Nifty's Upward Surge: Analyzing The Positive Factors Driving India's Market

Table of Contents

Strong Corporate Earnings Fuel Nifty's Rise

Improved financial performance across various sectors is a cornerstone of the Nifty 50's recent success. Indian companies have demonstrated impressive profitability and revenue growth, significantly boosting market sentiment. This strong performance reflects a healthy and expanding economy.

- Increased profits in the IT sector: Global demand for IT services has fueled significant profit growth for Indian IT giants, contributing substantially to the Nifty's performance.

- Robust FMCG sector: Strong domestic consumption has driven exceptional performance in the Fast-Moving Consumer Goods (FMCG) sector, showcasing the resilience of the Indian consumer market.

- Infrastructure boom: Increased government spending on infrastructure projects has created a ripple effect, boosting construction and related sectors, thereby contributing to overall economic growth and Nifty 50 performance. This improved infrastructure also directly contributes to improved profitability for many companies. The improved ease of logistics, for example, reduces operational costs.

The consistent and substantial revenue growth across these sectors highlights the underlying strength of the Indian economy and directly impacts the Nifty 50 index. This positive trend in corporate earnings is a key driver of the overall market surge. This sectoral growth is a vital indicator of a healthy and expanding economy, further reinforcing positive investor sentiment.

Positive Global Sentiment and Foreign Institutional Investment (FII)

Positive global economic indicators have played a crucial role in bolstering the Indian market. The improved global sentiment has led to increased risk appetite among international investors. Significant FII inflows have been instrumental in driving the Nifty's upward momentum.

- Increased Risk Appetite: Improved global economic data has led to increased risk appetite among investors, making emerging markets like India more attractive.

- Strong Macroeconomic Fundamentals: India's relatively strong macroeconomic fundamentals, including a young and growing population and a relatively stable political environment, continue to attract significant foreign capital.

- Government Initiatives: Pro-business government initiatives aimed at attracting foreign investment have further enhanced India's appeal to foreign institutional investors.

The confidence of FIIs in India's economic outlook is clearly reflected in the substantial inflows, significantly contributing to the Nifty 50 index's growth. This influx of foreign investment fuels liquidity and boosts the overall market valuation.

Government Reforms and Policy Initiatives

Government policies and reforms have been instrumental in creating a business-friendly environment and bolstering investor confidence. Several key policy changes have directly contributed to the Nifty's surge.

- Production Linked Incentive (PLI) Scheme: This scheme has provided significant incentives to domestic manufacturers in various sectors, boosting production and contributing to economic growth.

- Infrastructure Development Projects: Massive investments in infrastructure development have improved connectivity, logistics, and overall economic efficiency, creating a positive feedback loop for economic growth.

- Tax Reforms: Simplification of tax regulations and reduction in corporate tax rates have made India a more attractive destination for both domestic and foreign investment.

These government reforms have significantly improved the ease of doing business in India, attracting both domestic and foreign investment, directly contributing to the Nifty's growth and reflecting the positive impact of well-structured government policy.

Increased Domestic Consumption and Retail Investor Participation

The rise in domestic consumption is another crucial factor driving India's economic growth and influencing the Nifty. Simultaneously, the increasing participation of retail investors in the Indian stock market has added significant momentum.

- Growth of the Middle Class: The expansion of the Indian middle class has fueled increased consumer spending, driving demand and boosting economic activity.

- Accessibility of Online Trading: The proliferation of user-friendly online trading platforms has made stock market participation more accessible to retail investors.

- Financial Literacy Initiatives: Government initiatives to promote financial literacy have encouraged more individuals to participate in the stock market.

Increased market liquidity and stability result from this heightened retail investor participation, further contributing to the Nifty 50 index's growth.

Conclusion: Sustaining the Nifty's Upward Trajectory

The Nifty 50's upward surge is a result of a confluence of positive factors: strong corporate earnings, positive global sentiment fueled by FII inflows, impactful government reforms creating an improved business environment, and increased domestic consumption bolstered by greater retail investor participation. While the outlook remains positive, potential risks and challenges, such as global economic uncertainty and geopolitical factors, must be considered. Maintaining this upward trajectory requires sustained economic reforms, continued improvements in the ease of doing business, and careful management of potential risks. Stay informed on the latest developments impacting the Nifty 50 and make informed investment decisions based on a thorough understanding of the factors driving its growth. Conduct your own thorough Nifty 50 analysis before making any investment decisions. Understanding Nifty's growth requires continuous monitoring of these key indicators. Investing in the Nifty requires careful consideration of both opportunities and potential risks.

Featured Posts

-

Five Point Plan From Canadian Auto Dealers To Combat Us Trade Threats

Apr 24, 2025

Five Point Plan From Canadian Auto Dealers To Combat Us Trade Threats

Apr 24, 2025 -

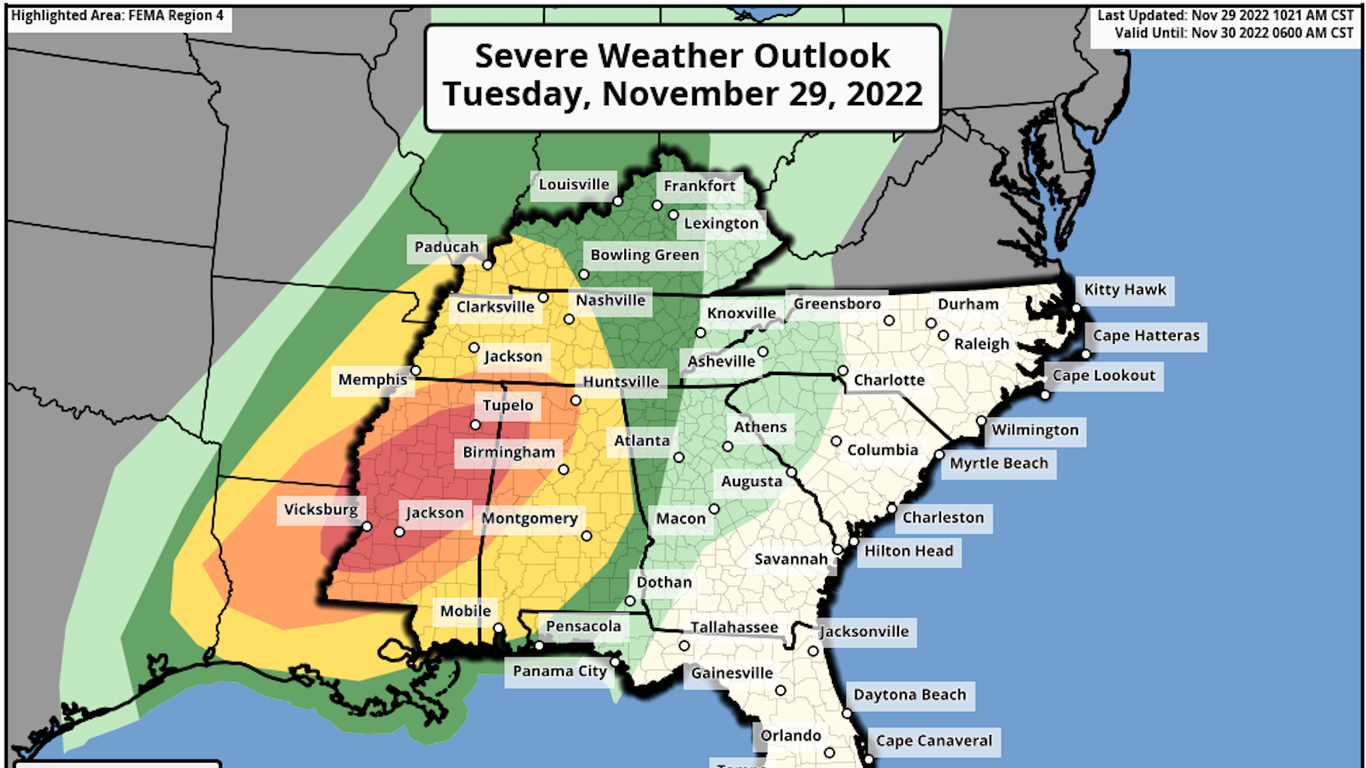

Weather Experts Sound Alarm Trump Cuts Increase Tornado Season Vulnerability

Apr 24, 2025

Weather Experts Sound Alarm Trump Cuts Increase Tornado Season Vulnerability

Apr 24, 2025 -

Are Bmw And Porsche Losing Ground In China Analyzing Market Trends

Apr 24, 2025

Are Bmw And Porsche Losing Ground In China Analyzing Market Trends

Apr 24, 2025 -

Columbia University Students Plea To Attend Sons Birth Rejected By Immigration

Apr 24, 2025

Columbia University Students Plea To Attend Sons Birth Rejected By Immigration

Apr 24, 2025 -

Canadian Auto Dealers Five Point Strategy To Navigate Us Trade Tensions

Apr 24, 2025

Canadian Auto Dealers Five Point Strategy To Navigate Us Trade Tensions

Apr 24, 2025