OPEC+ Meeting: Crucial Oil Production Quota Decisions Expected

Table of Contents

Current Global Oil Market Dynamics

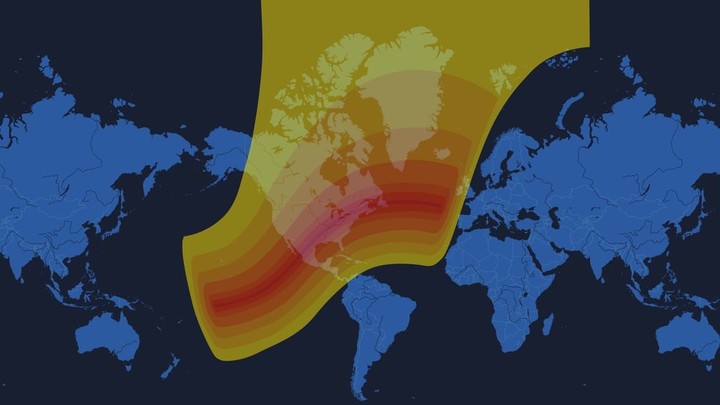

The global oil market is currently characterized by a complex interplay of supply and demand factors, significantly influencing crude oil prices and the overall energy landscape.

Supply and Demand Imbalance

The current global oil market exhibits a delicate balance between supply and demand. Several factors contribute to this dynamic:

- Impact of sanctions on Russian oil production: Sanctions imposed on Russia following its invasion of Ukraine have significantly disrupted global oil supply chains, leading to price volatility and uncertainty. The reduction in Russian oil exports has created a supply gap that OPEC+ has been tasked with addressing.

- OPEC+'s role in managing global oil supply: The Organization of the Petroleum Exporting Countries and its allies (OPEC+) play a crucial role in managing global oil supply. Their collective decisions on production quotas directly impact global oil prices and market stability. Their ability to effectively balance supply and demand is constantly tested.

- Rising energy consumption in developing economies: The increasing energy consumption in rapidly developing economies, particularly in Asia, is putting upward pressure on global oil demand. This increased demand further complicates the task of maintaining a balanced market.

Geopolitical Factors Influencing Oil Prices

Geopolitical instability is a major factor influencing oil prices and production levels.

- Influence of political instability in key oil-producing regions: Political unrest or conflict in major oil-producing regions can disrupt production and transportation, leading to price spikes. The security of oil infrastructure and supply routes is paramount to market stability.

- Impact of sanctions and trade disputes on oil markets: International sanctions and trade disputes can significantly impact the flow of oil, affecting both supply and prices. These factors create considerable uncertainty and volatility in the market.

- Role of speculation and market sentiment: Speculation and market sentiment play a significant role in oil price fluctuations. Investor confidence and expectations about future supply and demand can drive price movements independent of underlying fundamentals.

Potential Outcomes of the OPEC+ Meeting

The OPEC+ meeting could result in several scenarios, each with significant implications for the global oil market.

Maintaining Current Production Levels

Maintaining current production levels would likely result in:

- Potential impact on oil prices: Continued production at current levels might lead to relatively stable oil prices, although this depends on the evolving global demand.

- Potential effect on the global economy: Stable oil prices generally benefit the global economy by reducing energy costs for businesses and consumers.

- Implications for energy security: Maintaining current production levels might not fully address concerns regarding energy security in certain regions facing supply constraints.

Increasing Oil Production

An increase in oil production by OPEC+ could lead to:

- Effect on oil prices: Increased production would likely put downward pressure on oil prices, potentially easing inflationary pressures.

- Impact on competing oil producers: Increased supply could negatively impact smaller or less efficient oil producers who struggle to compete with lower prices.

- Potential for easing inflationary pressures: Lower oil prices could help to alleviate inflationary pressures globally, benefiting consumers and businesses.

Reducing Oil Production

A reduction in oil production by OPEC+ could result in:

- Effect on oil prices: Reduced production would likely cause oil prices to rise, potentially exacerbating inflationary pressures.

- Implications for global energy security: Decreased production could heighten concerns about global energy security, particularly for countries heavily reliant on oil imports.

- Potential impact on the global economy: Higher oil prices can negatively impact economic growth by increasing transportation and production costs.

Impact on Various Stakeholders

The OPEC+ decision will have far-reaching consequences for a variety of stakeholders.

Impact on Oil-Producing Countries

The OPEC+ decision will significantly impact oil-producing countries' economies:

- Impact on government revenues: Changes in oil prices directly affect government revenues from oil exports. A price increase benefits producing nations, while a decrease has the opposite effect.

- Effect on national budgets: Oil revenues form a substantial portion of many oil-producing countries' national budgets. Fluctuations in oil prices can impact government spending and social programs.

- Implications for social programs: Changes in oil revenues can directly affect the funding of essential social programs, including healthcare and education.

Impact on Oil-Consuming Countries

Oil-consuming countries will also experience significant impacts:

- Impact on inflation: Oil price changes directly affect inflation rates, impacting the cost of goods and services for consumers.

- Effects on transportation costs: Oil price increases lead to higher transportation costs, impacting businesses and consumers alike.

- Implications for economic growth: High oil prices can dampen economic growth by increasing input costs for businesses and reducing consumer spending.

Impact on Investors

Investors in the energy sector will closely watch the OPEC+ decision:

- Impact on stock prices: The decision will likely influence the stock prices of oil companies and related businesses.

- Effects on investment decisions: Investors will adjust their investment strategies based on anticipated oil price movements.

- Implications for future investment: The outcome of the meeting will shape future investment decisions in the energy sector.

Conclusion

The OPEC+ meeting's decisions regarding oil production quotas will significantly influence global oil prices and the broader energy landscape. Understanding the potential outcomes – from maintaining current levels to increasing or decreasing production – is crucial for governments, businesses, and individuals. The meeting's impact will ripple through various sectors, affecting everything from inflation rates to geopolitical stability. Stay informed about the OPEC+ meeting and its crucial oil production quota decisions to navigate the evolving energy market effectively. Follow our updates for continued coverage on the OPEC+ meeting and its implications for oil production quotas.

Featured Posts

-

Bay Area High School Sports Weekly Athlete Poll Is Live

May 29, 2025

Bay Area High School Sports Weekly Athlete Poll Is Live

May 29, 2025 -

Bring Her Back Trailer Sally Hawkins Terrifying Transformation In Talk To Me

May 29, 2025

Bring Her Back Trailer Sally Hawkins Terrifying Transformation In Talk To Me

May 29, 2025 -

Stranger Things Season 5 Bridge The Gap With This Eerily Similar 2011 Film

May 29, 2025

Stranger Things Season 5 Bridge The Gap With This Eerily Similar 2011 Film

May 29, 2025 -

Todos Los Radares De Zaragoza En 2025 Fijos Moviles Y De Tramo

May 29, 2025

Todos Los Radares De Zaragoza En 2025 Fijos Moviles Y De Tramo

May 29, 2025 -

Urgent Police Investigation Following Downtown Seattle Double Shooting

May 29, 2025

Urgent Police Investigation Following Downtown Seattle Double Shooting

May 29, 2025

Latest Posts

-

Se Cae Ticketmaster Actualizacion De Noticias Del 8 De Abril Grupo Milenio

May 30, 2025

Se Cae Ticketmaster Actualizacion De Noticias Del 8 De Abril Grupo Milenio

May 30, 2025 -

Ticketmaster Averias Y Problemas Reportados El 8 De Abril

May 30, 2025

Ticketmaster Averias Y Problemas Reportados El 8 De Abril

May 30, 2025 -

Oasis Concert Tickets And Ticketmaster An Analysis Of Consumer Protection Issues

May 30, 2025

Oasis Concert Tickets And Ticketmaster An Analysis Of Consumer Protection Issues

May 30, 2025 -

Ultimas Noticias Sobre La Caida De Ticketmaster El 8 De Abril

May 30, 2025

Ultimas Noticias Sobre La Caida De Ticketmaster El 8 De Abril

May 30, 2025 -

Oasis Tour Ticket Sales Investigating Ticketmasters Compliance With Consumer Protection Laws

May 30, 2025

Oasis Tour Ticket Sales Investigating Ticketmasters Compliance With Consumer Protection Laws

May 30, 2025