Onex Fully Recoups WestJet Investment With 25% Stake Sale

Table of Contents

Details of the Onex WestJet Investment Sale

The sale involved Onex divesting its 25% stake in WestJet, marking a complete exit from its investment in the Canadian airline. While the buyer and exact sale price haven't been publicly disclosed, industry analysts estimate the transaction to be worth billions of dollars, resulting in a substantial return on investment for Onex. Onex's involvement with WestJet spanned several years, during which they actively participated in the airline's strategic direction and operational improvements.

Key Figures (Estimates based on industry reporting):

- Date of the sale: [Insert Date if available, otherwise use "Recently"]

- Name of the buyer: [Insert Buyer's Name if available, otherwise use "Undisclosed"]

- Exact percentage of stake sold: 25%

- Total sale price: [Insert Estimated Sale Price if available, otherwise use "Billions of Dollars (estimated)"]

- Onex's initial investment amount: [Insert Initial Investment Amount if available]

- Calculated ROI for Onex: [Insert Calculated ROI if available, otherwise use "Complete recoupment and substantial profit (estimated)"]

The successful sale significantly impacts Onex's portfolio, demonstrating the firm's ability to identify and capitalize on opportunities within the airline industry. This successful exit strengthens Onex's reputation and may influence its future investment decisions in similar sectors. It also signals potential for further private equity activity in the airline space.

WestJet's Current Financial Performance and Market Position

WestJet's recent financial performance has been a key factor contributing to the attractiveness of this investment. While specific numbers fluctuate, WestJet has generally shown [Insert description of recent financial performance – e.g., "strong revenue growth," "improved profitability," or "market share gains"]. This positive trajectory, coupled with its position in the Canadian market, made it a desirable asset.

WestJet's primary competitor is Air Canada, but it also faces challenges from smaller regional airlines and international carriers operating within Canada and North America. WestJet's competitive strategy involves [Insert WestJet's key competitive strategies – e.g., "focus on low-cost carriers," "expansion of international routes," or "emphasis on customer service"].

Key Indicators and Market Dynamics:

- WestJet's key financial indicators (revenue, profit, etc.): [Insert data if available]

- WestJet's market share in Canada and North America: [Insert data if available]

- Key competitors and their market share: Air Canada (dominant market share), [Other relevant competitors]

- Relevant industry trends affecting WestJet's performance: [Mention relevant industry trends like fuel prices, travel demand, and economic conditions]

Strategic Implications for Onex and Future Investment Strategies

The successful Onex WestJet investment highlights the potential for strong returns in the airline industry, despite its inherent volatility. This successful exit will likely inform Onex's future investment strategies, possibly leading to a more aggressive approach to airline-related investments. Onex may also seek similar opportunities in other sectors exhibiting strong growth potential.

This experience provides valuable lessons about navigating the complexities of the airline industry and successfully managing private equity investments within a volatile market. Onex is likely to leverage these lessons in future deals, paying closer attention to [Mention key learning points based on the WestJet investment].

Future Focus Areas:

- Onex's future investment plans in the airline industry: [Speculate based on available information]

- Areas of focus for future private equity investments: [Speculate based on available information, considering diversification]

- Key takeaways from the WestJet investment experience: [Mention key lessons learned]

- Potential impact on Onex's overall investment strategy: [Discuss potential changes in investment approach]

Conclusion

The successful sale of Onex's 25% stake in WestJet represents a significant achievement, demonstrating a profitable exit and a strong return on investment. This case study provides valuable insights into the complexities of private equity investments within the airline sector. The complete recoupment of the initial investment underlines the potential for substantial returns in this sector, albeit with inherent risks. To delve deeper into Onex's investment strategies and explore similar successful ventures in the private equity market, further research into the Onex WestJet investment and related case studies is recommended.

Featured Posts

-

El Impacto Del Inusual Regalo De Uruguay En Las Exportaciones Ganaderas A China

May 11, 2025

El Impacto Del Inusual Regalo De Uruguay En Las Exportaciones Ganaderas A China

May 11, 2025 -

How Chaplin Can Lead Ipswich Town To Success

May 11, 2025

How Chaplin Can Lead Ipswich Town To Success

May 11, 2025 -

L Autruche Demasquee Dans Mask Singer 2025 Chantal Ladesou Et Laurent Ruquier Reagissent

May 11, 2025

L Autruche Demasquee Dans Mask Singer 2025 Chantal Ladesou Et Laurent Ruquier Reagissent

May 11, 2025 -

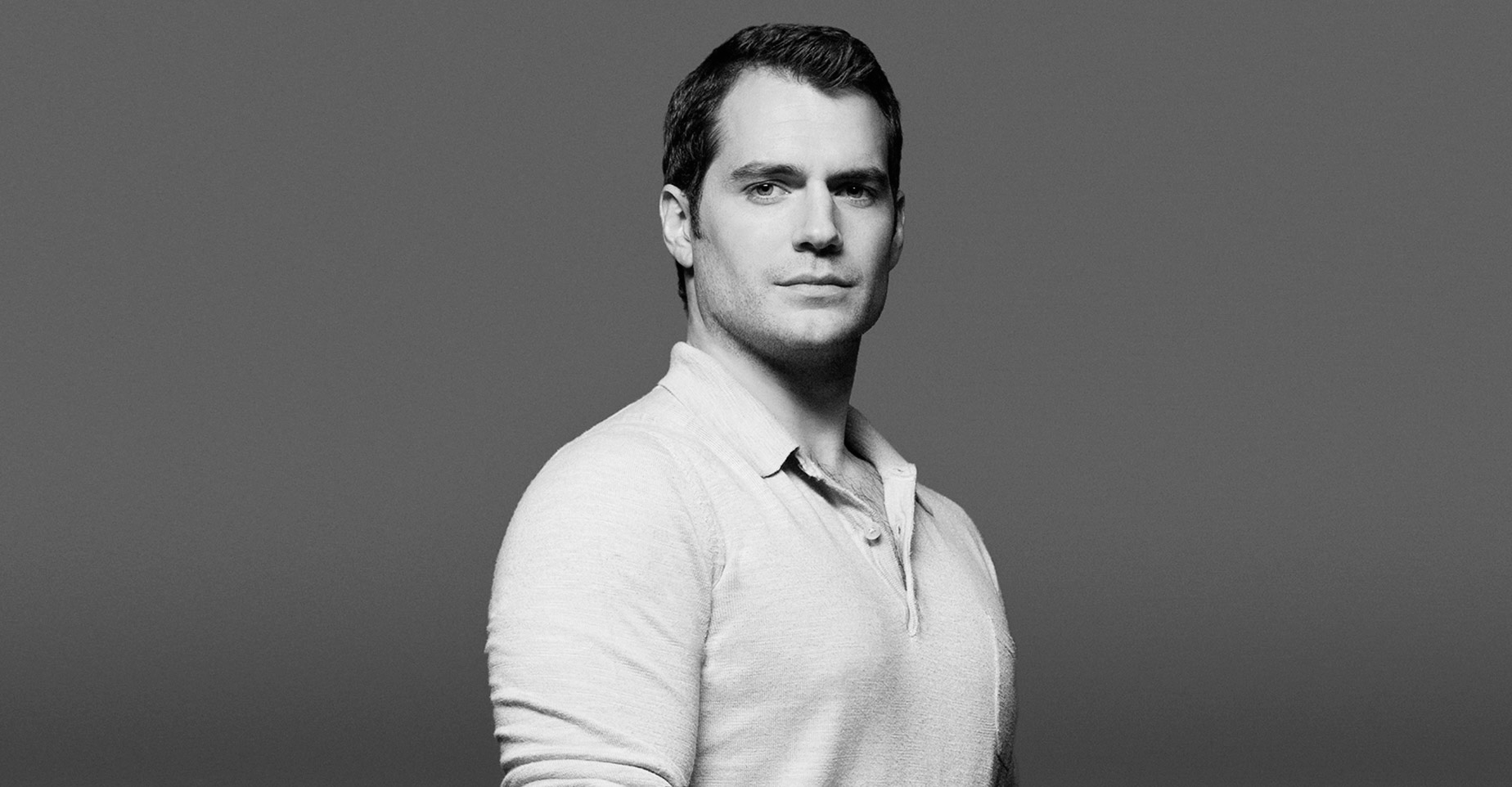

Henry Cavill In Talks For Marvels Nova Series Fact Or Fiction

May 11, 2025

Henry Cavill In Talks For Marvels Nova Series Fact Or Fiction

May 11, 2025 -

Palou Victorious Indy Car St Pete Grand Prix And De Francescos Return

May 11, 2025

Palou Victorious Indy Car St Pete Grand Prix And De Francescos Return

May 11, 2025