Ontario Budget 2024: Details On The Enhanced Manufacturing Tax Credit

Table of Contents

What is the Enhanced Manufacturing Tax Credit (EMTC)?

The Enhanced Manufacturing Tax Credit (EMTC) is a key initiative designed to incentivize investment and growth within Ontario's manufacturing sector. It provides a tax credit for eligible expenses incurred by businesses involved in manufacturing activities within the province. This credit aims to modernize Ontario's manufacturing base, fostering innovation and creating high-quality jobs.

The EMTC covers a range of eligible expenses, including:

- Machinery and equipment: This encompasses a wide variety of equipment used in the manufacturing process, from production lines to specialized tools.

- Software: Software directly used in the manufacturing process, such as CAD/CAM software, production management software, and quality control software, is eligible.

- Building renovations: Renovations directly related to improving manufacturing capacity or efficiency are included. This may include upgrades to factory floors, installation of new utilities, and improvements to safety infrastructure.

While the exact percentage rate of the EMTC may vary depending on specific factors and is subject to change, it represents a significant percentage of eligible expenses.

- Refundable Tax Credit: The EMTC is a refundable tax credit, meaning that if the credit exceeds the business's tax liability, the difference will be refunded to the business.

- Eligible Manufacturing Sectors: A broad range of manufacturing sectors are eligible, encompassing everything from automotive parts manufacturing to food processing and advanced technology production. Specific details on qualifying sectors should be verified with the relevant government resources.

- Qualifying Businesses: Businesses of all sizes – small, medium, and large enterprises – can benefit from the EMTC, provided they meet the eligibility criteria.

Eligibility Criteria for the EMTC

To qualify for the EMTC, businesses must meet several specific criteria. These primarily center around the location of the business, the nature of its manufacturing activities, and the level of investment made.

-

Key Eligibility Requirements:

- The business must be a qualifying manufacturing business operating in Ontario.

- The expenses must be incurred for eligible purposes related to the manufacturing process within Ontario.

- Businesses need to meet specific investment thresholds that may vary depending on the type and scale of the investment. Detailed thresholds and specific requirements are outlined in the official government documentation.

-

Limitations and Exclusions: Certain expenses are not eligible for the EMTC. These exclusions usually include items considered general operating expenses rather than capital investments directly related to manufacturing. Specific exclusions are detailed on the Ontario government's website related to the EMTC.

-

Determining Eligible Expenses: Detailed record-keeping is crucial for determining which expenses are eligible. Maintaining thorough documentation, including invoices, contracts, and other supporting evidence, is essential for a successful EMTC claim.

How to Claim the Enhanced Manufacturing Tax Credit

Claiming the EMTC involves several steps, requiring careful attention to detail and adherence to specific deadlines.

-

Step-by-Step Guide: The process generally involves gathering the necessary documentation, completing the appropriate tax forms (details on the specific forms will be available on the government website), and filing the claim through the designated channels. Consult a tax professional for assistance if needed.

-

Required Forms and Documents: This includes invoices for eligible expenses, contracts related to equipment purchases or renovations, and any other supporting documentation demonstrating that the expenses were incurred for eligible purposes.

-

Government Resources: The Ontario government provides various resources to guide businesses through the EMTC claim process. This typically includes online guides, frequently asked questions (FAQs), and contact information for dedicated support teams. Consult the official website for the most up-to-date information and forms. [Insert link to relevant government website here]

Maximizing the Benefits of the EMTC

Strategic planning can significantly enhance the return on investment from the EMTC. Businesses should strive to optimize their claims by carefully considering eligible expenses and potential interactions with other tax programs.

-

Accurate Record-Keeping: Meticulous record-keeping is paramount. Maintaining detailed records of all eligible expenses will significantly simplify the claiming process and minimize the risk of errors.

-

Identifying Eligible Expenses: A thorough review of all potential expenses is essential. Consulting with tax professionals can help identify all eligible expenses, even those that may not be immediately apparent.

-

Coordination with Tax Professionals: Tax professionals possess in-depth knowledge of tax regulations and can provide valuable guidance on optimizing EMTC claims and maximizing deductions. This will ensure compliance and help avoid potential errors or delays.

The EMTC and Sustainable Manufacturing Initiatives

The EMTC can play a significant role in supporting investments in environmentally friendly manufacturing practices. Ontario's government often provides additional incentives for businesses adopting green technologies and sustainable manufacturing processes. These incentives can significantly enhance the financial benefits derived from the EMTC. Investing in energy-efficient equipment, implementing waste reduction strategies, and adopting other environmentally conscious practices can further boost your return.

Conclusion

The Enhanced Manufacturing Tax Credit (EMTC) represents a significant opportunity for Ontario's manufacturing sector. By understanding the eligibility criteria, claiming process, and strategies for maximizing benefits, businesses can leverage this initiative to fuel growth, modernize operations, and strengthen their position within the province's economy. Don't miss out on this valuable opportunity to boost your bottom line. Learn more about the Enhanced Manufacturing Tax Credit and how it can benefit your business by exploring the resources listed above and contacting the relevant government agencies. Claim your Enhanced Manufacturing Tax Credit today!

Featured Posts

-

Lotto 6aus49 Vom 12 April 2025 Lottozahlen Und Gewinnzahlen

May 07, 2025

Lotto 6aus49 Vom 12 April 2025 Lottozahlen Und Gewinnzahlen

May 07, 2025 -

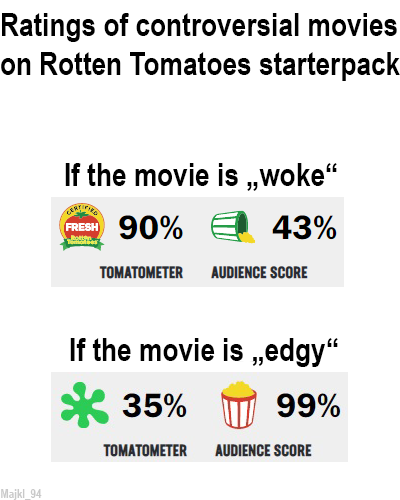

Rotten Tomatoes Wrong John Wick 4s Unexpectedly Low Score Explained

May 07, 2025

Rotten Tomatoes Wrong John Wick 4s Unexpectedly Low Score Explained

May 07, 2025 -

The Karate Kid Part Ii Locations Characters And Cultural Impact

May 07, 2025

The Karate Kid Part Ii Locations Characters And Cultural Impact

May 07, 2025 -

Rihannas Third Pregnancy A Look At Her Journey

May 07, 2025

Rihannas Third Pregnancy A Look At Her Journey

May 07, 2025 -

Lewis Capaldis Winning Streak New Album Dominates Charts

May 07, 2025

Lewis Capaldis Winning Streak New Album Dominates Charts

May 07, 2025