New HMRC Communication: Key Information For UK Residents

Table of Contents

The UK's Her Majesty's Revenue and Customs (HMRC) regularly issues communications that significantly impact UK residents. Staying updated on these announcements is paramount to ensure tax compliance and avoid potential penalties, including late filing penalties and interest charges. This article summarizes key information from recent HMRC communications, providing essential details for UK taxpayers to navigate the ever-evolving tax landscape.

Understanding Recent HMRC Communications

Recent HMRC communications have focused on several key areas, including updates to tax rates and allowances, changes to self-assessment deadlines, and the introduction of new online services designed to streamline tax processes. These communications arrive through various channels, such as formal letters sent via post, emails to registered accounts, and updates within the HMRC online portal itself. It’s vital to check all communication avenues regularly.

- Changes to self-assessment deadlines: HMRC frequently adjusts deadlines, so staying informed is crucial to avoid penalties.

- Updates to tax rates and allowances: Changes to personal allowances, income tax bands, and corporation tax rates are commonly communicated by HMRC. Understanding these updates is essential for accurate tax calculations.

- New initiatives for online tax filing: HMRC consistently improves its online services, making tax filing easier and more efficient. Familiarizing yourself with these updates is beneficial.

- Information about new penalties for non-compliance: HMRC regularly reinforces the consequences of non-compliance, emphasizing the importance of timely filing and accurate reporting.

- Guidance on claiming tax relief: HMRC provides regular updates on available tax reliefs and the processes for claiming them. Staying abreast of these updates can help you maximize your tax benefits.

Key Changes for Self-Assessment Taxpayers

Self-assessment taxpayers need to pay particular attention to recent HMRC communications. These communications often contain details on changes to the self-assessment process itself, impacting how and when you submit your tax return. Understanding these alterations is key to avoiding penalties.

- New online portal features for submitting self-assessment: HMRC is continually enhancing its online portal, introducing new features to simplify the self-assessment process. Learning to utilize these new tools efficiently can save time and effort.

- Changes to acceptable supporting documentation: The types of documents accepted as proof of income or expenses might change, so it's crucial to review HMRC guidelines.

- Updates to penalties for late filing or payment: HMRC frequently updates the penalties for late submissions and late payments. Knowing these penalties is essential for responsible tax management.

- Information on available support for completing self-assessment: HMRC provides various support resources, including online guides, helplines, and tax advisors, to assist taxpayers in completing their self-assessment accurately.

Navigating HMRC's Online Services

Effectively using HMRC's online services is crucial for managing your tax affairs efficiently. The HMRC website provides a wealth of information and tools, but knowing how to navigate it effectively is essential.

- Steps to register or log in to your HMRC online account: Registering for an online account grants access to a range of services, simplifying tax management.

- How to update personal details online: Ensuring your personal details are accurate and up-to-date is crucial for receiving correct tax information and avoiding complications.

- How to view tax statements and notices online: The online portal allows you to access your tax statements and notices conveniently, eliminating the need for postal correspondence.

- Guidance on using HMRC's online payment services: HMRC offers various online payment options, making tax payments simple and secure.

- Information on security measures to protect online accounts: Protecting your online account is crucial. HMRC provides advice on securing your account and preventing unauthorized access.

Staying Compliant and Avoiding Penalties

Tax compliance is paramount. Understanding your responsibilities and adhering to HMRC guidelines is crucial to avoid penalties and potential legal issues. Proactive tax management reduces stress and ensures financial well-being.

- Importance of keeping accurate records: Maintaining detailed and organized financial records is essential for accurate tax reporting.

- Understanding tax deadlines and penalties for missing them: Familiarity with all relevant deadlines is essential for avoiding penalties for late filing or payment.

- Seeking professional advice when needed: If you encounter difficulties understanding your tax obligations, seeking professional advice from an accountant or tax advisor is recommended.

- Steps to appeal a penalty if received: If you believe a penalty is unwarranted, understand the process for appealing the decision to HMRC.

Conclusion

Staying informed about new HMRC communications is essential for all UK residents. Understanding recent updates on self-assessment, online services, and penalty implications is key to ensuring tax compliance. By regularly checking the HMRC website and utilizing the available online resources, you can manage your tax affairs efficiently and avoid potential penalties. Ensure compliance with the latest HMRC guidelines and understand your responsibilities; stay informed about all new HMRC communications to maintain a healthy financial standing. Don't miss crucial updates; stay informed with the latest HMRC communications!

Featured Posts

-

Blockbusters Bgt Special A Comprehensive Guide

May 20, 2025

Blockbusters Bgt Special A Comprehensive Guide

May 20, 2025 -

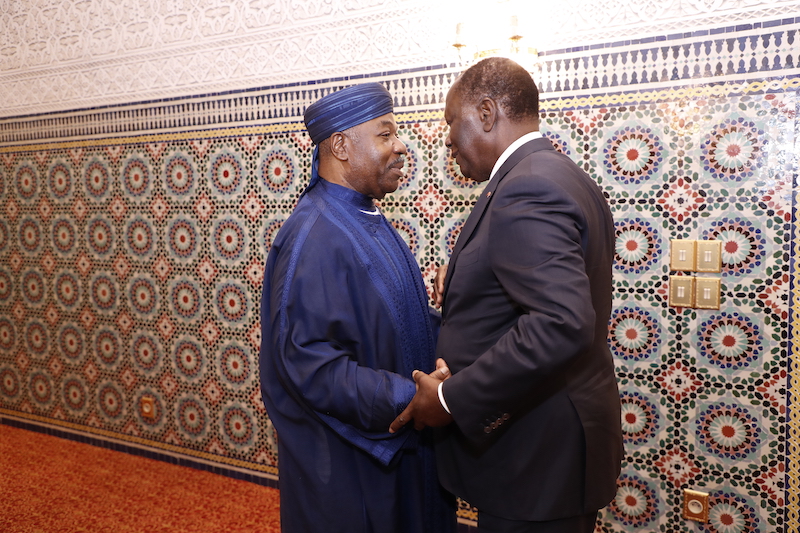

Visite D Amitie Et De Travail Du President Ghaneen Mahama A Abidjan Renforcement Des Liens Diplomatiques

May 20, 2025

Visite D Amitie Et De Travail Du President Ghaneen Mahama A Abidjan Renforcement Des Liens Diplomatiques

May 20, 2025 -

Rashford Scores Twice As Manchester United Defeats Preston In Fa Cup

May 20, 2025

Rashford Scores Twice As Manchester United Defeats Preston In Fa Cup

May 20, 2025 -

Novinata E Fakt Dzhenifr Lorns E Mayka Za Vtori Pt

May 20, 2025

Novinata E Fakt Dzhenifr Lorns E Mayka Za Vtori Pt

May 20, 2025 -

Drier Weather Ahead Practical Advice For Homeowners And Businesses

May 20, 2025

Drier Weather Ahead Practical Advice For Homeowners And Businesses

May 20, 2025