Net Asset Value (NAV) Of Amundi MSCI World Ex-United States UCITS ETF Acc: Explained

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the per-share value of an Exchange-Traded Fund's (ETF) underlying assets. It's a fundamental metric that reflects the true worth of the ETF's holdings. For ETFs like the Amundi MSCI World ex-United States UCITS ETF Acc, the NAV calculation involves a straightforward process:

- NAV represents the per-share value of an ETF's underlying assets. This includes all the stocks, bonds, or other securities held within the ETF's portfolio.

- It's calculated daily by subtracting liabilities from the total asset value and dividing by the number of outstanding shares. Liabilities might include management fees and other operational expenses.

- Understanding NAV helps gauge the ETF's performance. By tracking changes in the NAV over time, investors can assess the growth or decline of their investment.

- NAV fluctuates based on market movements of the underlying assets. If the value of the assets held by the ETF increases, so does the NAV, and vice versa.

Understanding the Amundi MSCI World ex-United States UCITS ETF Acc NAV

The NAV of the Amundi MSCI World ex-United States UCITS ETF Acc is calculated based on the value of its underlying assets, which are designed to track the MSCI World ex-USA Index. This index comprises a broad range of companies outside the United States, offering significant international diversification. Several factors influence this ETF's NAV:

- Focus on the MSCI World ex-USA index tracking methodology and its influence on NAV. The index's composition and weighting of different companies directly impact the ETF's NAV. Changes in the performance of individual companies within the index will be reflected in the overall NAV.

- Mention currency fluctuations and their effect on the NAV (if applicable). Because the ETF holds assets in various currencies, exchange rate fluctuations can affect the NAV calculated in a specific currency (e.g., Euros).

- Explain how dividends impact the NAV. When the underlying companies pay dividends, the ETF receives these payments, which, after deducting expenses, generally increase the NAV.

- Discuss the role of expense ratios in affecting the NAV. The ETF's expense ratio (management fees) reduces the overall NAV over time, as these expenses are deducted from the asset value.

Where to Find the Amundi MSCI World ex-United States UCITS ETF Acc NAV

Finding the daily NAV for the Amundi MSCI World ex-United States UCITS ETF Acc is straightforward. You can access this information through several reliable sources:

- Official ETF provider website (Amundi's website). Amundi's official website is the most reliable source for this information. Look for a section dedicated to ETF factsheets or pricing data.

- Reputable financial news websites and data providers. Major financial news sources and data providers (like Bloomberg, Yahoo Finance, Google Finance) usually list ETF NAVs.

- Brokerage platforms where the ETF is traded. Most brokerage platforms will display the current NAV and historical NAV data for ETFs held in your portfolio.

Using NAV to Make Informed Investment Decisions

The NAV of the Amundi MSCI World ex-United States UCITS ETF Acc provides crucial data for making informed investment choices:

- Tracking NAV changes over time to assess performance. Monitoring the NAV over several periods (daily, weekly, monthly) allows you to observe the ETF's performance trend.

- Comparing NAV to the ETF's market price to identify potential buying or selling opportunities (premium/discount). Sometimes the ETF's market price trades at a slight premium or discount to its NAV. Understanding this difference can help in identifying potential trading strategies.

- Using NAV to monitor long-term investment growth. Long-term NAV tracking shows the overall growth of your investment and helps in assessing the efficacy of your strategy.

- Mention the importance of considering other factors beyond NAV, such as investment goals and risk tolerance. While NAV is a crucial indicator, it's not the only factor to consider. Your investment goals and risk tolerance should guide your investment decisions.

Frequently Asked Questions (FAQs) about Amundi MSCI World ex-United States UCITS ETF Acc NAV

- How often is the NAV calculated? The NAV is typically calculated at the end of each trading day.

- What factors affect the NAV besides market fluctuations? Dividends, expense ratios, and currency fluctuations can also influence the NAV.

- Is there a difference between NAV and market price? Why? Yes, there can be a slight difference due to supply and demand in the market. The market price reflects the current trading price, which can deviate slightly from the NAV.

- How can I use the NAV information in my investment strategy? Use the NAV to track performance, compare it to the market price, and assess long-term growth in conjunction with your overall investment goals.

Conclusion

Understanding the Amundi MSCI World ex-United States UCITS ETF Acc NAV is essential for making well-informed investment decisions. By regularly monitoring the NAV, comparing it to the market price, and considering other relevant factors, you can effectively track your investment's performance and make strategic choices aligned with your investment objectives. Remember, while NAV is a crucial indicator, it's vital to combine this information with your broader investment strategy and risk tolerance. To learn more about the Amundi MSCI World ex-United States UCITS ETF Acc and its NAV, visit the Amundi website for detailed information and factsheets. Start making informed decisions by mastering the use of the Amundi MSCI World ex-United States UCITS ETF Acc NAV today.

Featured Posts

-

Evrovidenie 2025 Prognoz Konchity Vurst Na Chetyrekh Pobediteley

May 24, 2025

Evrovidenie 2025 Prognoz Konchity Vurst Na Chetyrekh Pobediteley

May 24, 2025 -

Yevrobachennya 2025 Eksklyuzivniy Prognoz Konchiti Vurst Vid Unian

May 24, 2025

Yevrobachennya 2025 Eksklyuzivniy Prognoz Konchiti Vurst Vid Unian

May 24, 2025 -

Joy Crookes New Track I Know You D Kill A Deeper Dive

May 24, 2025

Joy Crookes New Track I Know You D Kill A Deeper Dive

May 24, 2025 -

Kyle Walker And Annie Kilner New Ring Sparks Engagement Speculation

May 24, 2025

Kyle Walker And Annie Kilner New Ring Sparks Engagement Speculation

May 24, 2025 -

Czy Porsche Cayenne Gts Coupe To Idealny Suv Test I Opinia

May 24, 2025

Czy Porsche Cayenne Gts Coupe To Idealny Suv Test I Opinia

May 24, 2025

Latest Posts

-

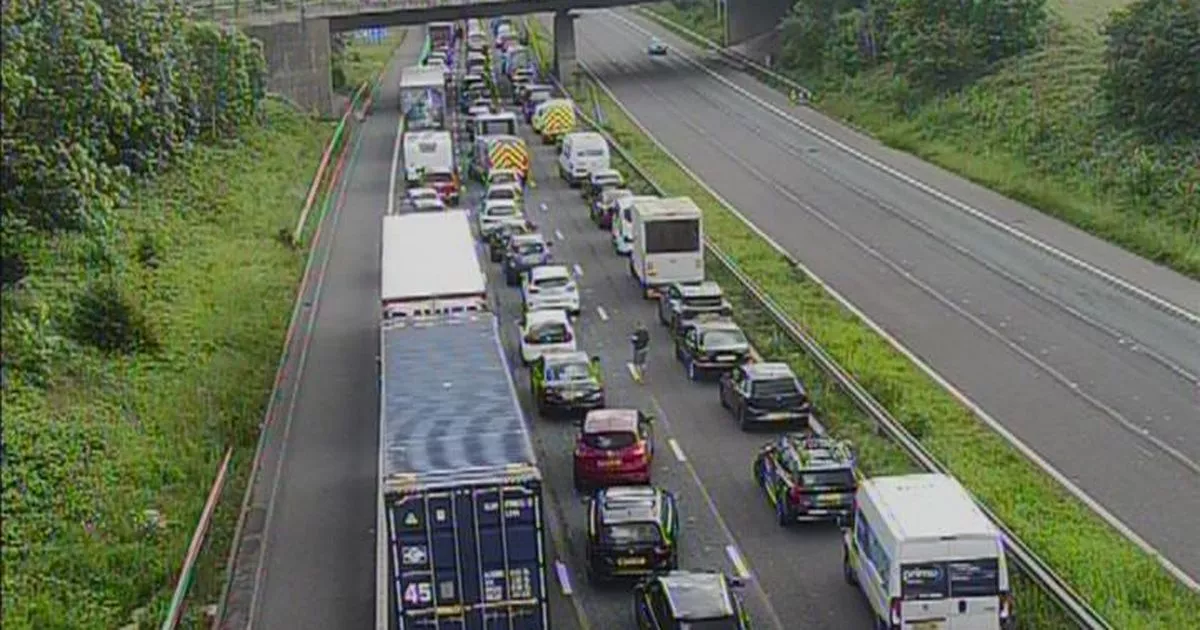

Severe M56 Crash Causes Significant Traffic Disruption Get Live Updates

May 24, 2025

Severe M56 Crash Causes Significant Traffic Disruption Get Live Updates

May 24, 2025 -

M56 Road Closure Live Traffic And Travel Updates After Accident

May 24, 2025

M56 Road Closure Live Traffic And Travel Updates After Accident

May 24, 2025 -

Long Queues On M56 Due To Crash Current Traffic Conditions

May 24, 2025

Long Queues On M56 Due To Crash Current Traffic Conditions

May 24, 2025 -

M56 Traffic Delays Live Updates Following Serious Crash

May 24, 2025

M56 Traffic Delays Live Updates Following Serious Crash

May 24, 2025 -

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025