Norwegian Cruise Line (NCLH): Earnings Surprise And Positive Outlook Drive Stock Growth

Table of Contents

<p>Norwegian Cruise Line Holdings Ltd. (NCLH) recently reported earnings, surprising analysts and investors with positive results. This unexpected surge in profitability, coupled with a promising outlook for the cruise industry's recovery, has significantly impacted NCLH stock. This article delves into the key factors driving this positive momentum and explores the implications for future investment in Norwegian Cruise Line (NCLH) stock.</p>

<h2>NCLH Earnings Surprise: Exceeding Expectations</h2>

<h3>Key Financial Highlights:</h3>

- Revenue Exceeded Projections: NCLH reported revenue significantly higher than analyst predictions, demonstrating a strong rebound in demand for cruises. For example, Q[Quarter] [Year] revenue was $[Amount], exceeding the projected $[Amount] by $[Amount] – a [Percentage]% increase.

- Improved Occupancy Rates: Occupancy rates climbed to [Percentage]%, a considerable improvement from [Percentage]% in the previous quarter, indicating strong consumer confidence in cruising.

- Reduced Operating Costs: The company successfully reduced operating costs by [Percentage]%, showcasing efficient cost management strategies that boosted profitability. This was achieved through [Specific cost-saving measures, e.g., optimized fuel consumption, streamlined operations].

- Strong Performance Across Segments: The positive results were not limited to a single area; both premium and contemporary brands experienced significant growth, driven by [Specific examples, e.g., high demand for Alaska cruises, strong bookings on newer ship classes].

<h3>Factors Contributing to the Positive Surprise:</h3>

- Pent-up Demand for Travel: The post-pandemic surge in travel demand significantly boosted NCLH's bookings. Consumers, eager to experience vacations after restrictions, flocked to cruise options.

- Effective Marketing Campaigns: Targeted marketing initiatives successfully attracted new and returning customers. These campaigns highlighted [Specific marketing strategies, e.g., value propositions, flexible booking options, enhanced onboard experiences].

- Successful Cost Management: NCLH's proactive approach to cost reduction played a crucial role in improving profit margins. This involved [Specific examples, e.g., negotiating better deals with suppliers, implementing operational efficiencies].

- Strategic Initiatives: The launch of new ships and innovative onboard amenities contributed to increased passenger satisfaction and repeat bookings. The success of [Specific initiatives, e.g., new ship launches, partnerships with entertainment companies] also boosted revenue.

<h2>Positive Outlook for NCLH and the Cruise Industry</h2>

<h3>Booking Trends and Future Demand:</h3>

- Strong Forward Bookings: Forward bookings for the remainder of [Year] and into [Year] are significantly ahead of previous years, indicating sustained consumer interest in cruises. Bookings are particularly strong for [Specific itineraries or destinations].

- Projected Occupancy Rates: Analysts predict occupancy rates to remain high, averaging around [Percentage]% for the next few quarters. This positive trend reinforces the strong demand for NCLH's services.

- Emerging Travel Trends: NCLH is proactively adapting to emerging travel trends, such as sustainable cruising and immersive experiences, further enhancing its appeal to a broader customer base.

<h3>Industry Recovery and Growth Potential:</h3>

- Industry-Wide Recovery: The cruise industry is experiencing a robust recovery, with many companies reporting improved financial performance. NCLH's strong position within this recovering market provides a positive outlook.

- Addressing Challenges: While challenges like fuel costs and inflation exist, NCLH is implementing strategies to mitigate their impact. These strategies include [Specific examples, e.g., fuel hedging, price adjustments, operational efficiencies].

- Long-Term Growth Potential: The long-term outlook for the cruise industry remains positive, driven by increasing disposable incomes, growing demand for leisure travel, and the appeal of cruise vacations. This bodes well for NCLH's future growth and stock performance.

<h2>Impact on NCLH Stock Price and Investment Implications</h2>

<h3>Stock Price Performance Post-Earnings:</h3>

- Immediate Reaction: Following the earnings announcement, the NCLH stock price saw a [Percentage]% increase, reflecting investor confidence in the company's positive results.

- Post-Announcement Performance: In the weeks following the announcement, the stock price has continued to show [positive/negative] momentum, trading at $[Price] as of [Date]. [Include a chart or graph illustrating the stock price movement].

- Market Sentiment: The market's reaction to NCLH's earnings suggests a positive shift in investor sentiment towards the company and the broader cruise industry.

<h3>Analyst Ratings and Future Predictions:</h3>

- Upgraded Ratings: Several analysts have upgraded their ratings on NCLH stock following the earnings announcement, citing the positive financial results and promising outlook.

- Price Targets: The average price target for NCLH stock is now $[Price], indicating a further potential upside for investors.

- Positive Investor Sentiment: The overall investor sentiment towards NCLH stock is positive, with many analysts predicting continued growth in the coming quarters.

<h2>Conclusion</h2>

<p>NCLH's recent earnings surprise, driven by strong bookings, effective cost management, and a robust industry recovery, has significantly boosted investor confidence. The positive outlook for the cruise industry, coupled with NCLH's strategic initiatives, makes it a compelling investment opportunity. The company's strong financial performance and positive forward guidance suggest continued growth potential. </p>

<p>Considering the positive earnings surprise and the bright outlook for the cruise industry, Norwegian Cruise Line (NCLH) stock presents a compelling investment opportunity. Conduct thorough research and consult with a financial advisor before making any investment decisions related to NCLH stock or any other investment.</p>

Featured Posts

-

Cbc Projects Poilievres Election Loss Conservative Leaders Seat In Jeopardy

Apr 30, 2025

Cbc Projects Poilievres Election Loss Conservative Leaders Seat In Jeopardy

Apr 30, 2025 -

Derrick White Leads Celtics To Victory Over Cavaliers 4 Crucial Takeaways

Apr 30, 2025

Derrick White Leads Celtics To Victory Over Cavaliers 4 Crucial Takeaways

Apr 30, 2025 -

Vymershie Giganty Izuchenie Vorombe Samykh Krupnykh Ptits V Istorii

Apr 30, 2025

Vymershie Giganty Izuchenie Vorombe Samykh Krupnykh Ptits V Istorii

Apr 30, 2025 -

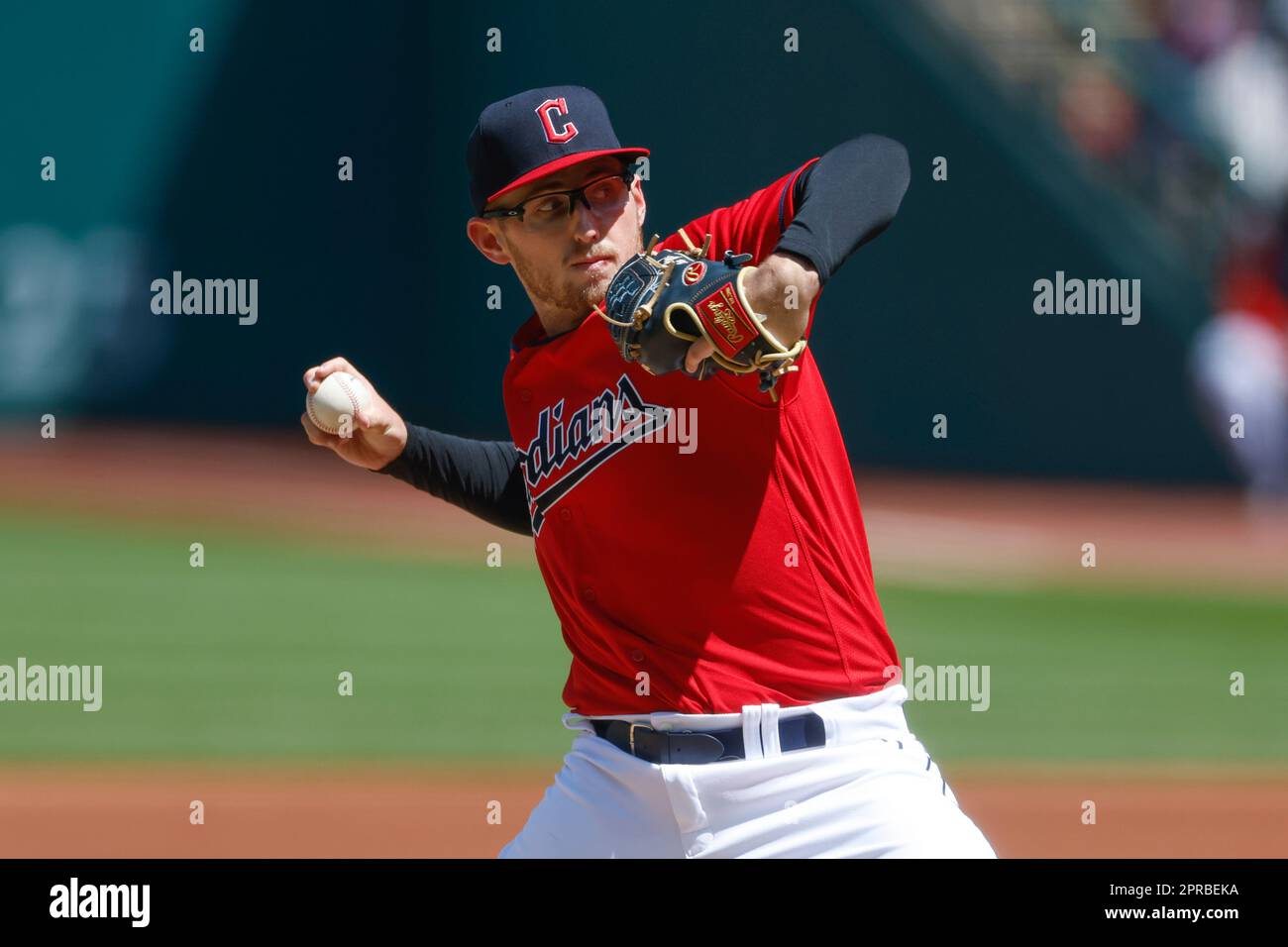

Yankees Fall To Guardians Judges Power Not Enough Against Bibees Resilience

Apr 30, 2025

Yankees Fall To Guardians Judges Power Not Enough Against Bibees Resilience

Apr 30, 2025 -

Eptk 2025

Apr 30, 2025

Eptk 2025

Apr 30, 2025