Oil Price Analysis: A Deep Dive Into May 16th's Market

Table of Contents

Global Supply and Demand Dynamics on May 16th

Understanding the forces of supply and demand is critical for any effective oil market analysis. On May 16th, several factors played a pivotal role in shaping crude oil prices.

OPEC+ Production Decisions and their Impact

OPEC+ (the Organization of the Petroleum Exporting Countries and its allies) meetings significantly influence global oil supply.

- Meeting Outcome: (Insert details of the OPEC+ meeting held around May 16th, 2024 – e.g., production quotas maintained, slight increase, unexpected cuts). This decision directly impacted the available supply of crude oil in the market.

- Country-Specific Production Quotas: (Specify production quotas for key players like Saudi Arabia, Russia, etc. and any changes announced). Variations in these quotas directly affected the overall supply and consequently impacted the crude oil price.

- Production Disruptions: (Mention any unexpected disruptions such as refinery outages, pipeline issues, or geopolitical instability in producing regions that may have tightened supply on May 16th). These unforeseen events can significantly shift the oil market analysis.

Global Oil Demand and Economic Indicators

Global oil demand is intrinsically linked to economic growth.

- Economic Growth Forecasts: (Mention any economic forecasts released around May 16th, focusing on key economies like the US, China, and the EU. Were there positive or negative revisions impacting demand projections?) Positive forecasts generally boost oil consumption and increase demand.

- Demand Shifts in Major Consuming Regions: (Analyze the demand trends in major consuming regions. Did any region show a significant increase or decrease in oil consumption around May 16th? This could include information on transportation fuel consumption, industrial activity, and other factors.) Shifts in consumption patterns can heavily influence price movements.

- Relevant Economic Reports: (Cite any significant economic reports – e.g., PMI data, GDP growth figures – released near May 16th that impacted market sentiment and oil demand.) Market reactions to these reports are an important factor in oil price analysis.

Geopolitical Factors Influencing Oil Prices on May 16th

Geopolitical events are major drivers of oil price volatility. Analyzing the political landscape is crucial for effective oil price analysis.

Geopolitical Tensions and their Effect on Oil Markets

- Ongoing Conflicts and Tensions: (Discuss any ongoing conflicts or tensions in oil-producing regions impacting supply routes or production – e.g., sanctions on specific countries, threats to major pipelines, political instability). These risks can lead to price spikes and uncertainty in the oil market.

- Sanctions and Trade Disputes: (Analyze the impact of any new sanctions or trade disputes that may have influenced oil trade flows or disrupted supply chains on May 16th.) These factors play a significant role in short-term oil price fluctuations.

- Specific Geopolitical Events: (Mention specific geopolitical events relevant to the May 16th oil market. Link these events to price changes with relevant data.) A comprehensive oil market analysis needs to consider these events.

Political Stability in Major Oil-Producing Countries

The political climate in major oil-producing nations significantly affects oil supply and price.

- Impact of Stability/Instability: (Discuss how political stability (or instability) in key oil-producing countries impacted the market on May 16th.) Instability often leads to higher oil prices due to supply concerns.

- Relevant Political Developments: (Mention any significant political developments in major oil-producing countries around May 16th that might have affected oil prices.) These developments need to be considered in any thorough oil price analysis.

The Role of the US Dollar and Currency Exchange Rates

The US dollar's strength significantly impacts oil prices, as oil is primarily traded in US dollars.

Dollar Strength and its Correlation with Oil Prices

- Inverse Relationship: (Explain the inverse relationship between the US dollar and oil prices – a stronger dollar generally leads to lower oil prices, and vice-versa.) This is a crucial factor in oil market analysis.

- Dollar Strength on May 16th: (Analyze the strength of the US dollar on May 16th and its correlation with oil price movements. Include relevant data points to support your analysis.) This data provides crucial insight for understanding the price movements on the specified date.

Impact of Other Major Currencies on Oil Pricing

While the US dollar is dominant, other major currencies influence oil pricing.

- Influence of Euro and Chinese Yuan: (Discuss the influence of the Euro and Chinese Yuan, along with other major currencies, on oil trading and pricing. How did their movement against the dollar potentially affect oil prices on May 16th?) These currencies' movements relative to the dollar can also contribute to price volatility.

Speculative Trading and Market Sentiment

Speculative trading and overall market sentiment play a significant role in shaping oil prices.

Impact of Investor Sentiment on Oil Prices

- Bullish or Bearish Sentiment: (Analyze the prevailing market sentiment towards oil on May 16th – were investors generally bullish (expecting price increases) or bearish (expecting price decreases)? Include evidence like price charts or news reports.) Sentiment significantly affects trading decisions.

- Role of Futures and Options: (Discuss how futures contracts and options trading contributed to price volatility on May 16th.) Speculative trading in these instruments can amplify price swings.

Major News Events and Market Reactions

Unexpected news events can dramatically impact market sentiment and oil prices.

- Impact of News Events: (Analyze the impact of any significant news events on May 16th – economic data releases, geopolitical developments, or company announcements – that affected oil market sentiment and prices.) These events are key factors in short-term volatility.

Conclusion: Key Takeaways and Call to Action

Our oil price analysis of May 16th reveals that oil prices are shaped by a complex interplay of global supply and demand dynamics, geopolitical factors, currency fluctuations, and market sentiment. Understanding these factors is crucial for investors and businesses operating in energy-related sectors. OPEC+ production decisions, economic growth forecasts, geopolitical tensions, the strength of the US dollar, and investor sentiment all played a significant role in determining the crude oil price on that day. To stay ahead of the curve, consistent monitoring of these factors is essential.

Stay informed about daily oil price movements – subscribe to our newsletter for daily oil price analysis and insights! Further resources on oil market analysis can be found at [link to relevant resources].

Featured Posts

-

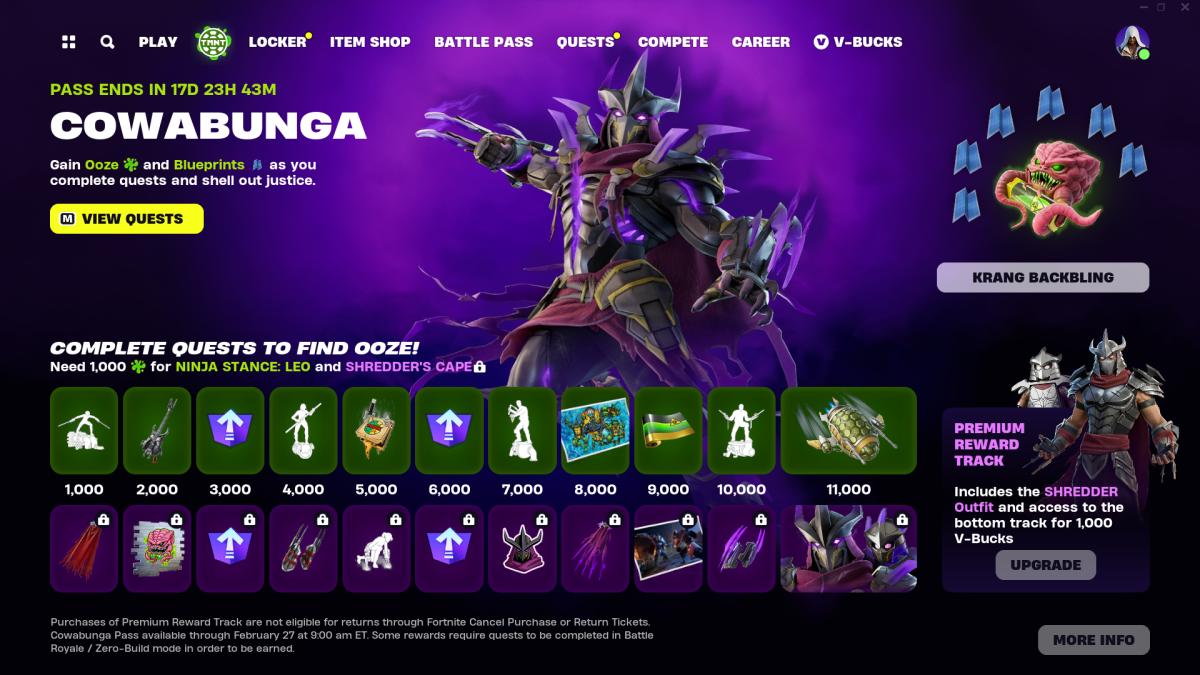

Unlocking Every Fortnite Tmnt Skin Locations Challenges And More

May 17, 2025

Unlocking Every Fortnite Tmnt Skin Locations Challenges And More

May 17, 2025 -

Fortnite Item Shop Skins That Are Likely Gone Forever

May 17, 2025

Fortnite Item Shop Skins That Are Likely Gone Forever

May 17, 2025 -

No Doctor Who Christmas Special This Year

May 17, 2025

No Doctor Who Christmas Special This Year

May 17, 2025 -

Jalen Brunsons Reported Discontent Could Mean Missing Next Weeks Raw

May 17, 2025

Jalen Brunsons Reported Discontent Could Mean Missing Next Weeks Raw

May 17, 2025 -

Knicks 105 91 Win Over 76ers Anunobys 27 Point Performance Fuels Victory

May 17, 2025

Knicks 105 91 Win Over 76ers Anunobys 27 Point Performance Fuels Victory

May 17, 2025