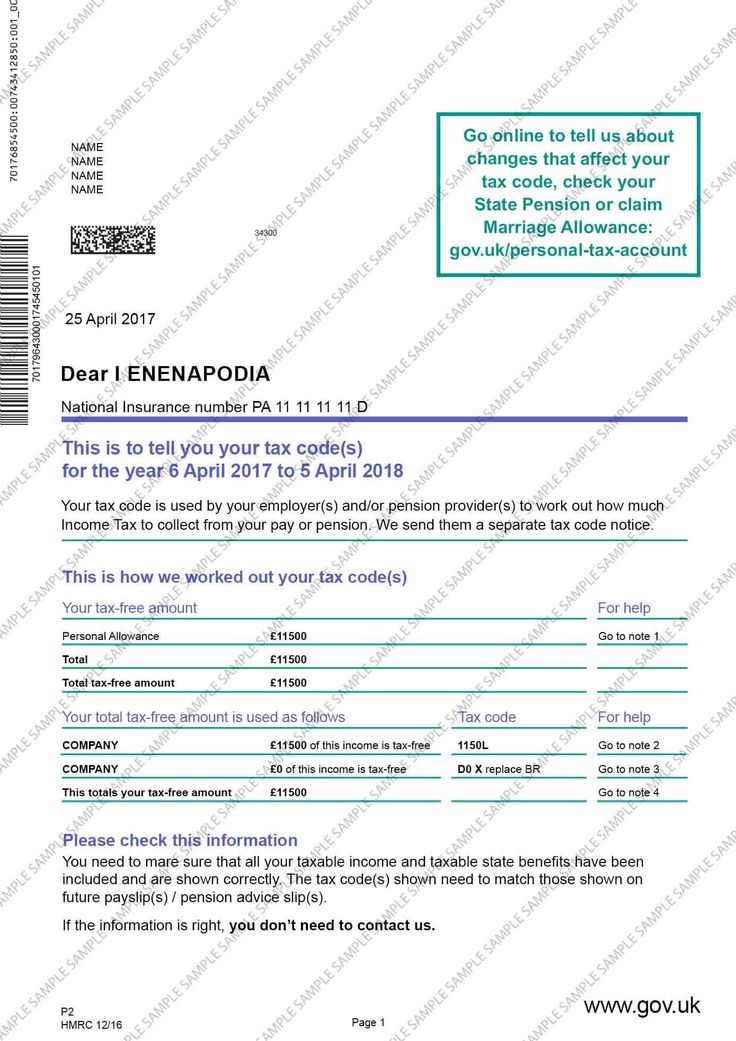

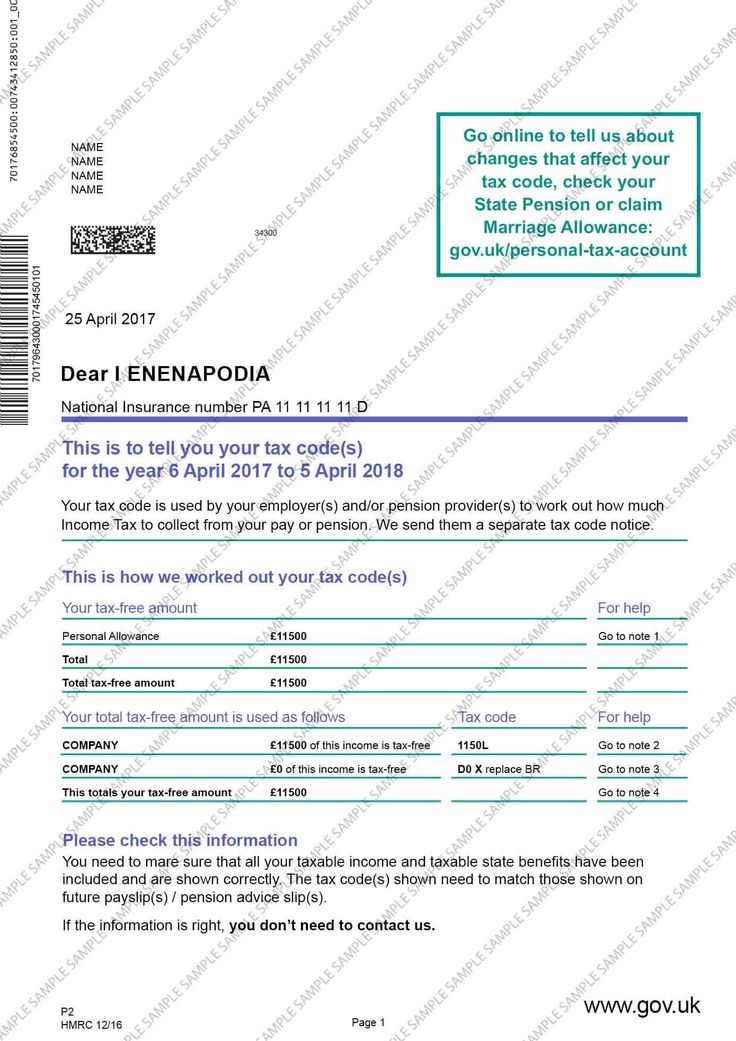

New HMRC Tax Code For Savers: What You Need To Know

Table of Contents

Understanding the New HMRC Tax Code for Savings

Understanding the HMRC savings allowance and its impact on your interest income is crucial. The personal savings allowance (PSA) allows you to earn a certain amount of interest each year tax-free. This allowance helps to simplify tax calculations for savers and encourages saving.

-

Personal Savings Allowance Limits: The current limits for the PSA vary depending on your tax bracket. Basic-rate taxpayers (those earning up to £37,700) can earn up to £1,000 in savings interest tax-free, while higher-rate taxpayers (those earning between £37,700 and £125,140) have a lower allowance of £500. Additional-rate taxpayers (earning over £125,140) do not receive a personal savings allowance. These limits are subject to change, so always check the latest HMRC guidance.

-

How the Allowance Works with Different Accounts: The PSA applies to interest earned from various savings accounts, including cash ISAs (Individual Savings Accounts), standard savings accounts, and building society accounts. However, interest earned within a cash ISA is already tax-free, meaning the PSA doesn't add further benefits to ISA savings.

-

Tax Implications for Exceeding the Allowance: If your savings interest exceeds your personal savings allowance, the excess interest will be taxed at your applicable income tax rate (basic, higher, or additional). This means that accurate record-keeping of your interest income is essential for accurate self-assessment.

-

Changes Compared to Previous Years: While the fundamental principles remain the same, the specific limits of the PSA might change annually based on government policy and inflation. Therefore, staying updated with the current allowances is essential for accurate tax planning.

-

Examples: A basic-rate taxpayer with £1,500 in savings interest would pay tax only on the £500 exceeding their £1,000 allowance. A higher-rate taxpayer with £750 in savings interest would pay tax on the £250 exceeding their £500 allowance.

Impact on Different Types of Savers

The new HMRC tax code affects different savers in unique ways. Understanding your tax bracket is key to maximizing your savings potential and minimizing tax liabilities.

-

High-Rate, Basic-Rate, and Additional-Rate Taxpayers: As mentioned earlier, the PSA significantly benefits basic-rate taxpayers, offering a more substantial tax-free allowance. Higher-rate taxpayers receive a smaller allowance, while additional-rate taxpayers receive none. Careful planning is crucial for higher-rate and additional-rate taxpayers to mitigate tax implications on their savings interest.

-

ISAs and Other Tax-Advantaged Savings: While the PSA applies to various accounts, remember that interest earned within a cash ISA remains tax-free, regardless of your income bracket. This makes ISAs an attractive option for all taxpayers. Other tax-advantaged savings vehicles, such as pensions, also exist and should be considered as part of a holistic savings strategy.

-

Interaction with Pension Contributions: Pension contributions are typically tax-deductible, offering further tax relief. This reduces your taxable income, indirectly affecting your overall tax liability on your savings interest. Strategic planning incorporating both pension contributions and savings accounts can significantly reduce your overall tax burden.

-

Savers Nearing Retirement: Individuals nearing retirement should carefully consider their overall financial picture, including their pension income and savings. Seeking professional financial advice to navigate the tax implications of various income streams in retirement is highly recommended.

Optimizing Your Savings Strategy Under the New Tax Code

Maximizing your savings allowance and minimizing your tax liability requires a strategic approach.

-

Maximizing Your Personal Savings Allowance: To maximize your PSA, ensure you understand your income and tax bracket. Avoid exceeding your allowance unless the return on investment is significantly greater than the tax payable.

-

Choosing the Right Savings Accounts: Consider using a combination of tax-free accounts (like ISAs) and standard savings accounts to balance tax-free savings with potentially higher interest rates.

-

Effective Tax Planning: Tax planning for savings should be an ongoing process, and it's advisable to review your savings strategy periodically. Seek professional financial advice for complex scenarios.

-

Seeking Professional Financial Advice: If you're unsure how the new tax code applies to your specific circumstances, consulting a qualified financial advisor is essential. They can provide personalized guidance and help you optimize your savings strategy.

-

Penalties for Non-Compliance: Failure to accurately report your savings interest can result in penalties from HMRC. Keeping thorough records of your savings interest and accurately declaring it on your self-assessment tax return is paramount.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions about the new HMRC tax code and savings:

-

Q: What happens if I exceed my allowance? A: Any interest exceeding your personal savings allowance will be taxed at your relevant income tax rate.

-

Q: How do I check my tax code? A: You can check your tax code online through your HMRC online account.

-

Q: Where can I find more information? A: You can find comprehensive information on the HMRC website and through their helpline.

Conclusion

The new HMRC tax code for savers presents both challenges and opportunities. By understanding the changes to the personal savings allowance and employing effective strategies, you can navigate the updated system and optimize your savings potential. Remember to stay informed about tax regulations and consider seeking professional financial advice if needed. Understanding your new HMRC tax code for savers is crucial for maximizing your returns. Take control of your finances and learn more about the updated regulations today! [Link to relevant resource/page]

Featured Posts

-

Understanding Michael Strahans Interview Acquisition A Ratings War Perspective

May 20, 2025

Understanding Michael Strahans Interview Acquisition A Ratings War Perspective

May 20, 2025 -

Ofitsialno Dzhenifr Lorns Otnovo E Mayka

May 20, 2025

Ofitsialno Dzhenifr Lorns Otnovo E Mayka

May 20, 2025 -

Transfer News I Los Antzeles Kynigaei Ton Giakoymaki

May 20, 2025

Transfer News I Los Antzeles Kynigaei Ton Giakoymaki

May 20, 2025 -

Big Bear Ai Bbai Stock Crash Analyzing The 17 87 Drop

May 20, 2025

Big Bear Ai Bbai Stock Crash Analyzing The 17 87 Drop

May 20, 2025 -

Keihard Optreden Fenerbahce Na Contact Tadic En Ajax

May 20, 2025

Keihard Optreden Fenerbahce Na Contact Tadic En Ajax

May 20, 2025