV. A strong performance from technology stocks, for instance, will positively influence the NAV.

-

Expense Ratios and Management Fees: The fund's expense ratio directly reduces returns, impacting the NAV. These costs are deducted from the fund's assets, thus lowering the NAV. Understanding the fund's fee structure is crucial for evaluating long-term returns.

Implications for Investors: Understanding NAV and Making Informed Decisions

Understanding the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is critical for monitoring investment performance and making informed decisions.

-

Monitoring Performance: Regularly tracking NAV changes helps investors assess the progress of their investments and compare them against their financial goals.

-

Investment Strategies: NAV fluctuations can influence buy/sell decisions. Long-term investors may take advantage of dips in the NAV to add to their positions, while short-term traders might react more aggressively to changes.

-

Long-Term vs. Short-Term: Focusing on long-term NAV trends is generally recommended. Short-term fluctuations should be considered within the context of the overall investment strategy.

-

Strategies for Long-Term Investors: A long-term perspective minimizes the impact of short-term market volatility. Regular contributions through dollar-cost averaging can also help mitigate the risk associated with fluctuating NAVs.

-

Tips for Monitoring NAV Changes: Set up alerts on your brokerage platform or utilize financial news websites to stay updated on NAV movements.

-

Portfolio Rebalancing: Periodic portfolio rebalancing based on NAV changes helps maintain your desired asset allocation and risk level.

Conclusion

The Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is a fundamental metric for understanding the fund's performance and making informed investment decisions. Its calculation, the various factors affecting it, and its implications for investment strategies have been discussed in this article. Actively monitoring the NAV of your Amundi MSCI All Country World UCITS ETF USD Acc investments, combined with a long-term investment strategy, will help you navigate market fluctuations and achieve your financial objectives. For more in-depth information on the Amundi MSCI All Country World UCITS ETF USD Acc, consult the fund's prospectus or your financial advisor.

Featured Posts

-

Glastonbury 2024 Unannounced Us Band Teases Festival Appearance

May 24, 2025

Glastonbury 2024 Unannounced Us Band Teases Festival Appearance

May 24, 2025 -

Gear Essentials For Ferrari Owners A Comprehensive Guide

May 24, 2025

Gear Essentials For Ferrari Owners A Comprehensive Guide

May 24, 2025 -

Hawaii Keikis Memorial Day Lei Making Poster Contest A Showcase Of Artistic Talent

May 24, 2025

Hawaii Keikis Memorial Day Lei Making Poster Contest A Showcase Of Artistic Talent

May 24, 2025 -

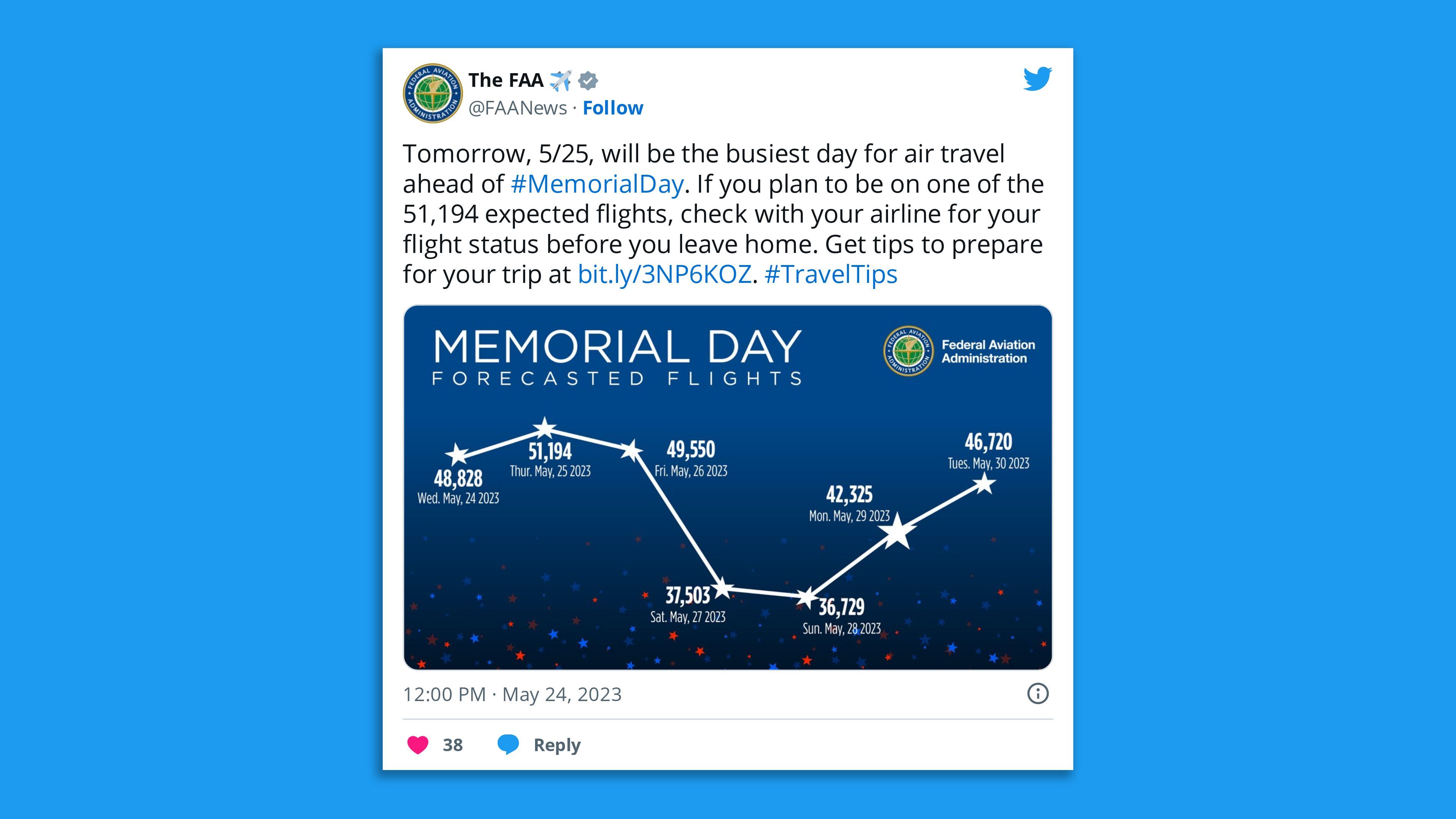

Best And Worst Days To Fly For Memorial Day Weekend 2025

May 24, 2025

Best And Worst Days To Fly For Memorial Day Weekend 2025

May 24, 2025 -

Escape To The Country Financing Your Rural Dream Home

May 24, 2025

Escape To The Country Financing Your Rural Dream Home

May 24, 2025

Latest Posts

-

Kyle Walkers Partying The Annie Kilner Fallout Explained

May 24, 2025

Kyle Walkers Partying The Annie Kilner Fallout Explained

May 24, 2025 -

Models Night Out Annie Kilners Posts And Allegations Against Kyle Walker

May 24, 2025

Models Night Out Annie Kilners Posts And Allegations Against Kyle Walker

May 24, 2025 -

Annie Kilner Seen Without Wedding Ring After Kyle Walkers Night Out

May 24, 2025

Annie Kilner Seen Without Wedding Ring After Kyle Walkers Night Out

May 24, 2025 -

Annie Kilners Posts Following Kyle Walkers Night Out Allegations Of Poisoning

May 24, 2025

Annie Kilners Posts Following Kyle Walkers Night Out Allegations Of Poisoning

May 24, 2025 -

Kyle Walkers Night Out Annie Kilner Spotted Running Errands

May 24, 2025

Kyle Walkers Night Out Annie Kilner Spotted Running Errands

May 24, 2025