Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF: A Comprehensive Guide

Table of Contents

What is the Amundi Dow Jones Industrial Average UCITS ETF?

The Amundi Dow Jones Industrial Average UCITS ETF is an exchange-traded fund that aims to track the performance of the Dow Jones Industrial Average (DJIA). The DJIA is a widely recognized stock market index composed of 30 large, publicly-owned companies in the United States. Investing in this ETF offers investors a cost-effective way to gain diversified exposure to this iconic benchmark.

Key features and benefits include:

- Diversification: Instant diversification across 30 leading US companies, reducing individual stock risk.

- Index Tracking: Aims to replicate the performance of the DJIA, offering broad market exposure.

- Liquidity: Traded on major exchanges, offering ease of buying and selling.

- Transparency: The ETF's holdings are publicly available, ensuring transparency.

- UCITS Compliant: Complies with the Undertakings for Collective Investment in Transferable Securities (UCITS) directive, ensuring regulatory oversight and investor protection.

The ETF's expense ratio, a crucial factor to consider, is readily available on Amundi's website and financial information providers. Remember to factor this expense ratio into your overall investment return calculations.

How is the NAV of the Amundi Dow Jones Industrial Average UCITS ETF Calculated?

The Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF represents the total value of its underlying assets minus its liabilities, divided by the number of outstanding shares. This calculation is performed daily, typically at the close of market hours.

The process involves:

- Asset Valuation: Determining the market value of all the ETF's holdings (the 30 Dow Jones Industrial Average stocks).

- Cash and Receivables: Adding the value of any cash holdings and other receivables.

- Liability Deduction: Subtracting all liabilities, including expenses and any outstanding obligations.

- NAV Calculation: Dividing the net asset value (assets minus liabilities) by the total number of outstanding shares.

Factors influencing the daily NAV include:

- Market Fluctuations: Changes in the prices of the underlying stocks directly impact the NAV.

- Dividends Received: Dividend payments from the underlying companies increase the ETF's assets, thus impacting the NAV.

- Foreign Exchange Rates: Fluctuations in exchange rates can affect the NAV if the ETF holds assets denominated in currencies other than its base currency.

Understanding the Components of NAV

The NAV is composed of several key components:

- Market Value of Holdings: This represents the largest portion of the NAV, reflecting the current market prices of the 30 stocks within the DJIA.

- Cash Holdings: The value of cash and cash equivalents held by the ETF.

- Liabilities: These include management fees, administrative expenses, and any other outstanding obligations. Understanding these liabilities is crucial for accurately interpreting the NAV.

Where to Find the NAV of the Amundi Dow Jones Industrial Average UCITS ETF?

The daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF is typically available from several sources:

- Amundi's Website: The official Amundi website is the primary source for accurate and up-to-date NAV data.

- Financial News Websites: Many reputable financial news websites provide real-time or end-of-day NAV data for ETFs.

- Brokerage Platforms: If you hold the ETF through a brokerage account, the platform will usually display the current NAV.

It's crucial to access NAV data from reliable sources to ensure accuracy. Always verify the information from multiple sources to confirm its validity. Understanding how the data is presented (e.g., currency, time zone) is crucial for accurate interpretation.

Using NAV to Make Informed Investment Decisions

Monitoring the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is critical for assessing its performance and making informed investment decisions.

- Performance Evaluation: Comparing the NAV over time provides insights into the ETF's performance relative to the DJIA.

- NAV and ETF Price: While the ETF's market price often closely tracks its NAV, discrepancies can occur.

- Premium/Discount to NAV: Sometimes the ETF's market price trades at a premium or discount to its NAV. Understanding the reasons for this discrepancy is important for making strategic investment choices.

By analyzing the NAV alongside other market indicators, investors can make better-informed decisions regarding buying, selling, or holding the ETF.

Conclusion: Monitoring the Net Asset Value (NAV) for Successful Investing in the Amundi Dow Jones Industrial Average UCITS ETF

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is essential for successful investing. By regularly monitoring the NAV and understanding its components, you can effectively assess the ETF's performance and make strategic investment decisions. Remember to utilize reliable sources for NAV data and consider the NAV in conjunction with other market analysis. Stay informed about the Net Asset Value of the Amundi Dow Jones Industrial Average UCITS ETF and make strategic investment decisions today! [Link to Amundi's website or ETF fact sheet]

Featured Posts

-

Chto Udalos Nashemu Pokoleniyu Vzglyad Na Proshloe I Buduschee

May 25, 2025

Chto Udalos Nashemu Pokoleniyu Vzglyad Na Proshloe I Buduschee

May 25, 2025 -

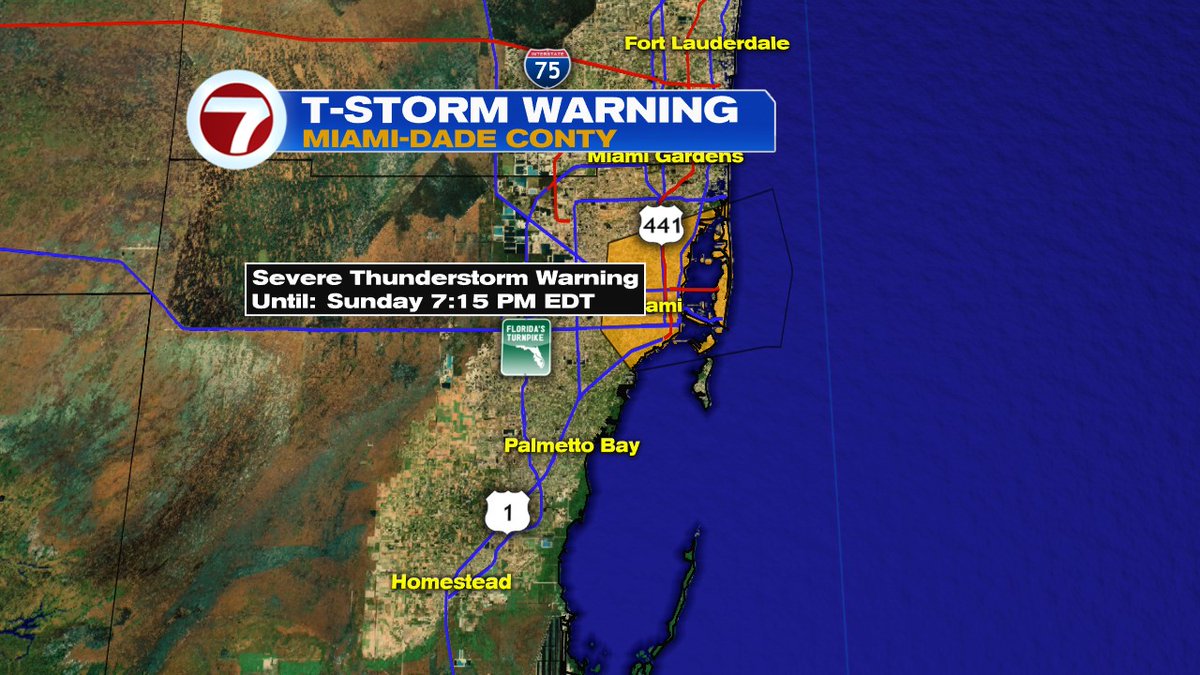

Miami Valley Flood Risk Severe Weather And Current Advisories

May 25, 2025

Miami Valley Flood Risk Severe Weather And Current Advisories

May 25, 2025 -

Gambling On Disaster The Rise Of Wildfire Betting And What It Means

May 25, 2025

Gambling On Disaster The Rise Of Wildfire Betting And What It Means

May 25, 2025 -

Avrupa Borsalarinda Gerileme Stoxx Europe 600 Ve Dax 40 In 16 Nisan 2025 Durumu

May 25, 2025

Avrupa Borsalarinda Gerileme Stoxx Europe 600 Ve Dax 40 In 16 Nisan 2025 Durumu

May 25, 2025 -

Rowing For A Cure A Fathers 2 2 Million Mission For His Son

May 25, 2025

Rowing For A Cure A Fathers 2 2 Million Mission For His Son

May 25, 2025