Nike Q3 Earnings: Jefferies Warns Of Impact On Foot Locker's Short-Term Performance

Table of Contents

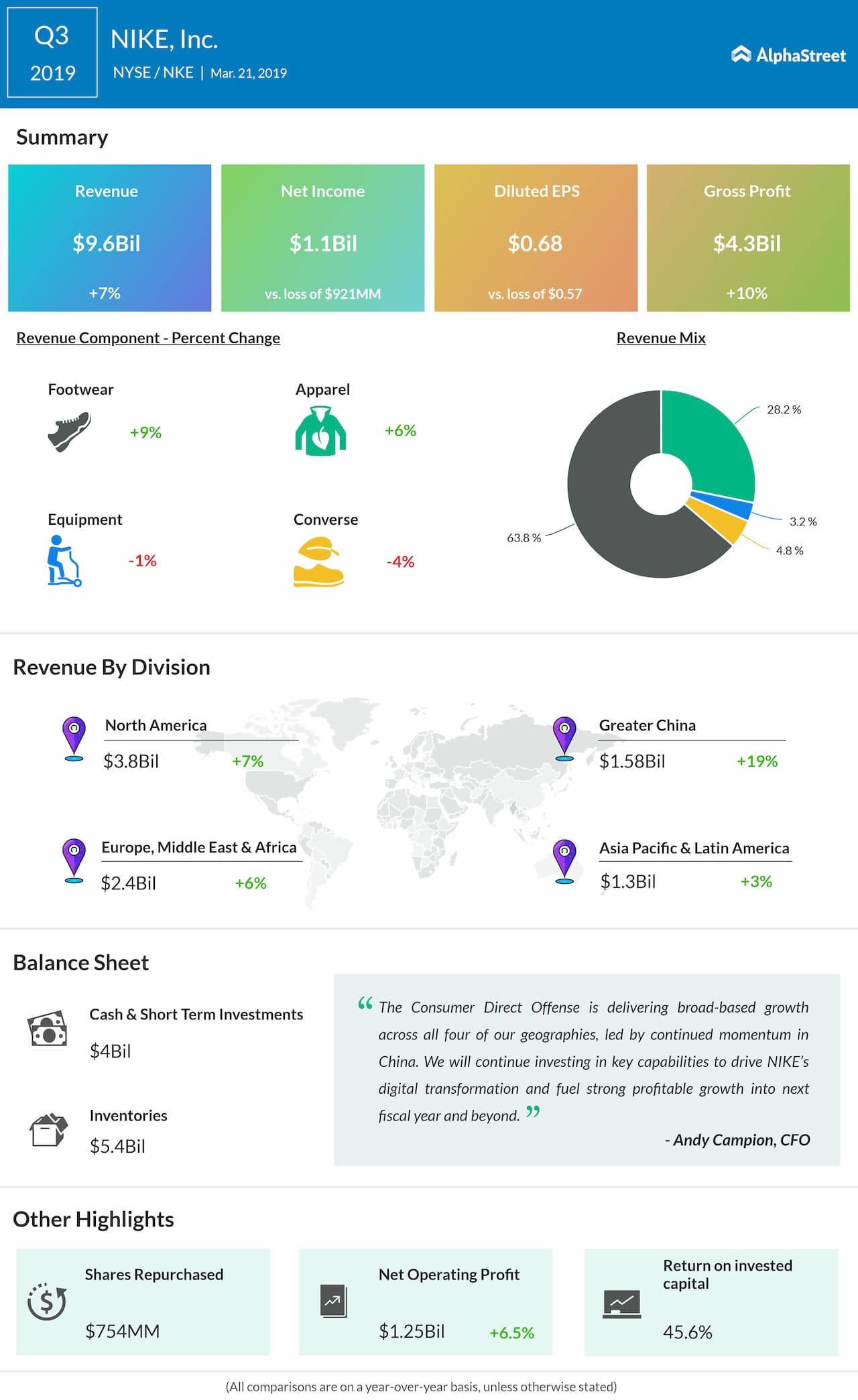

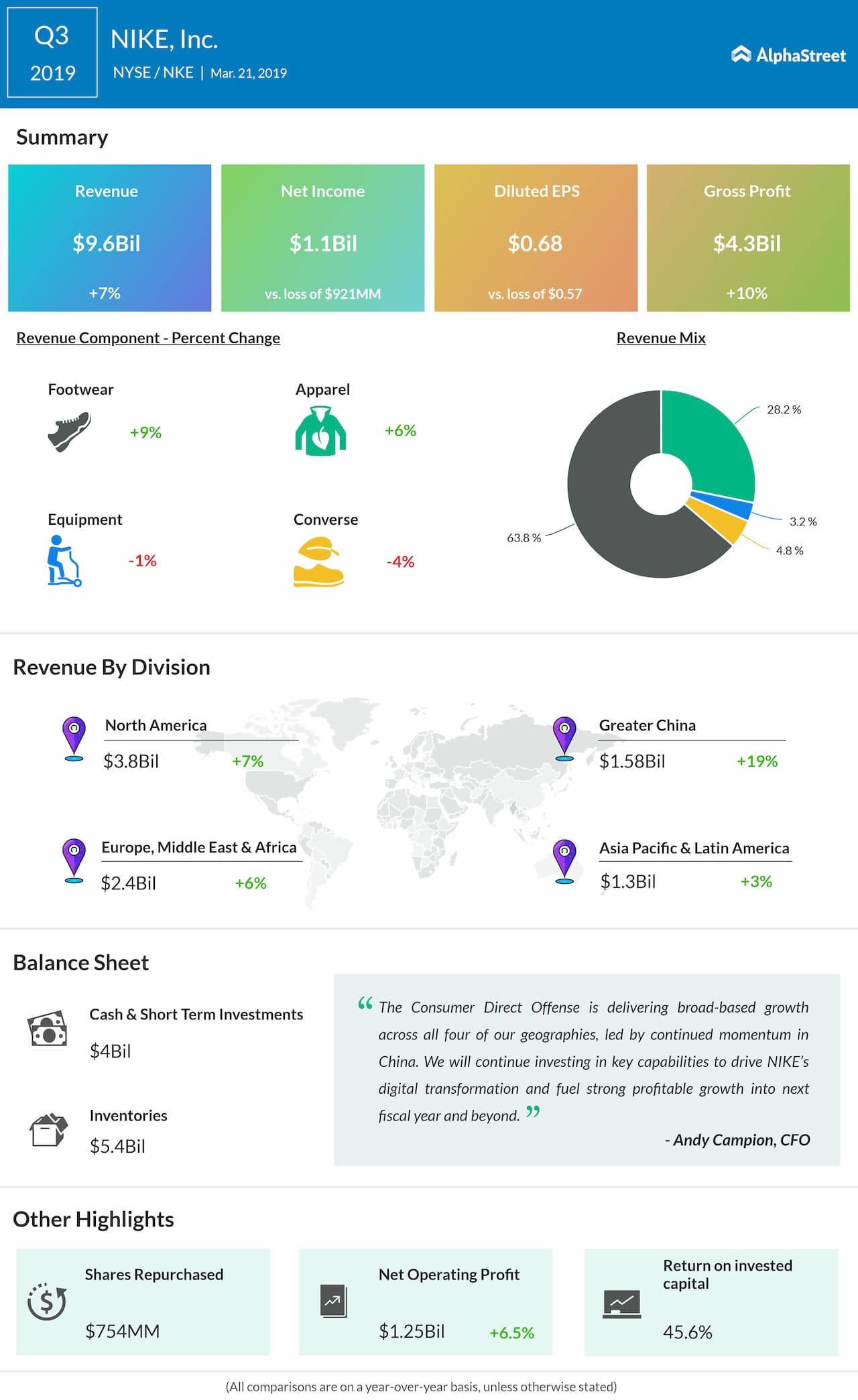

Jefferies' Concerns Regarding Nike's Q3 Results

Jefferies' analysis of Nike's Q3 results revealed several key concerns impacting the wider retail landscape, particularly for major Nike partners like Foot Locker. Their report pinpointed several factors contributing to a potentially challenging short-term outlook for Foot Locker.

-

Elevated Nike Inventory Levels: Jefferies highlighted significantly higher-than-expected inventory levels at Nike. This suggests potential overproduction and a need to aggressively move merchandise.

-

Increased Promotional Activity: To address the excess inventory, Nike is expected to increase promotional activity, including significant markdowns and sales events.

-

Margin Pressure for Retailers: This increased promotional activity will inevitably put pressure on margins for retailers like Foot Locker, who rely on maintaining healthy profit margins on Nike products. The resulting price competition could significantly impact Foot Locker's profitability.

-

Wholesale Channel Impact: A major concern for Jefferies is the impact on Foot Locker's wholesale channel, as a significant portion of their sales comes from Nike products. The discounted pricing strategies adopted by Nike directly affect Foot Locker's ability to maintain its own pricing structure.

-

Future Earnings Projections: Jefferies' analysis extends beyond the immediate impact, examining the potential effect of Nike's future earnings projections on Foot Locker's performance in subsequent quarters. The lingering effects of inventory clearance could extend beyond the short term.

Impact on Foot Locker's Short-Term Performance

Jefferies' report predicts a decline in Foot Locker's short-term sales and earnings as a direct consequence of Nike's actions. The ramifications are far-reaching and require a strategic response from Foot Locker.

-

Decline in Sales and Earnings: The increased promotional activity by Nike is projected to directly impact Foot Locker's sales figures and overall profitability in the coming quarters.

-

Pricing Strategy Adjustments: Foot Locker will likely need to adjust its pricing strategies to remain competitive, potentially further squeezing their already reduced profit margins. This delicate balancing act between maintaining competitiveness and protecting profitability is crucial for Foot Locker's survival.

-

Diversification Strategies: Foot Locker's reliance on Nike creates significant vulnerability. Their ability to successfully diversify their product offerings and mitigate the impact of Nike's strategies will determine their success.

-

Reliance on Nike Products: The report highlights Foot Locker's significant dependence on Nike products, underscoring the company's vulnerability to shifts in Nike's business strategies. This over-reliance necessitates a shift toward a more diverse product portfolio.

-

Revised Earnings Estimates: Consequently, analysts are likely to revise their earnings estimates for Foot Locker downwards, reflecting the predicted negative impact of Nike's actions.

Foot Locker's Response and Mitigation Strategies

Foot Locker's response to Jefferies' report and the subsequent market reaction will be crucial in determining its short-term performance. Their mitigation strategies will be closely watched by investors and industry analysts alike.

-

Public Statements and Response: Foot Locker's public communication regarding Jefferies' assessment and their plans to mitigate the potential negative impact will heavily influence investor sentiment.

-

Increased Focus on Other Brands: A key element of Foot Locker's response will involve enhancing its relationships with other athletic brands and expanding its product portfolio beyond its reliance on Nike.

-

Inventory Management Practices: Foot Locker will likely review and potentially adjust its inventory management practices to avoid similar vulnerabilities in the future.

-

Diversification Efforts: The success of any existing diversification efforts will be closely scrutinized. The effectiveness of strategies to reduce reliance on any single brand will be critical.

Implications for Investors and the Broader Retail Landscape

The situation presents significant implications for investors and the broader athletic retail landscape, extending beyond just Foot Locker and Nike.

-

Broader Athletic Retail Market Impact: Nike's inventory situation and its ripple effects underscore the interconnectedness and volatility within the athletic retail market. This highlights the risks involved in relying on a single dominant supplier.

-

Investor Confidence: The report's findings are likely to impact investor confidence in both Nike and Foot Locker, potentially leading to stock price fluctuations.

-

Stock Market Impact: The stock prices of both companies, along with other athletic retail stocks, could experience significant volatility in response to these developments.

-

Long-Term Adaptations: Both Nike and Foot Locker will need to adapt their long-term strategies to avoid similar situations in the future. This might involve refining inventory management, diversification, and supply chain strategies.

Conclusion:

Jefferies' warning regarding the impact of Nike Q3 earnings on Foot Locker's short-term performance underscores the interconnectedness of major players in the athletic retail sector. Foot Locker's reliance on Nike products creates vulnerability to fluctuations in Nike's inventory and sales strategies. Investors should carefully consider the implications of this report when making decisions regarding Foot Locker stock and other related investments. Understanding the dynamics of Nike Q3 earnings and their ripple effect on the retail landscape is crucial for informed investment decisions. Stay informed about future developments regarding Nike Q3 earnings and their impact on Foot Locker's performance.

Featured Posts

-

Mistrovstvi Sveta V Hokeji Svedska Nhl Dominance Vs Nemecka Skromnost

May 16, 2025

Mistrovstvi Sveta V Hokeji Svedska Nhl Dominance Vs Nemecka Skromnost

May 16, 2025 -

En Directo Crystal Palace Nottingham Forest

May 16, 2025

En Directo Crystal Palace Nottingham Forest

May 16, 2025 -

Foot Locker Anticipating Future Leadership Shifts

May 16, 2025

Foot Locker Anticipating Future Leadership Shifts

May 16, 2025 -

Tam Krwz Awr Ayk Mdah Ka Ghyr Memwly Waqeh Jwte Pr Pawn

May 16, 2025

Tam Krwz Awr Ayk Mdah Ka Ghyr Memwly Waqeh Jwte Pr Pawn

May 16, 2025 -

Tampa Bay Rays Sweep Padres Game Highlights And Analysis From Real Radio 104 1

May 16, 2025

Tampa Bay Rays Sweep Padres Game Highlights And Analysis From Real Radio 104 1

May 16, 2025