New Saudi Rules Unleash Untapped Potential In The ABS Market: A Market Larger Than Spain's

Table of Contents

New Regulatory Framework Fostering ABS Market Growth in Saudi Arabia

The Saudi Arabian Monetary Authority (SAMA) has implemented a new regulatory framework designed to stimulate growth within the Saudi ABS market. This framework focuses on simplifying issuance procedures, enhancing investor protection, and attracting foreign investment.

Streamlined Issuance Procedures

The new rules have significantly reduced bureaucratic hurdles associated with ABS issuance. This translates into:

- Reduced processing times: Faster approvals allow issuers to access capital more quickly, accelerating project timelines.

- Clearer regulatory guidelines: The simplified regulations provide greater transparency and predictability, reducing uncertainty for both issuers and investors.

- Increased transparency: Improved disclosure requirements enhance market confidence and attract a wider range of investors.

- Digitalization of processes: The shift towards online submissions and approvals further streamlines the process, minimizing paperwork and delays.

Enhanced Investor Protection Mechanisms

Protecting investor interests is paramount for building a robust and sustainable ABS market. The new regulations introduce:

- Stronger disclosure requirements: Issuers are now obligated to provide more detailed and comprehensive information about the underlying assets, reducing information asymmetry and enhancing transparency.

- Improved credit rating standards: The implementation of stricter credit rating methodologies ensures a more accurate assessment of risk, safeguarding investors’ capital.

- Robust dispute resolution mechanisms: Clear and efficient dispute resolution processes provide a safety net for investors in case of disagreements or disputes.

- Independent trustee oversight: The appointment of independent trustees adds a layer of protection, ensuring adherence to regulations and the interests of investors.

Attracting Foreign Investment into the Saudi ABS Market

The reforms align the Saudi ABS market with international best practices, making it more attractive to foreign investors. Key improvements include:

- Alignment with international standards: The new regulations conform to global best practices, reducing the barriers to entry for international investors familiar with established markets.

- Improved market infrastructure: Investments in technology and infrastructure have enhanced the efficiency and transparency of the market.

- Potential for high returns: The significant growth potential of the Saudi economy and its various sectors presents attractive investment opportunities with high potential returns.

- Government support: The Saudi government's commitment to developing the financial sector further bolsters investor confidence.

Untapped Potential Sectors Driving Saudi ABS Market Expansion

Several key sectors in Saudi Arabia are ripe for ABS issuance, contributing significantly to the market's expansion.

Real Estate ABS

Saudi Arabia's booming real estate sector offers substantial opportunities for ABS. This includes:

- Growing residential and commercial real estate markets: The rapidly expanding population and economic growth are driving strong demand for both residential and commercial properties.

- Potential for securitization of mortgages and other real estate-related assets: Mortgages, construction loans, and other real estate-related assets can be securitized, creating a diverse range of investment products.

- Government initiatives: Government initiatives aimed at boosting the housing market further stimulate growth in this sector.

Infrastructure Projects ABS

The ambitious Saudi Vision 2030 initiative fuels massive infrastructure development, creating immense potential for ABS:

- Saudi Vision 2030 infrastructure development plans: The extensive infrastructure projects under Vision 2030 require significant funding, making ABS an attractive financing mechanism.

- Potential for securitization of future infrastructure revenue streams: Future revenue streams from these projects can be securitized, providing a steady stream of income for investors.

- Public-private partnerships: The increased use of public-private partnerships further enhances the potential for ABS issuance in this sector.

Consumer Finance ABS

The expanding consumer finance market in Saudi Arabia offers another significant opportunity:

- Increasing consumer spending: Rising disposable incomes and a growing middle class are driving increased consumer spending, leading to a surge in consumer loans.

- Potential for securitization of auto loans, credit card receivables, and other consumer loans: These consumer finance assets can be packaged and securitized to attract investors.

- Technological advancements: The increasing use of fintech solutions streamlines the consumer lending process, facilitating the growth of this sector.

Comparing the Saudi ABS Market's Potential to Spain's Economy

The Saudi ABS market's potential is truly remarkable when compared to Spain's established economy.

Market Size and Growth Projections

While precise figures require further market development, initial estimates suggest the Saudi ABS market’s potential surpasses many established markets. [Insert chart or graph comparing projected growth of the Saudi ABS market to Spain's GDP growth].

Investment Opportunities and Returns

The potential for high returns in the Saudi ABS market is a significant draw for investors. While risk is inherent in any investment, the potential for higher returns compared to more mature markets like Spain’s, makes it attractive to those with a higher risk appetite.

Risk Assessment

Investing in emerging markets always involves risks. These include political, economic, and regulatory uncertainties. However, with careful due diligence and a diversified investment strategy, these risks can be mitigated.

Conclusion

The new Saudi regulations have unlocked unprecedented opportunities in the Saudi ABS market, a market poised for exponential growth, outpacing many established markets, including Spain. The streamlined issuance procedures, enhanced investor protection mechanisms, and the vast untapped potential across various sectors make it a compelling investment destination. Don't miss out on this chance to participate in a dynamic and rapidly expanding sector. Learn more about investing in the Saudi ABS market today! Explore the diverse opportunities within the Saudi ABS market and discover how you can benefit from this transformative phase of economic growth.

Featured Posts

-

Elon Musks Tesla Leadership Safe Board Rejects Replacement Reports

May 02, 2025

Elon Musks Tesla Leadership Safe Board Rejects Replacement Reports

May 02, 2025 -

Investing In Xrp Ripple In 2024 Is Sub 3 A Good Entry Point

May 02, 2025

Investing In Xrp Ripple In 2024 Is Sub 3 A Good Entry Point

May 02, 2025 -

Slim Opladen Met Enexis Goedkope Stroomtarieven In Noord Nederland

May 02, 2025

Slim Opladen Met Enexis Goedkope Stroomtarieven In Noord Nederland

May 02, 2025 -

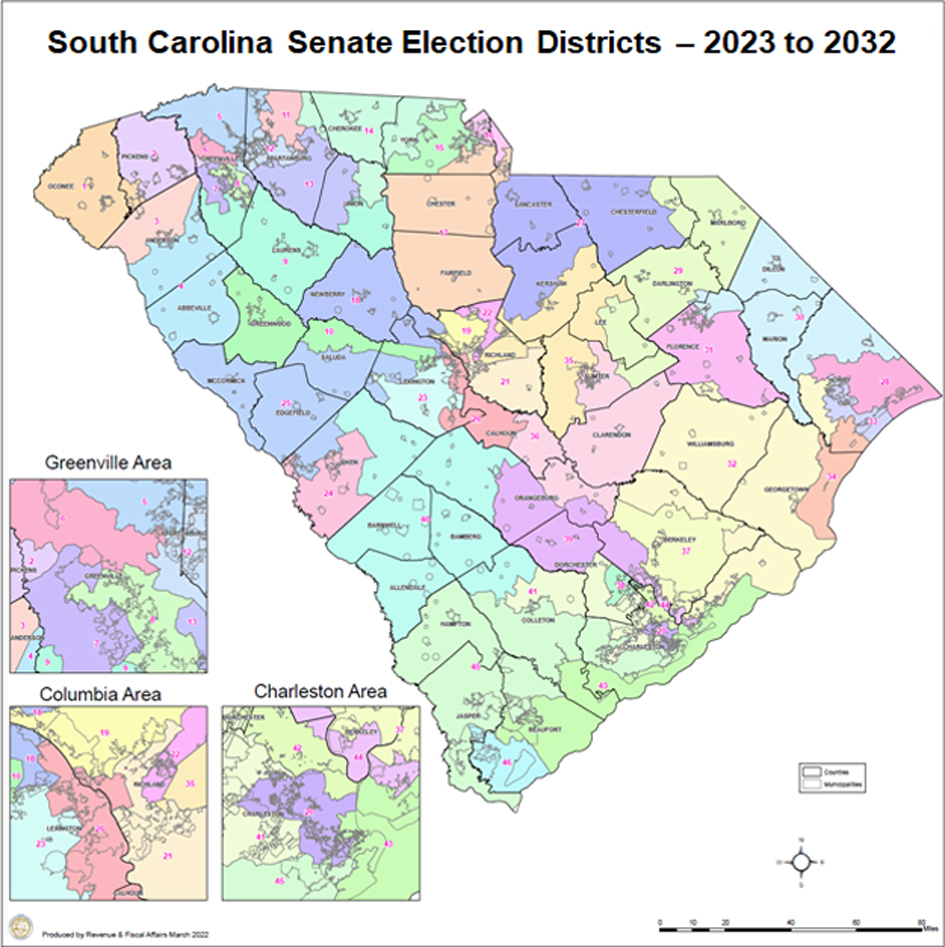

93 Trust South Carolina Elections Survey Results

May 02, 2025

93 Trust South Carolina Elections Survey Results

May 02, 2025 -

This Country Your Complete Travel Resource

May 02, 2025

This Country Your Complete Travel Resource

May 02, 2025

Latest Posts

-

Nyt Strands Game 357 Hints And Answers For February 23rd

May 10, 2025

Nyt Strands Game 357 Hints And Answers For February 23rd

May 10, 2025 -

Nyt Strands Hints And Answers Sunday February 23 Game 357

May 10, 2025

Nyt Strands Hints And Answers Sunday February 23 Game 357

May 10, 2025 -

Strands Nyt Crossword Solutions And Clues For February 15th Game 349

May 10, 2025

Strands Nyt Crossword Solutions And Clues For February 15th Game 349

May 10, 2025 -

Nyt Strands Game 349 Hints And Answers For February 15th

May 10, 2025

Nyt Strands Game 349 Hints And Answers For February 15th

May 10, 2025 -

Solve Nyt Strands Game 354 Thursday February 20 Hints And Answers

May 10, 2025

Solve Nyt Strands Game 354 Thursday February 20 Hints And Answers

May 10, 2025