OPEC+ Quota Review: July Output Decision Looms

Table of Contents

Current Global Oil Market Conditions

Supply and Demand Dynamics

The current global oil market is a complex interplay of supply and demand. Analyzing OPEC+ production is critical. While OPEC+ has historically aimed for production targets, adherence has varied, impacting global supply. Non-OPEC+ producers, such as the US, also play a significant role, with their output influencing the overall market balance. Global demand forecasts are crucial, considering economic growth (or slowdown) in major economies like China and the US, significantly impacting oil consumption. Seasonal changes also influence demand, particularly during peak driving seasons.

- Inventory Levels: Current global oil inventories are a key indicator of market tightness or surplus. High inventories suggest ample supply, potentially leading to lower prices, while low inventories could signal scarcity and upward pressure on prices.

- Economic Growth: Strong economic growth in major economies typically translates to increased oil demand, while economic slowdowns can lead to decreased consumption. China's economic recovery, for example, is a significant factor influencing global oil demand.

- Seasonal Demand: Demand for oil often fluctuates seasonally. Summer months typically see higher demand due to increased travel, while winter months might see higher heating oil consumption.

Geopolitical Factors

Geopolitical events significantly influence oil price volatility and OPEC+ strategy. The ongoing war in Ukraine has created significant uncertainty, impacting supply chains and energy markets globally. Sanctions imposed on Russia, a major oil producer, have further complicated the situation. Tensions in the Middle East, a region crucial for global oil production, also contribute to geopolitical risk.

- Sanctions and Disruptions: Sanctions on Russian oil have reduced its supply to the global market, contributing to tighter supply conditions and higher prices. Any further geopolitical instability in the region could disrupt supply chains even further.

- Supply Chain Resilience: The resilience of global oil supply chains in the face of geopolitical shocks is a critical factor influencing OPEC+'s decision-making process. Any perceived fragility could lead to more cautious decisions regarding production levels.

- Price Volatility: Geopolitical uncertainty inherently creates price volatility. OPEC+ might adjust production to manage this volatility and maintain price stability within a desired range.

OPEC+ Member Country Interests and Internal Dynamics

Differing National Agendas

OPEC+ members have diverse national agendas that impact their approaches to oil production. Saudi Arabia, a key player, has significant leverage and influence within the alliance. Its oil policy often sets the tone for the group's overall strategy. Russia, another major player, also holds considerable weight, and its interests may sometimes conflict with those of other members. Each country's economic situation and dependence on oil revenue significantly shape its position during the OPEC+ quota review.

- Saudi Arabia Oil Policy: Saudi Arabia's economic strategy and its role as a swing producer significantly impact global oil supply. Its decisions regarding production are closely watched by all market participants.

- Russia Oil Production: Russia's oil production and export capabilities are crucial to the global supply equation. Sanctions and geopolitical risks influence its ability to meet production targets and its overall influence within OPEC+.

- Diverse Economic Needs: OPEC+ members have varying economic needs and reliance on oil revenue. These differences can lead to internal disagreements during quota negotiations.

Internal Cohesion and Agreement

The success of the OPEC+ alliance depends heavily on the level of unity among its members. Reaching an agreement on production quotas requires navigating a complex web of competing interests. Any existing disagreements or tensions among members could significantly influence the outcome of the oil production quotas review. Internal cohesion is paramount for effectively influencing global oil prices and market stability.

- Internal Disagreements: Differences in national interests and economic conditions can lead to disagreements among OPEC+ members, potentially hindering their ability to reach a consensus on production quotas.

- Influence of Key Players: The positions of Saudi Arabia and Russia, as two of the largest oil producers, carry significant weight in shaping the final decision. Their willingness to compromise is crucial for achieving consensus.

- Impact on Market Stability: The level of internal cohesion within OPEC+ directly impacts the stability of global oil markets. Strong unity ensures a coordinated approach, while internal conflicts can lead to uncertainty and volatility.

Potential Outcomes of the July OPEC+ Quota Review

Scenario 1: Maintaining Current Production Levels

If OPEC+ chooses to maintain its current OPEC+ oil production, this would signal a relatively stable outlook for the global oil market. Oil prices would likely remain within a certain range, with the potential for slight fluctuations based on other market factors. The economies of OPEC+ member countries would continue to benefit from oil revenues at existing levels.

- Impact on Oil Prices: Maintaining current production levels would likely result in relatively stable oil prices, though the exact level would depend on several other factors including global demand and economic growth.

- Global Supply: The global oil supply would remain relatively unchanged, potentially leading to a balanced market if demand remains stable.

- OPEC+ Member Economies: The economies of OPEC+ members would continue to receive oil revenues at the current production levels.

Scenario 2: Increasing Production

An OPEC+ decision to increase oil production would likely lead to a decrease in oil prices. This could ease inflationary pressures globally, as lower oil prices impact transportation costs and various other goods and services. However, it would also reduce oil revenues for OPEC+ member countries.

- Oil Price Decline: Increased production would likely lead to lower oil prices, providing relief to consumers and businesses grappling with inflation.

- Global Supply: A significant increase in production would ease global supply concerns and potentially lead to a surplus in the market.

- Inflation Relief: Lower oil prices could contribute to easing inflationary pressures across the globe.

Scenario 3: Reducing Production

If OPEC+ decides to decrease oil production, it would likely lead to an increase in oil prices. This could increase market volatility and exacerbate inflationary pressures. The economies of OPEC+ members would potentially benefit from higher oil revenues but could also face challenges due to market instability.

- Oil Price Increase: A reduction in production would likely cause oil prices to rise, impacting consumers and businesses globally.

- Market Volatility: Decreased production increases the potential for market volatility, making it difficult to predict future price movements accurately.

- Increased Inflationary Pressures: Higher oil prices could exacerbate inflationary pressures in many economies.

Conclusion

The OPEC+ quota review in July will be a pivotal moment for the global energy market. The decision, whether to maintain, increase, or decrease oil production, will have far-reaching consequences for oil prices, global energy security, and the economies of both producing and consuming nations. Keeping a close eye on this OPEC+ quota review and understanding the diverse factors influencing it is crucial for navigating the ever-shifting energy landscape. To stay updated on the latest developments, continue to follow our analysis of the OPEC+ quota review and related news.

Featured Posts

-

Nike Air Jordan 9 Retro Cool Grey Online Retailers And Price Comparison

May 29, 2025

Nike Air Jordan 9 Retro Cool Grey Online Retailers And Price Comparison

May 29, 2025 -

Hujan Di Semarang Pukul 1 Siang Prakiraan Cuaca Lengkap Jawa Tengah 26 Maret

May 29, 2025

Hujan Di Semarang Pukul 1 Siang Prakiraan Cuaca Lengkap Jawa Tengah 26 Maret

May 29, 2025 -

Merkt Alastqlal Antsar Aliradt Alshebyt

May 29, 2025

Merkt Alastqlal Antsar Aliradt Alshebyt

May 29, 2025 -

Tate Mc Raes Musical Choice Examining The Political Fallout From The Wallen Collaboration

May 29, 2025

Tate Mc Raes Musical Choice Examining The Political Fallout From The Wallen Collaboration

May 29, 2025 -

Netherlands Eurovision 2025 Getting To Know Claude

May 29, 2025

Netherlands Eurovision 2025 Getting To Know Claude

May 29, 2025

Latest Posts

-

Eastern Manitoba Wildfires A Devastating Fight Against Nature

May 31, 2025

Eastern Manitoba Wildfires A Devastating Fight Against Nature

May 31, 2025 -

Manitoba Wildfires Crews Fight Deadly Spreading Blazes

May 31, 2025

Manitoba Wildfires Crews Fight Deadly Spreading Blazes

May 31, 2025 -

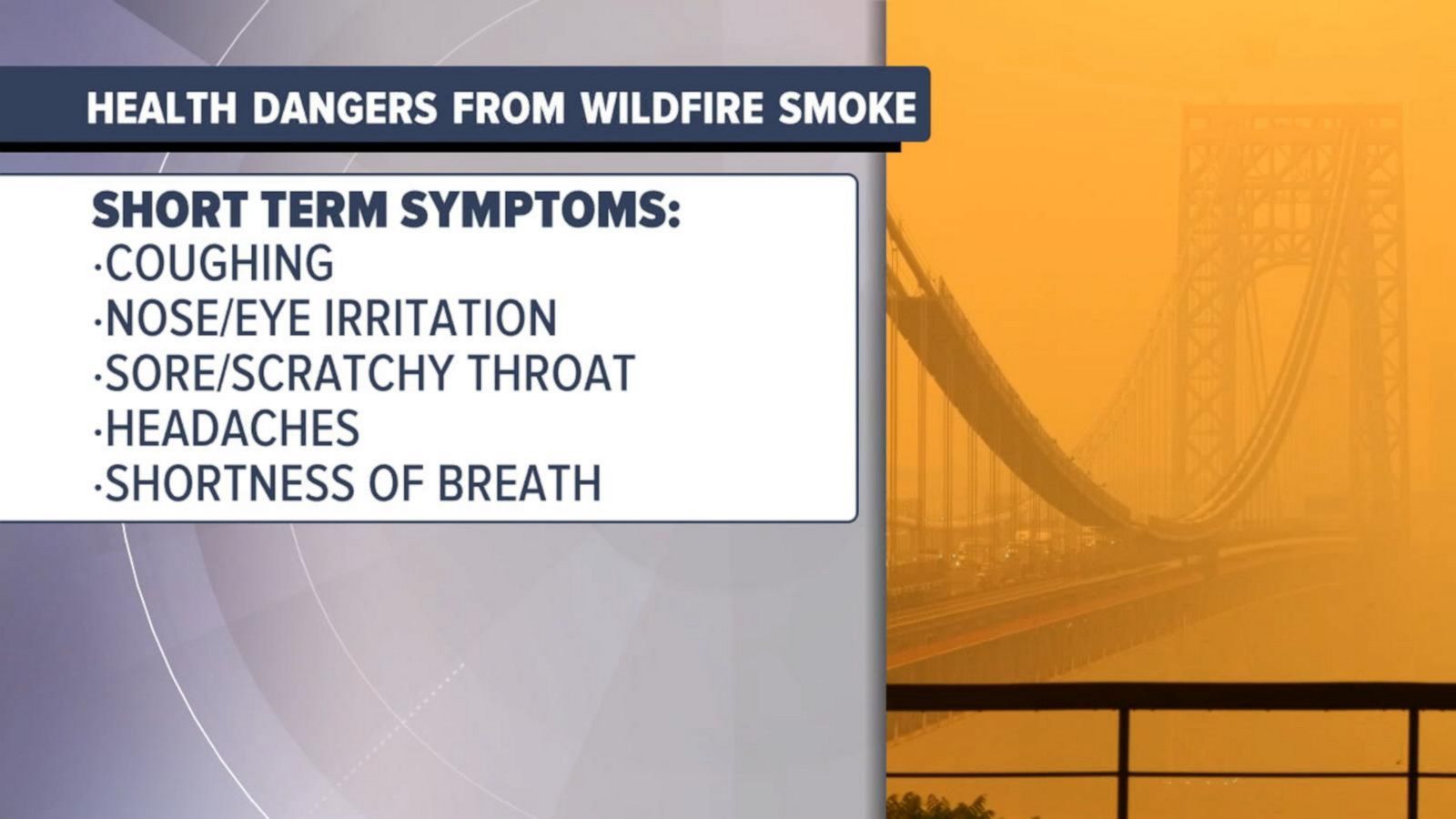

Canadian Wildfire Smoke Impacts Us Unprecedented Evacuation Underway

May 31, 2025

Canadian Wildfire Smoke Impacts Us Unprecedented Evacuation Underway

May 31, 2025 -

Massive Wildfires Force Largest Evacuation In Canadian History Us Air Quality Suffers

May 31, 2025

Massive Wildfires Force Largest Evacuation In Canadian History Us Air Quality Suffers

May 31, 2025 -

Wildfires Prompt Evacuation Of Hudbay Minerals Staff In Flin Flon Manitoba

May 31, 2025

Wildfires Prompt Evacuation Of Hudbay Minerals Staff In Flin Flon Manitoba

May 31, 2025