Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist: Key Considerations

Table of Contents

Defining Net Asset Value (NAV) and the Amundi MSCI World II UCITS ETF USD Hedged Dist

Net Asset Value (NAV) represents the total value of an ETF's underlying assets, minus its liabilities, divided by the number of outstanding shares. In simpler terms, it's the net worth of the ETF per share. For passively managed ETFs like the Amundi MSCI World II UCITS ETF USD Hedged Dist, the NAV closely reflects the value of the index it tracks – the MSCI World Index.

The Amundi MSCI World II UCITS ETF USD Hedged Dist is an exchange-traded fund that aims to track the performance of the MSCI World Index, but with a crucial difference: it's USD hedged. This means the fund employs strategies to mitigate the risk associated with fluctuations between the Euro (the base currency of the ETF) and the US dollar. This hedging is designed to provide relative stability for US dollar-based investors.

This article aims to provide a comprehensive understanding of the factors affecting the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist, enabling you to interpret NAV data effectively and make informed investment choices.

Factors Affecting the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Several factors interact to determine the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist. Understanding these factors is essential for informed investment decisions.

Currency Fluctuations and Hedging

The USD hedged aspect significantly impacts the NAV. Currency fluctuations between the Euro and the USD directly affect the value of the underlying assets when converted to USD.

- Mechanics of Currency Hedging: The ETF utilizes financial instruments like forward contracts or currency swaps to offset the impact of exchange rate movements. This aims to maintain a relatively stable NAV in USD.

- Effectiveness and Limitations: While hedging reduces currency risk, it's not entirely foolproof. Unexpected sharp shifts in exchange rates can still impact the NAV. Furthermore, hedging itself involves costs, which slightly reduce the NAV.

- Impact of Hedging Costs: The cost of implementing the currency hedge is deducted from the NAV, slightly reducing its overall value. This expense is typically factored into the overall expense ratio.

- Example: If the Euro strengthens against the USD, the unhedged NAV might increase, reflecting the higher value of the underlying European assets in USD terms. However, the hedged NAV would likely show a smaller increase, or even a slight decrease, due to the hedging strategy.

Underlying Asset Performance

The performance of the underlying assets within the MSCI World Index is the most significant driver of NAV changes. This index encompasses a large number of global equities, representing a diverse range of sectors and companies.

- Weighting and Sector Performance: The index weights companies based on their market capitalization, meaning larger companies have a greater impact on the overall NAV. Strong performance in technology, for example, could boost the NAV, while poor performance in energy might lower it.

- Market Volatility and its Effect: Market volatility, driven by factors such as economic news, geopolitical events, or investor sentiment, directly translates into NAV fluctuations. During periods of high volatility, the NAV can experience more significant swings.

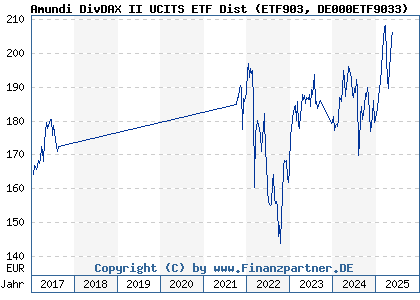

- [Insert Chart/Graph Here]: A chart illustrating the historical performance of the MSCI World Index and its correlation with the ETF's NAV would visually demonstrate this relationship.

Expense Ratio and Management Fees

The ETF's expense ratio represents the annual cost of managing the fund. These fees, deducted from the fund's assets, cumulatively impact the NAV over time.

- Expense Ratio: [State the current expense ratio of the Amundi MSCI World II UCITS ETF USD Hedged Dist]. This ratio is expressed as a percentage of the total assets under management.

- Fee Deduction: The expense ratio is deducted daily or periodically, directly impacting the NAV. Over the long term, these fees can significantly influence the overall return.

- Comparative Analysis: Comparing the expense ratio to similar ETFs helps assess its competitiveness in the market.

Monitoring and Interpreting the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Regular monitoring and understanding of NAV changes are critical for effective investment management.

Where to Find NAV Data

Reliable and up-to-date NAV information is readily available from several sources:

- ETF Provider's Website: Amundi's official website provides daily NAV updates.

- Financial News Sources: Major financial news websites and platforms often display real-time or end-of-day NAV data for ETFs.

- Brokerage Platforms: If you hold the ETF through a brokerage account, the platform will show your current holdings' NAV.

- Frequency of Updates: NAV is typically updated daily, reflecting the closing prices of the underlying assets.

Understanding NAV Changes

Interpreting NAV changes requires understanding the difference between the ETF's price and its NAV. While closely related, they can differ slightly due to market forces of supply and demand.

- Price vs. NAV: The ETF's price on the exchange can fluctuate throughout the trading day, influenced by buying and selling pressure. The NAV, however, is calculated at the end of the trading day.

- Significance of Changes: Significant NAV movements should be considered in the context of broader market trends and the performance of the underlying assets. Large, sudden drops might warrant further investigation.

Using NAV for Investment Decisions

While NAV is a key metric, it shouldn't be the sole factor in your investment decisions.

- Holistic Approach: Consider your investment goals, risk tolerance, and overall market outlook alongside NAV data.

- Long-Term Perspective: Focus on the long-term performance of the ETF rather than short-term NAV fluctuations.

Conclusion: Making Informed Decisions About Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

The NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is influenced by currency fluctuations (mitigated by hedging), the performance of the underlying MSCI World Index, and the ETF's expense ratio. Understanding these factors is crucial for interpreting NAV changes and making well-informed investment decisions. Regularly monitor the NAV, but remember to consider it alongside your broader investment strategy. For more in-depth analysis or tailored advice, consult with a financial advisor. By carefully analyzing the Net Asset Value and related factors, you can effectively manage your investment in the Amundi MSCI World II UCITS ETF USD Hedged Dist and similar ETFs.

Featured Posts

-

Net Asset Value Nav For Amundi Msci World Ii Ucits Etf Usd Hedged Dist What Investors Need To Know

May 24, 2025

Net Asset Value Nav For Amundi Msci World Ii Ucits Etf Usd Hedged Dist What Investors Need To Know

May 24, 2025 -

Hamiltons Controversial Comments Draw Scathing Criticism From Ferrari

May 24, 2025

Hamiltons Controversial Comments Draw Scathing Criticism From Ferrari

May 24, 2025 -

Glastonbury 2024 Unconfirmed Us Band Teases Festival Appearance

May 24, 2025

Glastonbury 2024 Unconfirmed Us Band Teases Festival Appearance

May 24, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc Understanding Net Asset Value Nav

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc Understanding Net Asset Value Nav

May 24, 2025 -

Listen Now Joy Crookes Shares Powerful New Single I Know You D Kill

May 24, 2025

Listen Now Joy Crookes Shares Powerful New Single I Know You D Kill

May 24, 2025

Latest Posts

-

Models Night Out Annie Kilners Posts And Allegations Against Kyle Walker

May 24, 2025

Models Night Out Annie Kilners Posts And Allegations Against Kyle Walker

May 24, 2025 -

Annie Kilner Seen Without Wedding Ring After Kyle Walkers Night Out

May 24, 2025

Annie Kilner Seen Without Wedding Ring After Kyle Walkers Night Out

May 24, 2025 -

Annie Kilners Posts Following Kyle Walkers Night Out Allegations Of Poisoning

May 24, 2025

Annie Kilners Posts Following Kyle Walkers Night Out Allegations Of Poisoning

May 24, 2025 -

Kyle Walkers Night Out Annie Kilner Spotted Running Errands

May 24, 2025

Kyle Walkers Night Out Annie Kilner Spotted Running Errands

May 24, 2025 -

Leeds United And Kyle Walker Peters Transfer Update

May 24, 2025

Leeds United And Kyle Walker Peters Transfer Update

May 24, 2025