Norwegian Cruise Line Holdings Ltd. (NCLH): Earnings Beat Fuels Stock Surge

Table of Contents

NCLH Q[Quarter] Earnings Report: A Deep Dive

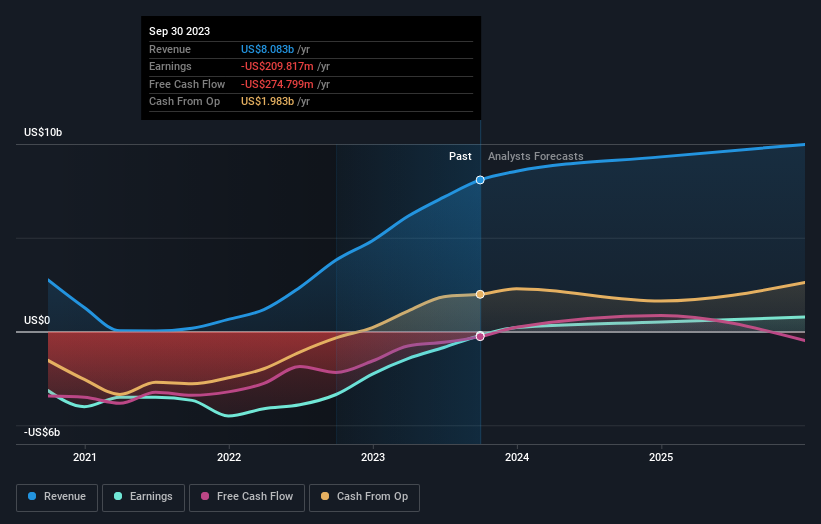

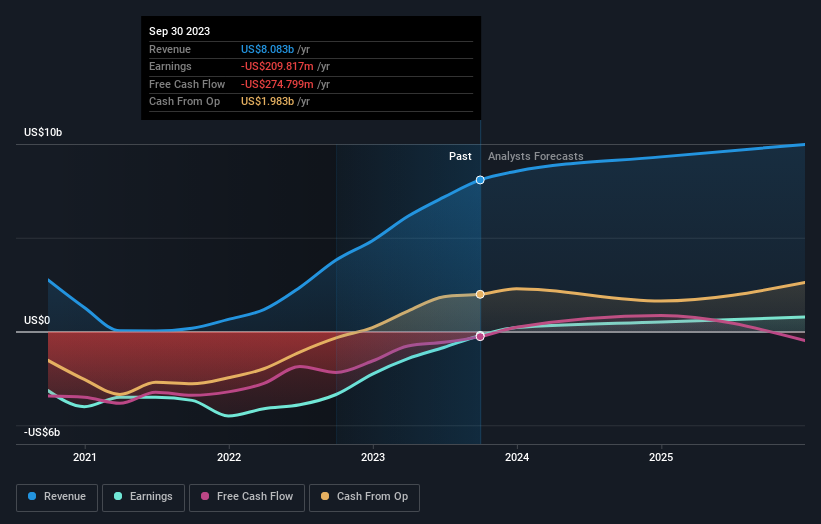

The recently released NCLH Q[Quarter] earnings report showcased impressive financial results, significantly surpassing analyst predictions and the previous quarter's performance. This robust performance provides a strong foundation for future growth and investor confidence in Norwegian Cruise Line Holdings Ltd. (NCLH) stock.

Revenue Exceeded Expectations

NCLH's revenue for Q[Quarter] [Year] reached $[Revenue Figure], significantly exceeding the anticipated $[Analyst Prediction] and the previous quarter's $[Previous Quarter Revenue]. This impressive growth can be attributed to several key factors:

- Strong Booking Trends: A surge in cruise bookings, fueled by pent-up demand and attractive pricing strategies, significantly boosted revenue.

- Increased Onboard Spending: Passengers spent more on onboard activities and amenities, contributing to higher-than-expected revenue streams.

- Successful Pricing Strategies: Strategic pricing adjustments and targeted promotions effectively maximized revenue generation.

- Strong International Bookings: Significant growth in international passenger bookings contributed to the overall revenue increase.

Profitability Surprises

The Q[Quarter] earnings report revealed a net income of $[Net Income Figure] and earnings per share (EPS) of $[EPS Figure], exceeding both analyst forecasts and the previous quarter's performance. Key profitability metrics that contributed to this success include:

- Improved Occupancy Rates: Higher occupancy rates across the NCLH fleet contributed to increased profitability.

- Effective Cost Management: Stringent cost-control measures resulted in significant savings and improved profit margins.

- Fuel Efficiency Improvements: Investments in fuel-efficient technologies reduced operational expenses.

Guidance for Future Quarters

NCLH's outlook for the coming quarters remains positive, with the company projecting continued growth driven by:

- Sustained Booking Momentum: The company anticipates strong booking trends to continue throughout [Year].

- New Itinerary Launches: The introduction of exciting new itineraries is expected to attract new passengers and boost demand.

- Fleet Modernization: Ongoing fleet modernization initiatives will enhance the passenger experience and increase operational efficiency.

However, potential challenges remain:

- Global Economic Uncertainty: Global economic fluctuations could impact consumer spending and demand for cruises.

- Fuel Price Volatility: Fluctuations in fuel prices could affect operational costs.

- Geopolitical Risks: Unforeseen geopolitical events could disrupt cruise operations.

Market Reaction to NCLH Earnings

The market reacted positively to NCLH's strong earnings report, resulting in a significant surge in the NCLH stock price.

Stock Price Surge

Immediately following the release of the earnings report, the NCLH stock price increased by [Percentage]% to $[Stock Price]. Trading volume also saw a significant increase, indicating strong investor interest. This surge reflects positive investor sentiment and confidence in the company's future performance. Long-term implications are positive given the company's strong financial footing. Short-term price fluctuations are expected, based on general market behavior.

Analyst Upgrades and Ratings

Several financial analysts upgraded their ratings and price targets for NCLH stock following the positive earnings report. [Analyst Name] increased their price target from $[Previous Price Target] to $[New Price Target], citing the company's strong performance and positive outlook. The overall consensus among analysts is largely positive, reflecting confidence in NCLH's future growth prospects.

Factors Contributing to NCLH's Strong Performance

NCLH's impressive performance is a result of a combination of factors, including resurgent demand, efficient cost management, and strategic initiatives.

Increased Demand for Cruises

The cruise industry is experiencing a significant rebound following the pandemic, with a substantial increase in demand for cruise vacations. This is evidenced by:

- Increased Passenger Numbers: Passenger numbers have significantly increased compared to pre-pandemic levels.

- Strong Advance Bookings: Advance bookings for future cruises indicate continued strong demand.

- Shifting Demographics: A broader range of demographics are now embracing cruise vacations.

Effective Cost Management

NCLH has implemented several effective cost-management strategies that have contributed to improved profitability. These include:

- Crew Optimization: Streamlined crew scheduling and training programs reduced labor costs.

- Fuel Efficiency Initiatives: Investments in fuel-efficient technologies lowered fuel expenses.

- Supply Chain Management: Improved supply chain management reduced procurement costs.

Strategic Initiatives

NCLH has undertaken several strategic initiatives that have positively impacted its performance. These include:

- Fleet Modernization: Upgrades to the NCLH fleet have enhanced the passenger experience and improved operational efficiency.

- New Itineraries: The introduction of exciting new itineraries has attracted new passengers and increased bookings.

- Partnerships and Alliances: Strategic partnerships have expanded market reach and access to new customer segments.

Conclusion

Norwegian Cruise Line Holdings Ltd. (NCLH) has delivered a strong earnings beat, significantly exceeding expectations and fueling a substantial surge in its stock price. This impressive performance is driven by a combination of factors, including resurgent demand for cruises, effective cost management, and strategic initiatives. While future performance is subject to market conditions and unforeseen circumstances, the recent results present a positive outlook for NCLH investors. Investors interested in the cruise sector and the NCLH stock should conduct thorough research and consider the potential risks before making investment decisions. Stay informed about future developments regarding Norwegian Cruise Line Holdings Ltd. (NCLH) stock for a comprehensive understanding of its future performance.

Featured Posts

-

Clase Nacional De Boxeo En El Zocalo Fotos Y Cronica Del Evento

Apr 30, 2025

Clase Nacional De Boxeo En El Zocalo Fotos Y Cronica Del Evento

Apr 30, 2025 -

Papal Funeral Seating Plan Challenges And Considerations

Apr 30, 2025

Papal Funeral Seating Plan Challenges And Considerations

Apr 30, 2025 -

Spd Navigates Youth Unrest In German Coalition Negotiations

Apr 30, 2025

Spd Navigates Youth Unrest In German Coalition Negotiations

Apr 30, 2025 -

Louisville Congressman Accuses Usps Of Lack Of Transparency On Mail Delays

Apr 30, 2025

Louisville Congressman Accuses Usps Of Lack Of Transparency On Mail Delays

Apr 30, 2025 -

Lich Thi Dau Cac Tran Chung Ket Thaco Cup 2025 Tat Ca Thong Tin Ban Can Biet

Apr 30, 2025

Lich Thi Dau Cac Tran Chung Ket Thaco Cup 2025 Tat Ca Thong Tin Ban Can Biet

Apr 30, 2025