Nike Q3 Results: Jefferies Predicts Impact On Foot Locker's Near-Term Performance

Table of Contents

Nike's Q3 Results: Key Takeaways and Concerns

Nike's Q3 results revealed some significant challenges that could have a ripple effect throughout the athletic footwear retail landscape. These challenges, highlighted by Jefferies, are primarily focused on inventory levels and strategic shifts.

Elevated Inventory Levels at Nike

Nike reported higher-than-expected inventory levels at the end of Q3. This surplus of athletic footwear and apparel presents several concerns:

- Discounted Pricing: High inventory levels often necessitate discounted pricing to clear shelves. This directly impacts Nike's profitability and, crucially, reduces wholesale margins for retailers like Foot Locker who rely on purchasing inventory at a certain price point.

- Erosion of Brand Value: Increased promotional activity, a common consequence of excess inventory, can dilute the perceived value of Nike products, potentially affecting long-term brand loyalty.

- Impact on Specific Product Lines: The excess inventory likely isn't evenly distributed across all Nike product lines. Certain categories might experience more significant price reductions than others, impacting the overall sales mix for Foot Locker and their ability to maintain profitable margins. Analysis of Nike's specific product categories with excess inventory will be key in determining the long-term impact.

Changing Nike Sales Strategies

Nike's increasing focus on its direct-to-consumer (DTC) strategy poses further challenges for wholesale partners.

- Reduced Wholesale Supply: As Nike prioritizes its own stores and website, the supply of products available to wholesalers like Foot Locker might decrease. This limits Foot Locker's ability to meet consumer demand and impacts their sales potential.

- Impact of Nike's Loyalty Programs and Exclusive Releases: Nike's growing loyalty programs and exclusive product drops further strengthen their DTC channel, diverting sales away from traditional retail partners like Foot Locker.

- Growth of Nike's DTC Revenue: Nike's Q3 results likely showcased a continued increase in DTC revenue, further emphasizing the shift away from the wholesale model and highlighting the competitive pressures on retailers.

Overall Market Conditions Affecting Athletic Footwear

Beyond Nike's internal strategies, broader economic factors also influence the athletic footwear market.

- Inflation's Impact on Consumer Spending: Rising inflation reduces consumer disposable income, potentially impacting demand for discretionary purchases like athletic footwear.

- Shifting Consumer Preferences: Changes in fashion trends and consumer preferences could also affect demand for specific Nike products, adding further uncertainty to Foot Locker's sales forecast.

- Competition from Other Athletic Brands: Competition from other major athletic brands further complicates the market landscape, making it challenging for Foot Locker to maintain its market share.

- Overall Market Growth or Decline: The overall growth or contraction of the athletic footwear market directly impacts Foot Locker's potential for success.

Jefferies' Predictions for Foot Locker's Near-Term Performance

Jefferies' analysis of Nike's Q3 results directly translates to specific predictions about Foot Locker's near-term performance.

Specific Projections from Jefferies' Report

Jefferies' report likely includes concrete financial projections for Foot Locker, encompassing:

- Projected Sales Figures: A decrease in sales is highly probable given the anticipated reduced supply of Nike products and potential impact on consumer spending.

- Expected Profit Margins: Reduced wholesale margins from Nike, coupled with potential discounting pressure, will likely result in lower profit margins for Foot Locker.

- Potential Impact on Foot Locker's Stock Price: Negative financial projections almost certainly lead to a negative impact on Foot Locker's stock price.

- Jefferies' Rationale and Supporting Data: Jefferies’ report should detail the specific data points and reasoning behind its predictions, providing a comprehensive analysis for investors.

Risks and Uncertainties

While Jefferies' forecast presents a concerning outlook, several uncertainties could affect the final outcome:

- Unforeseen Changes in Consumer Demand: Unexpected shifts in consumer preferences could positively or negatively impact Foot Locker's performance.

- Successful Marketing Campaigns by Foot Locker: Effective marketing campaigns could mitigate some of the negative impacts by driving sales and brand loyalty.

- Successful Inventory Management by Foot Locker: Foot Locker's ability to effectively manage its own inventory will be crucial in navigating the challenges posed by Nike's surplus.

- External Economic Factors: Unforeseen economic events could further impact consumer spending and market conditions.

Foot Locker's Response and Mitigation Strategies

Foot Locker will need to actively respond to the potential challenges outlined by Jefferies. Their response may involve:

- Changes in Foot Locker's Purchasing Strategies: Diversifying their supplier base to reduce reliance on Nike could be a crucial strategy.

- Diversification Efforts: Expanding their product portfolio beyond Nike to offer a wider range of athletic footwear and apparel brands will cushion them from potential Nike supply reductions.

- New Marketing Campaigns and Loyalty Programs: Creating compelling marketing campaigns and loyalty programs can drive sales and foster customer retention.

- Foot Locker's Own Financial Forecasts and Targets: Foot Locker will need to adapt their own financial forecasts and targets to reflect the potential challenges outlined by Jefferies’ analysis.

Conclusion

Nike's Q3 results, as analyzed by Jefferies, indicate potential significant short-term challenges for Foot Locker. The combination of elevated Nike inventory levels, changing sales strategies, and broader economic factors creates a challenging environment for the retailer. The potential reduction in Nike supply, coupled with the need for potential discounting, could severely impact Foot Locker's profit margins and overall financial performance. Jefferies' predictions underscore the importance of monitoring the evolving relationship between Nike and its wholesale partners.

Call to Action: Stay informed about the ongoing developments in the athletic footwear industry and the relationship between Nike and Foot Locker. Follow this blog for updates on Nike Q3 results and their impact on retail partners. Continue researching the effects of Nike's changes on the performance of other retailers in the sector. Understanding the impact of Nike Q3 results is crucial for navigating the complexities of the athletic footwear market.

Featured Posts

-

Predicting The Giants Vs Padres Game Padres Win Or One Run Difference

May 15, 2025

Predicting The Giants Vs Padres Game Padres Win Or One Run Difference

May 15, 2025 -

La Decentralisation Du Repechage De La Lnh Un Regret

May 15, 2025

La Decentralisation Du Repechage De La Lnh Un Regret

May 15, 2025 -

Tuerk Devletlerinin Kktc Karari 12 Milyon Avroluk Destegin Ayrintilari

May 15, 2025

Tuerk Devletlerinin Kktc Karari 12 Milyon Avroluk Destegin Ayrintilari

May 15, 2025 -

Post Export Ban How Congos Cobalt Quota Plan Will Reshape The Global Market

May 15, 2025

Post Export Ban How Congos Cobalt Quota Plan Will Reshape The Global Market

May 15, 2025 -

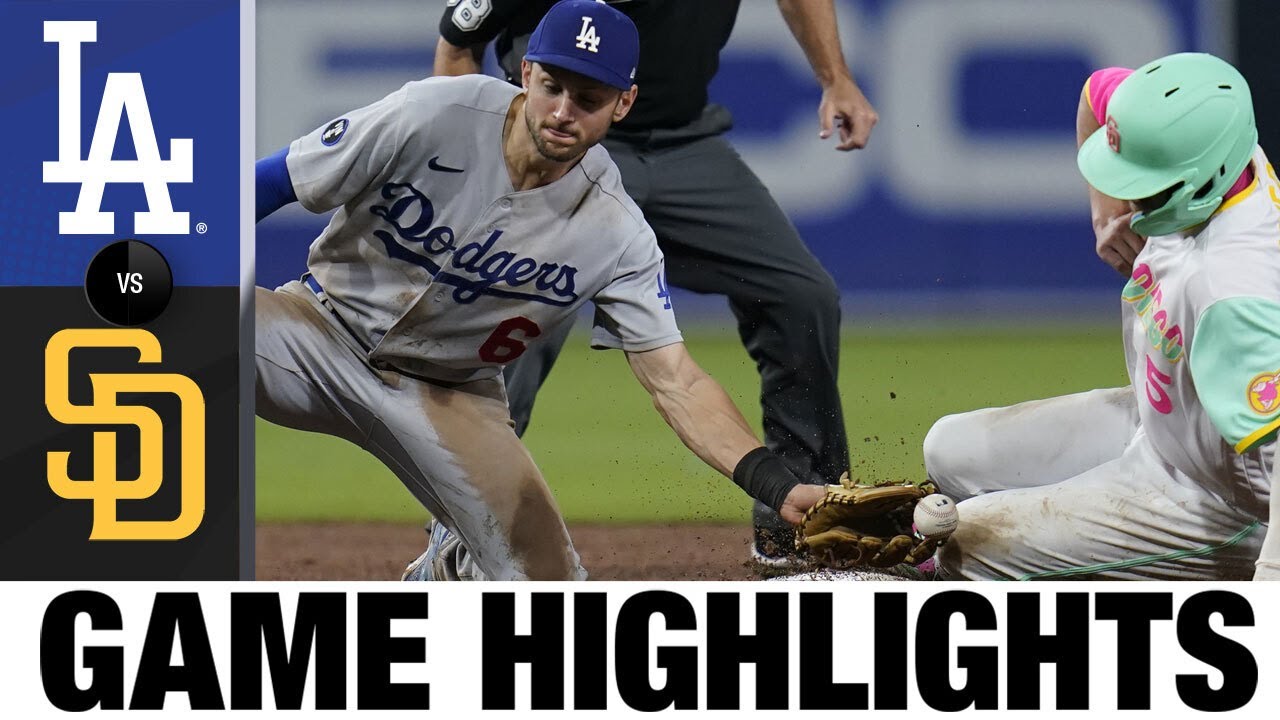

Padres Defiance A Major Obstacle To Dodgers Success

May 15, 2025

Padres Defiance A Major Obstacle To Dodgers Success

May 15, 2025